Kings Research Process

Data-Driven Intelligence for New Growth

At Kings Research, our core mandate is to transform market opportunities into proven business expansion roadmaps. We achieve this through a standardized, multi-phase research process designed for unparalleled accuracy, strategic relevance, and measurable business impact. Our process converts raw market data into high-value competitive intelligence across 2000+ markets and 15+ industries globally. Our analysis is always grounded in the question: "How does this drive client value?"

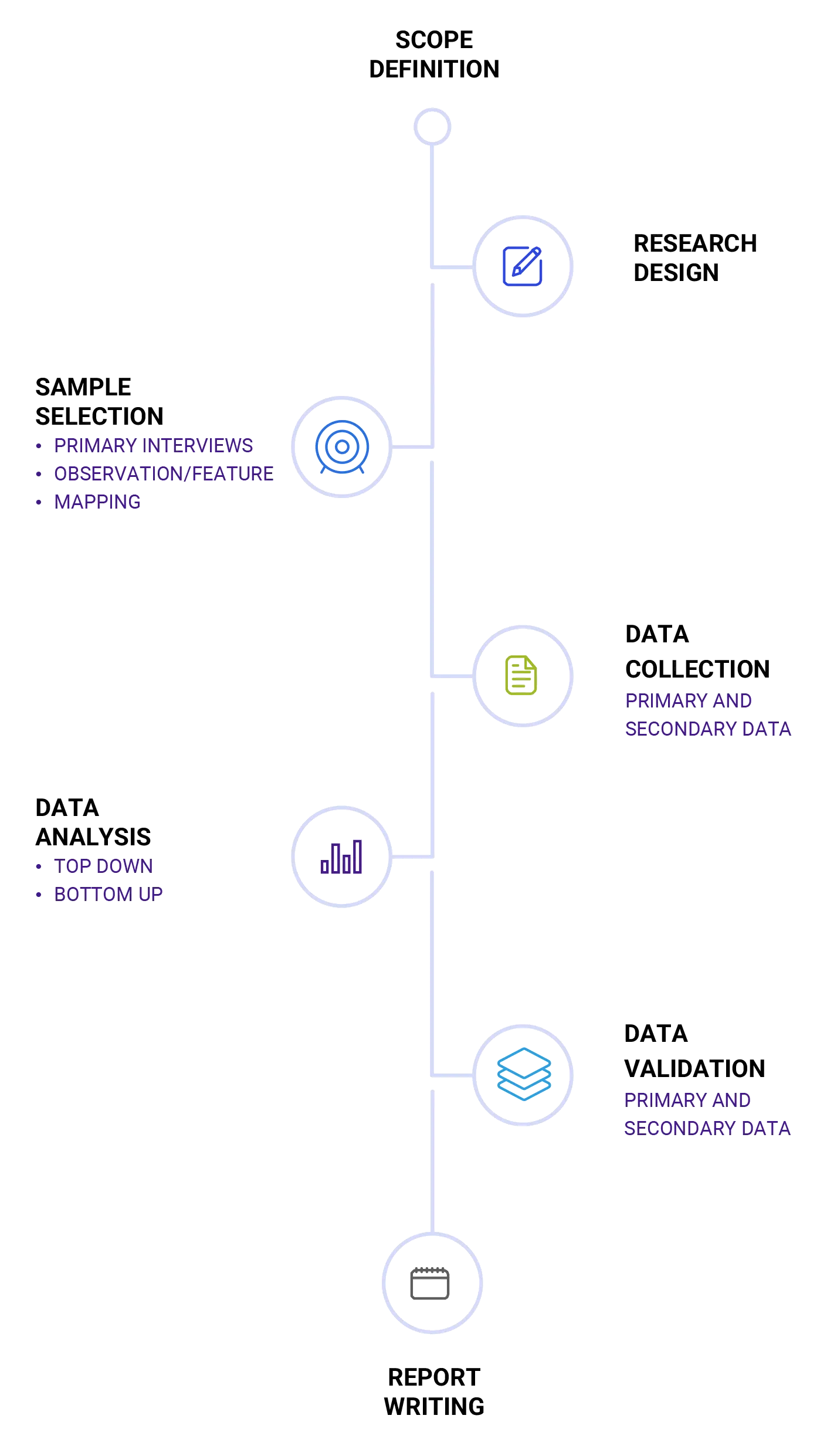

RESEARCH PROCESS

Scope Definition & Research Design: We start by defining the commercial objective and the Total Addressable Market (TAM). The goal is to design a research plan that directly addresses your growth questions.

Sample Selection: This isn't random outreach. We use strategic Mapping to pinpoint and engage the right executives and technical experts the Key Industry Participants whose insights will validate our hypotheses.

Data Collection: We rigorously blend primary (expert interviews) and secondary (paid financial/regulatory data) sources. This ensures we have both the hard numbers and the forward-looking perspective.

Data Analysis: Our analysts run both Top-Down (market scale) and Bottom-Up (segment granularity) models. This gives us confidence in the final figures and the market's true growth trajectory.

Data Validation: We impose a strict Triangulation mandate, verifying critical findings across multiple sources and subjecting them to external expert review. We challenge every conclusion.

Report Writing: The final step is delivering a clear, actionable report. We transform validated data into a precise expansion strategy focused on maximizing your ROI and securing New Growth.

Phase 1: Strategic Foundation & Secondary Intelligence

This phase is dedicated to building the quantitative framework for the market, establishing the Total Addressable Market (TAM), and understanding the competitive landscape.

- Initial Scoping: We define the market, segments, and geographic scope based on the client's commercial objective.

- Data Aggregation: Extensive collection from verified, credible sources, including proprietary paid databases (Bloomberg, Factiva, Reuters), corporate filings, white papers, and regulatory sources (e.g., IEA, EPA, regional government bodies).

- Quantitative Modelling: Analysis of historical data, segmental shares, pricing trends, and market structure. This provides the foundational data points necessary for calculating key metrics like CAGR and market penetration.

The market intelligence suggests the initial market size and potential growth trajectory, forming the hypothesis we must rigorously validate.

Phase 2: Primary Validation & Expert Insight

Primary research is our critical differentiator. It introduces forward-looking qualitative data to validate and enrich the quantitative findings, ensuring our final conclusions are tethered to current industry realities.

- Stakeholder Engagement: Structured interviews, surveys, and telephonic discussions with Key Industry Participants (KIPs) across the value chain. Participants include:

- Decision Makers: Executives from global corporations (CEOs, VPs of Strategy, Procurement Heads).

- Technical Experts: R&D Directors and Operations Managers in key verticals (e.g., Semiconductors, Cloud Computing, Automotive).

- Market Influencers: Industry Consultants, Regulatory Bodies, and Financial Analysts.

- Objective: To gain first-hand insights into product adoption curves, supply chain dynamics, cost optimization initiatives, and sustainability-driven chemical adoption trends.

- Validation Focus: We meticulously cross-verify our secondary data to ensure absolute clarity on usage rates, technological innovations, and the tangible impact of regulatory frameworks.

Phase 3: Analytical Rigor, Verification, and Market Sizing

Subject Matter Expert (SME) Vetting: Following primary research, all findings undergo a mandatory review by in-house Subject Matter Experts (SMEs). Our experts possess deep functional and industry knowledge across key verticals like Semiconductors, Cloud Computing, and Healthcare.

- Validation Focus: SMEs rigorously evaluate the completeness, coherence, and consistency of data across all parameters, including product segments, regional outlooks, and end-use applications.

- Strategic Alignment: This step ensures that the research findings align with actual market behavior and accurately reflect the technological, operational, and regulatory dimensions influencing market demand.

Market Sizing and Estimation

We employ a robust dual-pronged approach to market sizing, ensuring our final estimates are meticulously triangulated and verifiable.

Bottom-Up Approach:

- Granular Analysis: Demand is analysed across major applications, product types, and end-user segments.

- Volume Estimation: Data from regional regulatory bodies, industry activity databases, and service reports are used to estimate consumption volumes and intensity by location (e.g., number of installations, production output).

- Revenue Calculation: Country-level revenue estimates are calculated by multiplying verified consumption volumes by average product prices, adjusted for local supply chain margins and operational costs.

- Consolidation: Country-level data is aggregated into precise regional and global market estimates, cross-checked against revenue disclosures of leading global manufacturers and service providers.

Top-Down Approach:

- Macro Analysis: Historical spending patterns on the broader industry ecosystem are analyzed to determine the total proportion allocated to specific market segments.

- Intensity Ratios: Segment-specific spending ratios (e.g., product cost as a percentage of total project cost) are applied to estimate overall market potential across various activity levels.

- Refinement: Regional estimates are fine-tuned based on regulatory frameworks, technology adoption rates (like the 15.88% CAGR in Cloud Computing), and investment trends.

Triangulation: The final and most critical step is the cross-verification between the top-down and bottom-up estimates to ensure data accuracy and alignment with our projected growth trajectory.

Phase 4: Strategic Application & Commercialization

The final step is translating verified data into actionable strategies that optimize ROI and achieve our client's commercial objectives.

- Sustainable Advantage Analysis: Benchmarking the client's current market positioning and identifying areas for strategic differentiation.

- Growth Strategy Development: Creating tailored roadmaps for new market entry, technology investment, and optimal partnership structures.

- Deliverable Clarity: Every report ends with clear, definitive recommendations designed for immediate operationalization, ensuring the insights lead directly to sustainable revenue acceleration.

Phase 5: Quality Check

The analysis done by the research team was further reviewed to check for the accuracy of the data provided to suit the clients’ requirements. This process of revision was done in two phases for the authenticity of the data and to minimize errors in the report.

Phase 6: Final Review

After completion of the quality verification process, the final report underwent a comprehensive review to ensure clarity, coherence, and professional presentation. All findings were re-evaluated to confirm that client objectives were addressed, and key insights were presented in an accessible format. The next phase remains the dispatch of the report to the client.

Frequently Asked Questions

Why does Kings Research customize its methodology for every industry?

How do you ensure Expertise, Experience, and Trust?

We adhere to a strict Triangulation Mandate to build authority and confidence into every report:

- Verified Expertise: Our teams consist of experienced analysts and SMEs with deep vertical-specific knowledge.

- Primary Validation: We conduct interviews with Key Industry Participants (KIPs) like CEOs, CTOs, VP Supply Chain, and Product Managers.

- Data Rigor: We blend trusted secondary databases (Government, Financial, Scientific) with internal SME audits.

Why do you assess both Demand and Supply-Side market dynamics?

To avoid misleading forecasts, we balance the market equation:

- Demand-Side (Market Pull): We analyse end-use consumption, budget shifts, and purchase behaviour curves.

- Supply-Side (Market Push): We map capacity expansions, cost structures, and raw material bottlenecks. By reconciling "what is needed" with "what can be produced," we deliver a clear, verified perspective on the market's growth potential.

What are "Intent-Based Signals" and why do you track them?

Historical data tells you where the market was; intent signals tell you where it is going. We track early indicators of future demand, such as:

- Pilot project announcements and Patent filings.

- Venture funding and Hiring trends.

- Procurement shifts and new partnerships.

These signals allow our clients to be positioned to capitalize on "New Growth" before competitors react.

What GTM (Go-To-Market) insights do you provide?

Our GTM analysis is designed to accelerate adoption and optimize strategy. We answer:

- Channel Strategy: Which channels are positioned to drive the fastest Return on Investment (ROI)?

- Positioning: How should you strategically price and package your offering for maximum impact?

- Targeting: Which markets demonstrate high-intent and are ready for early adoption?

We combine demand signals and competitor moves to build a realistic, data-backed roadmap for scaling your business.

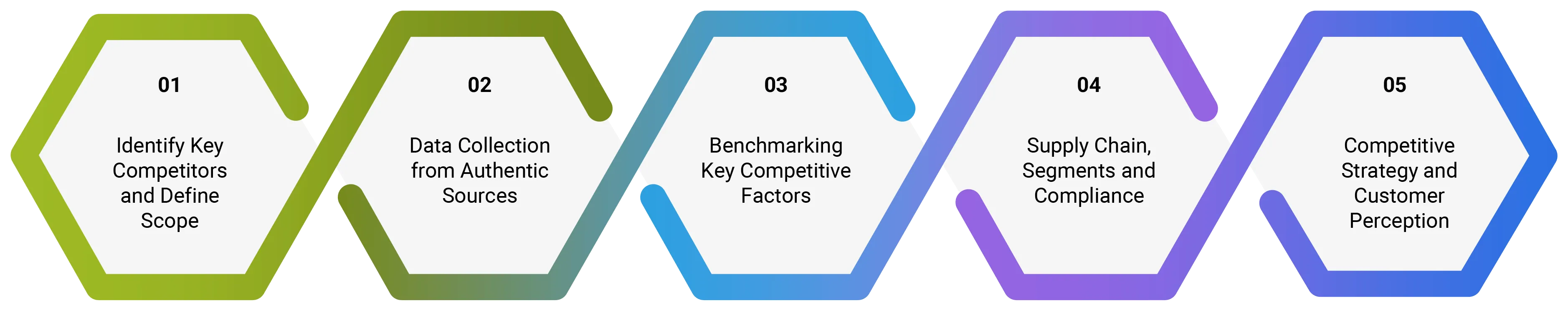

How does Kings Research conduct Competitive Analysis?

What does the final deliverable include?

Depending on the engagement, your Strategic Intelligence package will include:

- Executive Summary & Market Overview.

- 5-10 Year Forecast Models (Granular & rigorously validated).

- Demand & Supply-Side Analysis.

- Competitive Benchmarking & Pricing Structure.

- Strategic Action Roadmap: Carefully crafted, high-impact recommendations designed to inform and accelerate decisions for boardrooms, GTM teams, and investors.

We combine demand signals and competitor moves to build a realistic, data-backed roadmap for scaling your business.

How do I start a custom research engagement?