Market Definition

Automotive semiconductors are specialized, high-performance electronic components tailored for use in vehicles, supporting various electronic systems such as advanced driver-assistance systems (ADAS) and autonomous driving capabilities.

The market comprises a wide range of devices, including microcontrollers for subsystem management, power semiconductors for efficient power management, analog integrated circuits for signal processing, and sensors for data acquisition.

Automotive Semiconductor Market Overview

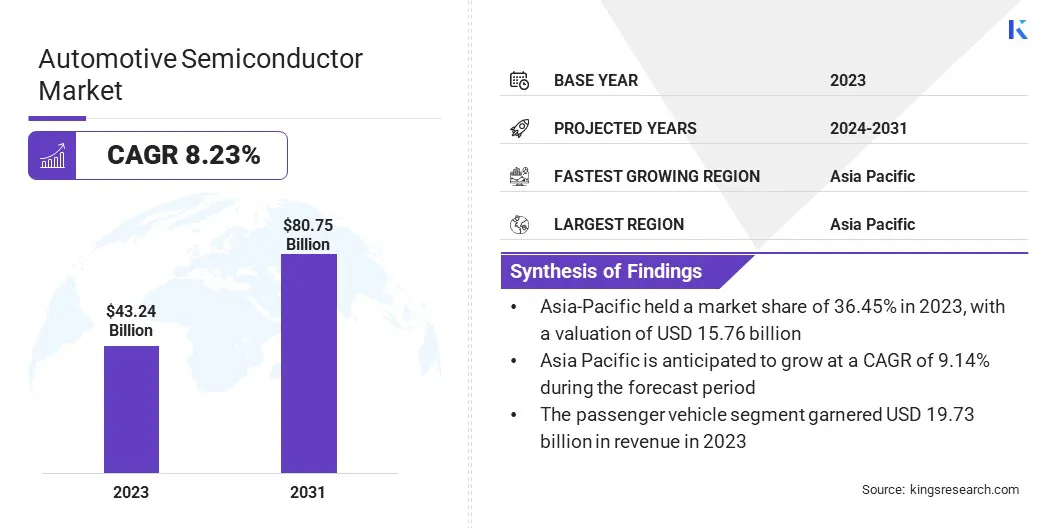

The global automotive semiconductor market size was valued at USD 43.24 billion in 2023 and is projected to grow from USD 46.43 billion in 2024 to USD 80.75 billion by 2031, exhibiting a CAGR of 8.23% during the forecast period.

The global demand for automotive semiconductors is fueled by advancements in autonomous vehicles, the growing adoption of vehicle-to-everything (V2X) communication, and increasing vehicle complexity.

Major companies operating in the automotive semiconductor industry are Infineon Technologies AG, NXP Semiconductors, STMicroelectronics, Texas Instruments Incorporated., Renesas Electronics Corporation., Toshiba Electronic Devices & Storage Corporation, Semiconductor Components Industries, LLC, Robert Bosch GmbH, Analog Devices Inc., Micron Technology, Inc., Qualcomm Technologies, Inc., Siemens, Samsung, Intel Corporation, NVIDIA Corporation, and others.

The ongoing transformation of the automotive industry, characterized by the rise of autonomous driving and ADAS technologies, is boosting the demand for advanced semiconductor solutions. Powerful processors, AI accelerators, and GPUs are essential for handling the complex computational demands of these systems.

Automotive semiconductor manufacturers are investing in research and development to improve product design and incorporate fail-safe mechanisms to mitigate risks.

- In September 2024, Stellantis and Foxconn established a joint venture, SiliconAuto, with a research and development center in Bengaluru, India. The center will focus on semiconductor product design and system-on-chip development for the automotive sector.

Key Highlights:

- The automotive semiconductor industry size was recorded at USD 43.24 billion in 2023.

- The market is projected to grow at a CAGR of 8.23% from 2024 to 2031.

- Asia Pacific region held a share of 36.45% in 2023, valued at USD 15.76 billion.

- The microcontrollers segment garnered USD 15.17 billion in revenue in 2023.

- The passenger vehicle segment is expected to reach USD 36.36 billion by 2031.

- The powertrain segment is projected to generate a revenue of USD 16.69 billion in 2024.

- Europe is anticipated to grow at a CAGR of 8.62% over the forecast period.

Market Driver

"EV Boom Fuels Demand for Automotive Semiconductors"

The growth of the automotive semiconductor market is propelled by the surging adoption of electric vehicles (EVs). These vehicles require a significantly higher number of semiconductors, including specialized power semiconductors such as SiC and GaN, to manage their complex electrical systems.

These components are essential for optimizing efficiency , maximizing range, and minimizing energy consumption. As global EV adoption accelerates, semiconductor companies have a significant opportunity to innovate and grow by developing specialized, high-performance solutions for this evolving market.

- In January 2025, Renesas Electronics Corporation launched 100V high-power N-Channel MOSFETs, designed to enhance high-current performance in applications such as battery management systems, motor control, power management and charging. The product is tailored for electric vehicles, e-bikes, charging stations, and power tools.

Market Challenge

"Increased Costs Due to Advanced Features"

Rising costs and complexities are presenting a major challenge to the expansion of the automotive semiconductor market. The advancement of features such as autonomous driving and connectivity necessitates more complex and costly semiconductor solutions.

Moreover, the rigorous testing and validation required for automotive-grade semiconductors to meet stringent safety standards add to these costs. To address these challenges, manufacturers are investing in advanced packaging technologies, such as system-in-package (SiP) and chiplet designs, to integrate multiple functionalities into smaller, more cost-effective solutions.

- In January 2025, YorChip, Inc. and Chipcraft developed a low-cost, low-power 8bit 200 Ms/s ADC chiplet. This innovative integrated circuit design is expected to enhance the affordability, efficiency, and functionality of future vehicles.

Market Trend

"Surging Adoption of Sustainable Practices in Manufacturing and Product Design"

Automotive semiconductor manufacturers are adopting sustainable practices to reduce their environmental impact while catering to the growing demands of consumers and investors. Companies are optimizing manufacturing processes to minimize energy consumption and waste through investments in energy-efficient equipment and technologies.

Furthermore, they are designing chips with lower power consumption to improve vehicle energy efficiency. Industry players are further demonstrating their commitment to sustainable material selection by incorporating recycled and bio-based materials in packaging and manufacturing processes.

- In November 2024, Infineon and Stellantis launched Silicon carbide (SiC) semiconductors and AUDRIX microcontrollers, designed to standardize power modules, improve performance, and enhance the efficiency of EVs. These innovations aim to reduce cost and improve the overall driver experience.

Automotive Semiconductor Market Report Snapshot

|

Segmentation

|

Details

|

|

By Vehicle Type

|

Passenger Vehicle, Light Commercial Vehicle (LCV), Heavy Commercial (HCV)

|

|

By Component

|

Microcontrollers (MCUs), Power Semiconductors, Analog Integrated Circuits (ICs), Sensors, Others

|

|

By Application

|

Powertrain, Chassis, Safety, Telematics & Infotainment, Body Electronics

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, U.K., Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation:

- By Component (Microcontrollers, Power Semiconductors, Analog Integrated Circuits, Sensors, and Others): The microcontrollers segment generated a revenue of USD 15.17 billion in 2023, mainly due to their diverse applicability and cost-effectiveness.

- By Vehicle Type (Passenger Vehicle, Light Commercial Vehicle, and Heavy Commercial): The passenger vehicle segment held a share of 45.63% in 2023, driven by rapid adoption of technology.

- By Application (Powertrain, Chassis, Safety, Telematics & Infotainment, and Body Electronics): The powertrain segment is projected to reach USD 33.39 billion by 2031, fueled by the growth in electric vehicles and advancements in engine management.

Automotive Semiconductor Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

The Asia Pacific automotive semiconductor market accounted for the largest revenue share of 36.45% in 2023, valued at USD 15.76 billion. The region, home to major automotive manufacturing hubs in China, Japan, and South Korea, creates a strong demand for automotive semiconductors.

Furthermore, lower labor costs and well-established manufacturing infrastructure enhance cost-effeciency in vehicle production. The combination of large-scale production, strong supply chains, and government fosters a cobducive environment for foreign investment in the automotive and semiconductor sectors.

- The report published by the International Trade Organization in January 2024 highlights China, India and Japan as the leading automotive markets globally. In 2023, Japan's automotive sector accounted for 13.9% of its manufacturing GDP.

The Europe automotive semiconductor industry is anticipated to grow at a CAGR of 8.62% through the forecast period. The region is at the forefront of the global transition toward electric vehicles (EVs), bolstered by ambitious targets and supportive regulations that are boosting adoption.

This shift is creating a surge in demand for automotive semiconductors, as EVs require a significantly more semiconductor content compared to traditional internal combustion engine (ICE) vehicles. Furthermore, substantial investments in EV charging infrastructure across Europe are further fueling demand, presenting a significant growth opportunity for semiconductor companies in the region.

- In December 2024, Stellantis and CATL invested USD 4.21 billion in a joint venture to set up large-scale LFP battery plant in Spain. The plant will utilize various automotive semiconductors such as microcontrollers, analog ICs, and power semiconductors, for battery prodcution.

Regulatory Framework:

- ISO 26262, established by the International Standards Organization, governs the design and development of electrical and electronic systems in road vehicles, requiring semiconductor manufacturers to meet stringent safety requirements.

- In the U.S., the National Highway Traffic Safety Administration (NHTSA) sets Federal Motor Vehicle Safety Standards (FMVSS), inlcuding FMVSS 126, which applies to electronic stability control systems reliant on semiconductor technology.

- The EU's General Safety Regulation (EC No. 661/2009) sets requirements for vehicle safety, encompassing electronic systems and components such as semiconductors. It covers various safety areas such as braking, steering, lighting, visibility, and occupant protection.

- Automotive Electronics Council (AEC) develops standards such as AEC-Q100, which qualifies integrated circuits for automotive applications, subjecting them to stress tests for reliability in in harsh environments.

- ISO/SAE 21434 standard, established by the International Standards Organization, addresses cybersecurity risks in road vehicles, prompting semiconductor manufacturers to enhance protection against physical attacks and reverse engineering, strenghtheing automotive system security.

Competitive Landscape

The global automotive semiconductor market is characterized by a large number of participants, including both established corporations and rising organizations. Autonomous driving technology is revolutionizing the automotive sector, creating new opportunities for semiconductor manufacturers.

Companies are responding to this trend by developing power semiconductors tailored to the unique demands of electric vehicles and autonomous systems. This includes a focus on miniaturization and efficiency through advanced packaging, as well as intensive R&D efforts in AI, sensor fusion, and high-speed connectivity.

- In May 2023, Stellantis Ventures invested in Lyten, Inc. to accelerate the commercialization of lithium-sulfur EV battery technology. This battery management system heavily relies on automotive semiconductors such as microcontrollers and analog integrated circuits.

List of Key Companies in Automotive Semiconductor Market:

- Infineon Technologies AG

- NXP Semiconductors

- STMicroelectronics

- Texas Instruments Incorporated.

- Renesas Electronics Corporation.

- TOSHIBA ELECTRONIC DEVICES & STORAGE CORPORATION

- Semiconductor Components Industries, LLC

- Robert Bosch GmbH

- Analog Devices Inc.

- Micron Technology, Inc.

- Qualcomm Technologies, Inc.

- Siemens

- Samsung

- Intel Corporation

- NVIDIA Corporation

Recent Developments (Acquisition/Partnership)

- In January 2025, NXP Semiconductors acquired TTTech Auto for $625 million to enhance their automotive software solutions for software-defined vehicles. The acquisition strengthens NXP’s automotive value proposition, enabling automakers to deploy their best-in-class, differentiated vehicle platforms more efficiently.

- In March 2024, Vishay Intertechnology acquired the Newport Wafer Fab fabrication facility for USD 177 million. This facility is the UK’s largest semiconductor fab which supplies components to the automotive and industrial markets.

- In September 2023, Robert Bosch acquired U.S. chipmaker TSI Semiconductors Corporation to further strengthen its manufacturing capabilities. Through this acquisition, the company aims to strengthen its local presence in Roseville and expand its international semiconductor manufacturing network.

- In August 2023, indie Semiconductor, a leading automotive semiconductor manufacturer, partnered with SiLC technologies to create high-performance, low-cost LiDAR platforms for various applications, including driver assistance and autonomous mobility.

- In May 2023, Qualcomm acquired Israel-based semiconductor company Autotalks to expand its Snapdragon Digital Chassis product portfolio. The company aims to deliver global V2X solutions for road safety and smart transportation.