Market Definition

The market involves technologies and solutions that enable the automatic collection, storage, and analysis of data for improved operational efficiency. It includes hardware, software, and services that support identification methods such as barcodes, RFID, smart cards, OCR, biometrics, and voice recognition.

The report includes segmentation based on component, product, vertical, and region. Key end-use sectors such as retail, transportation, healthcare, manufacturing, and BFSI leverage these technologies to enhance inventory management, streamline processes, and ensure accurate data tracking.

Automatic Identification and Data Capture Market Overview

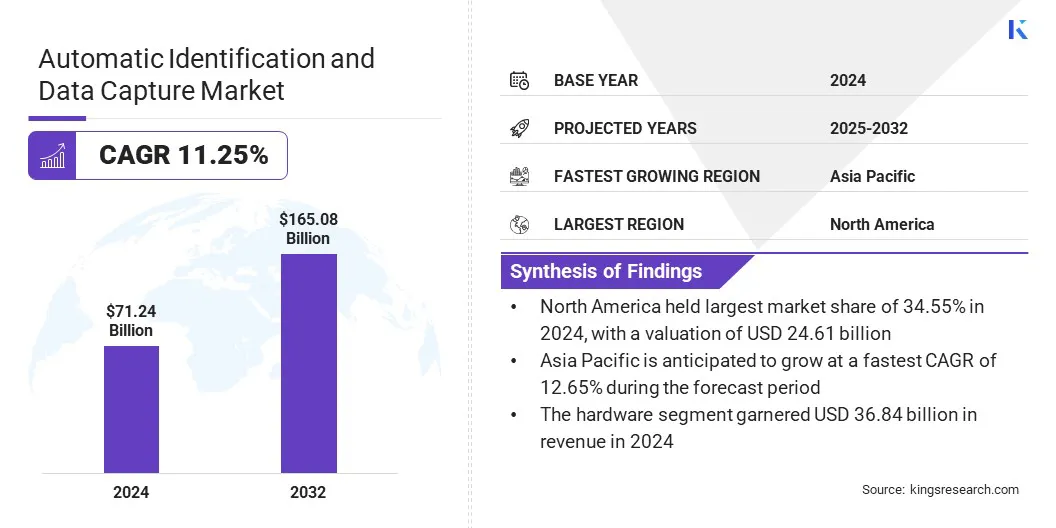

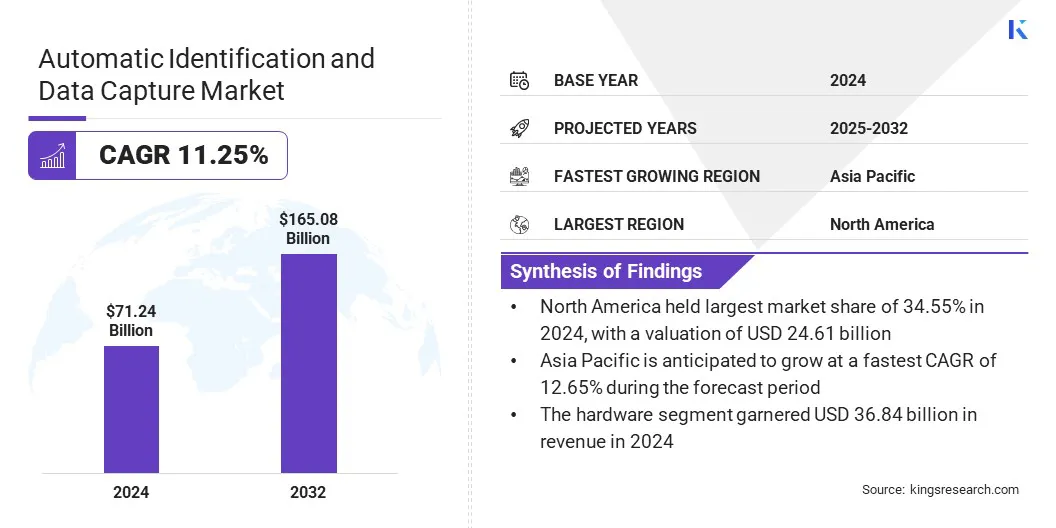

The global automatic identification and data capture market size was valued at USD 71.24 billion in 2024 and is projected to grow from USD 78.26 billion in 2025 to USD 165.08 billion by 2032, exhibiting a CAGR of 11.25% over the forecast period.

The market is driven by the integration of Internet of Things (IoT) technologies and smart logistics, which enable real-time asset tracking, predictive analytics, and optimized supply chain operations. Additionally, the adoption of cloud-based AIDC solutions allows businesses to access centralized data, enhance operational efficiency, and scale systems rapidly.

Key Highlights

- The automatic identification and data capture industry size was valued at USD 71.24 billion in 2024.

- The market is projected to grow at a CAGR of 11.25% from 2025 to 2032.

- North America held a market share of 34.55% in 2024, with a valuation of USD 24.61 billion.

- The barcode systems segment garnered USD 23.17 billion in revenue in 2024.

- The hardware segment is expected to reach USD 79.29 billion by 2032.

- The retail & e-commerce segment secured the largest revenue share of 26.55% in 2024.

- Asia Pacific is anticipated to grow at a CAGR of 12.65% over the forecast period.

Major companies operating in the automatic identification and data capture market are Zebra Technologies Corporation, Datalogic S.p.A., Cognex Corporation, Honeywell International Inc., SICK AG, TOSHIBA CORPORATION, SATO Corporation, Impinj, Inc., Alien Technology LLC, Avery Dennison Corporation, Epson, Panasonic Corporation, KEYENCE CORPORATION, NEC Corporation, and DENSO WAVE INCORPORATED.

Expansion of e-commerce and retail automation is significantly driving the growth of the market. Increasing online retail activity is creating demand for accurate inventory tracking and efficient order fulfillment. This rising need is encouraging retailers to implement barcode scanning, RFID tracking, and smart labeling systems for improved operational efficiency.

Adoption of these technologies supports automated warehouses and fulfillment centers in handling large volumes of products effectively. Integration of AIDC with enterprise resource planning (ERP) and warehouse management systems ensures better data accuracy and seamless process coordination.

- In May 2024, Zebra Technologies introduced its FS42 fixed industrial scanner and the 3S Series 3D sensors for high‑throughput manufacturing and logistics applications. The FS42 includes a neural processing unit (NPU) for deep‑learning based inspection and barcode/character recognition, and the 3S sensors provide sub‑millimetre 3D vision for large or moving objects.

What role does IoT and smart logistics integration play in market expansion?

Integration of IoT and smart logistics is accelerating the growth of the automatic identification and data capture market. AIDC technologies enable real-time tracking of assets, providing visibility across warehouses, supply chains, and distribution centers. This capability helps industries optimize fleet operations, reduce losses, and improve delivery efficiency.

Data collected from AIDC devices supports predictive analytics, allowing proactive maintenance and better resource allocation. Combining IoT connectivity with barcode, RFID, and smart labeling systems enhances operational accuracy and decision-making. The increasing emphasis on automation and digital supply chains is further driving the adoption of AIDC solutions across the industrial and logistics sectors.

- In November 2024, Zebra Technologies enhanced its Aurora machine‑vision software suite by adding deep‑learning capabilities for complex inspection, optical‑character‑recognition (OCR), and anomaly‑detection within manufacturing environments. These features allow AIDC systems to move beyond passive capture (scanning barcodes) toward intelligent inspection and real‑time decision‑support, increasing their value proposition in high‑quality production lines.

What challenges limit AIDC market growth?

The substantial investment required for deploying RFID networks, automated scanners, and software platforms is a critical challenge affecting the automatic identification and data capture market. Initial setup expenses, including hardware procurement, system integration, and employee training, are significant for enterprises of all sizes. Ongoing maintenance, software updates, and technical support further increase operational costs and complexity.

To address this challenge, market players are offering cloud-based solutions, modular deployment options, and managed service packages to reduce upfront and recurring expenses. These approaches are enabling wider adoption of AIDC technologies while improving operational efficiency and cost predictability.

- In February 2025, Cognex Corporation introduced its Cloud-Enabled AIDC Suite to simplify deployment and reduce upfront costs. The suite offers modular hardware options, software-as-a-service integration, and remote monitoring for barcode scanners and RFID systems.

What trends are shaping the AIDC market?

The adoption of cloud-based AIDC solutions to enhance operational efficiency is a significant trend in the automatic identification and data capture market. Cloud integration is enabling real-time access to data collected from barcode scanners, RFID systems, and other identification devices.

Centralized analytics are allowing businesses to monitor inventory, track assets, and identify operational bottlenecks instantly. Seamless enterprise connectivity is supporting cross-department collaboration and improving supply chain visibility. Companies in retail, logistics, and manufacturing are leveraging cloud-enabled AIDC to reduce errors and optimize workflow processes.

- In May 2025, Honeywell launched its Honeywell Cloud AIDC Platform for enterprise operations. The platform integrates barcode scanning, RFID, and smart labeling systems with cloud-based analytics to provide real-time inventory and asset tracking across multiple locations. It enables centralized monitoring, operational insight, and cross-department collaboration, helping retail, logistics, and manufacturing companies reduce errors and optimize workflow processes.

Automatic Identification and Data Capture Market Report Snapshot

|

Segmentation

|

Details

|

|

By Product

|

Barcode systems, RFID Systems, Smart Cards & Magnetic Stripe Cards, Optical Character Recognition (OCR), Biometric Systems, Voice Recognition, Others

|

|

By Component

|

Hardware, Software, Services

|

|

By Vertical

|

Retail & E-commerce, Transportation & Logistics, Healthcare & Life Sciences, Manufacturing, Banking, Financial Services & Insurance (BFSI), Government, Education, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Product (Barcode systems, RFID Systems, Smart Cards & Magnetic Stripe Cards, Optical Character Recognition (OCR), Biometric Systems, Voice Recognition, Others): The barcode systems segment earned USD 23.17 billion in 2024 due to its cost-effectiveness, widespread adoption across industries, and compatibility with existing inventory and logistics infrastructure.

- By Component (Hardware, Software, and Services): The hardware segment held 51.71% of the market in 2024, due to the high demand for durable and advanced devices such as barcode scanners, RFID readers, and wearable computers that enable efficient and accurate data capture.

- By Vertical (Retail & E-commerce, Transportation & Logistics, Healthcare & Life Sciences, Manufacturing, Banking, Financial Services & Insurance (BFSI), Government, Education, Others): The transportation & logistics segment is projected to reach USD 40.14 billion by 2032, owing to the high demand for real-time asset tracking, efficient supply chain management, and automation of warehouse and fleet operations.

Automatic Identification and Data Capture Market Regional Analysis

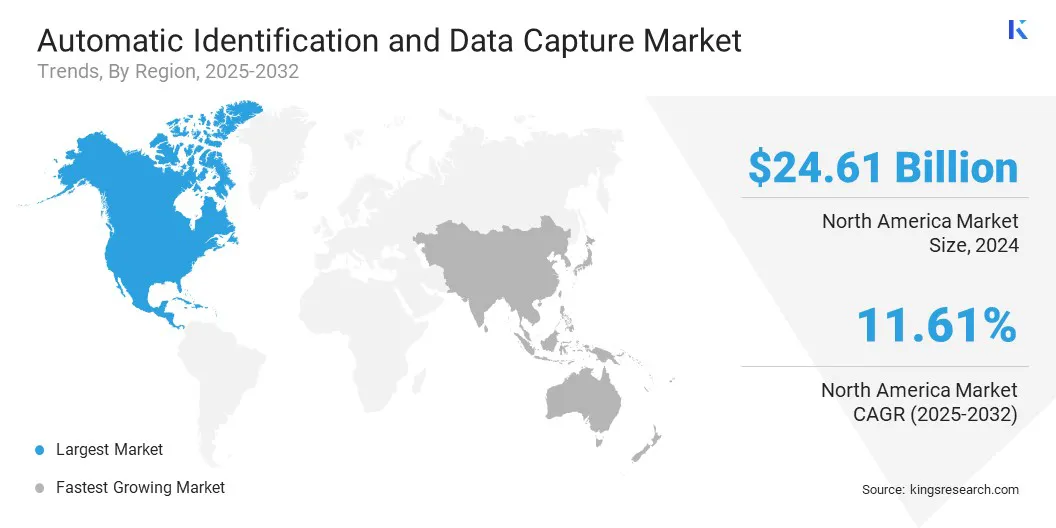

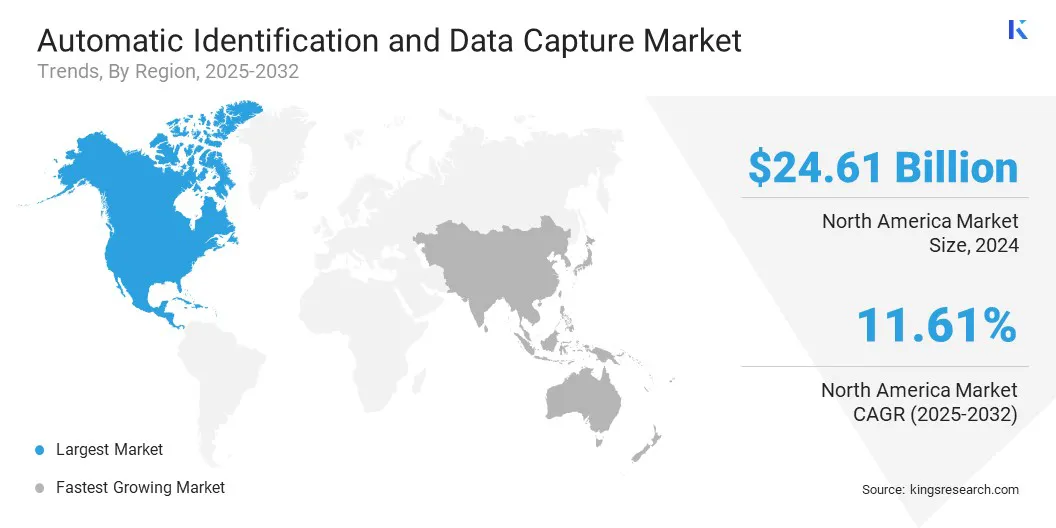

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

The North America automatic identification and data capture market share stood around 34.55% in 2024 in the global market, with a valuation of USD 24.61 billion. This dominance is attributed to widespread adoption of IoT-connected warehouses and logistics fleets across the U.S. and Canada.

Shipping and trucking companies are equipping vehicles with RFID readers and sensors to monitor cargo conditions and track shipments in real time. Manufacturing plants are integrating AIDC systems into production lines for automated quality checks and inventory updates.

- In August 2024, Cummins Inc. began permanent rollout of an RFID‑enabled returnable packaging system across its major U.S. manufacturing sites. The system uses RFID tags on totes and overhead readers at dock doors to track asset movements and provide real‑time logistics data. The initiative involves cloud‑based software analytics for asset utilization and predictive resource planning.

Companies are leveraging predictive analytics to optimize routes and warehouse layouts using captured data. Regional infrastructure investment in smart ports and automated cross-docking centers further increases adoption of AIDC solutions.

The market in Asia Pacific is expected to grow at a CAGR of 12.85% during the forecast period. This growth is due to the rapid rise of e-commerce platforms and regional logistics networks. Online retailers are investing heavily in smart warehouses and automated sorting centers that require advanced scanning and identification systems.

In November 2023, a report cited by Zebra Technologies found that around 70 % of warehouse decision‑makers in India and the broader Asia‑Pacific region planned to automate workflows by 2024, and 58 % intended to deploy RFID technology by 2028.

Logistics companies are adopting RFID and mobile scanning devices to optimize last-mile delivery and reduce errors. Logistics providers are increasingly relying on these technologies to manage complex cross-border supply chains efficiently. Integration with fleet management and inventory platforms enhances visibility across the network. Integration of AIDC with fleet management systems enhances visibility across distribution networks.

Regulatory Frameworks

- In the U.S., the Federal Communications Commission (FCC) regulates radio‑frequency devices under Title 47 of the Code of Federal Regulations (CFR), Part 15, which covers both intentional and unintentional radiators. For RFID and other AIDC equipment that emits radio waves, the device must be tested and authorized under the equipment‑authorization procedures before use.

- In the UK, AIDC systems that involve personal data must comply with the UK General Data Protection Regulation (UK GDPR) and related national privacy laws. The spectrum and radio‑equipment rules fall under Ofcom, which enforces technical compliance for radio devices.

- In China, the Ministry of Industry and Information Technology (MIIT) issued “Regulations on Radio‑Management of Radio Frequency Identification Equipment in the 900 MHz Frequency Band” (Regulation No. 76, 2024), which mandates approval, technical specifications, and usage constraints for RFID devices operating in the 920‑925 MHz band. Import, sale and use of AIDC equipment in the regulated frequencies require type‑approval and compliance with interference rules.

- Japan monitors radio equipment like RFID and AIDC devices under the Radio Law and its enforcement ordinances, administered by the Ministry of Internal Affairs and Communications (MIC). Devices classified as “Specified Radio Equipment” or “High‑Frequency Devices” must obtain type‑approval and carry the “Giteki” certification mark. Standards such as ARIB STD‑T107 set technical conditions for UHF RFID (916.7‑923.5 MHz).

- In India, the Wireless Planning & Coordination Wing (WPC) under the Department of Telecommunications (DoT) administers spectrum allocation and equipment approvals. The “Use of Low Power Equipment in the Frequency Band 865‑868 MHz for Short Range Devices (Exemption from Licence) Rules, 2021” exempts many RFID/AIDC devices from licenses, provided they meet type‑approval and technical criteria.

Competitive Landscape

Major players in the automatic identification and data capture industry are adopting strategies such as research and development, strategic partnerships, and technological advancements to remain competitive in the market. Companies are focusing on developing wearable and mobile devices that enhance operational efficiency in logistics, retail, and manufacturing environments.

Investment in ruggedized hardware and integration of advanced features like RFID and imaging capabilities allows businesses to meet demanding operational conditions. Collaboration with software providers and technology partners helps improve compatibility and expand solution ecosystems. Continuous innovation in device performance and workflow automation supports faster adoption by end-users.

- In March 2024, Zebra Technologies Corporation introduced its new RS2100 wearable scanner and WT6400/WT5400 wearable computers. These devices support hands‑free workflows, include integrated cameras for damage documentation, and enable inventory tasks in demanding environments (e.g., as low as ‑30 °C). The new TC5Xe mobile computer with integrated UHF RFID further strengthens Zebra’s device‑portfolio for rapid inventory and back‑room tracking.

Key Companies in Automatic Identification & Data Capture Market:

- Zebra Technologies Corporation

- Datalogic S.p.A.

- Cognex Corporation

- Honeywell International Inc.

- SICK AG

- TOSHIBA CORPORATION

- SATO Corporation

- Impinj, Inc.

- Alien Technology LLC

- Avery Dennison Corporation

- Epson

- Panasonic Corporation

- KEYENCE CORPORATION

- NEC Corporation

- DENSO WAVE INCORPORATED

Recent Developments

- In December 2024, SATO and Nakadai Holdings reported a successful proof‑of‑concept (PoC) for a full traceability system in resource recycling that uses AIDC technologies to capture data across disassembly, sorting, and processing. This marks an expansion of AIDC use beyond traditional retail/manufacturing logistics into circular‑economy and waste‑management domains.

- In August 2024, Zebra Technologies launched its inaugural AI Developer Challenge, inviting independent software vendors (ISVs) and partners to innovate in data‑capture and intelligent workflows. The initiative aims to accelerate deep learning and AI use‑cases in AIDC environments, enabling third‑party developers to build on Zebra’s platform.

- In September 2024, SATO Holdings Corporation announced development of a next‑generation cloud platform for labelling and connectivity, enabling no‑code application development and integration with ERP, WMS, and MES systems. The platform shifts SATO’s offering from primarily hardware (printers, labels, tags) toward a more software‑and‑services model and supports subscription‑based solutions linking labels, consumables, and data‑services.