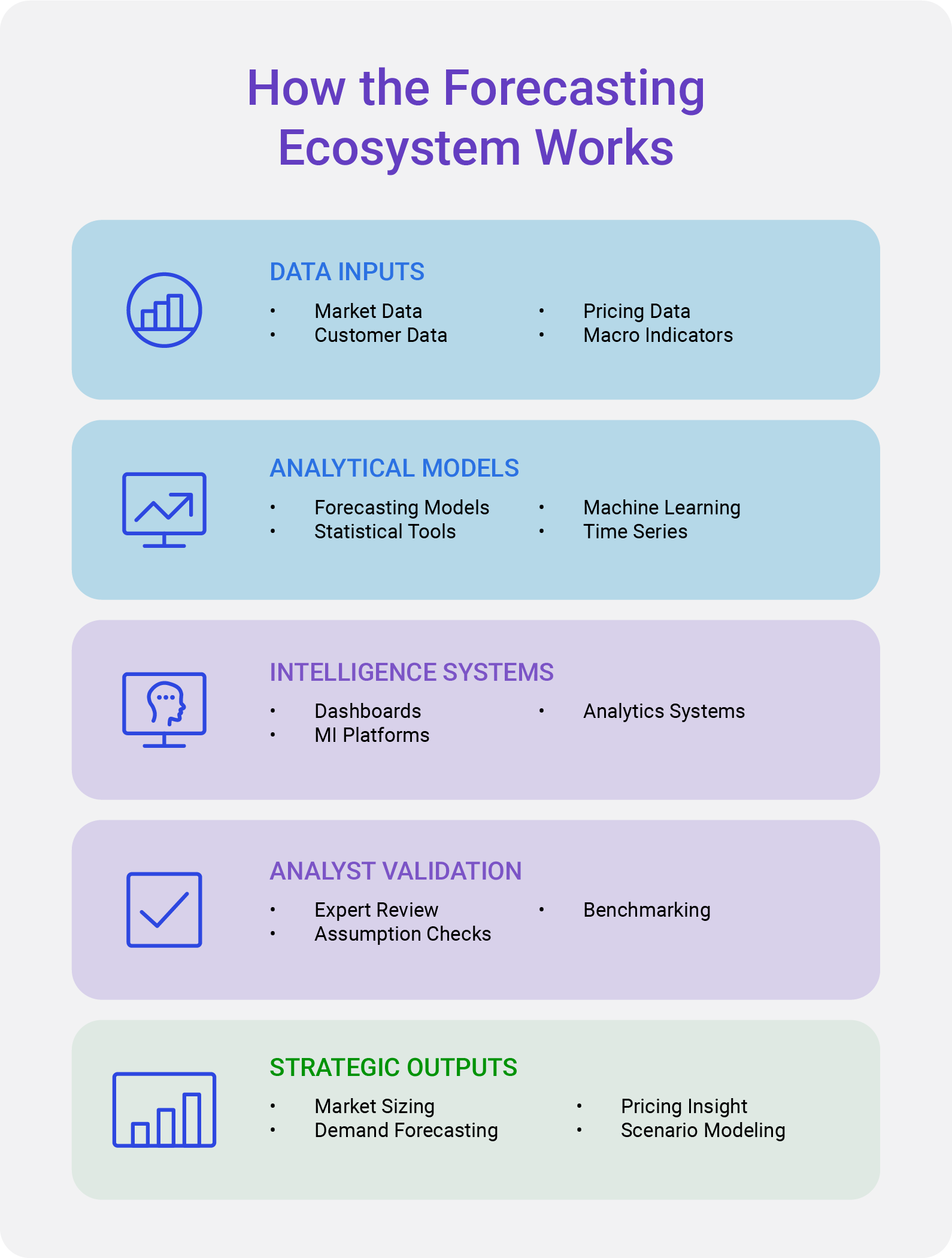

Forecasting has become one of the most strategic functions within modern market research and advisory work. As industries shift through cycles of innovation, global risks, and competitive restructuring, organizations rely on clear forward views to anchor planning and investment. Market forecasting provides this foundation by transforming data into structured expectations of future behavior. It helps decision makers interpret uncertainty, test future scenarios, allocate capital with confidence, and uncover emerging opportunities before they become visible in traditional indicators.

For research firms, forecasting is both a methodological discipline and a core value proposition. Clients no longer view forecasts as static figures. They expect explanations of underlying drivers, transparency in assumptions, and analytical models that stand up to scrutiny. This shift has redefined what it means to produce high quality forecasting in professional research. Today, forecasts must integrate multiple data ecosystems, blend top down and bottom up logic, incorporate triangulation, and apply emerging technologies that strengthen precision.

Why Forecasting Matters in Modern Market Research

Forecasting is no longer treated as an optional analytical output. It is now embedded into business planning, financial modeling, sales strategy, supply chain management, and competitive intelligence. The role of forecasting has expanded for three primary reasons.

1. Markets have become more interconnected. Shifts in one sector create ripple effects across adjacent industries. Forecasting helps leaders interpret these linkages and prepare for indirect consequences.

2. Technological cycles have accelerated. Products scale faster, customer preferences change more quickly, and investment horizons shorten. Organizations need forecasts that adjust to these cycles in near real time.

3. The cost of misjudging market momentum has increased. High capital expenditures, long innovation timelines, and global competition mean that inaccurate forecasting can produce significant financial and operational loss.

The Core Components of Forecasting in Market Research

Modern forecasting is built on a structured combination of methods rather than a single model. Each component plays a distinct analytical role.

1. Market Definition and Segmentation: Forecast accuracy begins with defining the scope of the market. Segmentation shapes how demand is interpreted, how value is allocated, and how future growth patterns are modeled. Effective segmentation requires identifying industries, applications, customer groups, price tiers, and regions that influence market behavior.

2. Demand Modeling: Demand models translate historical patterns and behavioral drivers into expectations for future consumption. They account for economic conditions, demographic dynamics, technological adoption, competitive factors, and regulatory changes. Strong demand models clarify what forces shape the baseline trajectory of a market.

3. Supply and Capacity Assessment: Market behavior is also influenced by production capacity, supply chain constraints, cost structures, and industry investment levels. Supply centric forecasting helps analysts evaluate scarcity, expansion cycles, or constraints that may influence pricing and demand realization.

4. Scenario Planning: No single forecast can capture every possibility. Scenario planning allows analysts to test alternative outcomes across optimistic, conservative, and baseline cases. This technique strengthens advisory recommendations by accounting for uncertainty.

5. Validation and Triangulation: Forecasts must be validated through multiple independent sources. Validation strengthens trust. Triangulation refines assumptions. This process supports the credibility required in executive level decision making.

How Forecasting Supports Business Decision Making

Forecasting is used for far more than growth estimation. In practice, it supports strategic decisions across the enterprise.

1. Capital Allocation

Investments in new products, capacity expansion, and technology development depend on reliable expectations of future demand. Forecasting clarifies where resources should be directed to maximize long term return.

2. Market Entry and Expansion

Companies rely on forecasting to evaluate market potential, assess competitive intensity, and determine whether conditions support entry. Forecast outputs help leaders test the viability of different entry strategies.

3. Pricing and Revenue Strategy

Forecasting identifies how customer adoption patterns, cost structures, and competitor actions influence pricing power. It also supports revenue modeling for subscription, licensing, or consumption based business models.

4. Risk and Uncertainty Management

Forecasting highlights potential downturns, saturation points, or disruptive events. Businesses use this insight to adjust supply chains, diversify portfolios, or accelerate innovation cycles.

Why Forecast Accuracy Has Become a Competitive Requirement

Accuracy in forecasting influences strategic outcomes directly. Three industry trends explain why accuracy has become essential.

1. Higher Accountability in Decision Making

Executives base decisions on forecasting outputs. The expectation for precision has increased as decisions become more complex.

2. Broader Stakeholder Requirements

Investors, regulators, internal leadership teams, and external partners all examine forecasting methodologies as part of strategic evaluation. Transparent and accurate forecasting supports alignment across stakeholders.

3. Competitive Differentiation for Research Firms

Research firms with strong forecasting accuracy earn credibility and long term client trust. Methodological strength has become a competitive advantage in the advisory industry.

The Expanding Role of Technology in Forecasting

AI, machine learning, automation, and advanced analytics are reshaping the forecasting landscape. The speed and scale of modern data ecosystems have made traditional manual models insufficient in many contexts. Research firms now use technology to identify complex relationships, detect early signals, and update forecasts dynamically. To know more explore our detailed analysis on AI and Machine Learning in Market Forecasting.

The Role of Triangulation in Strengthening Forecast Credibility

Triangulation has become a central quality standard in market forecasting because no single dataset or method can capture the full complexity of market behavior. By using multiple independent sources and comparing patterns across them, analysts create forecasts that are both more defensible and more aligned with real world conditions.

Triangulation typically involves aligning top down estimates with bottom up models and validating both through market benchmarks or primary research. Each method provides a different vantage point and exposes different risks. When the outputs align, analysts gain confidence in the structural integrity of the forecast. When they diverge, the discrepancy signals that assumptions or data quality require further investigation.

In advisory environments, triangulation has shifted from a best practice to an expectation. Executive stakeholders rely on models that show clear evidence trails and maintain methodological transparency. This approach enhances trust and demonstrates that conclusions were derived through disciplined reasoning rather than a singular analytical path.

The Role of Competitive Intelligence in Forecasting

Competitive intelligence now plays a significant role in forecasting accuracy because shifts in competitor capacity, strategy, or investment often precede broader market movement. Market share evolution, pricing behavior, product innovation cycles, and supply chain decisions all influence the trajectory of future demand.

By analyzing competitor activity at both macro and operational levels, research firms identify signals that may alter adoption patterns or reshape industry structure. This intelligence is integrated into forecasting models to adjust assumptions and refine scenario planning.

For example, early investment in automation within an industry may signal a reduction in operating costs that affects price trajectories. Similarly, rapid hiring in R&D functions may indicate accelerated innovation pipelines that influence market entry timelines. Competitive intelligence provides these signals and helps analysts test multiple scenarios based on different competitive outcomes.

1. Forecast Accuracy vs. Validation Frameworks

Forecast accuracy is not solely a function of model construction. It depends on how consistently the model reflects real market behavior over time. Research firms therefore apply systematic validation frameworks to measure accuracy and adjust inputs.

Three categories of validation guide this process.

2. Historical Backtesting

Analysts compare historical forecasts against actual performance to identify structural errors or recurring gaps. This process highlights whether assumptions about adoption, pricing, or competitive response require recalibration.

3. Benchmark Alignment

Forecasts are tested against industry benchmarks, comparable markets, or adjacent sectors. This step ensures that the trajectory reflects realistic behavior patterns and adheres to known industry dynamics.

4. Sensitivity Analysis

Key assumptions such as pricing elasticity, supply constraints, or adoption rates are stressed across multiple variables. Sensitivity analysis clarifies which factors have the greatest influence on the forecast and helps analysts understand risk exposure.

These validation processes work together to strengthen the reliability of forecasting outputs and help advisory firms provide clients with insights that hold up under scrutiny.

Integrating Forecasting into Go to Market Strategy

Forecasting plays a pivotal role in shaping go to market strategy. It helps organizations define the timing of product launches, identify the most promising customer segments, and evaluate expected revenue performance under different conditions. Forecasts also guide decisions related to distribution models, pricing structures, and partnership planning.

A well constructed forecast clarifies demand potential and adoption velocity at the segment level. This enables GTM teams to calibrate messaging, channel strategy, and resource allocation based on evidence. Forecasts also support scenario planning by showing how changes in competitor behavior, pricing, regulation, or technology adoption may impact commercial outcomes.

In markets with fast innovation cycles, forecasting reduces the risk of entering too early or too late. By integrating forecasting into GTM strategy, organizations strengthen the alignment between operations and market reality.

The Future of Forecasting in Market Research

Forecasting is entering a period of structural transformation. Several trends are shaping its future.

- Real Time Forecasting Systems

Static reports are being replaced by continuously updated forecasting dashboards that refresh as new information enters the ecosystem. These systems integrate data feeds, model recalibration, and analyst interpretation to maintain real time accuracy.

- Interconnected Market Modeling

Sectors no longer evolve independently. Energy policy affects transportation. Semiconductor supply affects consumer electronics. Forecasting systems now capture these interdependencies through integrated models that track cross sector impact.

- AI Assisted Forecasting

AI accelerates pattern detection, identifies weak signals, and supports analysts in hypothesis generation. The analyst remains central to interpretation while AI provides structural support and speed.

- Greater Demand for Transparency

Clients require visibility into assumptions and methodologies. Explainable forecasting frameworks are becoming essential in advisory work.

- Scenario Driven Strategic Planning

Organizations frequently rely on multi scenario projections to manage volatility. Forecasting models therefore incorporate flexible pathways rather than single linear views.

How Kings Research Advances Forecasting Excellence

Kings Research integrates methodological rigor with modern analytical tools to deliver forecasting systems that align with executive needs. The firm’s approach is built on several core principles.

Forecasts are grounded in clear market definitions and evidence based segmentation. Models draw from both top down and bottom up methods to gain structural clarity and granular accuracy. All forecasts undergo triangulation to ensure that conclusions are consistent with independent data sources.

Kings Research incorporates competitive intelligence, scenario planning, and validation frameworks to strengthen the strategic relevance of forecasting outputs. The firm applies advanced analytics to enhance speed and adaptability while maintaining full transparency in assumptions and methodology.

This combination of human expertise and analytical innovation positions Kings Research as a partner for organizations seeking dependable insight in environments defined by uncertainty and rapid change.

Conclusion

Forecasting is fundamental to strategic planning across industries. It shapes investment decisions, market entry timing, resource allocation, and risk management. The role of forecasting has expanded from producing numerical estimates to generating structured insights that interpret complex market behavior.

Modern forecasting integrates multiple methodologies, validation frameworks, and analytical tools. It requires a balance of top down structure, bottom up evidence, competitive intelligence, triangulation, and scenario based reasoning. Professionals across advisory and research environments increasingly rely on forecasting systems that are transparent, adaptive, and aligned with real time market dynamics.

Kings Research continues to refine these methods by applying a combined approach built on analytical precision, evidence based modeling, and technological enhancement. This foundation enables clients to navigate uncertainty with clarity and act with greater confidence in their strategic decisions.

FAQ: Forecasting in Market Research and Advisory

1. What is market forecasting in research?

Market forecasting in research refers to the process of estimating future market performance using structured models, historical evidence, competitive signals, and real world indicators. It supports decisions related to product development, investment planning, and long term strategy.

2. Why is forecasting important for business decision making?

Forecasting helps organizations anticipate demand, allocate resources, manage risk, and evaluate market opportunities. It ensures that strategic decisions are based on structured projections rather than assumptions or intuition.

3. What are the main forecasting methods used in market research?

The most widely used methods include top down forecasting, bottom up forecasting, competitive intelligence based models, scenario forecasting, and mixed or triangulated frameworks. Each method provides different insights depending on market structure and data availability.

4. How do top down and bottom up forecasting differ?

Top down forecasting begins with the overall market and narrows the estimate through filters and structural assumptions. Bottom up forecasting starts with unit level behavior in individual segments and builds the total market from the ground level. Both methods complement each other in validation.

5. What is triangulation in market forecasting?

Triangulation is the practice of validating a forecast by comparing outputs from multiple independent methods or data sources. It strengthens credibility by ensuring that conclusions are consistent across top down models, bottom up models, primary research, and external benchmarks.

6. How does competitive intelligence improve forecast accuracy?

Competitive intelligence reveals early signs of capacity shifts, product launches, pricing changes, and strategic moves that influence future demand. When integrated into forecasting models, these signals help analysts refine assumptions and build more realistic scenarios.

7. What role does AI play in modern forecasting?

AI supports faster pattern recognition, early signal detection, and automated model updates. Analysts still interpret the results, but AI improves speed, precision, and the ability to process complex datasets.

8. How often should forecasts be updated?

Forecasts should be updated whenever new evidence changes underlying assumptions. In fast moving markets, this may occur quarterly or monthly. In stable environments, annual updates are sufficient.

9. What makes a forecast credible to stakeholders?

Credible forecasts show clear segmentation logic, transparent assumptions, triangulated evidence, competitive intelligence, validation testing, and alignment with real world market behavior. Stakeholders expect a clear explanation of how the numbers were derived.

10. How does forecasting support go to market strategy?

Forecasting clarifies demand potential, segment attractiveness, pricing feasibility, and adoption velocity. GTM teams use forecasts to prioritize markets, sequence launches, and allocate resources effectively.

11. What challenges affect forecasting accuracy?

Common challenges include inconsistent data, volatile market cycles, rapid technological change, geopolitical disruptions, and limited visibility into emerging segments. Validation frameworks help mitigate these risks.

12. Do advisory firms use a single model or multiple models?

Advisory firms typically use a blend of models. Top down structure, bottom up evidence, competitive intelligence signals, and scenario frameworks are combined to create a more reliable and defensible forecast.