Market Definition

Green hydrogen is hydrogen produced through the process of electrolysis of water using renewable energy sources such as wind, solar, or hydroelectric power. It offers sustainability, zero greenhouse gas emissions, and versatility as a clean fuel and feedstock.

Green hydrogen is used in industrial processes, power generation, transportation, and chemical production. It functions as a clean energy source and feedstock, supporting the decarbonization of energy-intensive sectors.

Green Hydrogen Market Overview

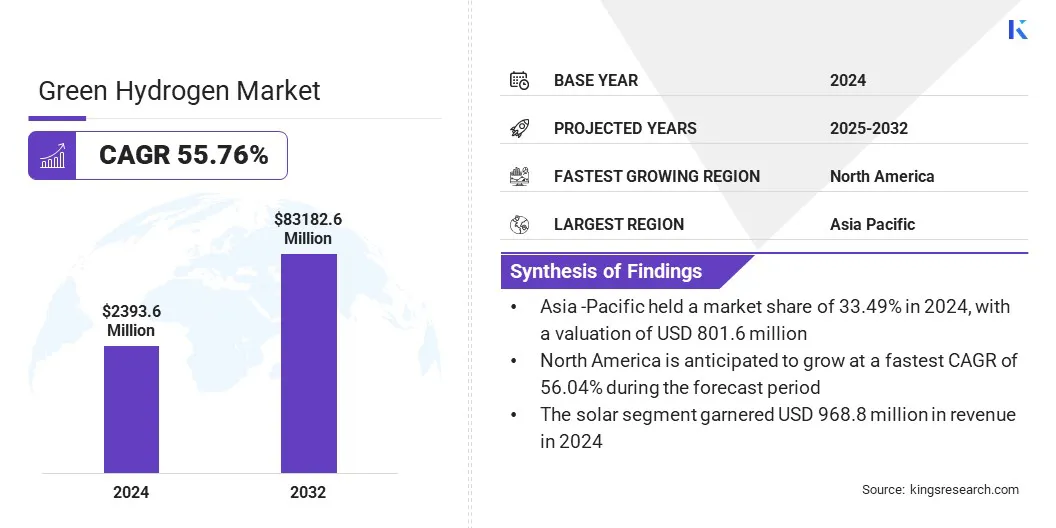

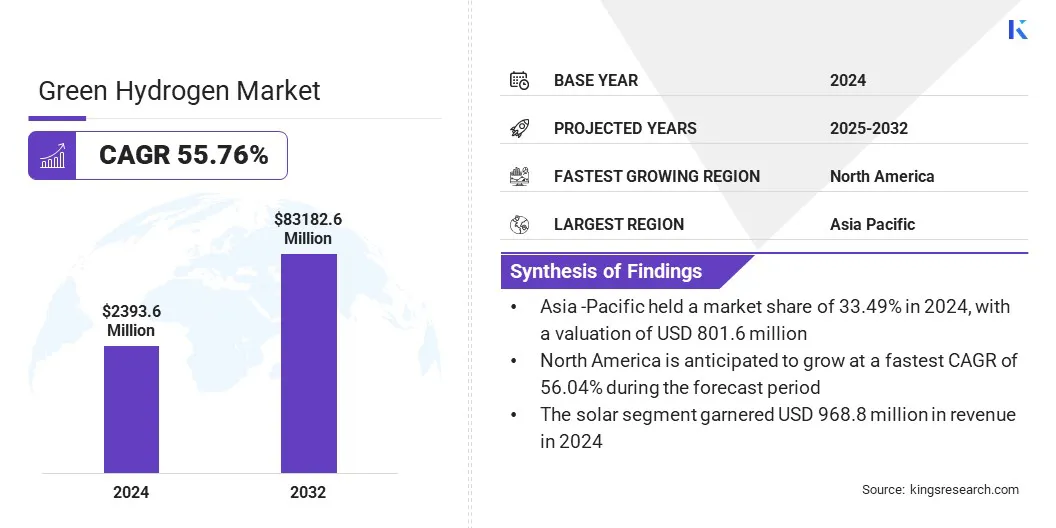

According to Kings Research, the global green hydrogen market size was valued at USD 2,393.6 million in 2024 and is projected to grow from USD 3,721.3 million in 2025 to USD 83,182.6 million by 2032, exhibiting a CAGR of 55.76% over the forecast period.

Market growth is driven by government and private sector initiatives to reduce carbon emissions through green hydrogen adoption. The expansion of renewable energy infrastructure is further supporting its integration across industrial, power, and transportation sectors.

Key Highlights:

- The green hydrogen industry size was recorded at USD 2,393.6 million in 2024.

- The market is projected to grow at a CAGR of 55.76% from 2025 to 2032.

- Asia Pacific held a share of 33.49% in 2024, valued at USD 801.6 million.

- The proton exchange membrane electrolysis segment garnered USD 795.6 million in revenue in 2024.

- The solar segment is expected to reach USD 33,312.2 million by 2032.

- The industrial segment is anticipated to witness the fastest CAGR of 56.17% over the forecast period.

- North America is anticipated to grow at a CAGR of 56.04% over the forecast period.

Major companies operating in the green hydrogen market are Nel ASA, L’AIR LIQUIDE S.A., Air Products and Chemicals, Inc, Bloom Energy Corporation, ITM Power plc, ENGIE Insight Services Inc, Siemens, The Messer SE & Co. KGaA, Plug Power Inc, Cummins Inc, Linde PLC, McPhy Energy S.A, Green Hydrogen Systems, ENAPTER S.r.l, and Topsoe A/S.

The growing focus of government on advancing low-carbon energy solutions and scaling renewable energy capacity is accelerating the adoption of green hydrogen. Additionally, public sector investments supporting green hydrogen development are expanding infrastructure and contributing to the market growth.

- In June 2024, the World Bank approved USD 1.5 billion to accelerate India’s low-carbon energy transition and support green hydrogen development.

Rising Government Investments in Hydrogen Infrastructure

A key factor propelling the growth of the green hydrogen market is rising government investments focused on accelerating the clean energy transition. Public funding is supporting the development of large-scale hydrogen production facilities, dedicated transmission pipelines, and advanced storage systems.

This is enabling industries such as chemicals, power, and transportation to replace fossil fuels with clean hydrogen. Additionally, growing emphasis by governments on green hydrogen infrastructure development, including production, storage, and distribution reducing operational challenge and driving market growth.

- In January 2025, the European Commission announced USD 1.30 billion under the Connecting Europe Facility for cross-border infrastructure to strengthen the Energy Union. This includes over USD 260 million for green hydrogen projects.

High Cost of Production

A key challenge impeding the growth of the green hydrogen market is the high cost of production compared to fossil fuel-based alternatives. Electrolysis powered by renewable energy requires expensive electrolyzer systems, advanced storage infrastructure, and integration with variable renewable sources. High electricity consumption further drives up operational expenses, creating financial barriers and slowing the widespread adoption of green hydrogen.

To address this challenge, market players are investing in advanced electrolyzer technologies such as proton exchange membrane (PEM) electrolyzers and alkaline electrolyzers that reduce the energy consumption of hydrogen production.

Companies are scaling up manufacturing capacities to achieve economies of scale and lower the unit costs of electrolyzers. They are partnering with renewable energy providers for affordable electrolysis power and collaborating with governments to secure subsidies and tax incentives.

Advancements in Electrolyzers

A key trend influencing the green hydrogen market is the advancement in electrolyzer technologies. Manufacturers are deploying proton exchange membrane, alkaline, and solid oxide electrolyzers that offer higher efficiency, durability, and modular scalability for industrial, power, and transportation applications.

These innovations reduce energy consumption and operational costs while enabling large-scale hydrogen production. These advancements are driving the adoption of green hydrogen solutions and support infrastructure development by enabling large-scale and cost-efficient production.

- In February 2025, Waaree Group launched a 300 MW electrolyzer manufacturing facility in Valsad, Gujarat, advancing India’s National Green Hydrogen Mission. The plant will supply electrolyzers to industrial sectors such as steel, refining, fertilizers, chemicals, transportation, food, and power generation.

Green Hydrogen Market Report Snapshot

|

Segmentation

|

Details

|

|

By Technology

|

Proton Exchange Membrane Electrolysis, Alkaline Electrolysis, Solid Oxide Electrolysis, Anion Exchange Membrane Electrolysis

|

|

By Source

|

Solar, Wind, Others

|

|

By End Use

|

Power & Energy, Transportation, Chemical, Industrial, Manufacturing, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation:

- By Technology (Proton Exchange Membrane Electrolysis, Alkaline Electrolysis, Solid Oxide Electrolysis, and Anion Exchange Membrane Electrolysis): The proton exchange membrane electrolysis segment earned USD 795.6 million in 2024, driven by high efficiency, scalability, and growing industrial adoption.

- By Source (Solar, Wind, and Others): The solar segment held 40.47% of the market in 2024, due to declining solar electricity costs and increasing integration with electrolyzer systems.

- By End Use (Power & Energy, Transportation, Chemical, Industrial, Manufacturing, and Others): The power & energy segment is projected to reach USD 20,747.3 million by 2032, owing to rising demand for clean hydrogen in electricity generation and grid decarbonization initiatives.

Green Hydrogen Market Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

Asia Pacific green hydrogen market share stood at 33.49% in 2024 in the global market, valued at USD 801.6 million. This dominance is attributed to the rising energy demand and rapid industrialization across the region.

Expanding investments by government and regional players in renewable energy generation in solar and wind are enabling large-scale, cost-effective green hydrogen production. Government policies promoting decarbonization, clean energy adoption, and incentives for renewable energy and hydrogen projects are further supporting market growth in this region.

Moreover, technological advancements by regional market players in electrolyzers, storage, and distribution systems are improving efficiency and scalability of green hydrogen production. The deployment of large-scale, integrated hydrogen production facilities by regional players is strengthening infrastructure and enhancing regional production capacity, reinforcing Asia Pacific’s leadership in the market.

- In July 2025, China’s Envision Energy launched the world’s largest green hydrogen and ammonia facility in Chifeng, Inner Mongolia. The plant operates entirely on renewable energy and uses AI to manage operations.

North America green hydrogen industry is set to grow at a robust CAGR of 56.04% over the forecast period. This growth is propelled by increasing government initiatives and incentives aimed at promoting clean energy adoption across the region.

Regional players are advancing electrolyzer, storage, and distribution technologies to enable more efficient and cost-effective hydrogen production. Increasing corporate and industrial efforts toward decarbonization are driving demand across power, transportation, and manufacturing sectors.

Additionally, rapid development of hydrogen production projects and infrastructure by regional players is strengthening production capabilities. This is supporting the large-scale deployment of green hydrogen and further driving market growth across the region.

- In September 2025, Electric Hydrogen acquired hydrogen project developer Ambient Fuels to expand its project development capabilities. The acquisition adds Ambient Fuels’ U.S.-based hydrogen production and development projects to Electric Hydrogen’s portfolio.

Regulatory Frameworks

- In the U.S., the Department of Energy (DOE) regulates the development and deployment of green hydrogen technologies. It oversees research, production, storage, sets standards, and provides funding programs to facilitate infrastructure development, ensuring safe, efficient, and scalable hydrogen solutions.

- In the UK, the Department for Business, Energy & Industrial Strategy (BEIS) regulates green hydrogen by setting strategic policies, funding initiatives, and production targets. It aims to expand low-carbon hydrogen production and promote adoption in energy-intensive industries and power generation.

- In China, the National Energy Administration (NEA) regulates green hydrogen by formulating policies, setting production targets, and establishing national hydrogen standards. It also monitors project implementation to promote large-scale adoption and integration with renewable energy.

- In India, the Ministry of New and Renewable Energy (MNRE) regulates green hydrogen through the National Green Hydrogen Mission, supporting production and infrastructure development. It also frames policies to promote clean hydrogen deployment across sectors.

Competitive Landscape

Major players operating in the green hydrogen industry are investing in high-efficiency proton exchange membrane, alkaline, and solid oxide electrolyzers to improve energy efficiency and scalability of hydrogen production. Key players are expanding production capacities and deploying modular systems to meet growing market demand for clean hydrogen across industrial, power, and transportation applications.

They are focusing on strategic partnerships with renewable energy providers to secure affordable electricity for electrolysis and ensure consistent hydrogen output. Additionally, Key players are acquiring green hydrogen projects to accelerate project development and increase renewable hydrogen generation capacity.

- In July 2025, H2Apex acquired a 1 GW green hydrogen project from the insolvent HH2E at the former Greifswald nuclear power station in Lubmin, Germany. The company plans to expand total renewable hydrogen capacity in northeastern Germany to 1.6 GW.

Key Companies in Green Hydrogen Market:

- Nel ASA

- L’AIR LIQUIDE S.A.

- Air Products and Chemicals, Inc

- Bloom Energy Corporation

- ITM Power plc

- ENGIE Insight Services Inc

- Siemens

- The Messer SE & Co. KGaA

- Plug Power Inc

- Cummins Inc

- Linde PLC

- McPhy Energy S.A

- Green Hydrogen Systems

- ENAPTER s.r.l

- Topsoe A/S.

Recent Developments

- In August 2025, Four Zeros Energy partnered with Vergia to co-develop and finance a UK green hydrogen portfolio. The facility will produce 2,000 tonnes of green hydrogen annually to replace natural gas in mining operations.

- In July 2025, L&T Energy GreenTech announced the development of a green hydrogen plant at Indian Oil Corporation’s refinery at Panipat, India. The plant will produce 10,000 tonnes of green hydrogen annually to decarbonize refinery operations.

- In September 2024, SSE and EET Hydrogen partnered to develop the 40 MWe Gowy Green Hydrogen facility at the Stanlow Manufacturing Complex in the North West of England. The project will supply hydrogen to local industrial consumers, enabling them to lower emissions and decarbonize their operations.

- In July 2024, Oil and Natural Gas Corporation (ONGC) announced plans to invest approximately USD 24 billion to establish renewable energy sites and green hydrogen plants in India.