Machine Learning Market Size

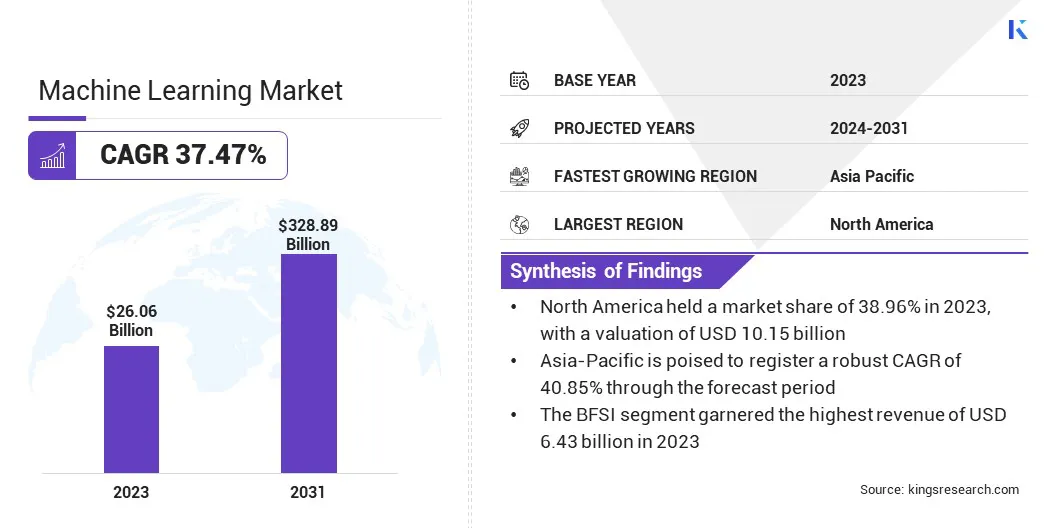

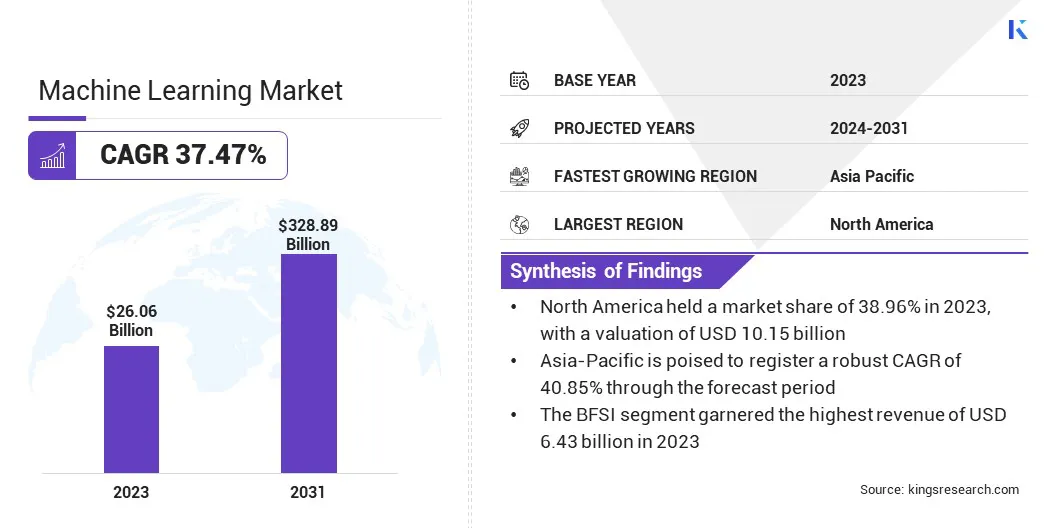

The global Machine Learning Market size was valued at USD 26.06 billion in 2023 and is projected to grow from USD 35.44 billion in 2024 to USD 328.89 billion by 2031, exhibiting a CAGR of 37.47% during the forecast period. Advancements in cloud computing and proliferation of big data are fostering the growth of the market.

In the scope of work, the report includes services offered by companies such as Amazon Web Services, Inc., Baidu, Inc., Google Inc., H2O.ai, Hewlett Packard Enterprise Development LP, Intel Corporation, IBM Corporation, Microsoft, SAS Institute Inc., SAP SE, and others.

The emergence of AI-powered cybersecurity solutions represents a significant opportunity for the development of the machine learning market. As cyber threats become more sophisticated, traditional security measures are becoming increasingly inadequate.

AI has the potential to revolutionize cybersecurity by enabling the development of advanced solutions that can predict, detect, and respond to threats in real-time. Machine learning algorithms can analyze vast amounts of data to identify patterns and anomalies indicative of malicious activity, thus enhancing the ability to prevent attacks before they occur.

- In September 2024, Tata Consultancy Services expanded its partnership with Google Cloud to introduce two new cybersecurity solutions aimed at enhancing enterprise cyber resilience. This collaboration leverages AI, machine learning, and automation to continuously monitor risks, identify deviations, and recommend corrective actions, empowering businesses with advanced, domain-focused cybersecurity innovations.

Furthermore, AI-powered systems can adapt to new threats by continuously learning from past incidents, making them more effective over time. This capability is particularly valuable for defending against zero-day attacks and other emerging threats that traditional security systems have not yet identified.

The increasing reliance on AI-driven cybersecurity across industries, including finance and healthcare, to protect sensitive data and ensure business continuity presents significant opportunities for market progress. Additionally, the growing demand for robust cybersecurity measures is anticipated to boost the development and deployment of AI-powered solutions.

Machine learning is a branch of artificial intelligence (AI) that enables machines to learn from data and enhance their performance over time. It involves the use of algorithms to analyze data, recognize patterns, and make predictions or decisions based on that information. It can be deployed in various ways across enterprises and industries.

In enterprises, machine learning can be used to enhance decision-making processes, automate repetitive tasks, and personalize customer interactions. For instance, in marketing, machine learning algorithms can analyze customer behavior to predict future purchases and tailor marketing strategies accordingly.

In industries such as healthcare, finance, and manufacturing, machine learning can be deployed to optimize operations, predict equipment failures, and improve patient outcomes through predictive analytics. The deployment of machine learning across these sectors may result in increased efficiency, cost savings, and the ability to innovate at a faster pace.

Moreover, data availability increases, machine learning models can be continuously refined to enhance their accuracy and effectiveness. The versatility and potential of machine learning make it a critical component in the digital transformation of businesses and industries worldwide.

Analyst’s Review

The machine learning market is experiencing robust growth, primarily due to technological advancements, the proliferation of data, and increasing demand across various industries. Key market players are strategically positioning themselves to capitalize on these trends through fostering innovation, forming partnerships, and increasing investments in research and development.

Companies are focusing on developing scalable machine learning platforms that cater to the diverse needs of different industries, including healthcare, finance, retail, and manufacturing. These platforms offer end-to-end solutions that simplify the deployment of machine learning models, making them accessible to enterprises with varying levels of expertise.

Additionally, the importance of cloud-based machine learning services is growing, as they allow businesses to leverage robust computing resources without significant upfront infrastructure investments.

- For instance, in September 2023, Merck announced strategic collaborations with BenevolentAI and Exscientia, both U.K.-based, to utilize AI-driven drug design and discovery technologies. These partnerships aim to produce novel drug candidates with first-in-class and best-in-class potential in oncology, neurology, and immunology, advancing Merck's research and development in these critical therapeutic areas.

The growth of the machine learning market is further supported by the increasing integration of machine learning with other emerging technologies such as edge computing, the Internet of Things (IoT), and blockchain. This integration creates new opportunities for innovation and expansion, particularly in areas such as autonomous systems, smart cities, and personalized medicine.

However, to maintain their competitive edge, companies must address data privacy, ethical AI, and the skills gap in the workforce. Ensuring compliance with data protection regulations and developing explainable AI models that can be trusted by users are becoming critical considerations.

Moreover, companies need to invest in upskilling their workforce and building a talent pipeline to meet the growing demand for machine learning expertise. As the market evolves, it is essential for key players to navigate these challenges while stimulating growth and fostering innovation in the machine learning landscape.

Machine Learning Market Growth Factors

Advancements in cloud computing are supporting the major driver of machine learning market. The availability of scalable, on-demand computing resources through cloud platforms is removing the barriers associated with the high costs and technical complexity of deploying machine learning models.

Cloud computing services provide necessary infrastructure, including powerful GPUs and vast storage capabilities, to handle the large datasets and intensive processing required for machine learning tasks.

Additionally, these platforms offer pre-built machine learning models and tools, which streamline the process of developing and deploying machine learning applications. This accessibility enables businesses of all sizes to utilize machine learning without significant investments in physical hardware or specialized expertise.

- In January 2023, IBM and Intel strengthened their partnership by launching the 4th Gen Intel Xeon processors on IBM Cloud Bare Metal and Virtual Servers. These processors are optimized for high performance in AI, machine learning, analytics, cloud, and more, enabling enterprises to maximize efficiency and scalability.

Moreover, cloud-based machine learning services allow for rapid experimentation and iteration, essential for refining models and improving accuracy. Enterprises are using these advancements to quickly scale their machine learning efforts, meet market demands, and gain a competitive edge.

The integration of machine learning with cloud computing is fostering innovation by facilitating global collaboration and resource sharing among developers, which accelerates the development of new applications and solutions. As cloud computing advances, it is likely to boost the widespread adoption and success of machine learning, offering businesses new opportunities and transforming their operations.

The skills gap in machine learning expertise is posing a significant challenge for organizations seeking to implement and scale their machine learning initiatives. As the demand for machine learning capabilities increases, there is a shortage of professionals with the necessary skills to develop, deploy, and manage machine learning models effectively. This gap is leading to delays in project timelines, increased costs, and missed opportunities for innovation.

Companies are facing difficulties in recruiting data scientists, machine learning engineers, and other specialized roles crucial for machine learning. The complexity and rapid evolution of machine learning are exacerbating this challenge, requiring experienced professionals to continuously upskill to keep updated with new developments.

To mitigate this challenge, organizations are investing in training and development programs to upskill their existing workforce, equipping employees with the current machine learning knowledge and tools.

- For instance, in September 2023, IBM pledged to train two million learners in AI by 2026, with a focus on underrepresented communities. This commitment includes expanding global AI education collaborations with universities, launching new generative AI courses through IBM SkillsBuild, and partnering to deliver AI training for adult learners, thereby enhancing access to AI education and in-demand technical roles.

Partnerships with academic institutions and online learning platforms are being established to create tailored educational programs that address specific industry needs.

Additionally, some companies are leveraging automated machine learning (AutoML) tools that simplify the model-building process, thus reducing the reliance on highly specialized expertise. Addressing the skills gap is expected to enable organizations to leverage machine learning effectively, fostering innovation and maintaining their competitive edge in the market.

Machine Learning Market Trends

The integration of edge computing is emerging as a notable trend revolutionizing machine learning market. Edge computing involves processing data closer to the source, such as IoT devices or local servers, rather than relying on centralized cloud infrastructures.

Integrating machine learning at the edge allows organizations to perform real-time data analysis and decision-making, which are crucial for addressing latency and bandwidth limitations. This trend is particularly relevant in manufacturing, healthcare, and autonomous vehicles, where immediate insights and actions are essential for optimizing operations, enhancing safety, and improving outcomes.

- For instance, in April 2024, Dell Technologies expanded its edge partner ecosystem by collaborating with Hyundai AutoEver and Intel to enhance manufacturers' ability to leverage edge data using AI. This partnership integrates Hyundai AutoEver’s solutions with Dell’s validated design for manufacturing edge, providing real-time monitoring, anomaly detection, and predictive maintenance to foster AI-driven optimizations across factory floors.

Moreover, the deployment of machine learning at the edge allows for more efficient and scalable solutions by processing data locally, thereby reducing the need for constant communication with cloud servers. This decreases latency and improves data privacy, as sensitive information can be analyzed on-site without being transmitted over the network.

Additionally, edge-based machine learning models are being continuously refined and updated, ensuring that they are adaptive to changing conditions and evolving threats. However, the proliferation of IoT devices and smart systems underscores the importance of integrating machine learning with edge computing. This integration is likely to be crucial for enabling intelligent, autonomous operations, fostering innovation, and enhancing the capabilities of connected systems.

Segmentation Analysis

The global market has been segmented on the basis of deployment, enterprise size, vertical, and geography.

By Deployment

Based on deployment, the market has been bifurcated into cloud-based and on-premises. The cloud-based segment captured the largest machine learning market share of 69.01% in 2023, largely attributed to the widespread adoption of cloud computing services across various industries. This growth is further fueled by the flexibility, scalability, and cost-effectiveness of cloud platforms.

Organizations are increasingly migrating their data and applications to the cloud, enabling them to leverage the vast computational power and storage capacity required for deploying machine learning models efficiently. This dominance is further supported by the growing trend of digital transformation, where companies are prioritizing cloud infrastructure to enhance operational agility and innovation.

In addition, cloud platforms are providing businesses with access to advanced machine learning tools and frameworks, which are streamlining the development and deployment of machine learning applications. The ability to scale resources on demand is allowing organizations to handle fluctuating workloads and large datasets without the need for significant upfront investments in hardware.

Moreover, cloud providers are offering integrated security measures and compliance certifications, which are critical for industries dealing with sensitive data. This is leading to the rising deployment of cloud-based machine learning, thereby contributing to segmental growth.

By Enterprise Size

Based on enterprise size, the machine learning market has been classified into small & medium enterprises, and large enterprises. The small and medium enterprises (SMEs) segment is poised to record a staggering CAGR of 38.56% through the forecast period, mainly propelled by the increasing accessibility of advanced technologies such as machine learning.

SMEs are increasingly recognizing the competitive advantages of machine learning, including improved decision-making, enhanced customer experiences, and greater operational efficiency. Unlike large enterprises, which often have extensive in-house resources, SMEs are leveraging cloud-based and automated machine learning platforms to overcome resource constraints.

These platforms provide affordable and scalable solutions that enable SMEs to implement sophisticated machine learning models without requiring specialized expertise or significant capital investment. Furthermore, the growing availability of machine learning as a service (MLaaS) is providing SMEs with the tools they need to experiment with and deploy machine learning models quickly and cost-effectively.

This trend is particularly impactful as SMEs are often more agile and able to adopt new technologies faster than larger organizations. This is leading to the rising use of machine learning to foster innovation in areas such as personalized marketing, inventory management, and fraud detection. The rapid adoption of machine learning technologies among SMEs, coupled with their increasing contribution to economic growth, is further propelling the growth of the segment.

By Vertical

Based on vertical, the market has been divided into BFSI, IT & telecommunication, healthcare, retail, advertising & media, and others. The BFSI segment garnered the highest revenue of USD 6.43 billion in 2023, mainly due to the sector's significant investment in machine learning technologies.

The adoption of machine learning in BFSI is fueled by the surging need to enhance security, optimize operations, and improve customer service in an increasingly digital and data-driven environment.

Machine learning is extensively used for fraud detection, risk management, and regulatory compliance, addressing the persistent challenges faced by the BFSI sector. Machine learning algorithms analyze large volumes of transactional data in real-time to identify suspicious activities and mitigate financial fraud, thereby protecting both customers and institutions.

Moreover, the BFSI sector is leveraging machine learning to personalize customer interactions by offering tailored financial products and services based on individual customer profiles and behaviors. This personalization is boosting customer engagement and loyalty.

Furthermore, the sector is utilizing machine learning to streamline operations through automation, thereby reducing costs and improving efficiency. The financial institutions are increasingly focusing on digital transformation, with the integration of machine learning into their processes.

Machine Learning Market Regional Analysis

Based on region, the global market has been segmented into North America, Europe, Asia-Pacific, MEA, and Latin America.

North America machine learning market accounted for a substantial share of 38.96% and was valued at USD 10.15 billion in 2023. This dominance is attributed to the early adoption of advanced technologies, robust technological infrastructure, and a high concentration of leading tech companies and startups in the United States and Canada.

North American enterprises are heavily investing in machine learning to gain a competitive edge, particularly in sectors such as healthcare, finance, and retail. The region's strong focus on research and development is fostering continuous innovation, resulting in cutting-edge machine learning applications that are transforming business operations.

- In May 2024, IBM disclosed its collaboration with Amazon Web Services (AWS) to integrate the full portfolio of IBM's watsonx AI and data platform with AWS services. This partnership aims to simplify the scaling of AI across enterprises by using an open, hybrid approach with comprehensive governance, enabling organizations to effectively manage and expand AI capabilities.

Furthermore, regional market development is supported by significant government and private sector investments in AI and related technologies. These investments are fostering the development of new machine learning tools and platforms. Additionally, the presence of a skilled workforce and leading academic institutions is contributing to the region's ability to develop and implement advanced machine learning solutions, thereby aiding regional market exoansion.

Asia-Pacific is poised to grow at the highest CAGR of 40.85% in the forthcoming years, reflecting the region's rapidly increasing adoption of machine learning technologies. This expansion is bolstered by several factors, including the increasing digital economy, significant investments in AI, and the surging need for advanced analytics across various industries.

Countries such as China, India, and Japan are at the forefront of this growth, supported by strong government initiatives, the rise of tech startups, and the availability of vast amounts of data generated by their large populations.

In Asia-Pacific, industries such as manufacturing, retail, and finance are leading the adoption of machine learning to improve efficiency, customer experiences, and decision-making processes. The region's rapid digital transformation is fueling the demand for machine learning applications that can enhance business operations and foster innovation.

Moreover, the growing availability of affordable cloud computing services is enabling small and medium enterprises (SMEs) in Asia-Pacific to access and deploy machine learning solutions, thereby aiding regional market growth.

Competitive Landscape

The global machine learning market report provides valuable insights, highlighting the fragmented nature of the industry. Prominent players are focusing on several key business strategies, such as partnerships, mergers and acquisitions, product innovations, and joint ventures, to expand their product portfolio and increase their market shares across different regions.

Companies are implementing impactful strategic initiatives, such as expansion of services, investments in research and development (R&D), establishment of new service delivery centers, and optimization of their service delivery processes, which are likely to create new opportunities for market growth.

List of Key Companies in Machine Learning Market

Key Industry Developments

- March 2024 (Expansion): Hewlett Packard Enterprise (HPE) announced updates to its AI-native portfolio at NVIDIA GTC, aimed at advancing the deployment of generative AI, deep learning, and machine learning applications. This solution is designed to help large enterprises, research institutions, and government bodies accelerate GenAI and deep learning initiatives, including large language models, recommender systems, and vector databases.

- November 2023 (Expansion): Amazon Web Services (AWS) announced an expanded partnership with Amgen to develop generative AI-based solutions for drug discovery and manufacturing efficiency. The new facility is designed to incorporate advanced digital and robotic technologies, utilizing AWS's Amazon SageMaker to build, train, and deploy machine learning models for daily data analysis in manufacturing processes.

The global machine learning market has been segmented:

By Deployment

By Enterprise Size

- Small & Medium Enterprises

- Large Enterprises

By Vertical

- BFSI

- IT & Telecommunication

- Healthcare

- Retail

- Advertising & Media

- Others

By Region

- North America

- Europe

- France

- UK

- Spain

- Germany

- Italy

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia Pacific

- Middle East & Africa

- GCC

- North Africa

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America