Market Definition

Supply chain management (SCM) is the structured coordination of sourcing, procurement, production, inventory, and logistics activities to ensure the efficient flow of goods, services, information, and finances from suppliers to end customers. It focuses on streamlining operations across all stages of the supply chain to optimize efficiency, reduce operational costs, improve responsiveness, and enhance customer satisfaction.

The market encompasses a wide range of software, services, and solutions that support activities such as demand forecasting, supplier relationship management, warehouse and inventory control, transportation management, order fulfillment, and real-time data analytics.

Supply Chain Management Market Overview

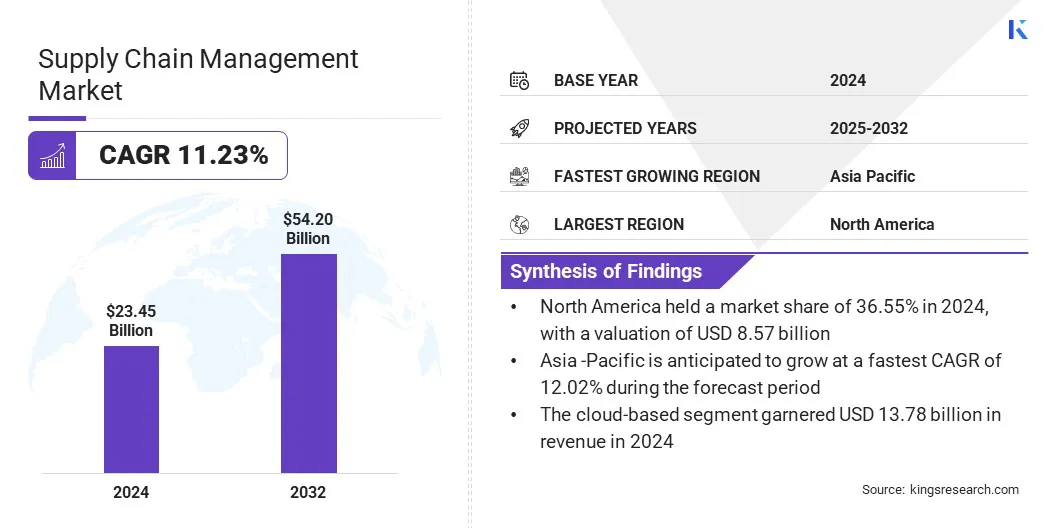

The global supply chain management market size was valued at USD 23.45 billion in 2024 and is projected to grow from USD 25.72 billion in 2025 to USD 54.20 billion by 2032, exhibiting a CAGR of 11.23% during the forecast period.

The market growth is attributed to expanding e-commerce and rising , which are driving the demand for agile supply chain networks to handle higher order volumes and faster deliveries. The market is advancing, due to the adoption of SCaaS models and cloud-based logistics systems that improve scalability and real-time visibility of supply chain operations.

Major companies operating in the supply chain management industry are IBM Corporation, Blue Yonder Group, Inc, Kinaxis Inc, SAP SE, Oracle, Epicor Software Corporation, Infor, GEP, Mahindra Logistics Ltd., OMP, The Descartes Systems Group Inc, Körber AG, Manhattan Associates, Trimble Inc., and Verizon.

The market is progressing, due to the increasing need for robust logistics networks as businesses expand their distribution reach and improve service to meet rising customer expectations. Organizations are adopting advanced supply chain management solutions that enhance inventory accuracy, delivery reliability, and end-to-end operational visibility across fast-growing commerce channels.

- In June 2025, Amazon invested USD 233 million in India to expand fulfillment centers and strengthen delivery infrastructure. This investment is enhancing capacity and accelerating delivery speed across its growing e-commerce network, thereby driving the demand for advanced supply chain management solutions to support faster and more efficient logistics operations.

Key Highlights:

- The supply chain management industry size was valued at USD 23.45 billion in 2024.

- The market is projected to grow at a CAGR of 11.23% from 2025 to 2032.

- North America held a market share of 36.55% in 2024, with a valuation of USD 8.57 billion.

- The software segment garnered USD 13.23 billion in revenue in 2024.

- The cloud-based segment is expected to reach USD 33.89 billion by 2032.

- The small & medium enterprises segment is anticipated to grow at a CAGR of 11.85% over the forecast period.

- The retail & e-commerce segment held a market share of 35.43% in 2024.

- The market in Asia Pacific is anticipated to grow at a CAGR of 12.02% through the forecast period.

Market Driver

Expanding E-commerce and Consumer Digitization

Expanding e-commerce and growing consumer digitization are driving the supply chain management market. Consumers are turning to online platforms for greater convenience and product variety. Hence, businesses are focusing on building agile and technology-driven supply chains that efficiently manage complex logistics and meet rising expectations for faster delivery.

This shift is driving the demand for integrated solutions across transportation, warehousing, and inventory management. Additionally, evolving customer behavior is prompting companies to invest in scalable and data-driven supply chain models to remain competitive and ensure seamless service experiences.

- According to Invest India, digital shopping by consumers is expected to contribute approximately 45% to the gross merchandise value of e-commerce by 2030 with a USD 2 trillion valuation target by 2033.

Market Challenge

Supply Chain Disruptions

A major challenge hindering the growth of the market is supply chain disruptions, which affect the timely flow of goods and materials across industries. These disruptions can arise from various factors, including geopolitical tensions, natural disasters, pandemics, and transportation bottlenecks. These events often lead to production delays, inventory shortages, and increased operational costs.

Businesses are struggling to maintain continuity and meet customer expectations in the face of unpredictable interruptions, which often lead to delayed deliveries and reduced productivity. The lack of resilience in traditional supply chains highlights the urgent need for diversification, better risk management, and real-time visibility across the value chain.

Market players are adopting a range of strategic measures aimed at increasing resilience and flexibility. They are diversifying supplier bases to reduce dependency on single sources and investing in regional sourcing and nearshoring.

Advanced technologies such as AI, IoT, and predictive analytics are being implemented to improve real-time visibility and risk forecasting. Additionally, providers are building buffer inventories, redesigning logistics networks, and strengthening collaborations with partners to ensure faster response times and greater adaptability during unexpected disruptions.

Market Trend

Rise of Supply Chain as a Service (SCaaS)

The rise of supply chain as a service (SCaaS) is transforming the supply chain management market by shifting traditional operations to flexible & cloud-based service models. Businesses are leveraging SCaaS to outsource key functions such as logistics, warehousing, and procurement to specialized providers for enabling faster scalability and operational efficiency.

This transformation supports real-time visibility, seamless integration with enterprise systems, and rapid adoption of new technologies. This shift enables organizations to build supply chains that are more agile, responsive, and cost-effective in an increasingly dynamic and competitive market.

- In April 2025, Bosch launched cloud-based Supply Chain Studio at the first Mobility Platform and Solutions (MPS) Summit. The platform is designed to digitalize transport, warehousing, and B2B commerce by addressing gaps in multimodal logistics. Integrated with ERPs and third-party platforms, it enhances visibility, automation, and operational efficiency across India’s fragmented supply chain ecosystem.

Supply Chain Management Market Report Snapshot

|

Segmentation

|

Details

|

|

By Component

|

Software (Transportation Management Systems (TMS), Warehouse Management Systems (WMS), Supply Chain Planning (SCP), Procurement & Sourcing, Manufacturing Execution Systems (MES)), Services (Consulting, Integration & Deployment, Support & Maintenance, Managed Services)

|

|

By Deployment Mode

|

On-premise, Cloud-based

|

|

By Enterprise Size

|

Large Enterprises, Small & Medium Enterprises

|

|

By End-Use Industry

|

Retail & e-Commerce, Healthcare, Automotive, Transportation & Logistics, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation:

- By Component (Software (Transportation Management Systems (TMS), Warehouse Management Systems (WMS), Supply Chain Planning (SCP), Procurement & Sourcing, Manufacturing Execution Systems (MES)) and Services ((Consulting, Integration & Deployment, Support & Maintenance, Managed Services)): The software segment earned USD 13.23 billion in 2024, due to the growing adoption of integrated platforms that optimize logistics, inventory, and procurement functions.

- By Deployment Mode (On-Premise and Cloud-Based): The cloud-based segment held 58.78% share of the market in 2024, due to its scalability and lower upfront infrastructure costs.

- By Enterprise Size (Large Enterprises and Small & Medium Enterprises): The large enterprises segment is projected to reach USD 29.70 billion by 2032, owing to their higher investment capacity and need for complex, end-to-end supply chain solutions.

- By End-Use Industry (Retail & e-Commerce, Healthcare, Automotive, Transportation & Logistics, and Others): The retail & e-commerce segment is anticipated to grow at a CAGR of 12.19% over the forecast period, due to rising online sales and increasing demand for faster, flexible delivery networks.

Supply Chain Management Market Regional Analysis

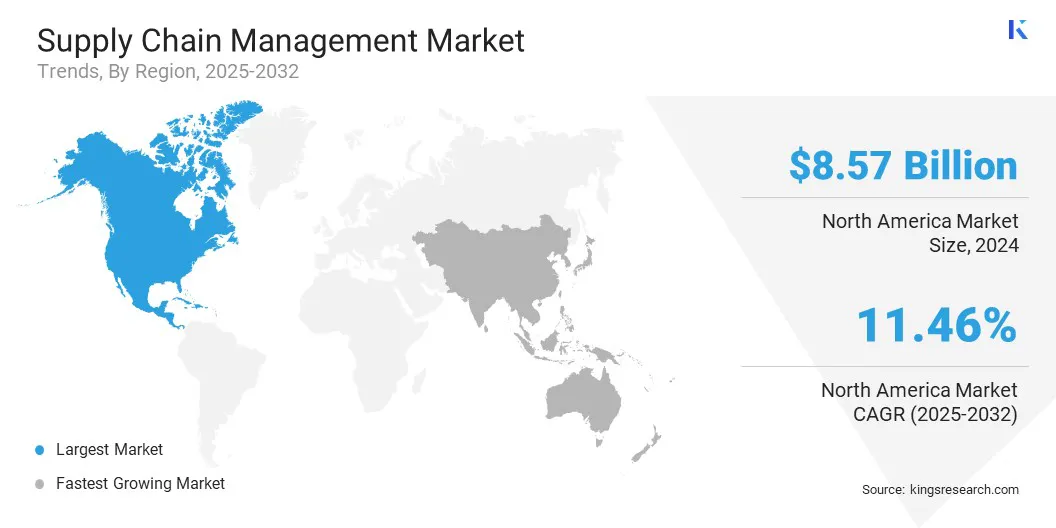

Based on region, the market has been classified into North America, Europe, Asia Pacific, the Middle East & Africa, and South America.

North America supply chain management market share stood at around 36.55% in 2024, with a valuation of USD 8.57 billion. This market dominance is attributed to the presence of leading software vendors and continuous investment by market players in digital supply chain platforms in North America.

The market is registering growth as enterprises across the region are adopting AI-driven planning tools to enhance operational visibility and support more informed decision-making. Businesses in the region are also responding to the need for end-to-end solutions that can manage demand fluctuations and enable scalable execution across retail, manufacturing, healthcare, and logistics.

The region is witnessing an increase in mergers and acquisitions that strengthen product portfolios and expand service capabilities. Market players across the region are prioritizing intelligent planning and digital transformation to enhance efficiency and responsiveness. These developments are contributing to the regional market growth.

- In April 2025, Aptean acquired Mahindra Logistics Ltd. for USD 14.30 per share in cash. This helps the company strengthen its enterprise software portfolio with Logility’s AI-first, end-to-end supply chain platform, and enhance digital planning & global SCM capabilities.

The supply chain management industry in Asia Pacific is set to grow at a robust CAGR of 12.02% over the forecast period. This growth is attributed to the increasing adoption of integrated transportation solutions and digital logistics platforms such as optimization systems, real-time tracking tools, and automated fleet management technologies across the region.

The market is advancing as companies are deploying smart fleet systems that enhance route efficiency and strengthen operational visibility. Market players in the region are also prioritizing short-haul logistics to support faster distribution within densely populated areas, which helps to improve turnaround times and meet rising delivery demands.

The region is also witnessing significant developments in sustainability-focused logistics as businesses adopt fuel-efficient vehicles and implement emission tracking systems. The market is progressing from the integration of real-time monitoring tools with warehouse and transportation systems that enable more effective planning and coordination. These advancements are collectively contributing to the regional market growth.

- In February 2025, Mahindra Logistics partnered with Asian Paints to provide integrated line haul transportation solutions aimed at improving supply chain efficiency & visibility and supporting operational control & sustainability across its supply chain network.

Regulatory Frameworks

- In the U.S., the Federal Trade Commission (FTC) regulates commercial practices within U.S. supply chains by overseeing antitrust compliance, fair competition, and consumer protection. It monitors mergers, supplier relationships, and deceptive practices that may disrupt market fairness.

- In China, the Ministry of Commerce (MOFCOM) governs China’s supply chain and trade logistics by overseeing import-export activities, foreign trade partnerships, and domestic distribution frameworks. It enforces regulations on sourcing, procurement standards, and cross-border logistics compliance.

- In India, the Central Board of Indirect Taxes and Customs (CBIC) regulates India’s supply chain ecosystem through customs enforcement, indirect taxation (like GST), and logistics standardization. It monitors cross-border trade flows, warehouse documentation, and inter-state goods movement.

Competitive Landscape

Major players in the supply chain management industry are focusing on building integrated platforms that enhance traceability and operational efficiency in the supply chain. They are combining advanced inventory systems with automated tracking technologies to improve compliance and streamline workflows in specialized sectors such as healthcare.

Providers are working to unify fragmented supply chain solutions into centralized platforms that meet regulatory standards and drive cost efficiency. Additionally, they are streamlining systems to reduce waste and enhance compliance while enabling real-time visibility across supply chain operations.

- In March 2025, PAR Excellence merged with TrackCore to create an integrated supply chain platform for the healthcare sector. The merger aims to improve compliance, visibility, and efficiency across over 1,300 facilities.

List of Key Companies in Supply Chain Management Market:

- IBM Corporation

- Blue Yonder Group, Inc

- Kinaxis Inc

- SAP SE

- Oracle

- Epicor Software Corporation

- Infor

- GEP

- Mahindra Logistics Ltd.

- OMP

- The Descartes Systems Group Inc

- Körber AG

- Manhattan Associates

- Trimble Inc.

- Verizon

Recent Developments (Product Launches)

- In February 2025, Oracle launched an AI-powered software to automate procurement workflows and streamline order fulfillment. This AI agent assists with tasks such as forecasting, compliance analysis, and delivery prediction, enabling smarter decision-making and operational agility.

- In July 2024, BigBasket launched its SaaS-based supply chain management platform, BB Matrix. The platform aims to transform supply chain operations globally, enhance efficiency, and reduce operational costs across diverse markets.