Market Definition

Industrial automation involves the deployment of control systems, machinery, and information technologies to automate industrial processes by reducing human intervention. It improves operational efficiency, accuracy, and consistency.

The market encompasses hardware such as programmable logic controllers (PLCs), sensors, industrial robots, and distributed control systems (DCS); software such as human-machine interface (HMI), supervisory control and data acquisition (SCADA), and manufacturing execution systems (MES); along with services such as system integration, maintenance, and consulting.

It is applied across manufacturing, energy, automotive, and pharmaceuticals, supporting productivity and data-driven decision-making through connected, intelligent systems.

Industrial Automation Market Overview

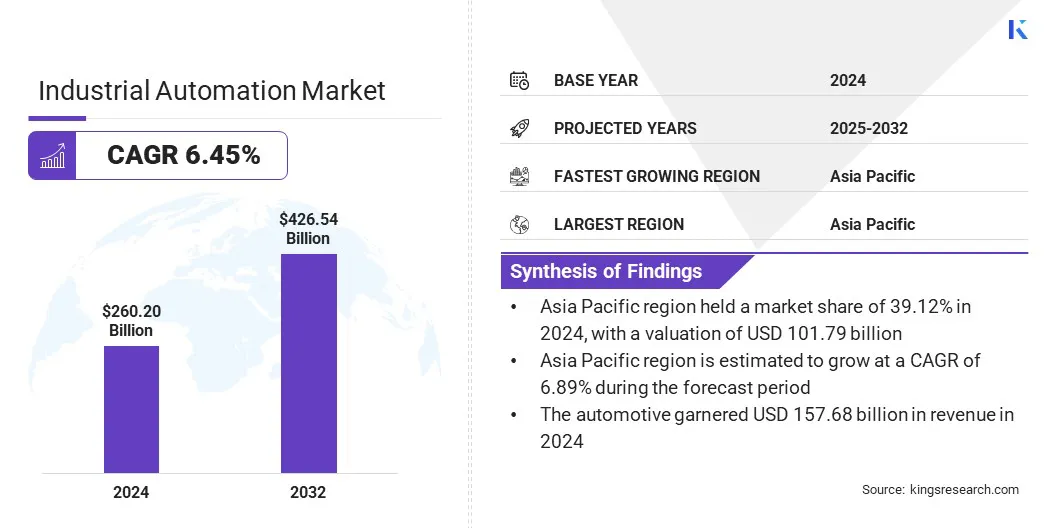

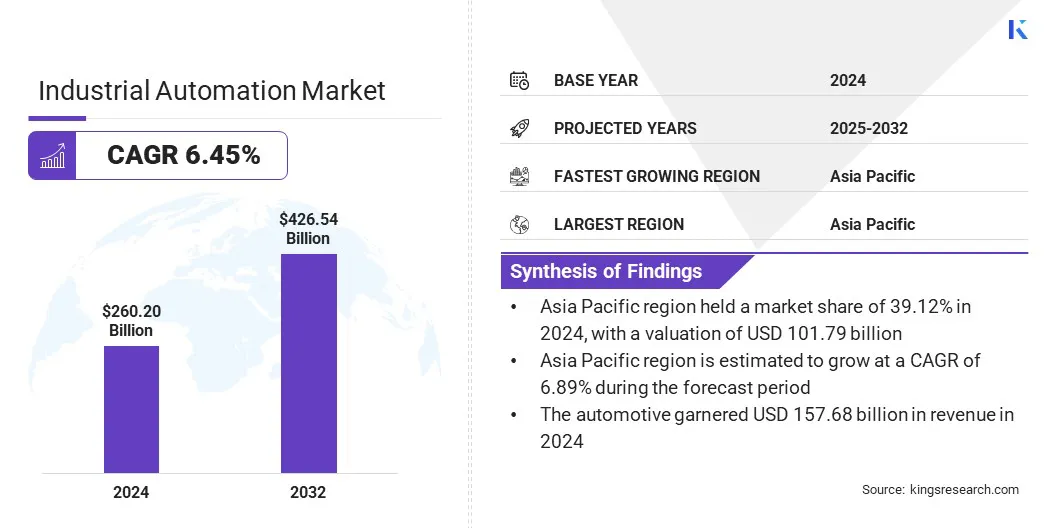

The global industrial automation market size was valued at USD 260.20 billion in 2024 and is projected to grow from USD 275.30 billion in 2025 to USD 426.54 billion by 2032, exhibiting a CAGR of 6.45% during the forecast period.

The market growth is attributed to smart manufacturing initiatives, with rising investments in Industry 4.0 and integration of artificial intelligence (AI) and machine learning (ML) which is transforming industrial operations through predictive maintenance and real-time process optimization.

Key Market Highlights:

- The industrial automation industry size was recorded at USD 260.20 billion in 2024.

- The market is projected to grow at a CAGR of 6.45% from 2025 to 2032.

- Asia Pacific held a share of 39.12% in 2024, valued at USD 101.79 billion.

- The industrial sensors segment garnered USD 63.23 billion in revenue in 2024.

- The DCS segment is expected to reach USD 121.59 billion by 2032.

- The electronics & semiconductors segment is anticipated to witness the fastest CAGR of 7.21% over the forecast period.

- Europe is anticipated to grow at a CAGR of 6.23% through the projection period.

Major companies operating in the industrial automation market are ABB, Cisco Systems, Inc., Emerson Electric Co., General Electric Company, Honeywell International Inc., IBM, Mitsubishi Electric Corporation, Rockwell Automation, Schneider Electric, Siemens, Oracle, SAP SE, Yokogawa Electric Corporation, OMRON Corporation, and Hitachi, Ltd..

The expansion of e-commerce is accelerating logistics automation, increasing demand for industrial automation in warehousing and distribution. Rising online retail volumes are pressuring supply chains to deliver faster order processing, maintain real-time inventory accuracy, and ensure seamless material handling.

Moreover, automation providers are aligning their product portfolios with e-commerce logistics needs by offering modular, scalable solutions built for high-speed distribution centers. They are integrating robotics, vision systems, and intelligent control software to enhance warehouse efficiency and throughput.

This targeted deployment of automation in logistics is boosting demand for industrial automation growth and expanding its role in digital transformation of retail supply chains.

- For instance, in March 2025, Symbotic acquired Walmart’s Advanced Systems & Robotics (ASR) and entered into a commercial agreement to automate Walmart’s accelerated pickup and delivery centers across hundreds of stores. This strategic move reflects rising automation in fulfillment operations, aligning with expanding e-commerce and logistics automation demand by enhancing speed, accuracy, and scalability in order processing.

Market Driver

Smart Manufacturing Initiatives

The expansion of smart manufacturing initiatives is fueling the growth of the market, backed by he rising investments from governments and enterprises in ndustry 4.0 technologies and digital transformation efforts.

These investments are enabling the implementation of cyber-physical systems, connected machinery, and real-time data platforms that improve efficiency and visibility in production environments.

This is enabling predictive maintenance, process automation, and operational analytics, transforming conventional facilities into intelligent and adaptive manufacturing environments.

Moreover, equipment manufacturers are responding by developing integrated solutions that enhance industrial connectivity and digital oversight. They are offering scalable systems, IoT-based platforms, and AI-driven technologies tailored for smart factory integration.

These offerings align with evolving manufacturing priorities, accelerating the adoption of industrial automation across digitally advancing production landscapes.

- For instance, in June 2024, the State of Maryland received a USD 1.01 million grant from the United States Department of Energy (DOE) under the State Manufacturing Leadership Program to expand its “Maryland Manufacturing 4.0” initiative. The program supports 26 small and mid-sized manufacturers with technology readiness assessments and technical assistance. This initiative advances the growth of smart manufacturing by promoting industrial digital transformation through government-backed adoption of Industry 4.0 technologies.

Market Challenge

High Implementation Costs

A key challenge impeding the expansion of the industrial automation market is the high initial cost of deployment, which includes capital investment in hardware, software integration, and skilled workforce training.

This cost burden restricts adoption among small and medium-sized enterprises, limiting market penetration across resource-constrained industries. Additionally, long return-on-investment cycles create uncertainty for stakeholders, delaying automation decisions and slowing overall implementation rates.

To address this challenge, manufacturers are introducing modular automation systems and subscription-based models that lower upfront expenditure. They are also offering scalable platforms that allow phased adoption, enabling gradual integration aligned with operational budgets.

These strategies are helping expand access to automation solutions and support broader market participation without compromising technological advancement.

Market Trend

AI and ML Integration

The growing integration of artificial intelligence (AI) and machine learning (ML) is emerging as a key trend in the market, transforming operational models across production environments. AI and ML are being applied in predictive maintenance, process optimization, and anomaly detection to enhance accuracy and responsiveness.

These technologies enable systems to adapt to real-time conditions and improve decision-making without manual intervention. It marks a transition from conventional automation to intelligent operations that enable ongoing optimization and contribute to the evolution of advanced industrial ecosystems .

- In March 2025, Siemens acquired Altair Engineering for USD 10 billion, integrating Altair’s simulation-driven AI capabilities into the Siemens Xcelerator digital twin platform, bolstering AI-powered predictive maintenance and process optimization. This strategic move highlights the growing integration of Artificial Intelligence (AI) and Machine Learning (ML) in industrial operations.

Industrial Automation Market Report Snapshot

|

Segmentation

|

Details

|

|

By Component

|

Industrial Sensors (Proximity Sensors, Pressure Sensors, Temperature Sensors, Flow & Level Sensors, Vision Sensors, Ultrasonic Sensors), Controllers (PLCs, IPCs) (Programmable Logic Controllers (Compact, Modular, Rack-mounted), Industrial PCs (Panel IPCs, Box IPCs, DIN Rail IPCs), Remote Terminal Units (RTUs), Motion Controllers, CNC Controllers), Industrial Robots (Articulated Robots, SCARA Robots,Cartesian Robots, Delta/Parallel Robots, Collaborative Robots (Cobots), Dual-Arm Robots), Drives & Motors (Variable Frequency Drives (VFDs), Servo Drives & Motors, Stepper Motors, Direct Drive Motors, Induction Motors), Machine Vision Systems (1D, 2D, and 3D Vision Systems, Smart Cameras, Vision Controllers, Frame Grabbers, Lighting & Optics), Relays, Switches, Others (Electromechanical & Solid-State Relays, Limit & Proximity Switches, Contactors, Terminal Blocks, Circuit Protection Devices, Power Supplies, Communication Modules)

|

|

By Industrial Control System

|

DCS, SCADA, PLC, HMI, MES, PAM

|

|

By End-Use Industry

|

Automotive, Electronics & Semiconductors, Pharmaceuticals & Chemicals, Food & Beverages, Oil & Gas, Energy & Utilities

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation:

- By Component (Industrial Sensors, Controllers (PLCs, IPCs), Industrial Robots, Drives & Motors, Machine Vision Systems and Relays, Switches ): The industrial sensors segment earned USD 63.23 billion in 2024, mainly due to its critical role in enabling real-time data acquisition, process monitoring, and system control across automated operations.

- By Industrial Control System (DCS, SCADA, PLC, HMI, MES, and PAM): The DCS segment held a share of 27.60% in 2024, fueled by its ability to provide centralized control, high reliability, and efficient management of complex and continuous industrial processes.

- By End-Use Industry (Automotive, Electronics & Semiconductors, Pharmaceuticals & Chemicals, and Energy & Utilities): The automotive segment is projected to reach USD 258.55 billion by 2032, owing to its extensive adoption of robotics, precision control systems, and automated assembly processes to enhance production efficiency and ensure consistent product quality.

Industrial Automation Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

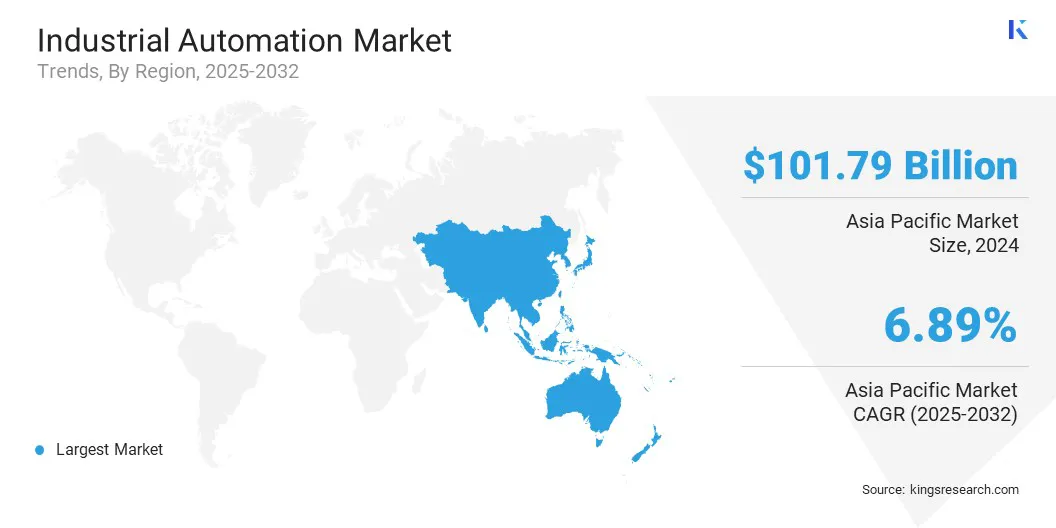

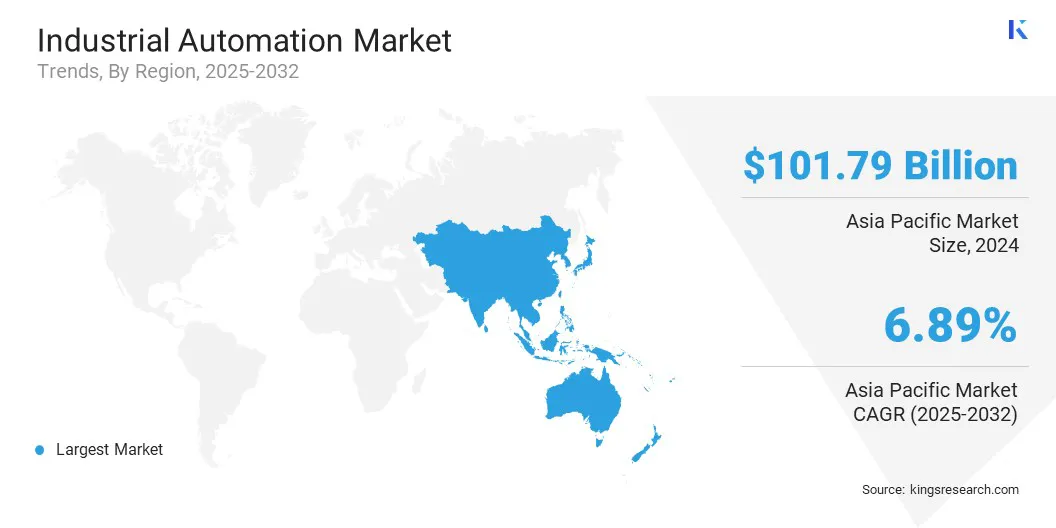

The Asia-Pacific industrial automation market share stood at 39.12% in 2024, valued at USD 101.79 billion. This dominance is attributed to substantial government investments in infrastructure and industrial development, supporting automation adoption across the region.

Moreover, these investments are enabling the construction of advanced manufacturing facilities equipped with intelligent systems. Additionally, large-scale infrastructure projects are creating demand for automated solutions to enhance operational efficiency and reduce labor dependency.

The continuous flow of government funding toward industrial expansion is strengthening the region’s automation capabilities, positioning Asia Pacific as a leading region for industrial automation.

- For instance, in August 2024, Singapore’s Economic Development Board (EDB) supported the launch of SMARTT Precision Manufacturing’s 17,000-square-metre semiconductor tooling facility, featuring integrated cleanrooms and a flexible, fully automated manufacturing system. This reflects how government-supported industrial infrastructure projects are facilitating the adoption of advanced automation technologies in high-value manufacturing.

The Europe industrial automation industry is set to grow at a CAGR of 6.23% over the forecast period. This growth is propelled by a robust automotive and manufacturing base in countries such as Germany, Italy, and France. These countries possess advanced industrial ecosystems that prioritize process optimization and high production efficiency.

Additionally, automotive manufacturers are accelerating the deployment of robotics and smart systems to meet precision and volume requirements. The broader manufacturing sector is integrating automation to enhance output consistency and reduce operational costs.

This concentrated industrial strength is boosting rapid automation adoption, positioning Europe as the fastest-growing region for industrial automation.

Regulatory Frameworks

- In China, the Ministry of Industry and Information Technology (MIIT) formulates national standards and regulates robotics, industrial control systems, and digital infrastructure under the Made in China 2025 initiative.

- In Europe, the European Commission (EC) enforces industrial automation regulations through the Machinery Regulation (EU) 2023/1230 and governs robotics, AI, and control systems under the Artificial Intelligence Act and Digital Europe Programme.

Competitive Landscape

The industrial automation market presents a dynamic, competitive landscape, marked by frequent product introductions focused on advancing technological performance. Newly launched solutions incorporate modular system designs, smart sensing technologies, and improved interoperability.

Furthermore, many of these offerings enable efficient integration with existing industrial infrastructure while maintaining compliance with regulatory requirements. These developments reflect deliberate strategies to enhance market positioning, meet sector-specific operational needs, and deliver differentiated value across critical industrial domains.

- For instance, in April 2024, Rockwell Automation Inc. launched the FLEXLINE 3500, a new low-voltage motor control center (MCC) for IEC markets globally, showcased at the Hannover Messe 2024 in Germany. This MCC enables manufacturers to access production data and enhance uptime and productivity through smart product integration. It provides real-time operational and diagnostic data for critical equipment by connecting with smart motor control devices.

Key Companies in Industrial Automation Market:

- ABB

- Cisco Systems, Inc.

- Emerson Electric Co.

- General Electric Company

- Honeywell International Inc.

- IBM

- Mitsubishi Electric Corporation

- Rockwell Automation

- Schneider Electric

- Siemens

- Oracle

- SAP SE

- Yokogawa Electric Corporation

- OMRON Corporation

- Hitachi, Ltd.

Recent Developments (Launches/expansion)

- In May 2025, Siemens expanded its industrial AI portfolio by introducing advanced AI agents integrated into its Industrial Copilot ecosystem. These agents represent a shift from reactive AI assistants to autonomous systems capable of executing complete processes independently. The new AI architecture includes a high-level orchestrator for managing complex industrial tasks.

- In May 2025, ABB and Red Hat collaborated to develop next-generation automation systems for industrial IT, supporting secure and modular deployment of control applications in process industries. The partnership leverages ABB’s expertise in automation and Red Hat’s enterprise open-source platforms, integrating data analytics and artificial intelligence to advance the transition to autonomous industrial operations.

- In May 2025, Rockwell Automation Inc. introduced the EtherNet/IP In-cabinet Solution to support the increasing demand for faster, smarter, and more connected manufacturing operations. Traditional hard-wired control panels often restrict data access and complicate upgrades. This solution simplifies in-panel device communication, enhances real-time data availability, and enables faster, data-driven decision-making while streamlining system integration.

- In February 2025, Schneider Electric launched the Open Automation Movement to promote software-defined, vendor-agnostic industrial automation. The initiative enables plug-and-play integration, seamless data flow, and flexible system architecture. It supports enhanced agility, improved engineering efficiency, and long-term operational adaptability, redefining the design and execution of industrial systems.