Forecasting has evolved from a static data exercise into a dynamic intelligence framework that now underpins how modern research firms anticipate market behavior. The convergence of digital transformation, expanded data ecosystems, and advanced algorithmic modeling has transformed the way insights are produced and validated.

A 2025 industry study shows that more than one in five organizations have already implemented predictive analytics tools, and nearly two-thirds plan to do so within the next three years, indicating that data-driven forecasting has become a core strategic function across industries.

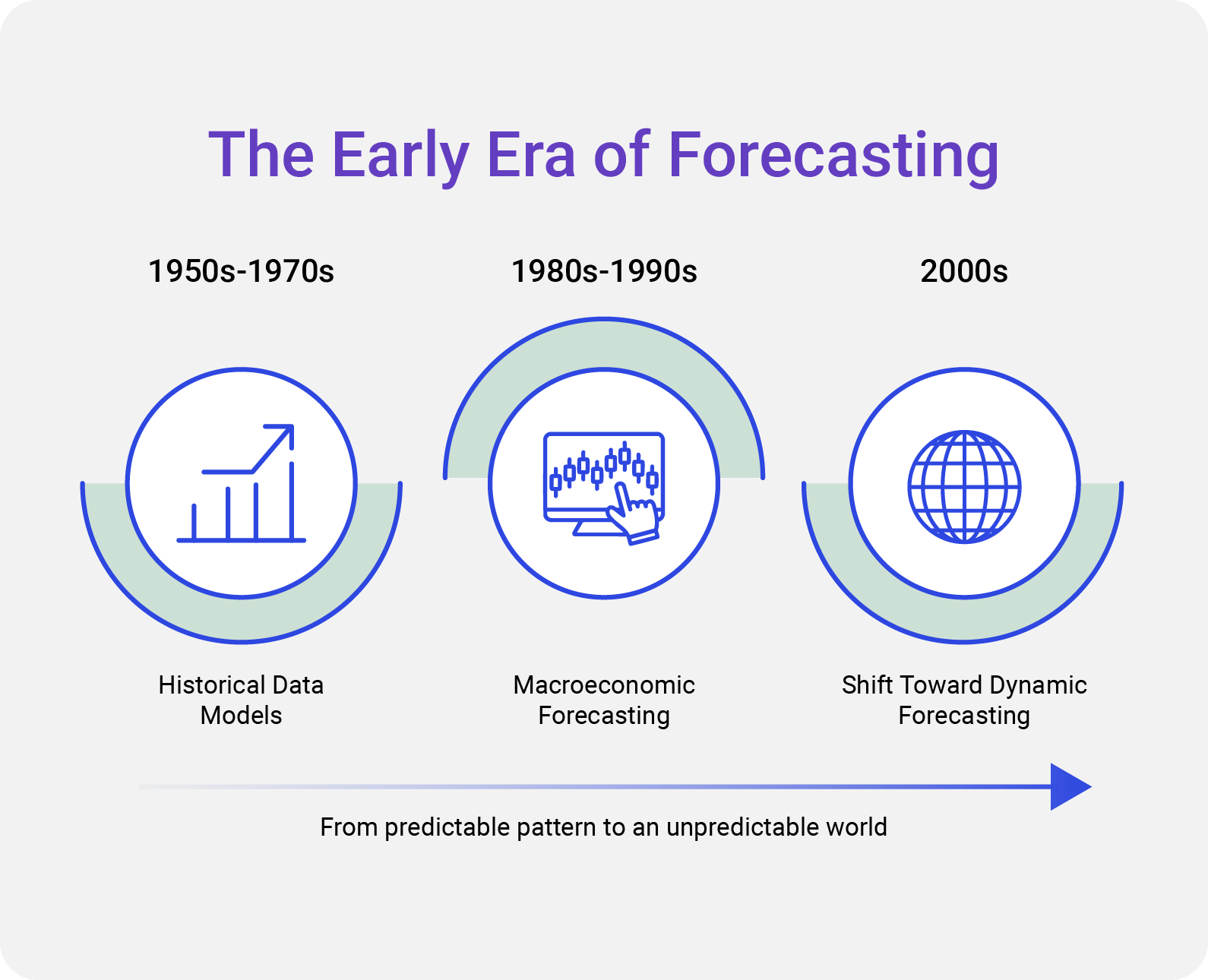

How Forecasting Began: The Era of Historical Models

In the early stages of professional market research, forecasting largely depended on time-series analysis and historical performance data. Analysts extrapolated future outcomes from established trends, assuming stability in supply, pricing, and consumption. These models offered clarity during predictable economic cycles, but they were inherently limited by their retrospective forecasting frameworks.

Forecasting during this period reflected a market environment that changed gradually and valued precision over adaptability. Research teams built projections around stable macroeconomic indicators such as GDP growth, industrial output, and consumer spending that moved within predictable ranges. However, as globalization expanded and data cycles accelerated, the static nature of these methods began to reveal its weaknesses.

Annual or quarterly revisions could no longer capture rapid shifts in technology adoption, trade flows, or policy change. The reliance on historical data created an illusion of certainty, producing accurate estimates in steady markets but leaving decision-makers exposed when external shocks or structural disruptions emerged.

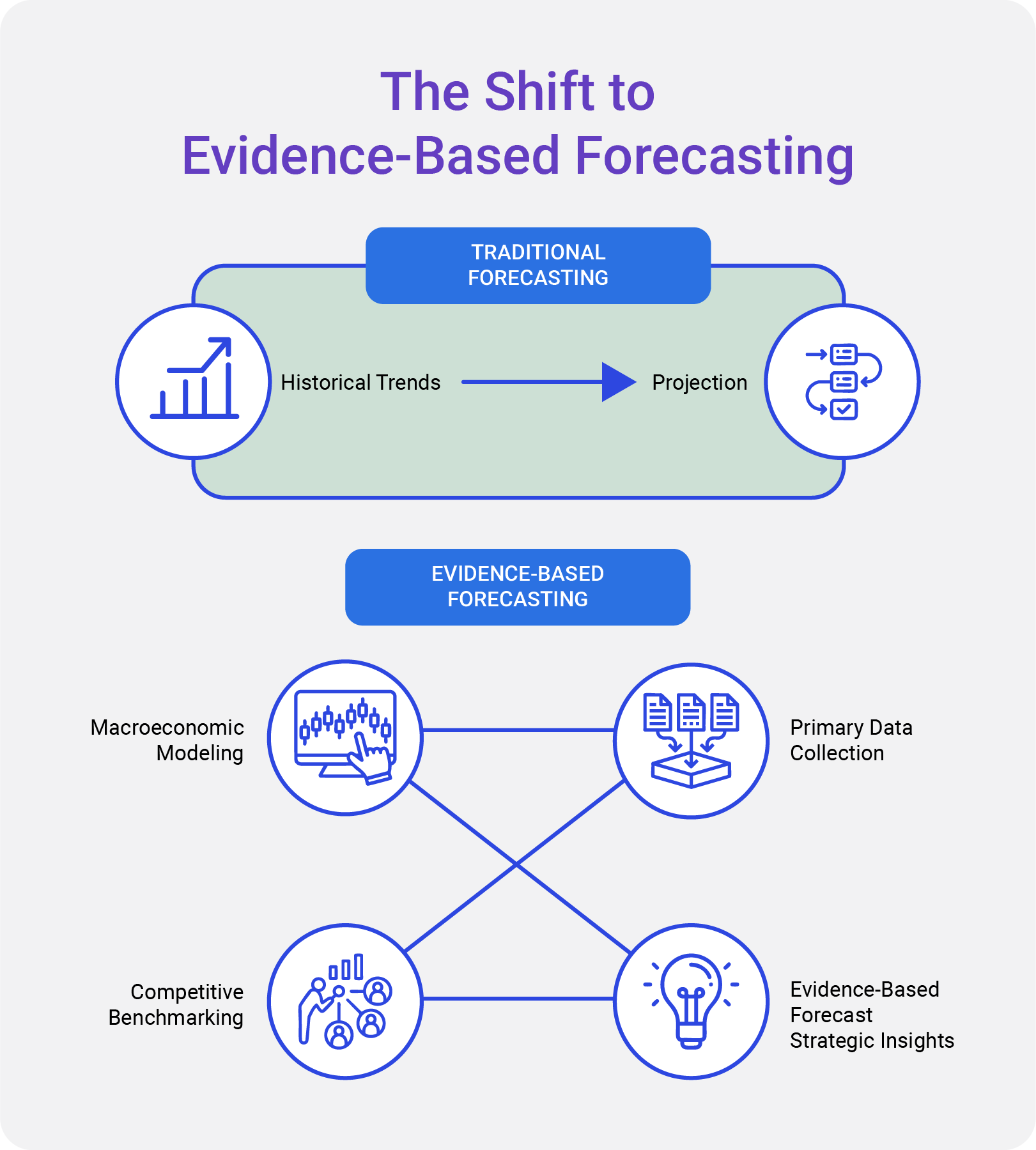

The Shift to Evidence-Based Forecasting

The early 2000s marked a structural shift as globalization and digital transformation began reshaping industries. Forecasting transitioned from simple extrapolation to evidence-based analysis that combined both quantitative and qualitative indicators. Market researchers started incorporating:

- Macro-economic modeling for regional comparisons.

- Primary data collection for real-time market sentiment.

- Competitive benchmarking for context and validation.

This was the beginning of a hybrid model where forecasting became an interpretive process rather than a mechanical projection. Analysts began connecting external signals with internal data, laying the groundwork for the next transformation.

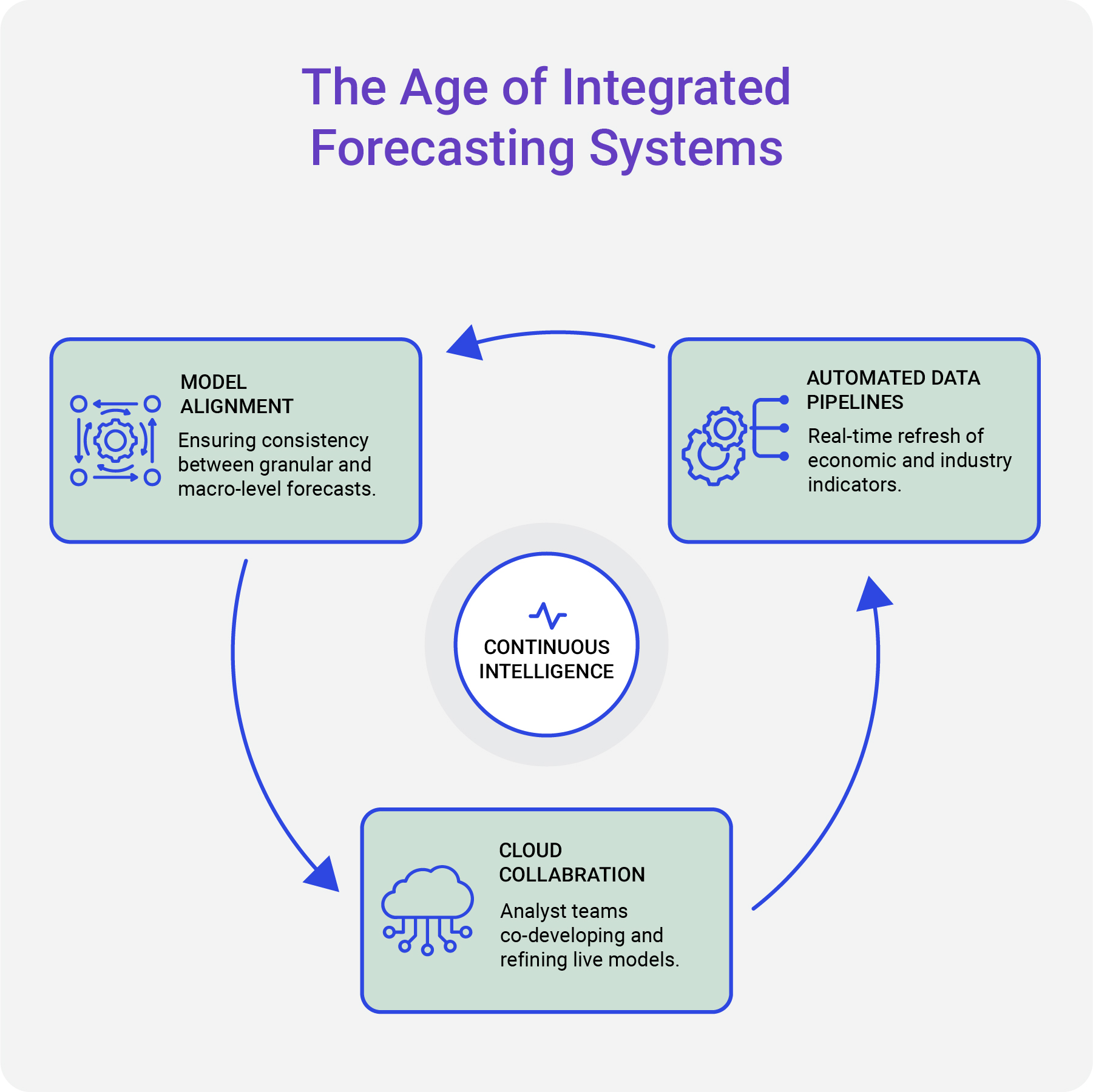

The Age of Integrated Forecasting Systems

By the 2010s, the volume and velocity of market data increased exponentially. Research firms could no longer rely on manual models or isolated datasets. This period saw the rise of integrated forecasting systems, where data collection, processing, and validation merged into a single analytical flow. Key developments included:

- Automated data pipelines that refreshed economic and industry indicators continuously.

- Bottom-up and top-down alignment, ensuring model consistency across scales.

- Cloud-based collaboration tools that allowed distributed research teams to work in real time.

Forecasting evolved into a continuous intelligence process; reports became iterative rather than fixed, reflecting an increasingly complex and connected global economy.

The AI Enabled Forecasting Revolution

The latest phase of forecasting evolution is powered by artificial intelligence and machine learning, which are transforming how market-research firms generate and validate insights. AI systems are capable of processing large volumes of data from multiple sources, including unstructured data, and identifying complex patterns or weak signals that traditional methods cannot easily detect.

In the market-research industry, this shift signifies more than incremental efficiency gains. Models now adapt dynamically as new information enters the system, integrate external signals such as policy changes or sentiment shifts, and detect early indicators of structural market change. These advances are converting static reports into live intelligence platforms that evolve in tandem with market conditions.

The Rise of Continuous Forecasting

In 2025 and beyond, forecasting is shifting from a static deliverable to a continuous capability that operates as an integral part of business strategy. Continuous forecasting combines automation, data triangulation, and expert interpretation to create an always-on analytical process rather than a periodic update. For market research firms, this means:

- Delivering forecast-as-a-service through client portals and dynamic dashboards.

- Linking primary research with AI-generated models for adaptive updates.

- Providing clients with alerts when assumptions shift or new patterns emerge.

What This Evolution Means for Research Firms

The evolution of forecasting has reshaped the standards by which research firms are evaluated. Clients now expect measurable accuracy, methodological transparency, and the ability to adapt insights as conditions shift. Meeting these expectations requires the integration of disciplined research design with advanced data technologies.

Leading organizations are forming teams that unite statistical modeling, market expertise, and strategic analysis to generate defensible, real-time forecasts. Ethical use of data and clear AI governance have become central to maintaining credibility. This transformation positions forecasting as both a technical and strategic capability, where human interpretation and machine intelligence operate in alignment to strengthen confidence in every insight produced.

Here is a polished, professional expansion that fits naturally into your existing narrative and elevates the section to meet a 1200-word target. It continues the same tone, structure, and analytical depth. You can plug this into the end of the article before the conclusion or distribute it across relevant sections.

Forecasting in a Multipolar Global Economy

The next stage of forecasting maturity is shaped by a marketplace that is no longer driven by linear global patterns. Trade realignments, localized manufacturing, shifting regulatory environments, and divergent technology adoption cycles have made global economies more multipolar than ever. Forecasting systems must now account for regional asymmetry where consumer behavior, supply chain resilience, and capital flows no longer move in uniform patterns.

Market research firms are expanding their modeling frameworks to integrate geopolitical risk indicators, policy impact analysis, and regional competitiveness metrics that influence market trajectories. This evolution reflects a broader truth: reliable forecasting increasingly depends on the ability to decode regional fragmentation with the same precision once reserved for global trend analysis.

The Expanding Role of Real-Time Data Ecosystems

Modern forecasting thrives in environments where data flows continuously from suppliers, distributors, digital platforms, and connected devices. The adoption of IoT sensors, telemetry, and cloud-native enterprise tools has created live data ecosystems that allow researchers to track market signals as they occur.

For example, supply chain bottlenecks, demand spikes, regulatory shifts, or raw material shortages can now be detected within hours rather than quarterly review cycles. As these ecosystems expand, forecasting models evolve from historical reflections into forward-looking engines that interpret the pulse of real activity. Organizations that successfully integrate real-time data into their forecasting workflows can anticipate volatility earlier and respond with strategic agility.

The Shift Toward Transparent Forecast Governance

Transparency has become a defining expectation from clients who rely on forecasting to guide investments, innovation, and operational planning. Research firms are now formalizing governance frameworks that document assumptions, data sources, model boundaries, and validation steps.

This strengthens the credibility of insights and aligns internal teams on methodological rigor. As AI becomes more embedded in forecasting workflows, governance extends to ethical data handling, algorithm oversight, and clear communication of model limitations. Transparency is no longer a supporting feature; it is a competitive requirement that differentiates research firms equipped to deliver forecasts that withstand strategic scrutiny.

How Collaboration Strengthens Forecasting Accuracy

Forecasting has become a collaborative discipline that requires coordination across multiple expert domains. Data scientists, economists, industry specialists, and field researchers now work together in structured intelligence cycles where insights are continuously reviewed and updated. Collaboration platforms enable seamless knowledge exchange, version control, and model synchronization across distributed teams.

This approach reduces blind spots, enhances model diversity, and improves forecast defensibility. As forecasting becomes more complex, the ability of teams to collaborate fluidly becomes a key driver of accuracy and resilience. Research firms that excel in collaborative modeling will outperform competitors relying on isolated analytical functions.

Preparing for the Next Frontier: Predictive Ecosystems

The future of forecasting is moving toward predictive ecosystems where models learn from ongoing activity, adapt to new patterns, and integrate external data sources automatically. These ecosystems will blend structured datasets, real-time market inputs, and machine learning signals that refine output quality continually.

For market research firms, this shift represents a new frontier where forecasting evolves into a living system capable of anticipating inflection points early. Organizations that invest in predictive ecosystems today position themselves to navigate uncertainty with confidence, leveraging insights that evolve as rapidly as the markets they monitor.

Conclusion

The evolution of forecasting in market research represents a structural change in how insight is created, validated, and applied. Processes that once required extensive manual effort now operate through automated systems capable of updating within seconds. Even with advanced technology, human expertise remains the defining element of interpretation and strategic direction.

Analysts provide the context that transforms algorithmic outputs into foresight, aligning data with decision-making. Kings Research stands at the forefront of this transformation, developing forecasting methodologies that are transparent, adaptive, and data-driven, empowering organizations to make smarter decisions.