Top down and bottom up forecasting represent the two most widely used methods for market sizing and strategic planning. Although each approach aims to estimate market potential and future demand, the way they gather evidence, structure assumptions, and model growth differs significantly. Understanding these differences is essential for selecting the method that produces the most reliable and defensible insights. In a landscape shaped by rapid technological change and volatile market conditions, choosing the right forecasting method can determine the accuracy of investment decisions and long-term strategy.

Understanding the Strategic Role of Forecasting Methods

Market forecasting serves as the foundation for product planning, capital allocation, competitive analysis, and long-range decision support. When the methodology aligns with the market structure and data environment, forecasts become more precise and more actionable. When the methodology is mismatched, forecasts may appear complete but remain structurally weak. As industries adopt technologies that are more complex and global markets become more interconnected, the ability to align forecasting methods with business needs becomes a strategic differentiator for research firms and decision makers.

Top down and bottom up approaches both offer clear strengths. Top down forecasting excels in understanding broad industry direction and macro level constraints, while bottom up forecasting provides a ground level view built on unit level behavior. The challenge for leaders lies in determining when each method is appropriate and how the two approaches complement each other in a modern forecasting framework.

How the Top Down Approach Interprets Market Potential

Top down forecasting begins with a high level view of the total addressable market and works downward to estimate the share that a product, service, or segment can capture. Analysts start by mapping global or regional market potential and then narrow the scope further by applying filters related to industry participation, adoption rates, and competitive structure. This method relies heavily on macroeconomic indicators, industry reports, infrastructure capacity, and structural market trends.

Because this approach offers a clear view of the market from a strategic distance, it can reveal long-term demand cycles and broad growth patterns. It is particularly effective in markets that are well documented, stable, or heavily influenced by external conditions such as regulatory shifts, demographic changes, or commodity availability. Top down forecasting also helps organizations understand the maximum achievable scale of an opportunity before investing in deeper research.

The Analytical Structure of Bottom Up Forecasting

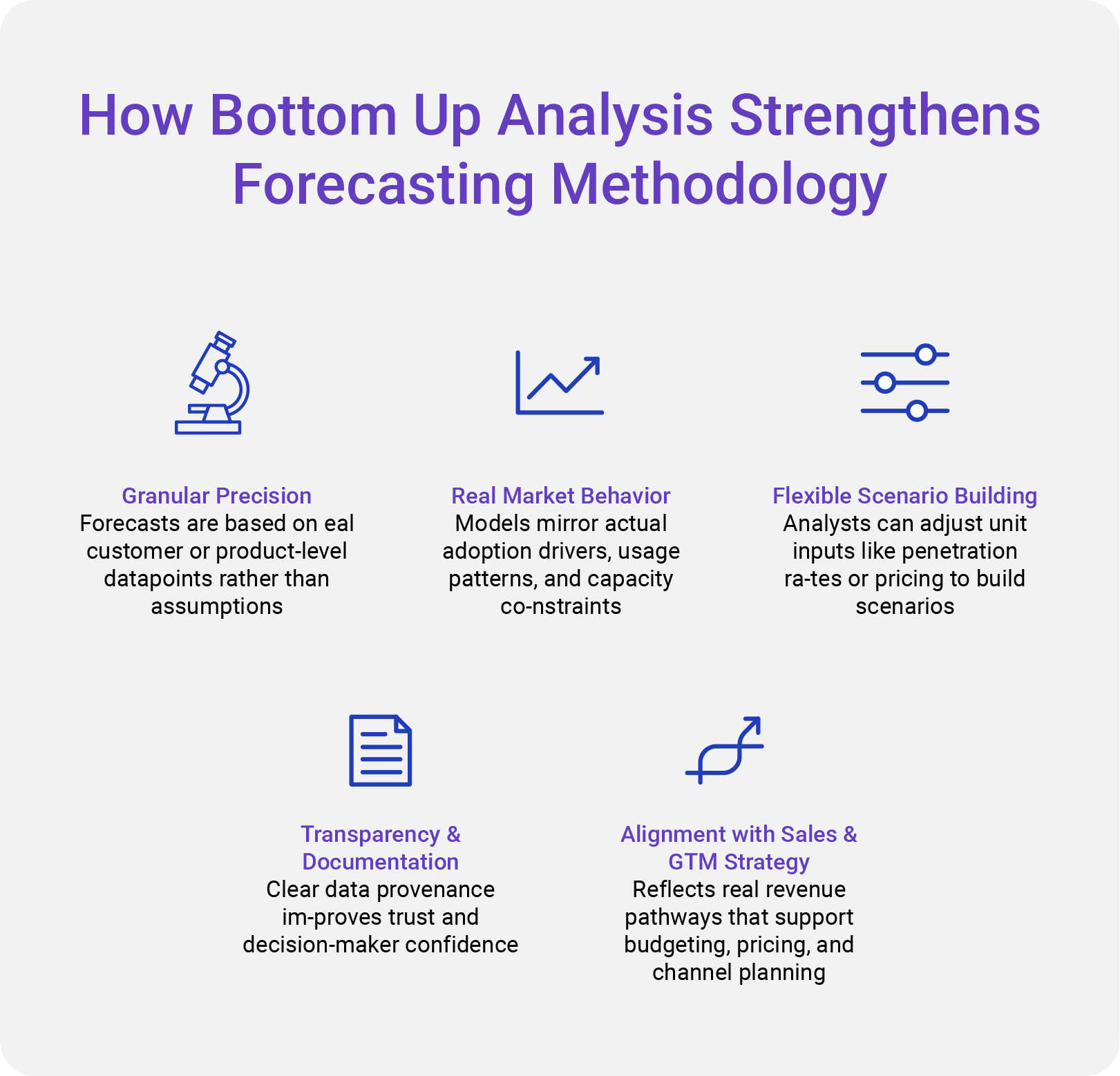

Bottom up forecasting works in the opposite direction. Instead of beginning with a global assumption, analysts build the forecast from unit level activity within individual segments. The process starts with segment definition, followed by unit counts, pricing structures, and operational indicators such as capacity or utilization rates. The bottom up method uses real world behavior to estimate demand and is particularly strong in markets with varied adoption patterns or fragmented customer bases.

This approach produces highly detailed estimates and identifies where value is created at the ground level. It is most effective for markets driven by operational decisions, emerging technologies, and specialized use cases where macro models fail to capture nuance. Because each segment is modeled independently, bottom up forecasting creates a transparent structure where every assumption can be traced back to evidence.

Key Differences between Top Down and Bottom Up Forecasting

Top down and bottom up forecasting differ in both structure and how they interpret market behavior. Top down forecasting simplifies the market into large, directional estimates. Bottom up forecasting reconstructs the market by aggregating real activity. Their assumptions differ, their data sources differ, and the risk of error differs.

Top down forecasting relies on market saturation limits, industry averages, and macroeconomic conditions. Its strength lies in perspective, but it can obscure emerging segments or localized dynamics. Bottom up forecasting relies on unit level precision and direct observation. Its strength lies in granularity, but its accuracy depends on the quality of underlying data.

Where Top Down Forecasting Delivers the Most Value

Top down forecasting is ideal when leaders need to understand the overall scale of a market or when macro forces dominate the competitive landscape. It supports strategic planning in situations where broad trends drive demand such as long-term infrastructure investments, demographic driven consumption patterns, or sector wide technology shifts. It is also useful when market level data is abundant but granular operational data is limited.

Top down forecasts are commonly used during early stage strategy development, initial market entry evaluations, and high-level financial modeling. They allow executives to test whether an opportunity is large enough to justify detailed analysis before committing resources. When paired with internal strategic considerations, top down forecasting helps organizations decide where to focus and how to allocate capital.

Where Bottom Up Forecasting Delivers the Most Value

Bottom up forecasting is most appropriate when leaders require precision, granularity, and direct alignment with operational realities. It is suited for markets where adoption varies significantly across industries, regions, or customer groups. It is also preferred when forecasting for innovative technologies, niche segments, or situations where unit level behavior determines overall demand.

This method is particularly valuable in product planning, competitive benchmarking, and high stakes investment decisions. Because it integrates real world evidence, bottom up forecasting provides a more dependable foundation for pricing strategies, capacity planning, and go to market initiatives. It is also essential for organizations developing financial models that depend on accurate volume assumptions.

How Integrated Forecasting Models Improve Reliability

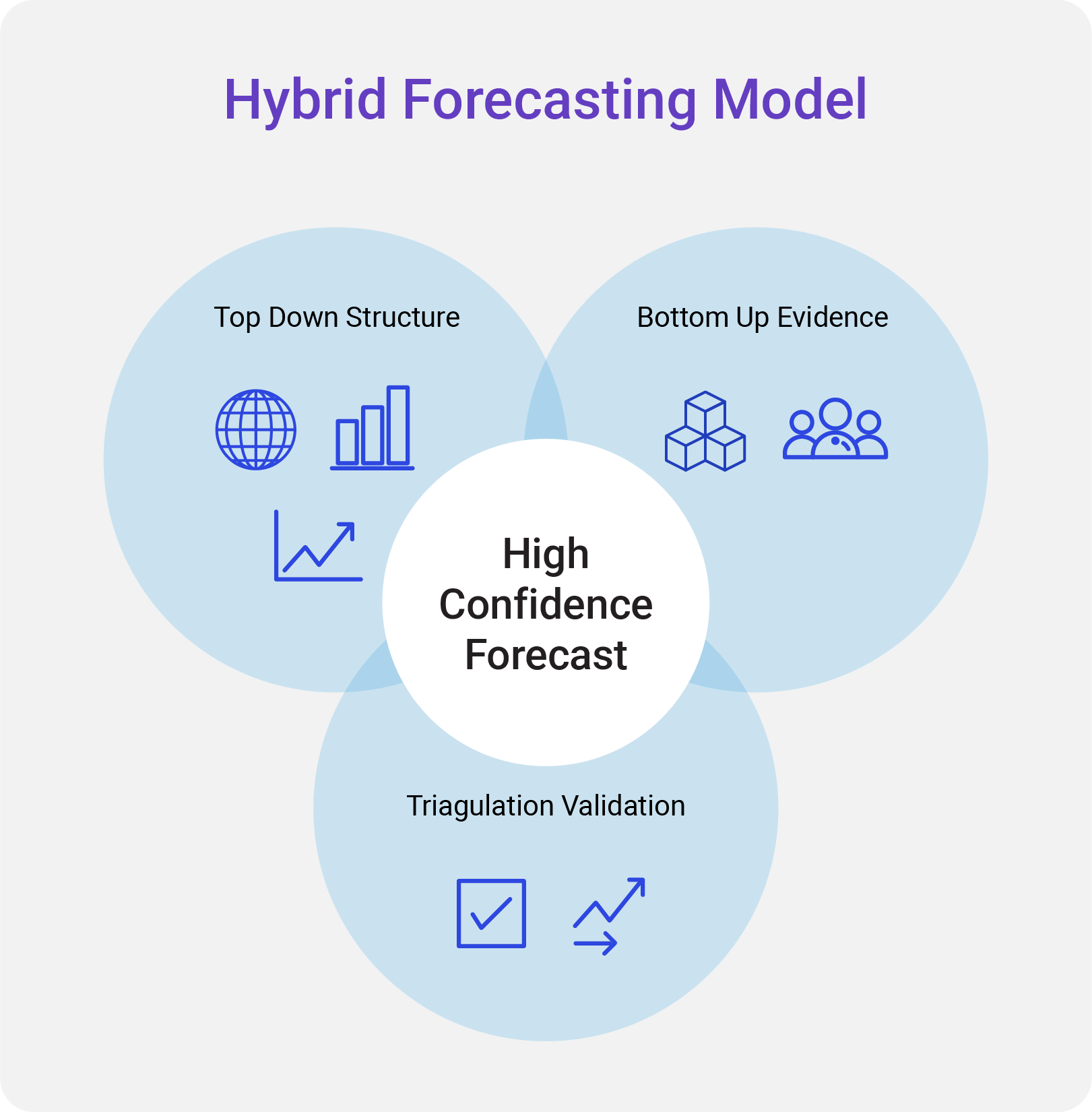

In many scenarios, the most reliable forecasts emerge when top down and bottom up methods are integrated. Market research firms increasingly use both approaches to triangulate results and validate assumptions. When the two methods converge, forecast confidence increases. When they diverge, analysts investigate the drivers of the discrepancy to refine the model.

Combining both methods is recommended when entering new markets, evaluating disruptive shifts, or presenting forecasts to stakeholders who require methodological transparency. The integration of both approaches also supports scenario modeling and risk assessment because it provides multiple vantage points for understanding demand.

Choosing the Right Forecasting Model for Your Business

The choice between top down and bottom up forecasting depends on the strategic purpose of the forecast, the maturity of the market, the availability of data, and the level of precision required. Leaders should begin by clarifying the decisions the forecast must support. If the goal is to size a market quickly or assess high-level potential, top down forecasting is sufficient. If the goal is to build a defensible financial model or plan operational capacity, bottom up forecasting is more appropriate.

Leaders should also assess the complexity of the market environment. Highly fragmented or rapidly evolving markets benefit from bottom up methodologies because they capture real changes faster than macro models. More stable markets with consistent patterns can rely more heavily on top down approaches. In most cases, the right answer is a balanced combination of both.

Methodology as a Competitive Advantage for Research Firms

Choosing the right forecasting method directly influences the credibility of the insights delivered to clients. Firms that base their forecasts on the wrong methodology risk producing outputs that misguide product development, go to market timing, or capital deployment. Firms that design their methodology around the unique characteristics of each market achieve stronger accuracy, higher client trust, and more consistent outcomes.

The market research industry is moving toward hybrid forecasting frameworks that use top down structure, bottom up evidence, and triangulation as the final verification layer. This blended approach aligns with client expectations for transparency, defensibility, and analytical depth.

Conclusion

Top down and bottom up forecasting represent two different yet complementary perspectives on market behavior. When used with clarity and methodological discipline, each approach helps leaders understand the true scale, direction, and momentum of a market. The most resilient forecasts come from a synthesis of both methods supported by robust triangulation. Kings Research continues to advance this integrated approach by combining structured top down models with evidence driven bottom up frameworks and validation systems that reinforce accuracy at every step.