Market Definition

Game development services include professional outsourcing of design, programming, testing, and support functions throughout the game creation lifecycle. These services enable developers to augment in-house capabilities, access global talent, and optimize production timelines.

The scope of the market covers console, mobile, cloud, VR/AR, and PC platforms across entertainment, educational, and simulation genres. Clients engage game development services for applications such as character modeling, gameplay mechanics, localization, quality assurance, and live‑service support to deliver high-quality, scalable interactive experiences.

Game Development Services Market Overview

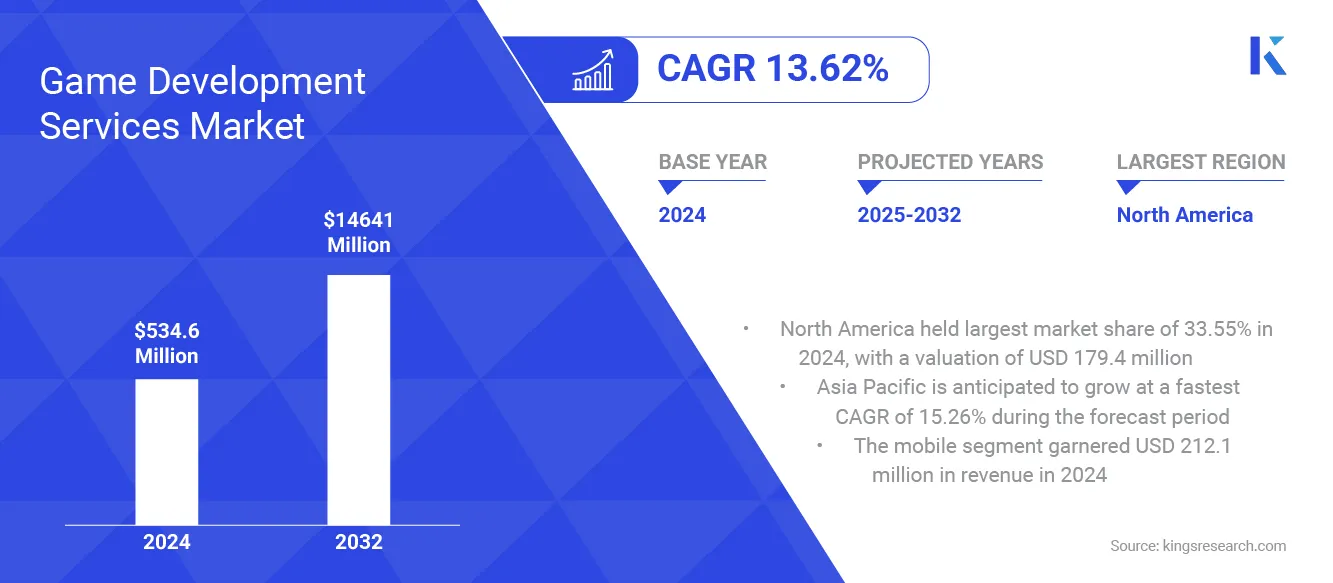

According to Kings Research, the global game development services market size was valued at USD 534.60 million in 2024 and is projected to grow from USD 598.83 million in 2025 to USD 1,464.07 million by 2032, exhibiting a CAGR of 13.62% during the forecast period.

The growth of the market is driven by rising demand for mobile, cloud-based, and cross-platform games, which require specialized development expertise. Additionally, the adoption of AI tools for asset creation and code generation is accelerating production timelines and reducing costs, encouraging studios to outsource more development tasks.

Key Market Highlights:

- The game development services industry size was valued at USD 534.60 million in 2024.

- The market is projected to grow at a CAGR of 13.62% from 2025 to 2032.

- North America held a market share of 33.55% in 2024, with a valuation of USD 179.36 million.

- The full game development segment garnered USD 222.39 million in revenue in 2024.

- The mobile segment is expected to reach USD 561.48 million by 2032.

- The game publishers segment secured the largest revenue share of 65.51% in 2024.

- Asia Pacific is anticipated to grow at a CAGR of 15.26% during the forecast period.

Major companies operating in the game development services market are Epic Games, Inc., CD PROJEKT S.A., Valve Corporation, Blizzard Entertainment, Inc., Sony Interactive Entertainment LLC, Capermint Technologies Pvt Ltd, JUEGO STUDIOS PRIVATE LIMITED, Moonfrog Labs Pvt Ltd, Hidden Path Entertainment, BRSOFTECH private limited, HashByte Studio, Quytech, Creatiosoft Solutions Private Limited, Kevuru Games, and Red Apple Technologies Pvt. Ltd.

Rising demand for live-service games and high-quality gaming content is accelerating the growth of the game development services market. Studios are increasingly launching titles that require continuous updates, in-game events, and content expansions to sustain player engagement.

The complexity of live-service operations is pushing developers to outsource specialized tasks such as art production, engineering, quality assurance, and live operations. Cloud gaming and high-end mobile games are also contributing to the need for scalable, on-demand development support.

- In April 2025, Dubai-based startup The Game Company (TGC) unveiled its AI-driven cloud gaming platform during Dubai AI Week. The platform offers instant access to over 1,300 AAA titles streamed directly from the cloud, eliminating the need for expensive consoles or local downloads. Powered by a custom AI framework, it leverages optimized GPU usage to deliver high-end visual performance, predictive forward buffering for uninterrupted gameplay, and cloud-agnostic compatibility to maintain smooth, low-latency experiences across all devices.

Market Driver

Growth in Mobile, Cloud, and Cross-Platform Development

Expansion of mobile gaming, cloud-based platforms, and cross-platform compatibility is fueling demand for game development service providers with multi-technology capabilities. Mobile gaming continues to account for the largest share of global gaming spend, prompting studios to invest heavily in scalable development across Android and iOS.

- According to research conducted by IDC and Sensor Tower, mobile gaming accounted for around 50% of the total global consumer gaming spend of USD 165 billion in 2024, maintaining its dominant position within the industry. Mobile games remained the dominant category in app stores, generating approximately USD 107.3 billion, nearly 63% of all consumer spending across mobile applications.

Cloud gaming is enabling device-agnostic access to high-quality titles, requiring optimization and backend support from experienced service partners. Developers are increasingly targeting seamless cross-platform experiences that function consistently across consoles, PCs, and mobile devices. This shift is driving the need for service providers skilled in multiple engines, network architectures, and performance optimization.

Market Challenge

Increased Project Failures and Market Saturation Disrupting Industry Stability

A key challenge in the game development services market is the rising frequency of project failures, especially among high-profile live-service titles that struggle to retain users or generate sustained revenue.

The growing cost of user acquisition, intense content competition, and market oversaturation are creating unpredictable project outcomes and financial instability. Studio teams often face compressed timelines and heavy workloads, leading to burnout, quality issues, and eventual layoffs.

To address this challenge, market players are adopting agile development practices, strengthening publisher-developer collaboration, and investing in data-driven pre-launch testing to improve project success rates. Companies are also diversifying their service offerings and optimizing resource planning to manage workload and reduce project risk.

Market Trend

AI-Driven Asset & Code Generation

A key trend in the market is the growing use of AI and machine learning to streamline asset creation and code generation. Studios and service providers are applying tools like large language model (LLM) agents, procedural content generation, and neural synthesis to automate repetitive tasks.

These techniques are reducing development time and allowing teams to scale production without proportional increases in resources.

- In February 2025, Microsoft introduced its first World and Human Action Model (WHAM), named “Muse.” This generative AI model can produce game visuals, controller actions, or a combination of both. Developed in collaboration with Ninja Theory, a studio under Xbox Game Studios, Muse represents a significant advancement in AI-driven video game creation.

AI is supporting faster prototyping, more consistent asset pipelines, and adaptive content creation. Service providers are integrating these capabilities to meet growing demand for high-volume, high-quality game assets across platforms.

Game Development Services Market Report Snapshot

| Segmentation | Details |

| By Service Type | Full Game Development, Art & Asset Production, Engineering & Porting Services, Others |

| By Platform | Mobile, PC, Console, VR/AR/MR, Cloud-based |

| By Client Type | Game Publishers, Indie Studios, IP Holders |

| By Region | North America: U.S., Canada, Mexico Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa South America: Brazil, Argentina, Rest of South America |

Market Segmentation

- By Service Type (Full Game Development, Art & Asset Production, Engineering & Porting Services, and Others): The Full Game Development segment earned USD 222.39 million in 2024 due to rising demand from publishers for end-to-end solutions that lower internal costs, and shorten development cycles.

- By Platform (Mobile, PC, Console, and VR/AR/MR): The Mobile segment held 39.67% of the market in 2024, due to its large global user base, faster development cycles, and strong demand for frequent content updates.

- By Client Type (Game Publishers, Indie Studios, and IP Holders): The Game Publishers segment is projected to reach USD 901.47 million by 2032, owing to their reliance on external teams to manage large-scale production, support multi-platform releases, and reduce development risks across multiple titles.

Game Development Services Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

The North America game development services market share stood around 33.55% in 2024 in the global market, with a valuation of USD 179.36 million. This dominance is due to the fact that North America is home to some of the world’s largest video game publishers and IP holders, including Activision Blizzard, Electronic Arts, Take-Two Interactive, and Warner Bros. Games.

These companies frequently outsource parts of their development pipelines to external service providers, particularly for co-development, art production, and platform porting. As demand for high-quality content expands across their franchises, the reliance on specialized third-party teams continues to grow, directly contributing to the development services market.

Additionally, many studios in the region are shifting toward live-service models, which require ongoing content updates, technical upkeep, and performance optimization. Popular titles such as Fortnite, Call of Duty, and Apex Legends consistently generate outsourcing needs, especially for LiveOps support, quality assurance, and platform-specific development work.

The game development services industry in Asia Pacific is poised for significant CAGR of 15.26% over the forecast period. This growth is driven by Asia Pacific being home to the largest gaming population globally, with hundreds of millions of players across mobile, PC, and console platforms.

This vast user base creates strong demand for new content, faster updates, and broader platform support, especially in mobile and free-to-play games. As a result, both regional and international game companies increasingly turn to external service providers in the region to meet development timelines and keep players engaged.

Asia-Pacific remains the leading region in terms of gaming population, with approximately 1.48 billion gamers in Asia as of 2024. According to Udonis, a mobile game marketing firm, the region accounts for nearly 45% of the global gaming audience.

Additionally, Asia Pacific offers a large pool of skilled professionals in game design, animation, programming, and quality assurance, often at lower costs than in North America or Europe. Many global studios outsource labor-intensive tasks, such as art asset creation, environment design, and manual QA to providers in the region, strengthening its position as a key center for game development services.

Regulatory Frameworks

- In the U.S., game development services are shaped by privacy, labor, and consumer protection laws. The California Consumer Privacy Act (CCPA) governs how player data is collected and managed. Antitrust oversight has increased, particularly regarding esports compensation and digital distribution practices. While there is no federal gaming regulator, studios must comply with the Children’s Online Privacy Protection Act (COPPA) when targeting players under 13, impacting design and data use.

- The EU’s Digital Services Act (DSA) and General Data Protection Regulation (GDPR) significantly influence game services. The DSA obligates platforms to monitor and report illegal content and algorithmic risks. GDPR governs data processing, user consent, and cross-border data transfer. Developers must ensure fairness in in-game purchases and protect minors from exploitative practices.

- In China, the National Press and Publication Administration (NPPA) enforces playtime limits for minors, capping gaming to one hour per day on weekends. Real-name authentication is mandatory, and loot boxes must disclose odds and limit purchases. Games undergo pre-approval for content, and foreign titles must partner with domestic firms. Data policies align with the Personal Information Protection Law, impacting how studios collect and use player data.

- Japan requires game companies to disclose gacha (loot box) probabilities under Consumer Affairs Agency rules. "Kompu gacha," a practice deemed exploitative, is banned. Game advertising must comply with the Act Against Unjustifiable Premiums and Misleading Representations, ensuring transparency in pricing and in-game promotions. Developers also face scrutiny under Japan’s Act on the Protection of Personal Information (APPI), particularly when handling user data across platforms or international servers.

Competitive Landscape

Market players in the game development services market are adopting strategies such as acquisitions, service expansion, and investment in specialized talent to stay competitive in the game development services space. Companies are focusing on strengthening capabilities in high-demand areas like real-time visual effects, scalable art production, and live-service support.

Many are also forming partnerships or acquiring niche studios to offer more comprehensive services to AAA and live-service game publishers. Additionally, investments in R&D and proprietary tools are helping studios improve workflow efficiency and meet evolving client needs. These approaches reflect a broader shift toward long-term content support and technical depth in outsourced game development.

- In April 2024, Virtuos announced the expansion of its game development services through the acquisition of Beyond-FX, a California-based VFX studio. Beyond-FX specializes in real-time visual effects for AAA and live-service games. The acquisition enhances Virtuos’ ability to deliver scalable art and VFX support for ongoing content development in titles that require continuous player engagement and post-launch updates.

Top Companies in Game Development Services Market:

- Epic Games, Inc.

- CD PROJEKT S.A.

- Valve Corporation

- Blizzard Entertainment, Inc.

- Sony Interactive Entertainment LLC

- Capermint Technologies Pvt Ltd

- JUEGO STUDIOS PRIVATE LIMITED

- Moonfrog Labs Pvt Ltd

- Hidden Path Entertainment

- BRSOFTECH private limited

- HashByte Studio

- Quytech

- Creatiosoft Solutions Private Limited

- Kevuru Games

- Red Apple Technologies Pvt. Ltd.

Recent Developments (M&A/Collaboration)

- In May 2025, Scopely acquired Niantic’s game division, adding several major titles to its portfolio. The deal includes category-leading games such as Pokémon GO, Pikmin Bloom, and Monster Hunter Now, along with Niantic’s community-focused platforms Campfire and Wayfarer.

- In April 2025, Unity collaborated with Konami Digital Entertainment B.V. (KONAMI) to develop Survival Kids for the Nintendo Switch 2. The game was built entirely using Unity 6, optimized specifically for the new platform. This project allowed Unity to enhance the engine’s performance and stability on Nintendo Switch 2 through real-world development and technical refinement.