Market Definition

The embedded systems market combines microprocessors, microcontrollers, and real-time software to enable automation, control, and data processing across connected environments. The report covers segmentation by component, functionality, end user, application, and region, providing insights into key growth factors, adoption trends, and technological advancements.

Embedded systems are widely deployed across automotive, industrial automation, healthcare, consumer electronics, and telecommunications sectors to enhance performance, reliability, and operational intelligence.

Embedded System Market Overview

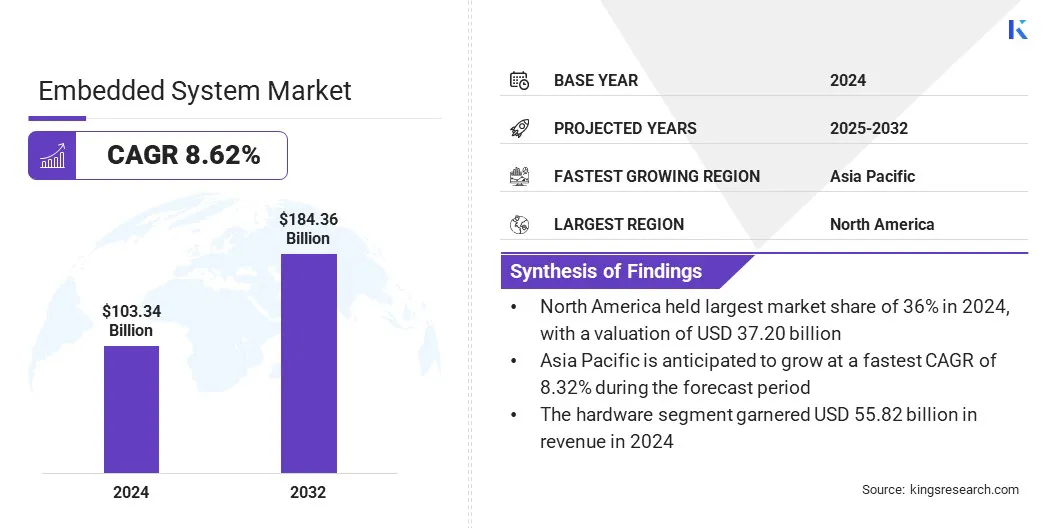

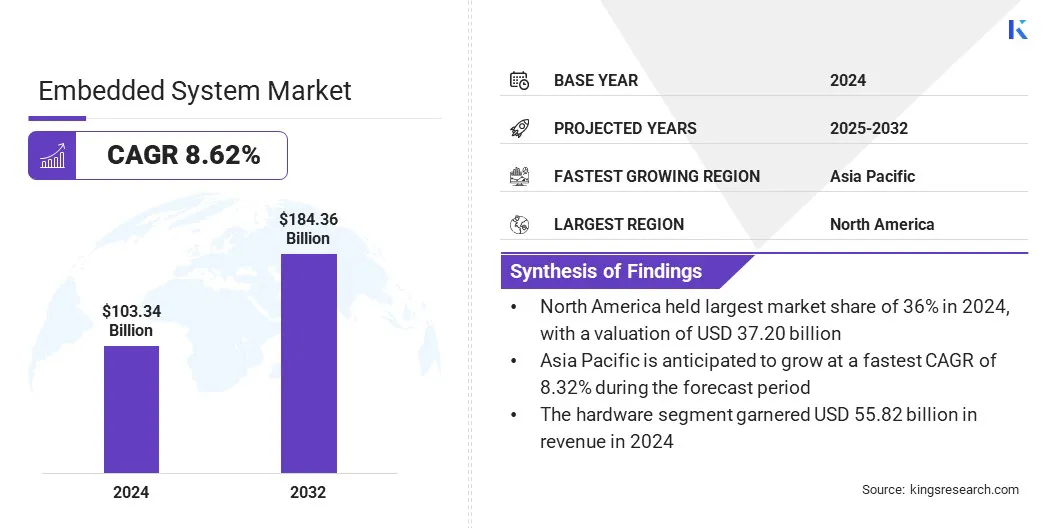

The global embedded system market size was valued at USD 103.34 billion in 2024 and is projected to grow from USD 110.48 billion in 2025 to USD 184.36 billion by 2032, exhibiting a CAGR of 8.62% over the forecast period.

This growth is driven by the rising need for immediate decision-making across industries such as automotive, healthcare, and manufacturing. Embedded systems improve operational efficiency and responsiveness through real-time data processing capabilities.

Key Highlights:

- The embedded system industry was recorded at USD 103.34 billion in 2024.

- The market is projected to grow at a CAGR of 8.62% from 2025 to 2032.

- North America held a share of 36% in 2024, valued at USD 37.20 billion.

- The hardware segment recorded USD 55.82 billion in revenue in 2024.

- The standalone system segment is expected to reach USD 60.70 billion by 2032.

- The medium-scale embedded system segment is anticipated to witness the fastest CAGR of 7.51% over the forecast period.

- The automotive segment is estimated to hold a share of 23.01% by 2032.

- Asia Pacific is anticipated to grow at a CAGR of 8.32% through the projection period.

Major companies operating in the embedded system market are Analog Devices, Inc., Renesas Electronics Corporation, NXP Semiconductors, Intel Corporation, SAMSUNG, Microchip Technology Inc., Qualcomm Technologies, Inc., Infineon Technologies AG, STMicroelectronics, Texas Instruments Incorporated, Advanced Micro Devices, Inc., Cognex Corporation, Keysight Technologies, Arm Limited, and Green Hills Software.

Market growth is driven by the increasing adoption of modular and scalable System-on-Chip (SoC) architectures in automotive electronics. These SoCs support functions such as advanced driver assistance systems, infotainment, and real-time diagnostics, helping automakers improve vehicle intelligence and reduce design complexity . The growing shift toward electric and autonomous vehicles further supports SoC integration for high-performance computing applications.

- In March 2024, NXP launched a unified software development platform integrating partner software and advanced NXP chips to standardize and boost automotive electronic system.

What role does 5G technology play in advancing automation?

The expansion of 5G networks, offering high-speed connectivity, ultra-low latency, and large data capacity, is accelerating automation across industries. 5G technology improves communication between smart devices, vehicles, and industrial systems, supporting seamless machine-to-machine interactions. Industries are utilizing 5G to strengthen IoT infrastructure, optimize automation, and improve real-time analytics capabilities.

These advancements are increasing the demand for high-performance embedded hardware and communication modules that ensure reliable, low-latency operations within 5G-enabled embedded systems. Strategic collaborations are driving the development of advanced 5G communication systems designed to enhance next-generation railway connectivity and operational performance.

- In September 2025, Kontron AG and Qualcomm Technologies developed a next-generation 5G FRMCS PC3 modem for the MORANE 2 initiative. The FRMCS standard enables adaptable, high-performance operational connectivity for rail organizations across Europe and international markets.

How does design complexity and hardware customization increase development costs?

The embedded system market experiences rising costs due to high initial investment in hardware design, software integration, and testing processes. Development of advanced processors, real-time operating systems, and customized firmware increases overall production costs.

Small and medium enterprises face additional pressure due to limited budgets and long return-on-investment cycles. These cost barriers often restrict innovation and adoption across emerging industries, impacting market scalability and competitiveness in cost-sensitive applications.

To address this challenge, companies are adopting modular design approaches, leveraging open-source platforms, and forming strategic collaborations to reduce development expenditure and improve cost efficiency in embedded system deployment.

The growing integration of edge AI is reshaping embedded systems by enabling faster, secure, and localized data processing. Industries such as automotive, healthcare, and deploying edge AI-driven systems to enhance predictive maintenance, automate functions, and optimize resource efficiency.

Hardware advancements, including AI accelerators and intelligent processors, are driving this transformation by improving real-time decision-making and energy efficiency. The rising adoption of edge AI platforms strengthens the role of embedded systems in intelligent, real-time computing environments.

Companies are expanding their automotive portfolios through advanced processor launches to strengthen their position in intelligent, safety-driven, and autonomous vehicle technologies.

- In January 2024, AMD expanded its automotive portfolio with the launch of the Versal AI Edge XA adaptive SoC and Ryzen Embedded V2000A Series processor at CES 2024. These devices reinforced AMD’s leadership in automotive technology and targeted key segments such as infotainment, driver safety, and autonomous driving.

Embedded System Market Report Snapshot

|

Segmentation

|

Details

|

|

By Component

|

Hardware, Software

|

|

By Function

|

Standalone system, Real-time system, Network system, Mobile system

|

|

By System Size

|

Small-scale Embedded System, Medium-scale Embedded System, Large-scale Embedded System

|

|

By Application

|

Automotive, Consumer electronics, Industrial Automation, Healthcare, Telecommunications, Media & entertainment, Military & defense, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation:

- By Component (Hardware and Software): The hardware segment generated USD 55.82 billion in revenue in 2024, mainly due to increasing demand for high-performance processors, sensors, and microcontrollers supporting advanced automation and connected device applications.

- By Function (Standalone system, Real-time system, Network system, and Mobile system): The real-time system segment is poised to record a CAGR of 7.69% over the forecast period, driven by rising adoption of mission-critical applications requiring low-latency processing and immediate data responsiveness.

- By System Size (Small-scale Embedded System, Medium-scale Embedded System, and Large-scale Embedded System): The small-scale embedded system segment is estimated to hold a share of 40.05% by 2032, fueled by rapid deployment across consumer electronics, wearables, and compact industrial devices emphasizing low-cost and efficient designs.

- By Application (Automotive, Consumer electronics, Industrial Automation, Healthcare, Telecommunications, Media & entertainment, Military & defense, and Others): The automotive segment is projected to reach USD 42.43 billion by 2032, owing to growing integration of embedded control systems in electric vehicles, ADAS, infotainment, and connected mobility infrastructure.

What is the market scenario in North America and Asia Pacific region?

Based on region, the global embedded system market has been segmented into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

North America held a 36% share of the global embedded system market in 2024, valued at USD 37.20 billion. This growth is attributed to the large-scale integration of embedded technologies in industrial automation, healthcare, telecommunications, and automotive applications.

The strong presence of semiconductor manufacturers and increasing deployment of intelligent embedded platforms across data centers, autonomous systems, and smart infrastructure are supporting market expansion. Advancements in edge computing and AI-enabled embedded architectures continue to enhance innovation, thereby driving market growth.

- In October 2024, Analog Devices unveiled a developer-focused portfolio integrating hardware, software, and services to accelerate innovation at the Intelligent Edge. The launch featured CodeFusion Studio, a unified embedded software environment leveraging open-source tools to simplify heterogeneous processor development, and improve security and efficiency.

The Asia Pacific market is projected to grow at a CAGR of 8.32% over the forecast period, driven by large-scale electronics manufacturing, rapid industrial automation, and rising adoption of smart consumer devices.

Increasing investments in semiconductor fabrication, along with rising adoption of embedded platforms across automotive and industrial sectors, contribute to regional momentum. Additionally, the expanding IoT ecosystem and growing implementation of AI-driven embedded processors across smart cities and connected infrastructure boost market growth.

- In October 2025, Silicon Labs launched the Simplicity Ecosystem, a next-generation modular software suite designed to transform embedded IoT development. The platform incorporated planned AI augmentation to enhance design efficiency, scalability, and system intelligence.

Regulatory Frameworks

- In the EU, the Radio Equipment Directive (RED) 2014/53/EU governs the compliance of wireless and embedded communication devices. It ensures safety, electromagnetic compatibility, and efficient spectrum use in embedded systems.

- In the U.S., the Federal Communications Commission (FCC) Part 15 Regulation oversees electromagnetic emissions from embedded electronic equipment. It mandates manufacturers to meet emission standards to prevent interference among connected devices.

- In Japan, the IEC 61508 Functional Safety Standard regulates the safety of embedded systems in industrial, automotive, and automation environments. It ensures system reliability through hardware and software risk mitigation frameworks.

- In Germany, the ISO/SAE 21434 Standard supervises cybersecurity risk management in automotive embedded systems. It establishes security-by-design principles for vehicle electronics, safeguarding data integrity and operational resilience.

- In India, the IEC 62304 Standard enforces software lifecycle processes for embedded medical systems. It ensures system reliability, patient safety, and regulatory compliance in health technology applications.

Competitive Landscape

Key players in the embedded system industry are focusing on continuous R&D investment to improve processing performance, scalability, and security. Companies are expanding their portfolios to include AI-integrated chipsets, real-time operating systems, and modular hardware platforms to meet evolving industry demands.

Strategic collaborations and acquisitions are strengthening supply chains and expanding market reach across industrial, automotive, and consumer domains. Leading participants are also focusing on software optimization and edge computing integration to improve system responsiveness.

Expanding design partnerships and regional manufacturing capacities remains vital for sustaining competitiveness and driving consistent innovation in embedded technologies. In addition, companies are introducing advanced testing solutions to enhance efficiency, compliance, and performance across embedded system development.

- In February 2025, Rohde & Schwarz showcased its advanced test and measurement solutions for the embedded industry at the Embedded World Exhibition & Conference. The company demonstrated technologies are designed to enhance energy efficiency, accelerate EMC compliance, improve digital protocol debugging, and ensure adherence to wireless interface regulatory standards.

Key Companies in Embedded System Market:

- Analog Devices, Inc.

- Renesas Electronics Corporation

- NXP Semiconductors

- Intel Corporation

- SAMSUNG

- Microchip Technology Inc.

- Qualcomm Technologies, Inc.

- Infineon Technologies AG

- STMicroelectronics

- Texas Instruments Incorporated

- Advanced Micro Devices, Inc.

- Cognex Corporation

- Keysight Technologies

- Arm Limited

- Green Hills Software

Recent Developments (Partnerships/Product Launch)

- In July 2025, SolidRun collaborated with Amarisoft to validate a fully functional 4G/5G base station integrating gNB and 5GC on SolidRun’s Ryzen Embedded V3000 platform. This development demonstrated the feasibility of compact, energy-efficient 5G infrastructure without reliance on large, power-intensive servers.

- In May 2025, Keysight Technologies’ Quantum Control System (QCS) was integrated into a newly developed 256-qubit quantum computer at the RIKEN RQC-FUJITSU collaboration center. This milestone marked progress toward fault-tolerant quantum computing and reflected the growing convergence of specialized processors, including GPUs, TPUs, and quantum processing units.

- In March 2025, Altera Corporation introduced its latest Agilex FPGAs, Quartus Prime Pro software, and FPGA AI Suite designed for embedded developers. These programmable solutions enabled rapid development of customized embedded systems across robotics, industrial automation, and medical edge applications, reinforcing advancements in intelligent edge computing.