Market Definition

The semiconductor chip ecosystem comprises the framework supporting chip innovation, production, and deployment across industries. It includes raw material suppliers, EDA providers, equipment manufacturers, foundries, and assembly and testing services. The applications span consumer electronics, automotive, industrial, healthcare, and defense demonstrating its role in computing, connectivity, and automation.

Semiconductor Chip Ecosystem Market Overview

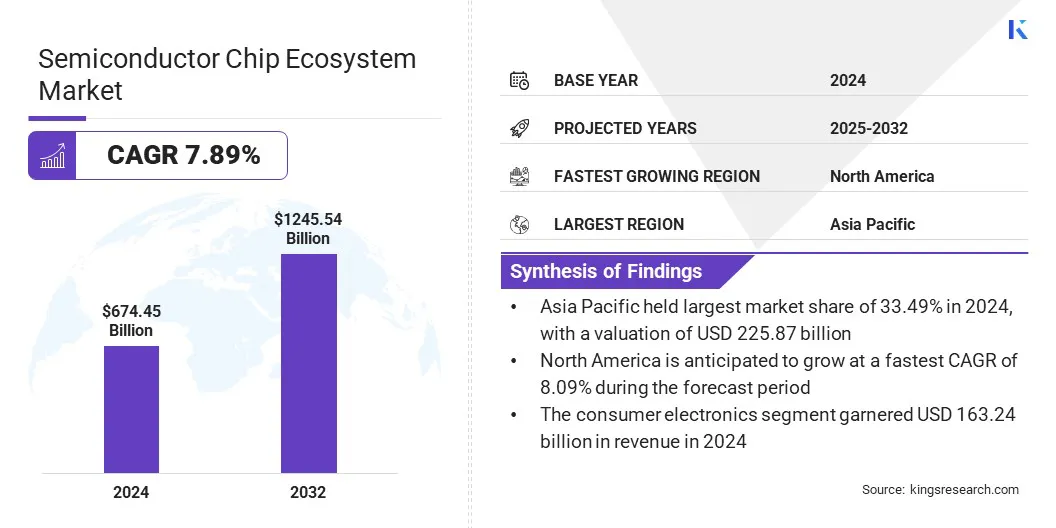

The global semiconductor chip ecosystem market size was valued at USD 674.45 billion in 2024 and is projected to grow from USD 725.37 billion in 2025 to USD 1,245.54 billion by 2032, exhibiting a CAGR of 7.89% over the forecast period.

This growth is driven by the rising demand for advanced electronics, data-intensive applications, and digital infrastructure. Expanding of AI, 5G, cloud computing, and electric vehicles continues to accelerate chip requirements across technology nodes.

Key Highlights:

- The semiconductor chip ecosystem industry was recorded at USD 674.45 billion in 2024.

- The market is projected to grow at a CAGR of 7.89% from 2025 to 2032.

- Asia Pacific held a share of 33.49% in 2024, valued at USD 225.87 billion.

- The logic devices segment garnered USD 165.01 billion in revenue in 2024.

- The 7-14 nm segment is expected to reach USD 461.65 billion by 2032.

- The industrial automation segment is anticipated to witness the fastest CAGR of 8.04% over the forecast period.

- North America is anticipated to grow at a CAGR of 8.09% through the projection period.

Major companies operating in the semiconductor chip ecosystem market are Texas Instruments Incorporated, Intel Corporation, Taiwan Semiconductor Manufacturing Company Limited, Samsung, SK HYNIX INC., Micron Technology, Inc., Qualcomm Technologies, Inc., Broadcom, NVIDIA Corporation, Advanced Micro Devices, Inc., ASML Holding N.V, Infineon Technologies AG, NXP Semiconductors, MediaTek, and Semiconductor Components Industries, LLC.

The market is expanding due to rising adoption of semiconductors in healthcare devices and wearables, supported by advances in imaging, diagnostics, real-time monitoring, miniaturized sensors, low-power processors, and personalized healthcare solutions.

Miniaturized sensors and MEMS improve monitoring accuracy, while low-power processors support compact, continuous-use devices. Growing demand for personalized healthcare solutions creates opportunities for semiconductor manufacturers to supply specialized components that meet stringent safety and reliability standards.

- In October 2024, Samsung introduced the Galaxy Ring in India, a compact wearable integrated with advanced sensors that provide personalized health insights. The device reflects growing reliance on the semiconductor chip ecosystem to power next-generation AI-driven healthcare wearables.

Market Driver

Rising Investment in Semiconductor Manufacturing Capacity Expansion

The growth of the market is strongly supported by large-scale investments in manufacturing capacity expansion. Global foundries and integrated device manufacturers are expanding fabrication plants to meet the rising demand for advanced chips across industries such as manufacturing, automotive, and consumer goods.

Governments are also offering financial incentives to encourage domestic manufacturing and strengthen supply chain resilience. Capacity expansion addresses current shortages, which secures the future availability of high-performance devices. This continued wave of investment is driving the ecosystem toward greater scale, technological progress, and enhanced global competitiveness.

- In March 2025, Infineon expanded its presence in India by setting up a global capability center in Ahmedabad, Gujarat, focused on semiconductor chip R&D, product software, IT, supply chain management, and systems engineering. This strategic expansion is aimed at enhancing its global innovation capabilities and supports the delivery of next-generation semiconductor solutions.

Market Challenge

Rising R&D and Fabrication Costs at Advanced Technology Nodes

The semiconductor chip ecosystem market faces increasing pressure from escalating R&D and fabrication costs at advanced technology nodes such as 7nm and below. These nodes demand extensive capital expenditure for lithography equipment, cleanroom facilities, and process optimization.

Companies face the challenge of balancing innovation with cost efficiency amid shorter product lifecycles. Collaborative models, technology partnerships, and government-supported funding programs are being adopted to share risks and ease financial pressures.

To overcome this challenge, semiconductor manufacturers are adopting collaborative R&D models, chiplet-based design, and government-supported funding. These strategies reduce individual capital burdens, optimize fabrication efficiency, and accelerate innovation at advanced nodes while sustaining competitiveness in the market.

Market Trend

Increasing Adoption of AI-Optimized Chips Across Data Centers and Edge Devices

A key trend in the semiconductor chip ecosystem market is the growing adoption of AI-optimized chips for data centers and edge computing. The processors, such as GPUs, TPUs, and AI accelerators, enable faster model training, efficient inference, and low-latency decision-making.

Their integration across automotive, industrial, and consumer devices improves performance, lowers energy consumption, and enhances efficiency. This creates opportunities for manufacturers to expand portfolios and strengthen market presence.

- In May 2025, the Semiconductor Industry Association reported that India sanctioned its sixth semiconductor fabrication facility through an HCL–Foxconn joint venture under the India Semiconductor Mission. With five additional units nearing completion, the government continues to attract foreign investments to expand domestic capabilities in chip design, fabs, ATMP units, and supporting infrastructure.

Semiconductor Chip Ecosystem Market Report Snapshot

|

Segmentation

|

Details

|

|

By Component

|

Integrated Circuits, Memory Chips, Logic Devices, Optoelectronics, Discrete Power Devices, Sensors & MEMS, Others

|

|

By Technology Node

|

Less than 7 nm, 7–14 nm, 14–28 nm, Above 28 nm

|

|

By End User

|

Consumer Electronics, Automotive & Transportation, Industrial Automation, Communications, Healthcare, Aerospace & Defense, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation:

- By Component (Integrated Circuits, Memory Chips, Logic Devices, Optoelectronics, Discrete Power Devices, Sensors & MEMS, and Others): The logic devices segment captured the largest share of 24.47% in 2024, due to rising demand for processors, GPUs, and FPGAs powering AI, cloud computing, and advanced automotive applications.

- By Technology Node (Less than 7 nm, 7–14 nm, 14–28 nm, and Above 28 nm): The less than 7 nm segment is poised to record a CAGR of 8.70% through the forecast period, owing to technological advancements, growing AI workloads, and demand for energy-efficient processors.

- By End User (Consumer Electronics, Automotive & Transportation, Industrial Automation, Communications, Healthcare, Aerospace & Defense, and Others): The consumer electronics segment held 24.20% of the market in 2024, due to high production of smartphones, wearables, and smart devices requiring powerful, miniaturized semiconductors with advanced performance capabilities.

Semiconductor Chip Ecosystem Market Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

Asia Pacific semiconductor chip ecosystem market share stood at 33.49% in 2024 in the global market, with a valuation of USD 225.87 billion. The region benefits from extensive wafer fabrication capacity, the presence of outsourced semiconductor assembly and testing (OSAT) providers, and high-volume production of memory chips.

Moreover, robust government policies, strategic investments by companies in advanced technology nodes, and a mature supplier base strengthen its leadership. Additionally, increasing demand from regional consumer electronics and automotive manufacturing supports sustainable market growth across diverse application areas.

- In April 2025, the Indian government approved five semiconductor projects under the Semicon India Program, including one fabrication facility and four ATMP/OSAT units, with investments of USD 18.24 billion and a completion timeline of 4–6 years. Additionally, MoUs with the USA, EU, Japan, and Singapore aim to strengthen India’s semiconductor ecosystem.

North America is poised for a CAGR of 8.09% over the forecast period. This growth is driven by the rising demand for AI-optimized chips in data centers, increasing use of automotive semiconductors, and advancements in electronic design automation tools.

Federal funding programs and industry collaborations are strengthening supply chain resilience, while robust regional R&D capabilities continue to support progress in advanced process nodes and next-generation semiconductor architectures, positioning the region for sustained expansion.

Regulatory Frameworks

- In the EU, the EU Chips Act regulates semiconductor research, production, and crisis response mechanisms. It aims to boost local fabrication, ensure technology sovereignty, and reduce dependence on external supply chains in the market.

- In China, the Made in China 2025 Policy regulates the strategic development of domestic semiconductor capabilities. It promotes self-sufficiency, accelerates investment in advanced nodes, and drives innovation across the market.

- In Japan, the Semiconductor and Digital Industry Strategy regulates initiatives for chip manufacturing and digital transformation. It focuses on R&D funding, advanced lithography collaboration, and strengthening Japan’s position in the market.

- In South Korea, the K-Semiconductor Belt Strategy regulates incentives for R&D, tax benefits, and infrastructure for fabs. It supports scaling production, enhancing competitiveness, and sustaining growth in the market.

- In India, the Semicon India Programme regulates policies for chip design, fabrication, and display manufacturing. It provides financial support to attract global investments and foster domestic innovation within the market.

Competitive Landscape

Key players in the semiconductor chip ecosystem industry are focusing on capacity expansion and partnerships to address global demand and innovation needs. Investments are directed toward AI-enabled design, chiplet architectures, and advanced lithography for performance improvement.

Collaborations with research institutions and suppliers support risk mitigation and faster development. Key priorities focus on enhancing supply chain resilience, optimizing manufacturing efficiency, and addressing high capital costs while sustaining profitability. Companies are also adapting strategies to align with rapidly evolving end-user requirements across applications.

- In October 2024, Qualcomm Incorporated and STMicroelectronics announced a strategic collaboration to advance next-generation industrial and consumer IoT solutions powered by edge AI. The partnership integrates Qualcomm’s AI-driven wireless connectivity system-on-a-chip with ST’s STM32 microcontroller ecosystem, enabling seamless software integration and accelerating global adoption through ST’s distribution network.

Key Companies in Semiconductor Chip Ecosystem Market:

- Texas Instruments Incorporated

- Intel Corporation

- Taiwan Semiconductor Manufacturing Company Limited

- Samsung

- SK HYNIX INC.

- Micron Technology, Inc.

- Qualcomm Technologies, Inc.

- Broadcom

- NVIDIA Corporation

- Advanced Micro Devices, Inc.

- ASML Holding N.V

- Infineon Technologies AG

- NXP Semiconductors

- MediaTek

- Semiconductor Components Industries, LLC

Recent Developments (Collaboration/Expansion)

- In July 2025, Semiconductor Components Industries, LLC collaborated with NVIDIA to advance 800 Volts Direct Current (VDC) power architectures to enhance efficiency, power density, and sustainability. The partnership supports next-generation AI data centers with higher performance and reduced environmental impact.

- In March 2025, ASML Holding N.V. and Interuniversity Microelectronics Centre (IMEC) entered a five-year strategic partnership to combine expertise in advancing semiconductor innovation and driving sustainable initiatives. The collaboration focuses on delivering solutions that strengthen industry progress while promoting long-term environmental responsibility.

- In March 2025, TSMC announced plans to increase its U.S. semiconductor manufacturing investment by an additional USD 100 billion, raising its total to USD 165 billion. The expansion covers three fabs, advanced packaging facilities, and a major R&D center.