Market Definition

The market comprises specialized platforms designed to store, manage, and index high-dimensional vector embeddings that represent unstructured data such as text, images, and audio for semantic retrieval.

The databases are critical to generative AI applications, supporting real-time natural language processing, computer vision, and personalized recommendations across BFSI, retail and e-commerce, and healthcare. As a result, the market is growing due to increased adoption of context-aware AI to extract value from large volumes of unstructured data.

Vector Database Market Overview

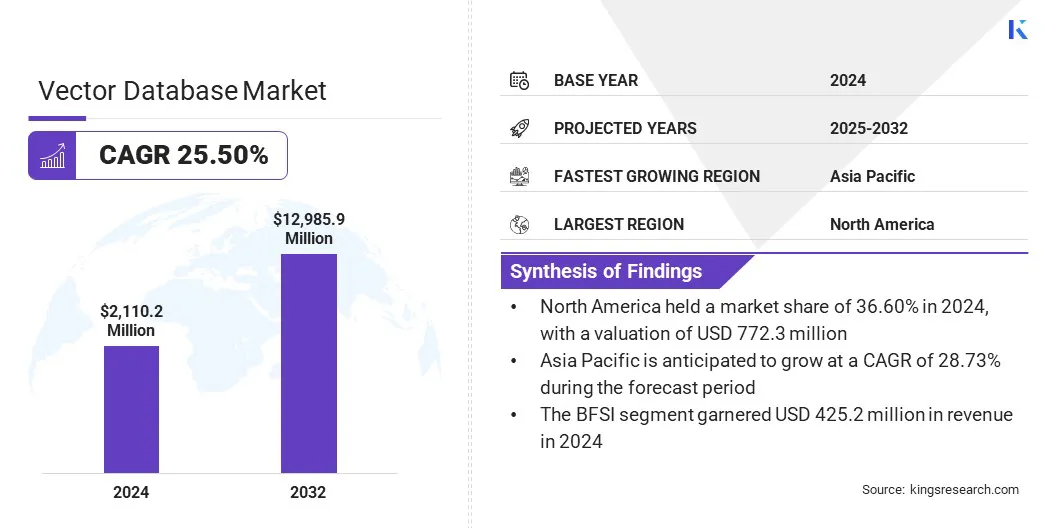

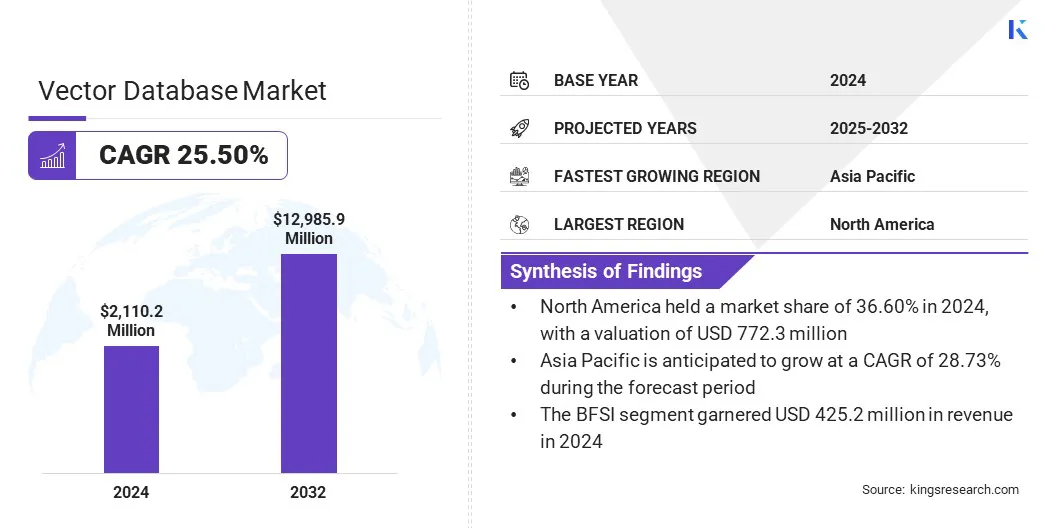

The global vector database market size was valued at USD 2,110.2 million in 2024 and is projected to grow from USD 2,648.4 million in 2025 to USD 12,986.4 million by 2032, exhibiting a CAGR of 25.5% during the forecast period.

Market growth is driven by rapid adoption of generative AI, which necessitates efficient processing of high-dimensional unstructured data. As enterprises integrate natural language processing and computer vision, vector databases are becoming essential for scaling personalized recommendation systems and delivering real-time, context-aware business intelligence.

Key Market Highlights:

- The vector database industry size was recorded at USD 2110.2 million in 2024.

- The market is projected to grow at a CAGR of 25.5% from 2025 to 2032.

- North America held a share of 36.6% in 2024, valued at USD 772.3 million.

- The natural language processing technology segment garnered USD 1077.3 million in revenue in 2024.

- The solutions segment is expected to reach USD 8467.7 million by 2032.

- The retail & e-commerce segment is anticipated to witness the fastest CAGR of 28.35% over the forecast period.

- Asia Pacific is anticipated to grow at a CAGR of 28.73% through the projection period.

Major companies operating in the vector database market are Microsoft, Alibaba Cloud, Elastic, MongoDB, Redis, SingleStore, DataStax, Zilliz, Pinecone, Google, AWS (Amazon Web Services), KX, Milvus, GSI Technology, and Clarifai.

The rapid adoption of generative AI and large language models (LLMs) is boosting demand for scalable, high-performance infrastructure capable of storing, processing, and querying high-dimensional vector data. As AI applications increasingly rely on embeddings for contextual understanding, traditional databases are becoming insufficient.

Moreover, industries such as BFSI and retail are experiencing growing demand for real-time, personalized recommendations that require low-latency, high-precision semantic search. These factors are accelerating the adoption of vector databases to support efficient similarity search, contextual retrieval, and advanced AI-driven decision-making at scale.

- In March 2024, Kinetica launched a real-time vector similarity search engine leveraging NVIDIA RAPIDS RAFT to transform market. This solution delivers five times faster ingestion, providing enterprises a strategic opportunity to maximize growth through immediate, low-latency generative AI analytics.

How is rising unstructured data and demand for advanced AI applications driving vector database adoption across industries?

The Organizations are leveraging these databases to support advanced natural language processing, computer vision, and retrieval-augmented generation in generative AI models, enabling actionable insights from complex datasets. Furthermore, rising demand for hyper-personalized recommendations in retail and media is accelerating the deployment of vector search solutions to enhance user engagement and operational efficiency.

- In February 2024, Google Cloud integrated vector support and LangChain capabilities across its entire database portfolio to accelerate generative AI development globally. This strategic enhancement allows enterprises to implement advanced retrieval-augmented generation workflows and optimized search.

How do high computational complexity, legacy integration challenges, and skills shortages constrain enterprise adoption of vector databases?

Enterprises, particularly in regulated sectors like BFSI and healthcare, face difficulties integrating vector search with legacy infrastructure while ensuring strict data privacy compliance. Additionally, the scarcity of skilled personnel proficient in optimizing vector algorithms and managing unstructured data pipelines limits widespread adoption. These factors create significant barriers to entry, slowing the deployment of advanced AI applications in cost-sensitive markets.

To mitigate these challenges, market players are prioritizing the development of fully managed, cloud-native solutions that reduce infrastructure complexity and operational costs.

Incorporating hybrid search capabilities allows for smoother integration with existing systems, while enhanced encryption and role-based access controls address security concerns in sensitive industries. Furthermore, vendors are investing in comprehensive developer training and automated optimization tools, democratizing access to vector technology and accelerating its deployment across retail, IT, and manufacturing sectors.

How is the convergence of hybrid search with cloud-native services reshaping accuracy and accessibility in vector database adoption?

The vector database market is witnessing a strategic shift toward hybrid search, merging vector capabilities with traditional databases to refine accuracy. This convergence allows industries like BFSI and retail to optimize recommendation systems by combining semantic context with keyword precision.

Furthermore, the rapid adoption of cloud-native managed services is expanding access to infrastructure and streamlining the deployment of natural language processing solutions. Collectively, these trends are accelerating enterprise adoption of vector databases by lowering implementation complexity and cost, while broadening use cases beyond early AI adopters.

- In October 2025, Elastic introduced DiskBBQ, a disk-optimized format designed to improve vector search scalability by reducing memory dependency in large‑scale applications. The solution aims to lower infrastructure costs and enhance performance for IT sectors, offering a cost-effective alternative to HNSW.

Vector Database Market Report Snapshot

|

Segmentation

|

Details

|

|

By Offering

|

Solutions (Vector Generation, Vector Search, Storage And Retrieval Vectors), Services (Professional Services, Managed Services)

|

|

By Technology

|

Natural Language Processing (Semantic Search, Document/Text Retrieval, Sentiment Analysis, Chatbots & Virtual Assistants, Others), Computer Vision (Image Retrieval, Object Detection, Face/Image Recognition, Others), Recommendation Systems (Collaborative Filtering, Content-Based Filtering, Session-Based Recommendations, Others)

|

|

By Industry

|

BFSI, Retail & E-commerce, Healthcare & Life Sciences, IT & ITeS, Media & Entertainment, Manufacturing, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Offering (Solutions and Offerings): The solutions segment earned USD 1452.8 million in 2024, primarily due to rising demand for integrated, end-to-end digital solutions across enterprise customers.

- By Technology (Natural Language Processing, Computer Vision, and Recommendation Systems): The computer vision segment held a share of 27.9% in 2024, fueled by rapid adoption across manufacturing and other industries.

- By Industry (BFSI, Retail & E-commerce, Healthcare & Life Sciences, IT & ITeS, Media & Entertainment, Manufacturing, and Others): The BFSI segment is projected to reach USD 3,122.7 million by 2032, supported by rising AI investments, proliferation of smart cameras, and widespread enterprise adoption.

How Are Generative AI Leadership in North America and Rapid Digitization in Asia-Pacific Reshaping the Global Vector Database Market?

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

North America vector database market share stood at 36.6% in 2024, valued at USD 772.3 million. The growth of the North American market is driven by the region’s position as a leading hub for generative artificial intelligence and large language model (LLM) development.

In addition, the widespread adoption of natural language processing (NLP) and computer vision technologies across the BFSI and healthcare sectors—particularly for fraud detection, risk analytics, and drug discovery—is contributing to market expansion. Furthermore, the strong presence of major cloud hyperscalers and continued investment in scalable, low-latency search and retrieval architectures are reinforcing the region’s market leadership.

- In April 2024, GSI Technology released two Gemini-I APU servers featuring compute-in-memory technology, enhancing fast vector search and AI workloads. This innovation strengthens the company's solutions segment by offering high-capacity, low-power processing, unlocking significant efficiency opportunities for healthcare and IT infrastructure.

The Asia-Pacific vector database industry is set to grow at a CAGR of 28.73% over the forecast period. This notable expansion is propelled by rapid enterprise digitization across key economies such as China and India, coupled with favorable government initiatives supporting AI ecosystems.

Expanding retail and e-commerce sectors are leveraging vector search for personalized recommendations, thereby stimulating demand. Additionally, rising unstructured data volumes and modernization of IT frameworks by local technology leaders are leading to the widespread uptake of vector database solutions.

- In July 2023, Alibaba Cloud upgraded its AnalyticDB vector engine, enabling enterprises to access large language models for custom generative AI. This upgrade lowers financial and technical barriers, allowing faster deployment of sector-specific applications and improved operational efficiency.

Regulatory Frameworks

- The U.S. governs vector data through state laws such as CCPA and federal oversight by the FTC on data privacy. The NIST AI Risk Management Framework provides guidance on secure and responsible vector deployment.

- The EU enforces GDPR to ensure data minimization and the "right to be forgotten" within vector embeddings. The EU AI Act mandates transparency and compliance for high-risk AI systems using these databases.

- China regulates vector databases under the Personal Information Protection Law and Data Security Law, with a focus on national security. The CAC requires strict security assessments for cross-border transfer of training data and embeddings.

- Japan oversees vector data via the APPI, requiring explicit consent for processing personal information in embeddings. The Digital Agency promotes "Data Free Flow with Trust" while strictly monitoring non-reproductive data usage in AI.

- The ISO establishes global technical standards such as ISO/IEC 42001 for AI governance. The OECD and G7 Hiroshima Process advocate for interoperable privacy frameworks for responsible cross-border vector data management.

Competitive Landscape

Major players operating in the vector database industry are leveraging their extensive cloud ecosystems to offer scalable vector data solutions. At the same time, specialized providers focus on high-performance similarity search and AI-native capabilities. This diverse competitive landscape is fostering rapid innovation, strategic partnerships, and continuous product advancements across the market.

- In September 2025, MongoDB integrated search and vector search capabilities into its self-managed offerings, enhancing AI application development for medical imaging. This integration allows PET/CT and PET/MRI manufacturers to streamline radiotracer analysis and hybrid search locally, reducing system complexity and accelerating diagnostic breakthroughs in global oncology and neurology markets..

Key Companies in Vector Database Market:

- Microsoft

- Alibaba Cloud

- Elastic

- MongoDB

- Redis

- SingleStore

- DataStax

- Zilliz

- Pinecone

- Google

- AWS (Amazon Web Services)

- KX

- Milvus

- GSI Technology

- Clarifai

Recent Developments

- In February 2024, Marqo secured USD 12.5 million in Series A funding, led by Lightspeed, to advance its vector search platform. The investment supports the development of multimodal search and retrieval-augmented generation capabilities, enabling enterprises to extract value from unstructured data.