Market Definition

The market involves the production of aviation fuels through more sustainable and environmentally friendly methods compared to traditional jet fuels. SAF is derived from renewable resources like plant oils, algae, agricultural waste, as opposed to fossil fuels like kerosene.

The report presents a comprehensive assessment of the primary drivers propelling the market, alongside a detailed examination of regional analysis and the competitive landscape impacting industry dynamics.

Sustainable Aviation Fuel Market Overview

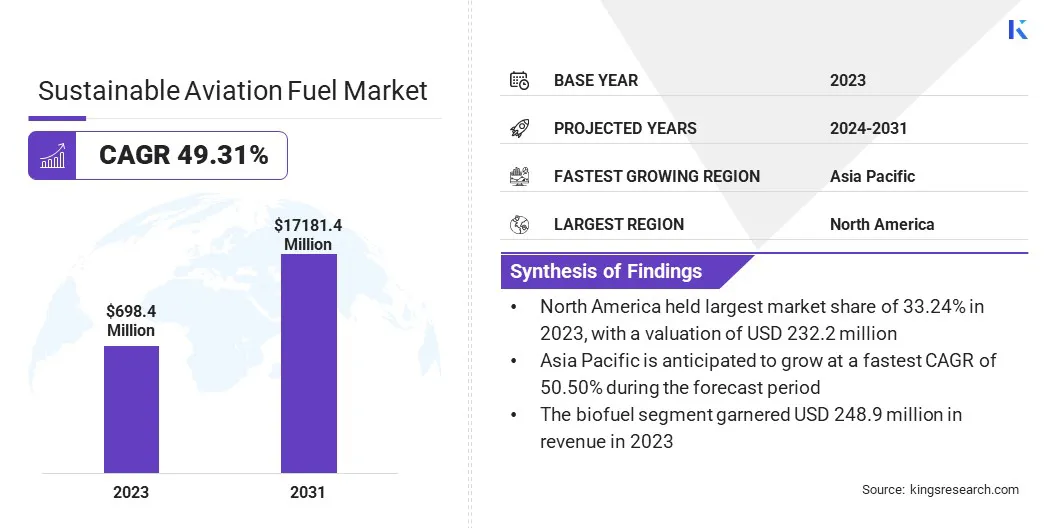

The global sustainable aviation fuel market size was valued at USD 698.4 million in 2023, which is estimated to be USD 1038.6 million in 2024 and reach USD 17181.4 million by 2031, growing at a CAGR of 49.31% from 2024 to 2031.

The availability of sustainable feedstock, such as agricultural waste, algae, and carbon captured from the air, is a key driver of the market, enabling the production of greener aviation fuels at scale.

Major companies operating in the global sustainable aviation fuel industry are Neste, LanzaTech, World Energy, LLC, Fulcrum Bioenergy, Essar, TotalEnergies, Aemetis, Inc., Alder Energy, LLC, BP p.l.c., Eni S.p.A., DGFuels, LLC., Gevo, MV Aktiengesellschaft, Shell, and SkyNRG B.V.

The market is poised for substantial growth, driven by a surge in the consumer demand for carbon-neutral travel and heightened corporate responsibility initiatives. Airlines and industry players are prioritizing SAF to meet stricter sustainability targets and reduce emissions as environmental concerns become more prominent.

Government support, including regulations and incentives, further propels the adoption of SAF. This market is evolving rapidly as both businesses and passengers seek greener travel options, positioning SAF as a crucial solution in the aviation industry's shift toward sustainability.

- In February 2024, Airbus and TotalEnergies formed a strategic partnership to accelerate aviation decarbonization, focusing on SAF. The collaboration aims to reduce CO2 emissions, with TotalEnergies supplying SAF for Airbus and advancing research for 100% sustainable fuels.

Key Highlights:

Key Highlights:

- The sustainable aviation fuel industry size was valued at USD 698.4 million in 2023.

- The market is projected to grow at a CAGR of 49.31% from 2024 to 2031.

- North America held a market share of 33.24% in 2023, with a valuation of USD 232.2 million.

- The biofuel segment garnered USD 9 million in revenue in 2023.

- The 30% to 50% segment is expected to reach USD 6415.2 million by 2031.

- The Fischer-Tropsch Synthetic Paraffinic Kerosene (FT-SPK) segment held a market share of 28.47% in 2023.

- The regional transport aircraft segment is anticipated to grow at a CAGR of 50.04% during the forecast period.

- The market in Asia Pacific is anticipated to grow at a CAGR of 50.50% during the forecast period.

Market Driver

"Feedstock Availability"

The availability of sustainable feedstocks drives the sustainable aviation fuel market, as it ensures a continuous supply of raw materials necessary for fuel production. Agricultural waste, algae, and captured carbon are ideal sources, offering both environmental benefits and scalability.

These feedstocks help reduce dependency on fossil fuels, support the circular economy, and mitigate the impact of conventional jet fuel on climate change. The SAF market is projected to expand significantly as more innovative methods are developed to utilize these feedstocks.

- In April 2024, Kent secured the FEED contract for Fulcrum BioEnergy’s NorthPoint project in the UK, which will convert waste into 100 million liters of SAF. Kent’s scope includes engineering services, cost-estimating, procurement planning, managing licensors, and execution planning, supporting the availability of sustainable feedstocks crucial for aviation decarbonization.

Market Challenge

"High Production Costs"

A major challenge facing the SAF market is its high production costs, which are significantly higher than traditional jet fuel. This cost disparity limits its widespread adoption and scalability, hindering efforts to reduce aviation emissions.

Overcoming this challenge involves investing in research to improve production technologies, increasing economies of scale, and securing government incentives or subsidies. Costs are expected to decrease as SAF production processes become more efficient and feedstock availability expands, making SAF more commercially viable and accessible for airlines globally.

Market Trend

"Blended SAF Adoption"

Adoption of blended SAF is a key trend in the aviation industry, with airlines gradually mixing SAF with conventional jet fuel to reduce emissions without requiring significant infrastructure changes. This blending approach allows airlines to reduce their carbon footprint while maintaining compatibility with existing engines and fueling systems.

Usage of blended SAF is expected to increase as SAF production scales up and becomes cost-competitive, offering a practical solution for the aviation sector to meet decarbonization targets in the near term.

- In July 2024, Neste and HELLENiQ ENERGY collaborated to supply blended SAF to Greece. The partnership will enhance SAF availability at airports across Greece, reducing Greenhouse Gas (GHG) emissions, with the delivery being the first bulk shipment by ship to Thessaloniki.

Sustainable Aviation Fuel Market Report Snapshot

|

Segmentation

|

Details

|

|

By Type

|

Biofuel, Hydrogen Fuel, Power to Liquid Fuel, Gas-to-Liquid

|

|

By Blending Capacity

|

Below 30%, 30% to 50%, Above 50%

|

|

By Technology

|

Hydroprocessed Esters and Fatty Acids Synthetic Paraffinic Kerosene (HEFA-SPK), Fischer-Tropsch Synthetic Paraffinic Kerosene (FT-SPK), Synthetic Iso-Paraffins from Fermented Hydroprocessed Sugar (HFS-SIP), Alcohol-to-Jet Synthetic Paraffinic Kerosene (ATJ-SPK), Catalytic Hydrothermolysis Jet (CHJ)

|

|

By End Use

|

Commercial, Regional Transport Aircraft, Military Aviation, Business & General Aviation, Unmanned Aerial Vehicles

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation:

- By Type (Biofuel, Hydrogen Fuel, Power to Liquid Fuel, Gas-to-Liquid): The biofuel segment earned USD 248.9 million in 2023, due to the increasing demand for eco-friendly alternatives and rising sustainability awareness.

- By Blending Capacity (Below 30%, 30% to 50%, Above 50%): The 30% to 50% segment held 37.74% share of the market in 2023, due to the rising adoption of SAF for blended fuel applications in airlines.

- By Technology [Hydroprocessed Esters and Fatty Acids Synthetic Paraffinic Kerosene (HEFA-SPK), Fischer-Tropsch Synthetic Paraffinic Kerosene (FT-SPK), Synthetic Iso-Paraffins from Fermented Hydroprocessed Sugar (HFS-SIP), Alcohol-to-Jet Synthetic Paraffinic Kerosene (ATJ-SPK), Catalytic Hydrothermolysis Jet (CHJ)]: The Fischer-Tropsch Synthetic Paraffinic Kerosene (FT-SPK) segment is projected to reach USD 4898.0 million by 2031, owing to technological advancements and growing demand for SAF in the aviation sector.

- By End Use (Commercial, Regional Transport Aircraft, Military Aviation, Business & General Aviation, Unmanned Aerial Vehicles): The regional transport aircraft segment is anticipated to register a CAGR of 50.04% during the forecast period, driven by increased investments in smaller, sustainable aircraft solutions.

Sustainable Aviation Fuel Market Regional Analysis

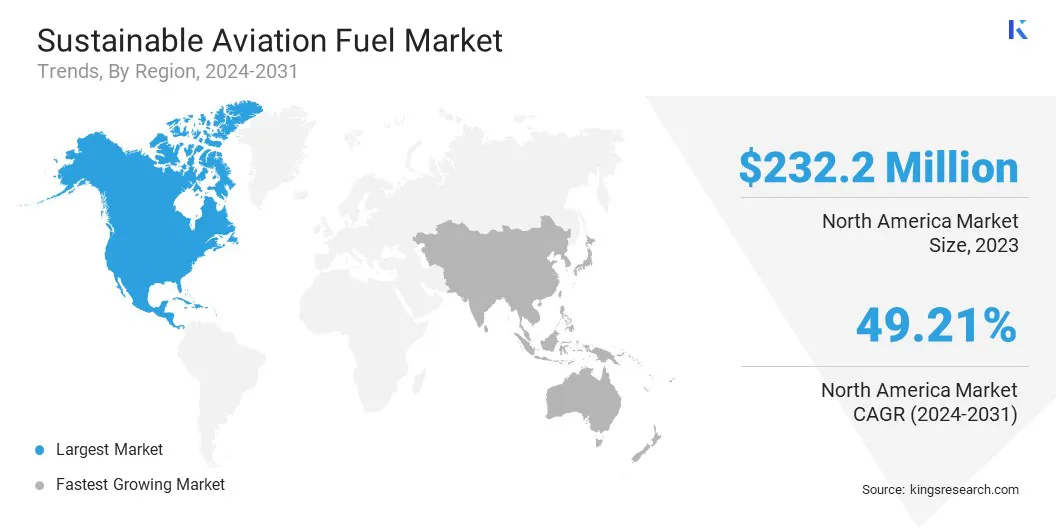

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

North America sustainable aviation fuel market accounted for a market share of around 33.24% in 2023, with a valuation of USD 232.2 million. North America remains the dominant region in the market, due to its strong regulatory frameworks, significant investments in renewable technologies, and growing focus on sustainability within the aviation sector.

North America sustainable aviation fuel market accounted for a market share of around 33.24% in 2023, with a valuation of USD 232.2 million. North America remains the dominant region in the market, due to its strong regulatory frameworks, significant investments in renewable technologies, and growing focus on sustainability within the aviation sector.

The region benefits from a well-established infrastructure, extensive Research and Development (R&D) efforts, and government incentives aimed at reducing carbon emissions.

Additionally, strategic collaborations between airlines, fuel producers, and technology innovators in North America further strengthen the market dominance in the region, positioning it as a key region for SAF adoption and market growth globally.

- In September 2023, United Airlines, a U.S.-based company, entered into an agreement with Cemvita to purchase up to one billion gallons of SAF from Cemvita’s first full-scale SAF plant. This strategic partnership aims to significantly boost the availability of SAF for aviation, supporting sustainability goals.

The sustainable aviation fuel industry in Asia Pacific is poised for significant growth at a robust CAGR of 50.50% over the forecast period. Asia Pacific is the fastest-growing region in the market, driven by rapid industrialization, increasing air traffic, and evolving environmental regulations.

The region’s emphasis on clean energy alternatives, combined with significant investments in infrastructure and technology, supports this growth. Additionally, growing collaborations between governments, airlines, and fuel producers are increasing the production capacity of SAF. The rising demand for sustainable solutions and the region’s push toward carbon neutrality further fuel the rapid expansion of the SAF market in Asia Pacific.

Regulatory Frameworks

- In the U.S., the Renewable Fuel Standard (RFS) program, established by the Energy Policy Act of 2005 and expanded by the 2007 Energy Independence and Security Act, aims to reduce GHG emissions and promote renewable fuels.

- In India, the National Policy on Biofuels (2018) promotes advanced biofuels, including Second and Third Generation ethanol, biodiesel, and bio-CNG, aiming to reduce import dependency, cut emissions, and foster rural employment through sustainable biofuel production.

- In the EU, the Renewable Energy Directive sets targets for increased renewable energy use, fostering cooperation among member states to achieve sustainable energy goals and reduce GHG emissions across the region.

Competitive Landscape:

Companies in the sustainable aviation fuel industry are significantly increasing production capacities, focusing on utilizing waste and residues for biofuel production. They are investing in advanced technologies to produce sustainable aviation fuels and are working to meet regulatory mandates for higher SAF shares.

Additionally, efforts are underway to integrate circular economy principles, reduce CO2 emissions from air transport, and develop complementary renewable energy solutions to support the broader decarbonization goals of the aviation sector.

- In June 2023, TotalEnergies announced significant investments at its Grandpuits site, including doubling its SAF production capacity to 285,000 tons annually and constructing a biomethane production unit. These initiatives align with the company’s commitment to sustainability and decarbonization.

List of Key Companies in Sustainable Aviation Fuel Market:

- Neste

- LanzaTech

- World Energy, LLC

- Fulcrum Bioenergy

- Essar

- TotalEnergies

- Aemetis, Inc.

- Alder Energy, LLC

- BP p.l.c.

- Eni S.p.A.

- DGFuels, LLC.

- Gevo

- MV Aktiengesellschaft

- Shell

- SkyNRG B.V.

Recent Developments (Expansion/Product Launch)

- In March 2025, EET Fuels, a key player in the UK's energy transition and aviation fuel supply, expanded its network to nine UK airports by securing jet fuel supply agreements with two major airports. This growth strengthens fuel security and supports the aviation industry's expansion while reinforcing EET Fuels’ commitment to the UK’s low-carbon future. Operating from the Stanlow Refinery, EET Fuels continues to invest in low-carbon solutions and sustainable energy advancements.

- In June 2024, LanzaTech and LanzaJet introduced CirculAir, a commercial solution that converts waste, carbon, and renewable power into SAF. This innovative technology integrates gas fermentation and alcohol-to-jet pathways to produce SAF from various waste feedstocks, offering a cost-effective and scalable approach to reduce aviation emissions. CirculAir aims to significantly contribute to decarbonizing the aviation industry globally by enabling large-scale SAF production with carbon-negative potential.

- In April 2023, LanzaTech announced plans for Wales’ first SAF production facility in Port Talbot. The facility aims to transform emissions into SAF using innovative carbon recycling technologies. With support from the UK’s Advanced Fuels Fund, the project will significantly reduce aviation emissions, providing a sustainable fuel source and supporting the country’s climate goals. Construction is slated to begin in 2025, with production expected to start in 2026-27.