Market Definition

The market involves the use of digital technologies and data analytics to deliver advertisements that align with the context of a webpage, application, or digital platform. The report covers segmentation by approach, type, deployment, end user, and region, offering insights into emerging trends, technological innovations, and growth drivers shaping the industry.

Contextual advertising enhances audience engagement by analyzing keywords, topics, and user intent to deliver relevant ads in real time. It enables brands to improve targeting accuracy, campaign efficiency, and return on investment across digital media, e-commerce, and mobile platforms.

Applications extend across industries such as retail, technology, travel, and entertainment, helping organizations increase customer interaction, strengthen brand relevance, and achieve measurable marketing outcomes.

Contextual Advertising Market Overview

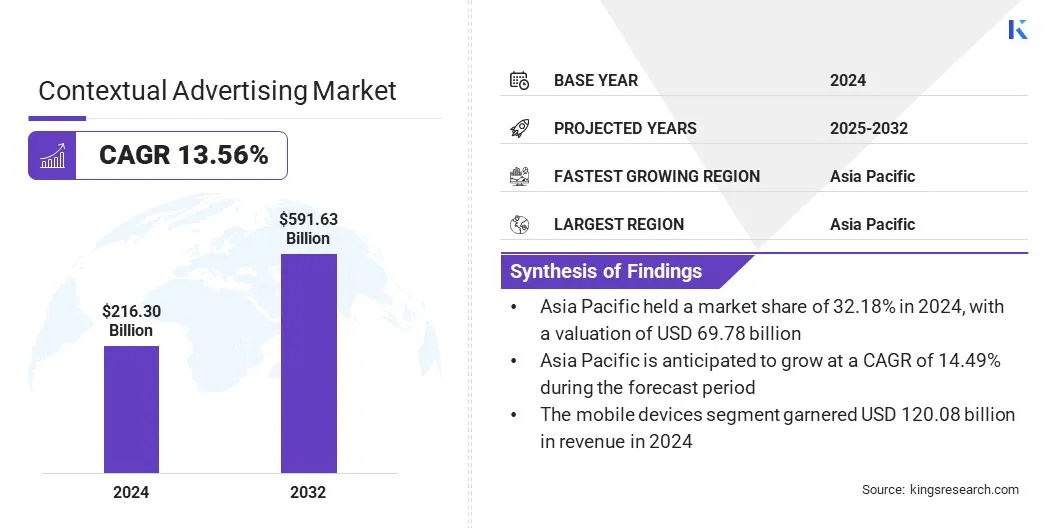

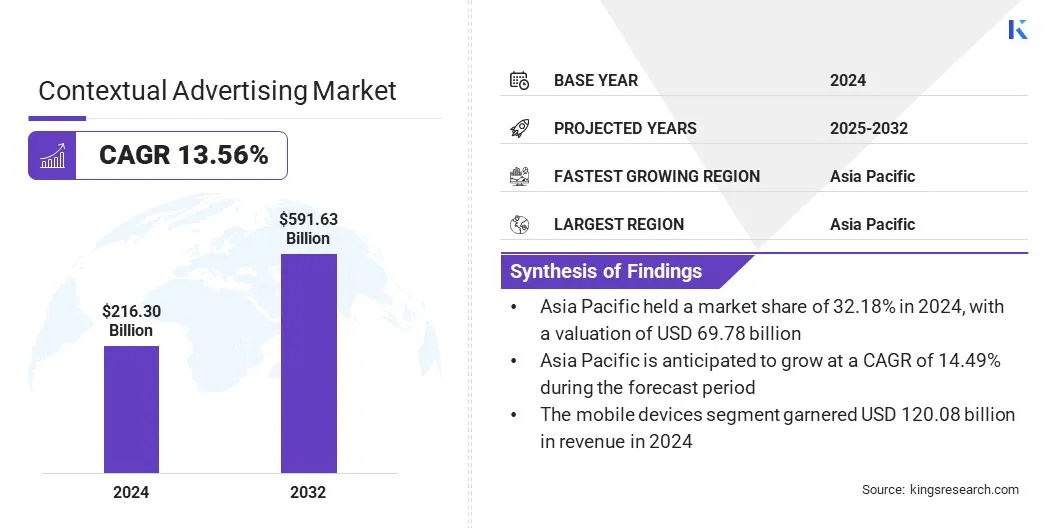

The global contextual advertising market size was valued at USD 216.83 billion in 2024 and is projected to grow from USD 242.93 billion in 2025 to USD 591.63 billion by 2032, exhibiting a CAGR of 13.56% over the forecast period.

This growth is due to the increasing demand for relevant digital advertising to boost user engagement and improve marketing outcomes. Growing use of AI-driven algorithms, real-time data analytics, and programmatic ad platforms allows accurate targeting, higher conversion rates, and optimized advertising spend.

- In June 2025, Seedtag launched neuro-contextual advertising, integrating artificial intelligence with neuroscience to assess consumer interest, emotion, and intent. This innovation improves ad targeting across connected television, video, and open web platforms, surpassing traditional keyword-based methods. The company’s AI agent, Liz, analyzes deeper cognitive signals to optimize campaign effectiveness.

Key Highlights

- The contextual advertising industry size was valued at USD 216.83 billion in 2024.

- The market is projected to grow at a CAGR of 13.56% from 2024 to 2032.

- Asia Pacific held a market share of 32.18% in 2024, valued at USD 69.78 billion.

- The mass contextual advertising segment generated USD 73.44 billion in revenue in 2024.

- The activity-based advertising segment is expected to reach USD 241.08 billion by 2032.

- The mobile devices segment is anticipated to witness the fastest CAGR of 14.23% over the forecast period.

- The retail & e-commerce segment generated USD 48.72 billion in revenue in 2024.

- North America is anticipated to grow at a CAGR of 13.37% over the projected period.

Major companies operating in the contextual advertising market are Google LLC, GumGum, Inc., Outbrain Inc., Amazon.com, Inc., SEEDTAG ADVERTISING, S.L., Microsoft, InMobi, Infolinks, Oracle, Media.net, Playwire LLC, Taboola, Yahoo, Amobee, and Criteo.

Brands, marketers, and digital publishers are prioritizing personalized customer experiences, driving integration of contextual advertising into marketing strategies. Additionally, technological innovations, along with strategic campaigns and omnichannel digital initiatives by organizations, are accelerating market growth.

How is the growth of digital media and mobile platforms driving the contextual advertising market?

The growth of digital media and mobile platforms is playing a pivotal role in driving the market, as consumers increasingly shift their attention toward online and mobile-based content. The widespread use of smartphones, social media, and video streaming services has created new, dynamic touchpoints for advertisers to deliver contextually relevant messages in real time.

Brands are leveraging these channels to enhance personalization, optimize ad placement, and improve audience engagement through behavior- and content-based targeting.

The continuous rise in mobile app usage and on-demand digital content consumption provides advertisers with rich contextual data, enabling precise targeting and higher conversion rates. This ongoing digital expansion is strengthening the adoption of contextual advertising as businesses seek to connect with audiences seamlessly across diverse platforms and digital environments.

How does limited contextual relevance hinder the growth of the contextual advertising market?

Limited contextual relevance poses a significant challenge to the growth of the market, as algorithms and AI-driven platforms may fail to accurately interpret page content, tone, or user intent, resulting in ads that appear irrelevant or misaligned with the surrounding context. This reduces user engagement, weakens brand perception, and diminishes overall campaign effectiveness.

Industries across retail, technology, travel, and entertainment face additional hurdles, as high relevance is critical to achieving measurable marketing outcomes and maintaining audience trust. The lack of advanced targeting models or real-time content analysis can further limit campaign performance.

To address these challenges, organizations are increasingly adopting AI and machine learning algorithms, enhanced semantic analysis tools, and real-time monitoring solutions. These approaches aim to improve contextual accuracy, optimize ad targeting, and ensure advertisements consistently resonate with intended audiences.

How are advancements in artificial intelligence and machine learning shaping the future of the contextual advertising market?

Advancements in artificial intelligence and machine learning are transforming contextual advertising by enabling real-time content analysis, predictive targeting, and automated campaign optimization.

These tools improve the precision and efficiency of ad placements, boost engagement and conversion rates, and scale contextual relevance across large volumes of digital content. This is particularly valuable for industries such as retail, technology, travel, and entertainment, where large volumes of digital content and diverse audiences require accurate ad delivery.

- In March 2024, Audacy launched dynamic AI contextual advertising for podcasts, enabling precise, content-based ad targeting. This platform transcribes episodes and tags content across categories like business, entertainment, sports, and travel, following IAB standards. This allows advertisers to insert relevant ads at moments of peak listener engagement, enhancing effectiveness and the overall listening experience.

Organizations are increasingly adopting AI-driven contextual advertising solutions to improve targeting accuracy, optimize marketing spend, and measure campaign performance. Advanced algorithms help reduce irrelevant placements, improve user experience, and provide actionable insights for data-driven marketing strategies. As a result, AI and analytics are emerging as essential enablers for effective, scalable, and results-oriented digital advertising.

- In September 2025, JioStar launched Moment.AI, an AI-driven contextual ad insertion tool that places ads during moments of high emotional impact in video content. The platform analyzes over 600 emotions and objects to optimize ad placement, enhancing brand visibility, recall, and audience engagement. Early results indicate a 34% improvement in advertising effectiveness compared to traditional placements.

Contextual Advertising Market Report Snapshot

|

Segmentation

|

Details

|

|

By Approach

|

Mass Contextual Advertising, Focused Contextual Advertising, Contextual Behavioral Advertising, and Contextual Billboard Advertising

|

|

By Type

|

Activity-Based Advertising, Location-Based Advertising, and Others

|

|

By Deployment

|

Mobile Devices, Desktops, and Digital Billboards

|

|

By End User

|

Retail & E-commerce, Media & Entertainment, IT & Telecommunication, Automotive & Transportation, Banking, Financial Services, & Insurance (BFSI), Healthcare & Pharmaceuticals, Government & Public Sector, and Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Approach (Mass Contextual Advertising, Focused Contextual Advertising, Contextual Behavioral Advertising, and Contextual Billboard Advertising): The mass contextual advertising segment earned USD 73.44 billion in 2024, primarily due to its broad reach and ability to engage large audiences across diverse digital platforms.

- By Type (Activity-Based Advertising, Location-Based Advertising, and Others): The activity-based advertising held 41.73% of the market in 2024, due to its effectiveness in targeting users based on real-time online behavior and engagement patterns.

- By Deployment (Mobile Devices, Desktops, and Digital Billboards): The mobile devices segment is projected to reach USD 344.58 billion by 2032, owing to the widespread smartphone adoption and increasing consumption of digital content on mobile platforms.

- By End User (Retail & E-commerce, Media & Entertainment, IT & Telecommunication, Automotive & Transportation, Banking, Financial Services, & Insurance (BFSI), Healthcare & Pharmaceuticals, Government & Public Sector, and Others): The retail & e-commerce segment anticipated to grow at a CAGR of 14.67% through the projection period, fueled by the rising demand for personalized shopping experiences and targeted promotional campaigns.

Which regions are driving the growth of the contextual advertising market?

The market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America, by region.

The Asia Pacific contextual advertising market share stood at 32.18% in 2024, valued at USD 69.78 billion. This dominance is due to the rapid digitalization, high smartphone usage, and the growth of e-commerce and social media platforms. Early adoption of AI-driven advertising, programmatic platforms, and real-time content analysis, along with investments in mobile and connected technologies, is improving campaign precision and audience engagement.

Additionally, increasing collaboration between brands, digital publishers, and technology providers is enabling substantial investments in advanced contextual targeting, improving ad relevance and marketing ROI.

The growing focus on personalized user experiences and data-driven marketing strategies is further accelerating regional market growth. Advancements in machine learning, analytics, and programmatic advertising are also improving targeting accuracy and supporting long-term market expansion.

- In April 2024, GumGum integrated Playground xyz’s media portfolio into its Asia-Pacific operations. This enhances GumGum’s AI-powered contextual advertising solutions, improving audience targeting and attention metrics. Playground xyz’s Attention Intelligence Platform continues as a standalone data solution, supporting global attention measurement. The integration completes the rollout of The Mindset Platform, combining advanced targeting tools to better connect brands with consumers.

The North American contextual advertising industry is set to grow at a CAGR of 13.37% over the forecast period. This growth is fueled by the increasing adoption of digital marketing strategies, AI-driven targeting, and advanced analytics across industries such as retail, technology, and media.

Expanding enterprise investments in programmatic advertising, mobile platforms, and connected television are improving ad relevance, user engagement, and overall campaign performance. Furthermore, advancements in real-time content analysis and semantic targeting, along with growing collaboration between brands and technology providers, are driving broader market adoption and strengthening the supporting infrastructure.

- In September 2023, U.S.-based OpenX introduced ConteX, a supply-side platform delivering contract-free contextual advertising solutions. The platform allows brands and agencies to access premium data partners directly, enabling efficient, privacy-compliant targeting without individual negotiations. ConteX improves targeting accuracy, provides deeper campaign insights, and leverages predictive methodologies to engage relevant audiences across multiple content verticals.

Furthermore, organizations are prioritizing personalized user experiences, data-driven decision-making, and performance optimization to drive long-term adoption. The expansion of digital ecosystems and growing consumer demand for relevant, non-intrusive advertising further boost regional market growth.

Regulatory Frameworks

- In the European Union, the General Data Protection Regulation (GDPR) regulates the collection, processing, and storage of personal data. It ensures that organizations obtain user consent, protect personal information, and maintain transparency, directly impacting personalized and targeted advertising practices in the market.

- The California Consumer Privacy Act (CCPA) regulates the use and sale of consumers’ personal data. It grants consumers rights to access, delete, and opt out of the sale of their data, influencing how contextual advertisers collect and utilize information for targeted campaigns.

- The Advertising Standards Council of India (ASCI) regulates responsible and ethical advertising practices. It ensures advertisements are truthful, non-misleading, and socially responsible, shaping content and targeting strategies in contextual advertising.

Competitive Landscape

Companies operating in the contextual advertising industry are maintaining competitiveness through investments in artificial intelligence, machine learning, and programmatic advertising technologies. These firms are deploying contextual advertising solutions for real-time content analysis, predictive targeting, and campaign optimization, enabling more effective marketing operations across retail, technology, media, and entertainment sectors.

Market players are expanding their offerings with AI-driven targeting platforms and integrated programmatic tools to improve ad relevance and campaign performance.

They are establishing regional support centers and collaborating with publishers, technology providers, and marketing agencies to facilitate adoption and improve advertising effectiveness. Additionally, companies are providing training, technical support, and real-time performance monitoring to optimize campaigns and sustain competitive positioning.

- In December 2024, FreeWheel, a Comcast company, launched its Contextual Marketplace, enabling publishers to automate and scale monetization across premium streaming inventory. The platform allows advertisers to target media buys using advanced video-level insights, improving relevance and engagement. Partner integrations with KERV.ai and Proximic by Comscore improve targeting capabilities, supporting precise ad placement across premium video content.

Key Companies in Contextual Advertising Market:

- Google LLC

- GumGum, Inc.

- Outbrain Inc.

- Amazon.com, Inc.

- SEEDTAG ADVERTISING, S.L.

- Microsoft

- InMobi

- Infolinks

- Oracle

- Media.net

- Playwire LLC

- Taboola

- Yahoo

- Amobee

- Criteo

- TripleLift

- GENIEE USA Inc.

- MonetizeMore

Recent Developments (Partnerships/Launch)

- In June 2025, Integral Ad Science (IAS) launched AI-driven contextual category reporting for Meta platforms, enhancing brand safety and content suitability on Facebook and Instagram Feed and Reels. The tool provides insights across 46+ contextual categories in 34 languages and integrates with IAS’s Content Block List for frame-by-frame video analysis. This solution supports advertisers in optimizing campaigns, improving targeting precision, and reducing wasted ad spend.

- In May 2025, PubMatic partnered with Overtone to enhance contextual advertising across the internet. The collaboration uses Overtone’s AI to analyze content at page and paragraph levels, enabling brand-safe, relevant ad placements. This approach improves campaign performance while supporting quality content and maintaining consumer trust.

- In March 2025, Spherex introduced AI-powered scene-level contextual ad targeting within its SpherexAI platform. The tool analyzes visual, audio, dialogue, and text signals to place ads that align with the cultural and emotional context of video content. Leveraging its Cultural Knowledge Graph, it ensures relevance and brand safety across over 200 countries, enhancing engagement and campaign effectiveness.

- In December 2024, CMI Media Group partnered with Anoki to launch the first pharmaceutical contextual CTV campaign targeting both direct-to-consumer and healthcare provider audiences. Using Anoki’s ContextIQ technology, the AI-driven campaign delivers privacy-compliant, highly relevant ads at optimal viewing moments. The initiative aims to boost engagement and campaign effectiveness while meeting strict healthcare marketing standards.

- In April 2024, Seedtag introduced Contextual TV, an AI-driven solution for Connected TV (CTV) advertisers. The platform allows brands to run privacy-compliant, high-performing campaigns across the open web and advanced TV, using AI insights and tailored creative strategies. Contextual TV is designed to optimize CTV advertising effectiveness and enhance audience engagement.