Market Definition

Synthetic fuels, or synfuels, are liquid or gaseous energy carriers produced through chemical synthesis rather than traditional petroleum refining. They can be derived from coal, natural gas, biomass, or captured carbon dioxide combined with hydrogen.

Production pathways, including Fischer–Tropsch synthesis and power-to-liquids (PtL) processes, enable large-scale application. When integrated with renewable energy and carbon capture technologies, synthetic fuels serve as a low-carbon alternative to conventional fossil fuels. Their compatibility with existing storage, distribution, and combustion infrastructure makes them a key component in decarbonizing transportation and industrial sectors.

Synthetic Fuels Market Overview

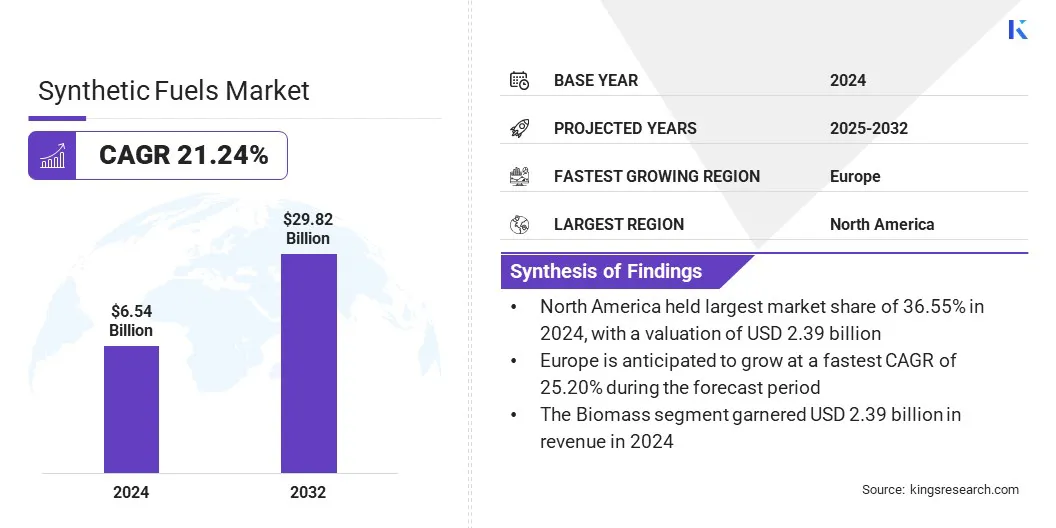

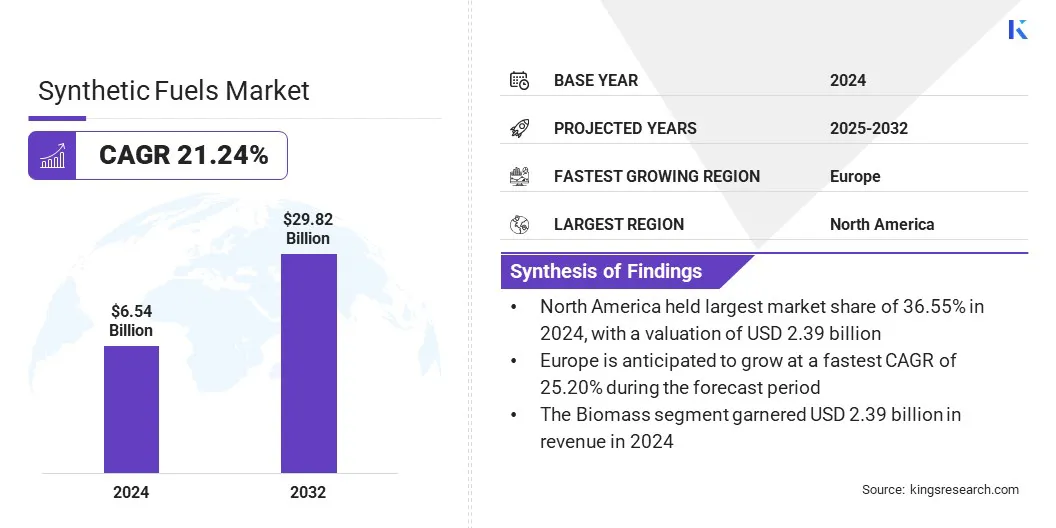

The global synthetic fuels market size was valued at USD 6.54 billion in 2024 and is projected to grow from USD 7.74 billion in 2025 to USD 29.82 billion by 2032, exhibiting a CAGR of 21.24% during the forecast period. This expansion is fueled by the growing emphasis on reducing carbon emissions across sectors such as aviation, shipping, and manufacturing.

Additionally, increasing investments in power-to-liquids and carbon capture technologies are creating demand for synthetic fuels as a sustainable alternative, offering compatibility with existing infrastructure while supporting global decarbonization targets.

Key Highlights:

- The synthetic fuels industry size was recorded at USD 6.54 billion in 2024.

- The market is projected to grow at a CAGR of 21.24% from 2025 to 2032.

- North America held a share of 36.55% in 2024, valued at USD 2.39 billion.

- The Biomass segment garnered USD 2.39 billion in revenue in 2024.

- The Fischer-Tropsch Synthesis segment is expected to reach USD 11.55 billion by 2032.

- The Transportation segment is anticipated to witness the fastest CAGR of 23.03% during the forecast period.

- Europe is anticipated to grow at a CAGR of 25.20% over the forecast period.

Major companies operating in the synthetic fuels market are Shell, Sasol, Exxon Mobil Corporation., TotalEnergies, BP p.l.c., Eni S.p.A., CHN ENERGY Investment Group Co.,LTD, NESTE, PetroSA, Gevo, Dakota Gasification Company, Phillips 66 Company, Chiyoda Corporation, Qatar Energy, and LanzaTech..

Increasing emphasis on sustainable energy transition is boosting the demand for synthetic fuels in the industrial and transportation sectors. Synthetic fuels are helping reduce lifecycle carbon emissions by replacing conventional fossil fuels, supporting cleaner energy consumption across aviation, shipping, and heavy-duty transport.

Advanced production technologies, such as power-to-liquid and gas-to-liquid processes, are improving conversion efficiency and enabling the use of captured CO₂ and renewable hydrogen as feedstocks. Companies are adopting synthetic fuel solutions to meet regulatory emission targets, enhance energy security, and support long-term decarbonization goals, making them a critical component of low-carbon energy strategies.

- In June 2025, INERATEC partnered with Rheinmetall to deploy scalable Power-to-Liquid (PtL) solutions across defense and critical infrastructure sectors. The collaboration focuses on developing resilient energy systems that operate independently of fossil fuel supply chains while delivering secure, sustainable power.

Market Driver

Stringent Environmental Regulations and Decarbonization Targets

The expansion of the synthetic fuels market is driven by stringent environmental regulations and global decarbonization targets that are accelerating the adoption of synthetic fuels. These fuels enable industries to reduce lifecycle emissions and provide a sustainable alternative to conventional fossil fuels.

Regulatory measures are prompting refineries and transportation sectors to integrate cleaner fuel options, while synthetic fuels also allow compatibility with existing infrastructure. Governments and industries are increasingly investing in production technologies to meet compliance requirements, generating a strong demand for synthetic fuels.

- According to the International Civil Aviation Organization (ICAO), the Carbon Offsetting and Reduction Scheme for International Aviation (CORSIA) mandates airlines to reduce emissions and promotes the use of sustainable aviation fuels, including synthetic fuels.

Market Challenge

High Production Costs

A key challenge impeding the progress of the synthetic fuels market is the high production cost compared to conventional fossil fuels. The complex conversion processes, including power-to-liquid and gas-to-liquid technologies, require significant energy input and advanced infrastructure, making synthetic fuels less economically competitive. This cost barrier limits large-scale adoption and poses challenges for commercial viability.

To address this challenge, companies are investing in process optimization, renewable energy integration, and scaling up production facilities to achieve cost reductions. Strategic collaborations and government subsidies are also being leveraged to tackle the price challenge and foster adoption.

Market Trend

Integration of Renewable Energy in Synthetic Fuel Production

A notable trend influencing the synthetic fuels market is the integration of renewable energy sources such as solar, wind, and hydropower into fuel synthesis processes. Companies are increasingly employing renewable-powered electrolysis to produce green hydrogen, a vital feedstock for synthetic fuel generation. This lowers production emissions and aligns synthetic fuels with circular energy strategies, highlighting their role in renewable energy adoption.

- In May 2025, Infinium, a producer of eFuels, began constructing its second U.S.-based production site, Project Roadrunner, in Reeves County, Texas, near Pecos. The project, backed by investors Brookfield Asset Management and Breakthrough Energy Catalyst, marked a major step in expanding synthetic fuel capacity by converting waste CO₂ and renewable energy into sustainable aviation fuel (SAF) and other synthetic fuels.

Synthetic Fuels Market Report Snapshot

|

Segmentation

|

Details

|

|

By Feedstock

|

Biomass, Natural Gas, Coal, Others

|

|

By Production Process

|

Fischer-Tropsch Synthesis, Methanol Synthesis, Electrolysis, Coal Liquefaction

|

|

By End-Use

|

Transportation, Power Generation, Industrial, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Feedstock (Biomass, Natural Gas, Coal, and Others): The biomass segment earned USD 2.39 billion in 2024, primarily due to increasing adoption of renewable feedstocks and government incentives promoting low-carbon fuel production.

- By Production Process (Fischer-Tropsch Synthesis, Methanol Synthesis, Electrolysis, and Coal Liquefaction): The Fischer-Tropsch synthesis segment held a share of 43.23% in 2024, propelled by its ability to produce high-quality synthetic fuels with lower sulfur content and compatibility with existing fuel infrastructure.

- By End-Use (Transportation, Power Generation, Industrial, and Others): The transportation segment is projected to reach USD 18.15 billion by 2032, owing to the growing demand for low-carbon fuels in aviation, shipping, and heavy-duty road transport.

Synthetic Fuels Market Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

North America synthetic fuels market share stood at 21.43% in 2024, valued at USD 2.39 billion. This dominance is supported by strong policy frameworks, technological advancements, and increasing investments in clean energy projects.

North America synthetic fuels market share stood at 21.43% in 2024, valued at USD 2.39 billion. This dominance is supported by strong policy frameworks, technological advancements, and increasing investments in clean energy projects.

The regional market further benefits from government-backed initiatives, including funding under the U.S. Department of Energy’s clean energy programs and state-level low-carbon fuel standards, which promtoe the production and adoption of sustainable fuels.

The aviation and transportation sectors are further boosting demand for synthetic fules as they strive to meet stringent emission reduction targets. Furthermore, private companies are increasing investments in eFuel and power-to-liquid projects, stimulating regional market progress.

- In July 2020, the U.S. Department of Energy (DOE) announced more than USD100 million over five years to support research and development in synthetic fuel technologies, including advancing artificial photosynthesis for fuel production from sunlight.

The Europe synthetic fuels industry is estimated to grow at a robust CAGR of 25.20% over the forecast period. This rapid growth is bolstered by the region’s strong regulatory framework and ambitious climate policies. Initiatives such as the European Union’s Fit for 55 package and Green Deal initiatives are stimulating the adoption of sustainable fuels by enforcing clear mandates for the reduction of greenhouse gas emissions.

Furthermore, the availability of dedicated funding such as the EU Innovation Fund further strengthens the commercialization prospects. Europe’s stringent climate targets, public-private collaboration, and early adoption of clean technologies are expected to spur regional market expansion over the forecast period.

Regulatory Frameworks

- In North America, the U.S. Environmental Protection Agency (EPA) regulates low-carbon fuel standards and oversees renewable fuel credits, while the Department of Energy (DOE) provides funding and incentives for R&D in sustainable fuel technologies.

- In Europe, the European Union enforces the Renewable Energy Directive (RED III) and the Fit for 55 package, which set binding targets for carbon reduction and renewable fuel adoption.

- In Japan, the Ministry of Economy, Trade and Industry (METI) regulates alternative fuel integration, supporting SAF and synthetic fuels for industrial and transportation applications, while providing guidelines for technology adoption and emissions reduction.

- Globally, the International Civil Aviation Organization (ICAO) establishes governance frameworks for sustainable aviation fuels and synthetic fuels, promoting global collaboration to achieve emission reduction targets while ensuring safe, standardized implementation.

Competitive Landscape

Major players operating in the synthetic fuels industry are prioritizing technological innovation, targeted R&D, and strategic partnerships to enhance production efficiency and support cost-effective fuel solutions.

By developing advanced synthesis processes and integrating renewable energy sources, companies are enabling flexible feedstock use, including captured CO₂ and green hydrogen, reducing dependence on conventional fossil fuels. These initiatives align with industry priorities for decarbonization, sustainability, and operational efficiency, positioning synthetic fuels as a viable low-carbon alternative across transportation, aviation, and industrial sectors.

Key Companies in Synthetic Fuels Market:

- Shell

- Sasol

- Exxon Mobil Corporation.

- TotalEnergies

- BP p.l.c.

- Eni S.p.A.

- CHN ENERGY Investment Group Co.,LTD

- NESTE

- PetroSA

- Gevo

- Dakota Gasification Company

- Phillips 66 Company

- Chiyoda Corporation

- Qatar Energy

- LanzaTech

Recent Developments

- In May 2025, Swiss aviation technology company Metafuels AG announced plans to establish a new synthetic sustainable aviation fuel (e-SAF) production facility at the Port of Rotterdam. The company collaborated with Evos to expand production capacity for sustainable aviation fuels.

- In October 2023, Aramco partnered with ENOWA, NEOM’s energy and water company, to sign a joint development agreement for the construction of a first-of-its-kind synthetic electro-fuel (e-fuel) demonstration plant.