Market Definition

The market comprises high-performance computing systems engineered to process large-scale artificial intelligence workloads with high speed and precision. The report covers segmentation by component, deployment type, end-use industry, and region, providing insights into technological advancements, investment trends, and performance benchmarks.

AI supercomputers enable complex data modeling, neural network training, and simulation across research, industrial, and commercial domains. Applications extend to autonomous systems, healthcare analytics, financial modeling, and scientific research, driving accelerated innovation and computational efficiency.

AI Supercomputer Market Overview

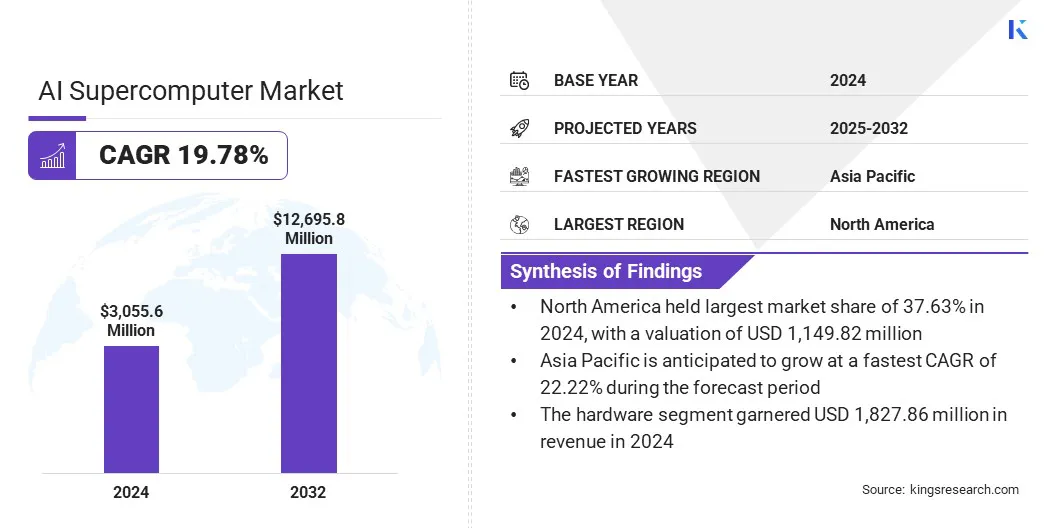

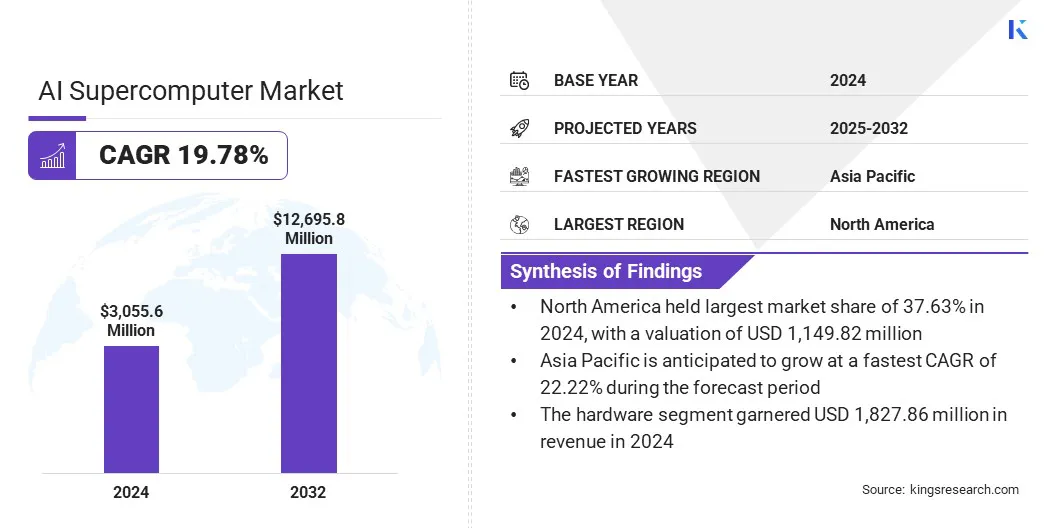

The global AI supercomputer market size was valued at USD 3,055.60 million in 2024 and is projected to grow from USD 3,589.02 million in 2025 to USD 12,695.78 million by 2032, exhibiting a CAGR of 19.78% over the forecast period.

This growth is driven by the rising demand for advanced computing systems capable of handling large-scale artificial intelligence workloads in healthcare, finance, manufacturing, retail, government, and research. Increasing deployment of AI models in research, autonomous systems, and data-intensive enterprise applications is strengthening the need for high-performance infrastructure.

Key Highlights

- The AI supercomputer industry size was valued at USD 3,055.60 million in 2024.

- The market is projected to grow at a CAGR of 19.78% from 2025 to 2032.

- North America held a market share of 37.63% in 2024, valued at USD 1,149.82 million.

- The hardware segment garnered USD 1,827.86 million in revenue in 2024.

- The cloud segment is expected to reach USD 6,171.73 million by 2032.

- The healthcare segment is anticipated to witness the fastest CAGR of 21.30% over the forecast period.

- Asia Pacific is anticipated to grow at a CAGR of 22.22% through the projection period.

Major companies operating in the AI supercomputer market are NVIDIA Corporation, IBM, Hewlett Packard Enterprise Development LP, Dell Inc., Fujitsu Limited, Lenovo, Atos SE, NEC Corporation, Penguin Solutions, INSPUR Co., Ltd., Intel Corporation, Advanced Micro Devices, Inc., Cerebras., Huawei Technologies Co., Ltd., and Microsoft.

Growing investments from governments and technology providers in next-generation supercomputing facilities are further propelling market growth. Moreover, continuous advancements in processor technologies, cooling systems, and energy-efficient architectures are enhancing performance capabilities and accelerating the adoption of AI supercomputers worldwide.

- In October 2025, NVIDIA and Oracle Corporation partnered with the U.S. Department of Energy to develop a cutting-edge AI supercomputer at Argonne National Laboratory. Powered by 100,000 NVIDIA Blackwell GPUs, the system will accelerate research in energy, national security, climate modeling, and scientific discovery.

How is the proliferation of artificial intelligence and machine learning workloads driving the growth of the AI supercomputer market?

The rapid proliferation of artificial intelligence and machine learning workloads is a major factor driving the growth of the market. Enterprises and research institutions are processing increasingly complex models that demand exceptional computational speed, scalability, and efficiency.

The rise of generative AI, natural language processing, and autonomous system development is amplifying the need for advanced infrastructure capable of handling massive datasets and intensive training cycles. This accelerating adoption of AI-driven applications across industries is expanding the deployment of supercomputers purpose-built for large-scale model training and real-time analytics.

How does complexity in system integration and scalability hinder the growth and efficient deployment of AI supercomputers?

Complexity in system integration and scalability remains a key obstacle to the expansion of the AI supercomputer market. Integrating these high-performance systems with diverse data infrastructures, legacy environments, and multi-cloud platforms demands advanced technical coordination and customization.

Achieving consistent scalability to support evolving AI models and massive datasets further increases implementation difficulty and operational costs. To address these challenges, organizations are focusing on modular architectures, advanced orchestration software, and collaborative partnerships with technology providers to streamline integration and improve system performance.

The market is experiencing a strong shift toward cloud-based deployment models to support growing computational demands. The increasing need for scalable, cost-efficient infrastructure capable of training large AI models is driving organizations to adopt cloud-based supercomputing services.

These platforms provide flexibility, faster deployment, and seamless integration with enterprise data ecosystems, enabling users to accelerate research and innovation. Technology providers are continuously enhancing cloud architectures with advanced GPUs, AI accelerators, and optimized networking to improve performance and accessibility. This transition is expanding the reach of AI supercomputing across industries, supporting greater innovation and operational efficiency.

AI Supercomputer Market Report Snapshot

|

Segmentation

|

Details

|

|

By Component

|

Hardware, Software, and Services

|

|

By Deployment Type

|

Cloud, On-premises, and Hybrid

|

|

By End Use Industry

|

Healthcare, Financial Services, Manufacturing, Retail, and Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Component (Hardware, Software, and Services): The hardware segment earned USD 1,827.86 million in 2024 primarily due to rising demand for high-performance processors, GPUs, and accelerators essential for large-scale AI model training and computation.

- By Deployment Type (Cloud, On-premises, and Hybrid): The cloud segment held a share of 42.71% of the market in 2024, due to growing preference for scalable, cost-efficient, and easily accessible AI supercomputing resources among enterprises and research institutions.

- By End Use Industry (Healthcare, Financial Services, Manufacturing, Retail, and Others): The healthcare segment is projected to reach USD 3,270.13 million by 2032, owing to increasing adoption of AI supercomputers for drug discovery, medical imaging analysis, and precision diagnostics requiring large-scale data processing.

What is the current market scenario in North America and Asia Pacific for this market?

Based on region, the AI supercomputer market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

North America AI supercomputer market share stood at 37.63% in 2024, valued at USD 1,149.82 million. This leadership is supported by substantial investments by hyperscalers and major technology firms, alongside public funding and national laboratory programs directed by the U.S. Department of Energy and research institutions. Demand is concentrated in healthcare and life sciences, financial services, manufacturing and automotive, retail, energy, and government and research institutions.

Ongoing initiatives are reinforcing North America’s dominant position in the market. These include the U.S. Department of Energy’s public–private partnerships to build next-generation AI supercomputers at national laboratories and the creation of the National Artificial Intelligence Research Resource to provide shared compute and data resources. Additionally, major hyperscaler capital expenditure expansion in AI-optimized data centers continues to strengthen the region’s AI computing capacity.

- In October 2025, Advanced Micro Devices (AMD) and the U.S. Department of Energy (DOE) announced a USD 1 billion partnership to deploy two next-generation supercomputers, “Lux” and “Discovery,” at Oak Ridge National Laboratory. Lux, launching in 2026, will serve as the nation’s first AI Factory for Science. It will be powered by AMD Instinct MI355X GPUs and EPYC CPUs.

Asia Pacific AI supercomputer industry is set to grow at a CAGR of 22.22% over the forecast period. This growth is driven by expanding government investments in artificial intelligence infrastructure, rapid digitalization, and rising demand for advanced computing power across industrial and research sectors. Increasing deployment of AI applications in manufacturing, healthcare, and autonomous technologies is accelerating the need for high-performance computing systems in the region.

Supportive national strategies promoting technological self-reliance and innovation are strengthening market development. Governments across Asia Pacific, including China, Japan, South Korea, and India, are advancing semiconductor innovation through national chip programs and investments in high-performance computing.

Regional collaboration among research institutions, technology firms, and governments is also expanding shared resources and joint AI development, enhancing the region’s scalability and competitiveness in the AI supercomputer market.

Regulatory Frameworks

- In the European Union, the Council Regulation (EU) 2021/1173 establishes the European High-Performance Computing Joint Undertaking (EuroHPC JU) to coordinate and fund the development of advanced supercomputing infrastructure. It facilitates collaboration between the European Commission, member states, and industry to deploy AI-capable systems and data facilities, strengthening Europe’s AI research and innovation capacity.

- In the U.S., the National Artificial Intelligence Initiative Act of 2020 regulates the federal coordination and strategic development of AI technologies. It supports investments in AI research, computing infrastructure, and inter-agency collaboration, fostering the growth of AI supercomputing capabilities across academic, government, and industrial sectors.

- In China, the New Generation Artificial Intelligence Development Plan (2017) regulates the strategic advancement of AI technologies and supporting infrastructure. It emphasizes large-scale investments in AI supercomputers, data centers, and national computing hubs to strengthen technological leadership and innovation capacity.

Competitive Landscape

Companies in the AI supercomputer industry are enhancing their competitive position through investments in advanced processor architectures, high-speed interconnects, and AI-optimized hardware solutions. They are focusing on improving computational performance, scalability, and energy efficiency to support increasingly complex AI and machine learning workloads across industries.

Market participants are expanding their offerings through cloud-based supercomputing platforms, integrated software ecosystems, and managed AI infrastructure services. Additionally, they are strengthening their global presence through strategic partnerships, research collaborations, and investments in data center modernization to meet the growing demand for large-scale AI model training and deployment.

- In October 2025, Eli Lilly and Company partnered with NVIDIA Corporation to build an AI supercomputer using over 1,000 NVIDIA Blackwell Ultra GPUs in a DGX SuperPOD configuration. The system is designed to accelerate drug discovery, molecular modeling, and clinical development while supporting secure data collaboration through Lilly’s TuneLab platform.

Key Companies in AI Supercomputer Market:

- NVIDIA Corporation

- IBM

- Hewlett Packard Enterprise Development LP

- Dell Inc.

- Fujitsu Limited

- Lenovo

- Atos SE

- NEC Corporation

- Penguin Solutions

- INSPUR Co., Ltd.

- Intel Corporation

- Advanced Micro Devices, Inc.

- Cerebras.

- Huawei Technologies Co., Ltd.

- Microsoft

Recent Developments (Launch)

- In October 2025, NVIDIA launched the DGX Spark, a compact AI supercomputer delivering one petaflop of performance with 128 GB unified memory. It enables local training of large-scale models and will be distributed globally by major OEMs including Dell, HP, Lenovo, and ASUS.