Market Definition

Edge computing is a decentralized approach that processes data close to its source, such as devices or local servers, rather than relying solely on centralized cloud infrastructure. This approach minimizes latency, enhances data privacy, and reduces bandwidth requirements, making it highly efficient for real-time operations.

Its adoption spans industries such as manufacturing, healthcare, automotive, smart cities, and telecommunications, where immediate data processing is essential. Key applications include predictive maintenance, autonomous driving, remote patient monitoring, traffic management, and real-time analytics, helping organizations improve responsiveness and operational efficiency.

Edge Computing Market Overview

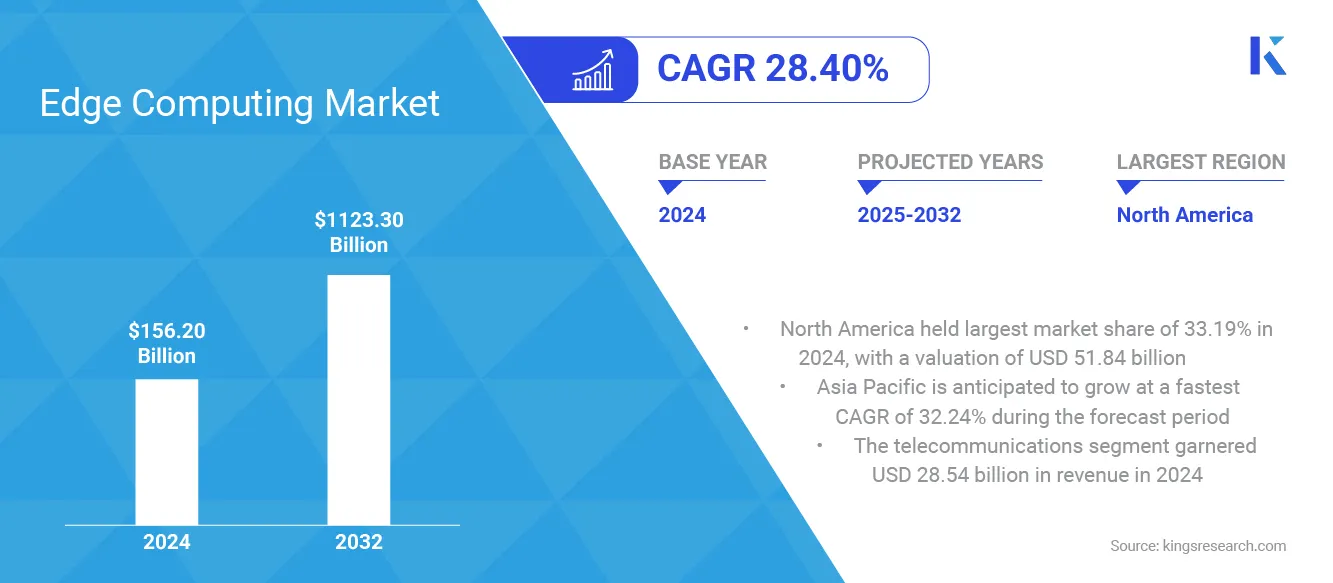

According to Kings Research, the global edge computing market size was valued at USD 156.20 billion in 2024 and is projected to grow from USD 195.18 billion in 2025 to USD 1,123.30 billion by 2032, exhibiting a CAGR of 28.40% during the forecast period.

This growth is attributed to the rapid proliferation of IoT devices that generate massive volumes of real-time data, requiring processing closer to the source. Additionally, containerization and edge-oriented orchestration are streamlining application deployment and management across distributed environments, making edge infrastructure more scalable and efficient.

Key Market Highlights:

- The edge computing industry size was recorded at USD 156.20 billion in 2024.

- The market is projected to grow at a CAGR of 28.40% from 2025 to 2032.

- North America held a share of 33.19% in 2024, valued at USD 51.84 billion.

- The telecommunications segment garnered USD 28.54 billion in revenue in 2024.

- The IoT applications segment is expected to reach USD 404.09 billion by 2032.

- The hardware segment secured the largest revenue share of 43.61% in 2024.

- The hybrid edge segment is estimated to grow at a robust CAGR of 33.42% through the forecast period.

- The large enterprises segment is projected to attain the largest revenue share of 62.52% by 2032.

- Asia Pacific is anticipated to grow at a CAGR of 32.24% over the forecast period.

Major companies operating in the edge computing market are Amazon Web Services, Inc., Microsoft, Google LLC, Cisco Systems, Inc., IBM, Huawei Technologies Co., Ltd., Dell Inc., Hewlett Packard Enterprise Development LP, Intel Corporation, NVIDIA Corporation, Oracle, Akamai Technologies, Schneider Electric, Siemens, and EdgeConneX Inc.

Growing demand for real-time data analysis in applications such as autonomous vehicles, remote surgery, and industrial automation is boosting the adoption of edge computing. Autonomous vehicles require instant processing of sensor and navigation data to ensure safe and accurate decision-making on the road.

Remote surgery procedures depend on ultra-low latency connections, allowing surgeons to operate robotic systems without delay. Industrial automation relies on edge computing to process machine data locally, enabling predictive maintenance and operational efficiency. This is prompting organizations to prioritize reduced latency and faster response times closer to the data source.

- In December 2024, STMicroelectronics launched the STM32N6 series microcontrollers, designed specifically for edge AI and machine learning applications. These MCUs enable local real-time image and audio processing without sending data to centralized servers. Automotive and industrial-grade versions allow devices such as vehicles, factory equipment, or wearable tech to execute complex tasks with minimal latency and lower energy consumption.

Market Driver

Proliferation of IoT Devices

The increasing number of connected devices in smart homes, cities, and industries is generating massive data volumes, highlighting the need for local processing. Smart homes are using connected appliances, sensors, and security systems that are continuously producing data, needing immediate analysis.

Smart city infrastructure depends on IoT devices for traffic management, energy optimization, and public safety monitoring that function effectively only with localized data processing. Industrial IoT deployments are producing high-frequency machine and sensor data, requiring edge computing for real-time decision-making.

Healthcare devices such as wearables and remote monitoring systems are generating continuous patient data streams that are demanding efficient local analysis.

- In January 2025, Synaptics partnered with Google to develop Edge AI technology for IoT devices. The collaboration integrates Google’s machine learning core with Synaptics’ Astra hardware to accelerate the development of AI-capable IoT devices. These devices are designed to support real-time, multimodal data processing, including vision, image, voice, and sound, directly at the edge.

Market Challenge

Security Vulnerabilities

A key challenge impeding the progress of the edge computing market is addressing the increased vulnerability of distributed edge nodes to cyberattacks.

The decentralized architecture introduces multiple entry points for threats, including malware, data breaches, and device hijacking. Furthermore, integration with IoT devices and reliance on real-time data processing amplify risks, as compromised nodes can disrupt critical applications across industries.

To address this challenge, market players are implementing advanced endpoint protection systems, adopting zero-trust security frameworks, and deploying AI-driven monitoring solutions to detect and mitigate threats in real time. These measures are strengthening overall network resilience and ensuring secure operation of edge infrastructures in diverse application areas.

Market Trend

Containerization and Edge-Oriented Orchestration

The edge computing market is witnessing the growing use of lightweight containerization technologies to improve application portability and efficiency across distributed edge nodes. Edge-optimized orchestration platforms, including customized Kubernetes variants, are enabling seamless deployment, scaling, and lifecycle management of workloads in resource-constrained environments.

This approach reduces complexity, supports rapid service rollout, and enhances interoperability between devices, networks, and cloud systems. Containerization and orchestration are significant in ensuring scalability, reliability, and the cost-effective management of edge applications.

- In June 2025, Barbara introduced version 3.0 of its secure edge-native orchestration platform, tailored for industrial environments. Barbara 3.0 enables the deployment and orchestration of containers, AI models, and microservices across distributed edge nodes. It offers features such as real-time monitoring, remote firmware and software updates, and scalable management of thousands of edge nodes from a central interface, without reliance on cloud connectivity.

Edge Computing Market Report Snapshot

| Segmentation | Details |

| By Component | Hardware, Software, Services |

| By Deployment Type | On-premise, Cloud-based, Hybrid Edge |

| By Organization Size | Small & Medium Enterprises (SMEs), Large Enterprises |

| By Application | Predictive Maintenance, Remote Monitoring, IoT Applications, Robotics & Automation, Content Delivery and Media, Others |

| By Industry Vertical | Telecommunications, Manufacturing, Healthcare, Energy & Utilities, Transportation & Logistics, Government & Defense, Others |

| By Region | North America: U.S., Canada, Mexico Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa South America: Brazil, Argentina, Rest of South America |

Market Segmentation

- By Component (Hardware, Software, and Services): The hardware segment earned USD 68.12 billion in 2024, due to the high demand for servers, gateways, and edge devices that enable real-time data processing and low-latency performance at distributed sites.

- By Deployment Type (On-premise, Cloud-based, and Hybrid Edge): The cloud-based segment held a share of 41.07% in 2024, fueled by its ability to provide scalable infrastructure, centralized management, and seamless integration with AI and IoT applications across multiple industries.

- By Organization Size (Small & Medium Enterprises (SMEs) and Large Enterprises): The large enterprises segment is projected to reach USD 702.32 billion by 2032, owing to its substantial IT budgets, extensive adoption of IoT and cloud technologies, and need for low-latency data processing across multiple global locations.

- By Application (Predictive Maintenance, Remote Monitoring, IoT Applications, Robotics & Automation, Content Delivery and Media, and Others): The IoT applications segment is estimated to grow at a significant CAGR of 33.45% through the forecast period, attributed to the increasing deployment of connected devices across industries, generating vast volumes of real-time data that require local processing to reduce latency and enhance operational efficiency.

Edge Computing Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

North America edge computing market share stood at 33.19% in 2024, valued at USD 51.84 billion. This dominance is reinforced by extensive 5G rollouts led by major telecom operators. The rapid expansion of 5G networks has increased the need for edge computing to minimize latency and process data closer to end-users.

Telecom providers are deploying mobile edge computing to enable advanced use cases such as autonomous systems, smart city solutions, and high-bandwidth video services.

Moreover, leading cloud service providers, including AWS, Microsoft Azure, and Google Cloud, are partnering with telecom and enterprise players to strengthen their edge capabilities. Initiatives such as AWS Wavelength and Azure Edge Zones are helping reduce adoption challenges and supporting faster integration of edge computing into enterprise operations.

- In May 2025, AWS announced the general availability of a new AWS Wavelength Zone in Lenexa, Kansas, in partnership with Verizon. This service enables ultra-low latency compute, storage, and network services to run within Verizon’s 5G network infrastructure. It extends AWS cloud capabilities to the telecom network edge, supporting applications in healthcare, finance, gaming, and smart cities.

The Asia-Pacific edge computing industry is set to grow at a significant CAGR of 32.24% over the forecast period. This growth is attributed to the high penetration of smartphones, sensors, and industrial IoT devices, which generate massive volumes of data every day.

Key industries such as automotive, consumer electronics, and utilities are adopting connected technologies on a large scale. Managing this data at the edge helps ease congestion on central networks while enabling real-time applications, aiding regional market expansion.

Moreover, the region is experiencing rapid digital transformation, supported by large-scale investments in data centers, fiber connectivity, and advanced mobile networks. This rapid infrastructure expansion is facilitating the broader deployment of edge computing solutions.

- In March 2025, NTT expanded its edge computing and data center infrastructure across key Asia Pacific markets, including India, Indonesia, and Vietnam, to support the rising demand for IoT, 5G, and real-time applications. This initiative leverages the region’s rapid digital transformation, characterized by high smartphone penetration, industrial IoT adoption, and government-backed investments in connectivity.

Regulatory Frameworks

- In the European Union, the Network and Information Security Directive 2 (NIS2) expands cybersecurity obligations across critical infrastructure, including cloud and data centers. The Cyber Resilience Act (CRA) establishes mandatory security requirements for connected devices, while the Digital Operational Resilience Act (DORA) addresses ICT risks in financial services. Alongside the EU Cybersecurity Act, these frameworks create a strict regulatory environment for edge computing adoption.

- In China, the Network Data Security Management Regulations, effective since January 2025, govern both personal and non-personal data. Companies must classify, document, and secure important datasets. Large digital platforms are subject to strict accountability, while data localization rules restrict the transfer of sensitive information abroad.

- In Japan, the Act on the Protection of Personal Information (APPI) enforces robust data protection and cybersecurity standards. The law requires companies to obtain consent for personal data use and implement adequate security safeguards. For edge deployments, enterprises must ensure that data processed locally meets APPI’s requirements.

Competitive Landscape

Key players operating in the edge computing market are adopting strategies such as partnerships, technology integration, and security-focused solutions to remain competitive. Collaborations between technology providers and service companies are enabling enterprises to scale edge deployments more effectively, while addressing challenges such as secure connectivity and network performance.

Companies are also prioritizing research and development in areas, including AI-enabled security, low-latency data processing, and cloud-edge integration. These strategies help firms strengthen their service portfolios, meet enterprise demands for secure edge environments, and strengthen their market position.

- In November 2024, Cisco and LTIMindtree expanded their partnership, with LTIMindtree adopting Cisco Secure Access as its security service edge solution. This implementation provides zero-trust network access and AI-enabled functionality. The agreement extends integrated Secure Access Service Edge and SD-WAN offerings to LTIMindtree’s global clients.

Top Companies in Edge Computing Market:

- Amazon Web Services, Inc.

- Microsoft

- Google LLC

- Cisco Systems, Inc.

- IBM

- Huawei Technologies Co., Ltd.

- Dell Inc.

- Hewlett Packard Enterprise Development LP

- Intel Corporation

- NVIDIA Corporation

- Oracle

- Akamai Technologies

- Schneider Electric

- Siemens

- EdgeConneX Inc.

Recent Developments

- In February 2025, Cisco expanded its partnership with NVIDIA. The initiative aims to integrate Cisco Silicon One with NVIDIA’s Spectrum-X Ethernet networking platform. Cisco will be the only partner silicon included in Spectrum-X, enabling unified architectures for AI-ready data center networks.

- In September 2024, Intel announced that its next-generation Intel 18A process node is on track for production in 2025. The node incorporates RibbonFET and PowerVia technologies, designed to enhance processor scale and efficiency for AI and edge computing applications.

- In March 2024, Intel established Altera as a standalone FPGA business. Altera now operates independently, while Intel retains a 49 percent ownership and continues to be actively involved in operations. The new company now offers Agilex 5 FPGAs, featuring AI integration and optimization for embedded and edge applications.

- In March 2024, Microsoft and NVIDIA announced significant collaborations, including Azure’s adoption of NVIDIA’s Grace Blackwell GB200 superchip to support generative AI and simulation workloads. The integration also includes NVIDIA’s DGX Cloud with Microsoft Fabric for AI model development.