Clean Energy Market Size

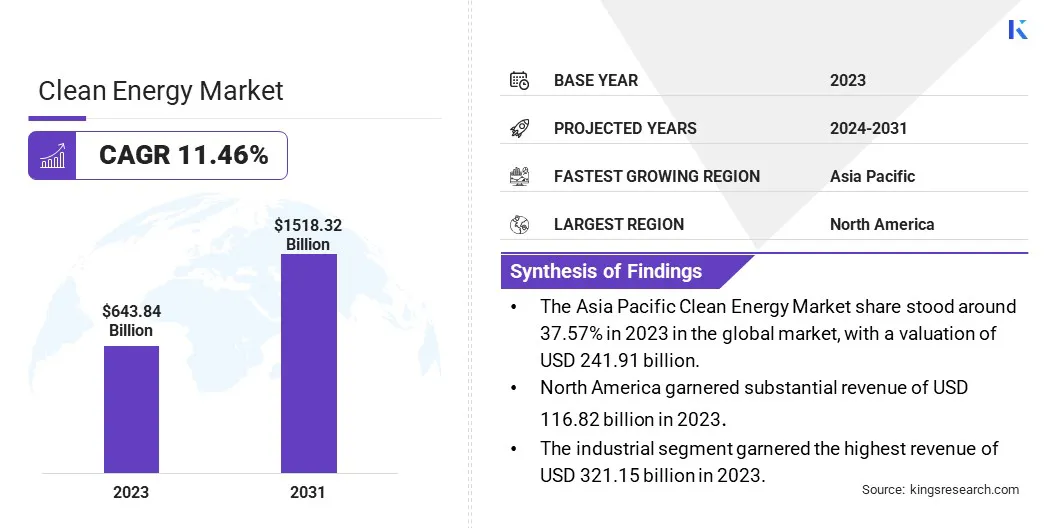

Global Clean Energy Market size was recorded at USD 643.84 billion in 2023, which is estimated to be at USD 710.35 billion in 2024 and projected to reach USD 1518.32 billion by 2031, growing at a CAGR of 11.46% from 2024 to 2031. The global clean energy market is experiencing remarkable growth and transformation driven by a several factors including technological advancements, policy support, declining costs of clean energy generation, and increasing environmental awareness. In the scope of work, the report includes solutions offered by companies such as Siemens Gamesa Renewable Energy, Enel Spa, Vestas, Calpine, NextEra Energy, Inc., Canadian Solar, Beta Utensili S.p.A., Orsted A/S, Statkraft AS, ADM, and others.

One of the most notable trends in the clean energy market is the rapid expansion of solar and wind power installations. The declining costs of solar photovoltaic (PV) panels and wind turbines, coupled with improvements in efficiency and scalability, have made these technologies increasingly competitive when compared to conventional fossil fuels. Due to this, countries around the world are setting ambitious targets for renewable energy deployment and phasing out coal-fired power plants.

Government policies and incentives play a crucial role in fostering investment and deployment of clean energy technologies. Initiatives such as feed-in tariffs, tax credits, renewable portfolio standards, and carbon pricing mechanisms have incentivized both private and public sector investment in renewables. Moreover, the growing emphasis on decarbonization and climate mitigation efforts, exemplified by the Paris Agreement, has propelled the adoption of clean energy solutions on a global scale.

- According to IEA, global renewable capacity additions are projected to surge by 107 gigawatts (GW) in 2023, marking the largest absolute increase on record, bringing the total to over 440 GW.

This sector encompasses a diverse range of renewable energy sources such as solar, wind, hydroelectric, biomass, and geothermal, as well as energy storage solutions and energy efficiency technologies. Furthermore, it refers to the economic ecosystem comprising renewable energy sources and associated technologies aimed at reducing greenhouse gas emissions and mitigating climate change. It includes the production, distribution, and consumption of clean energy resources, as well as related industries such as manufacturing, construction, and research and development.

Analyst’s Review

The global clean energy market is poised to witness substantial growth in the forecast years, mainly attributed to increasing environmental awareness, favorable government policies, and technological advancements in the generation of clean energies. Key players in the market are adopting strategies such as expanding their renewable energy portfolios, investing in research and development for innovative clean energy technologies, forming strategic partnerships and collaborations to enhance market presence and competitiveness, and focusing on cost reduction and efficiency improvements to capitalize on the growing demand for clean energy solutions. These strategies enable companies to leverage opportunities in emerging markets, address evolving customer needs, and contribute to the transition towards a sustainable energy future.

Clean Energy Market Growth Factors

The global Clean Energy Market size is witnessing remarkable growth, propelled by the increasing global energy demand due to population growth and economic expansion, which is necessitating sustainable solutions to meet future needs. Clean energy emerges as a viable option, offering scalability and environmental benefits while effectively addressing this rising demand. For instance, countries such as China and India, which are experiencing rapid urbanization and industrialization, are striving to adopt renewable energy sources to power their burgeoning economies while curbing emissions.

Furthermore, rising concerns regarding climate change are accelerating the transition to clean energy sources. With growing awareness of the environmental impacts of fossil fuels, governments, businesses, and consumers are increasingly adopting renewables as a means to mitigate greenhouse gas emissions and combat global warming. Initiatives such as the Paris Agreement underscore the pressing need for cleaner energy alternatives to mitigate carbon emissions.

Additionally, reducing costs of clean energy technologies is reshaping the energy landscape, making renewables increasingly competitive with traditional sources. For instance, the declining prices of solar panels and wind turbines have led to significant investment in utility-scale projects worldwide, thereby contributing to the expansion of clean energy capacity.

Moreover, the decentralization of energy production is influencing the energy sector, with consumers actively engaging in generating their own clean power. This shift toward distributed energy systems, facilitated by advancements in technologies, including rooftop solar and microgrids, is enhancing energy resilience and fostering community engagement in sustainability efforts.

However, developing economies face significant challenges in transitioning to clean energy. Grid modernization is imperative to accommodate the integration of variable renewable energy sources as existing infrastructure often lacks the necessary upgrades. This bottleneck inhibits the scalability of renewables and hampers efforts to diversify energy portfolios. Policy and regulatory uncertainty, compounded by inconsistent or ambiguous policies that deter investment, hinders the growth of clean energy market in developing nations.

Clean Energy Market Trends

The global energy landscape is undergoing a profound transformation due to the notable shift toward renewable energy sources such as solar and wind, which are experiencing rapid growth and are poised to capture a larger share of the energy mix. For instance, in 2020, renewable energy accounted for nearly 90% of new electricity capacity additions globally, highlighting the increasing dominance of renewables in the energy sector, mainly in the developed economies.

Moreover, there is a growing focus on improving energy efficiency across sectors as a means to reduce overall energy demand and support the integration of clean energy technologies. Initiatives aimed at enhancing energy efficiency in buildings, transportation, and industrial processes are gaining traction worldwide, propelled by both economic and environmental imperatives.

Furthermore, the digitalization of the energy grid is transforming the management and distribution of energy. Smart grids and digital technologies enable real-time monitoring, optimization, and control of energy flows, facilitating the integration of renewables and enhancing grid reliability and resilience.

Additionally, emerging clean energy technologies, such as geothermal, hydrogen, and ocean energy, present promising opportunities for diversifying the energy mix and addressing specific challenges associated with renewable energy deployment. These technologies hold the potential to tap into new sources of clean energy and contribute to the decarbonization efforts across various sectors.

Moreover, there is an increasing focus on grid integration and energy storage solutions to manage the intermittency of renewable energy sources and ensure grid stability. Innovations in grid-scale energy storage technologies such as batteries, pumped hydro, and hydrogen storage are essential for balancing supply and demand and enabling the seamless integration of renewables into the grid.

Segmentation Analysis

The global clean energy market is segmented based on source, end user, and geography.

By Source

Based on source, the market is categorized into wind, solar, bio, hydroelectric, and others. The hydroelectric segment captured the largest share of 41.18% in 2023. The established infrastructure and mature technology of hydroelectric power provides a reliable and cost-effective source of renewable energy. Countries with abundant water resources, such as China, Brazil, and Canada, have significantly invested in large-scale hydroelectric projects, thereby supporting the expansion of the segment.

Moreover, hydroelectric power offers the advantage of grid stability and energy storage capabilities, allowing adaptation to fluctuations in electricity demand. This makes it a crucial component in balancing intermittent renewable sources such as wind and solar. Additionally, the relatively low operational and maintenance costs of hydroelectric plants, along with their long operational lifespans, contribute to their economic attractiveness. Environmental benefits further play a major role in the growth of the hydroelectric segment.

- In 2023, as reported by IEA, additions in the capacity of solar PV utility were recorded at 33.3 GW, distributed solar PV at 48.6 GW, onshore wind energy at 28.7 GW, and offshore wind energy at 4.9 GW

- According to the World Bioenergy Association, bioenergy accounted for 9% of the energy mix, producing 685 TWh. Of this total, 69% originated from solid biomass, and 17% was derived from municipal and industrial waste.

By End User

Based on end user, the market is divided into residential, commercial, and industrial. The industrial segment garnered the highest revenue of USD 321.15 billion in 2023. The energy-intensive nature of industrial operations is leading to a significant demand for reliable and cost-effective energy solutions. Industries such as manufacturing, mining, and processing require substantial power consumption, which makes the transition to clean energy sources both economically and environmentally beneficial. Additionally, many industrial players are increasingly focusing on sustainability and reducing their carbon footprints in response to regulatory pressures and corporate social responsibility commitments.

Moreover, advancements in clean energy technologies, such as industrial-scale solar panels, wind turbines, and bioenergy systems, have become more accessible and cost-effective, thereby resulting in widespread adoption. Financial incentives and government subsidies further support this transition by offsetting initial investment costs, which fosters the growth of the segment.

Clean Energy Market Regional Analysis

Based on region, the global clean energy market is classified into North America, Europe, Asia-Pacific, MEA, and Latin America.

The Asia Pacific Clean Energy Market share stood around 37.57% in 2023 in the global market, with a valuation of USD 241.91 billion. Rapid economic growth, coupled with urbanization and governmental support, is contributing to a significant shift toward clean energy solutions. Countries including China, Japan, and India are experiencing unprecedented economic expansion, which is leading to a surge in energy demand. This is resulting in increased investments in renewable energy infrastructure to meet growing needs sustainably. With rapid urbanization across the region, particularly in densely populated areas, the demand for cleaner energy sources is rising to mitigate air pollution and improve public health.

Moreover, government subsidies and incentives play a pivotal role in promoting clean energy adoption. Nations such as Japan, South Korea, and Australia are offering substantial financial support to bolster the development and deployment of renewable energy technologies, thereby fostering innovation and market competitiveness. This support extends to manufacturing, research, and development initiatives, thus positioning Asia-Pacific as a key region in the global clean energy market.

North America garnered substantial revenue of USD 116.82 billion in 2023. The region is experiencing robust growth, mainly attributed to abundant natural resources, deregulated electricity markets, and technological innovation. In the U.S., the considerable solar potential in states such as California, Arizona, and Nevada, has led to a significant increase in solar power installations,. This growth has been supported by favorable policies and incentives.

Furthermore, wind-rich regions, such as Texas and the Great Plains, have witnessed substantial investments in wind energy projects, thereby bolstering the region's renewable energy capacity. Moreover, deregulated electricity markets in states, including Texas, New York, and Illinois, have fostered competition and innovation, thereby promoting the adoption of renewable energy technologies. Additionally, advancements in grid modernization and energy storage technologies are enhancing grid reliability and enabling the integration of intermittent renewable energy sources. Additionally, government policies aimed at increasing the production of other clean energy sources such as geothermal and bio energy are propelling regional market growth.

- As reported by the Energy Information Administration of U.S., in 2022, wind and solar contributed 14% of U.S. electricity generation. This share increased approximately to 16% in 2023 and is projected to increase by 18% in 2024. However, coal's share decreased from 20% in 2022 to 17% in 2023.

Competitive Landscape

The global clean energy market report will provide valuable insight with an emphasis on the fragmented nature of the industry. Prominent players are focusing on several key business strategies such as partnerships, mergers and acquisitions, product innovations, and joint ventures to expand their product portfolio and increase their market shares across different regions. Companies are implementing impactful strategic initiatives, such as expanding services, investing in research and development (R&D), establishing new service delivery centers, and optimizing their service delivery processes, which are likely to create new opportunities for market growth.

List of Key Companies in Clean Energy Market

- Siemens Gamesa Renewable Energy

- Enel Spa

- Vestas

- Calpine

- NextEra Energy, Inc.

- Canadian Solar

- Beta Utensili S.p.A.

- Ørsted A/S

- Statkraft AS

- ADM

Key Industry Developments

- April 2024 (Acquisition): Copenhagen Infrastructure Partners, through its CI V fund, acquired Liberty Renewables, a wind energy company, established in 2019. The company has 1.3GW wind projects in pipeline.This strategic acquisition underscores CIP's commitment to expanding its footprint in the US onshore wind sector and enhancing its renewable energy portfolio. The integration of Liberty Renewables’ significant project pipeline aligns with CIP’s broader objectives of advancing clean energy initiatives and contributing to sustainable energy solutions.

- February 2024 (Acquisition): Elia acquired a stake in the American clean energy company energyRe Giga. The Elia Group committed to invest $400 million over the next three years to acquire a 35.1% share in energyRe Giga Projects. This transaction aligns with Elia's strategic plan to expand its geographical presence and foster growth across the U.S. and Europe, with the aim of establishing itself as a leading global energy company.

The Global Clean Energy Market is Segmented as:

By Source

- Wind

- Solar

- Bio

- Hydroelectric

- Others

By End User

- Residential

- Commercial

- Industrial

By Region

- North America

- Europe

- France

- U.K.

- Spain

- Germany

- Italy

- Russia

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia-Pacific

- Middle East & Africa

- GCC

- North Africa

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America