Market Definition

The market involves analytical methods and tools designed to measure cellular and biochemical metabolic activities. This enables the quantification of processes such as energy production, nutrient utilization, mitochondrial function, and metabolite generation.

Metabolism assays evaluate dynamic metabolic interactions and convert biochemical changes into measurable optical, fluorescent, luminescent, or electrochemical signals for precise and real-time analysis. They play a vital role in advancing drug discovery, disease modeling, cell health assessment, and functional genomics across biotechnology, clinical studies, and pharmaceutical research.

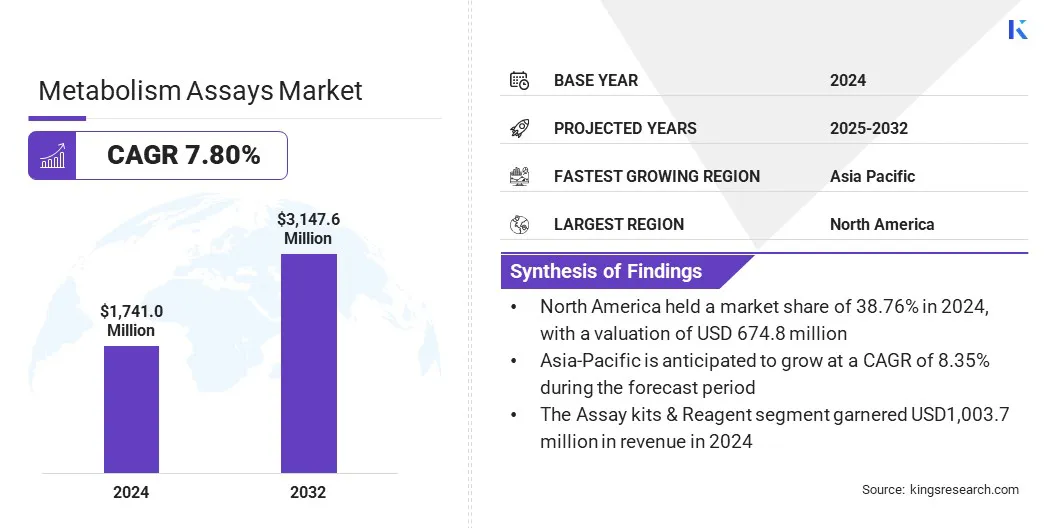

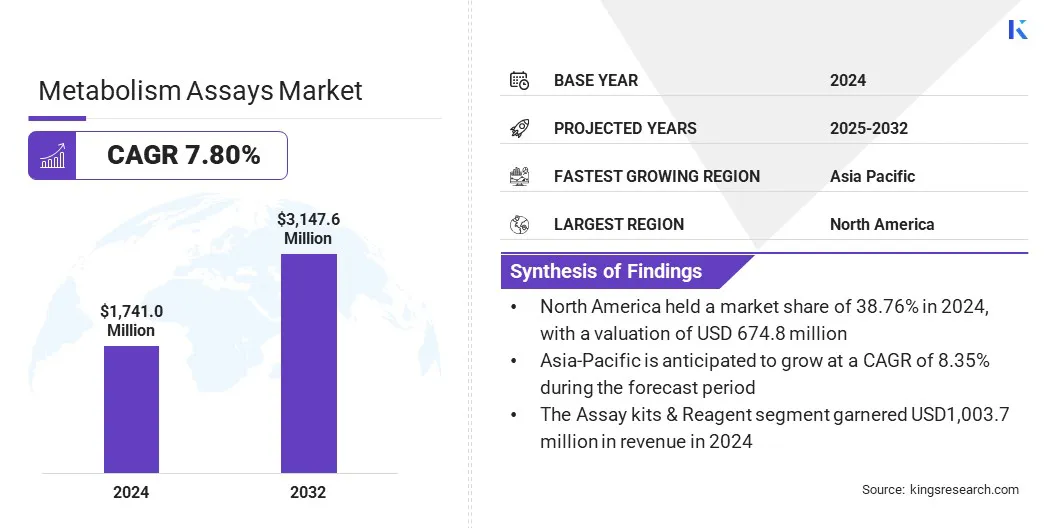

The global metabolism assays market size was valued at USD 1,741.0 million in 2024 and is projected to grow from USD 1,860.9 million in 2025 to USD 3,147.6 million by 2032, exhibiting a CAGR of 7.80% over the forecast period.

The market is expanding due to the rising demand for advanced tools that measure cellular energy pathways, mitochondrial activity, and metabolic health. The market growth is supported by increased drug discovery workflows, broader use of cell-based assays in academic and industrial research, and rapid adoption of high-throughput analytical technologies across research settings.

Key Market Highlights:

- The metabolism assays industry size was recorded at USD 1,741.0 million in 2024.

- The market is projected to grow at a CAGR of 7.80% from 2024 to 2032.

- North America held a market share of 38.76% in 2024, with a valuation of USD 674.8 million.

- The assay kits & reagents segment garnered USD 1,003.7 million in revenue in 2024.

- The colorimetry segment is expected to reach USD 1,087.1 million by 2032.

- The diagnostics segment is expected to register a market share of 63.83% by 2032.

- The pharma & biotech companies & CROs segment registered a market share of 41.34% in 2024.

- Asia Pacific is anticipated to grow at a CAGR of 8.35% over the forecast period.

Major companies operating in the metabolism assays market are Agilent Technologies, Inc., Thermo Fisher Scientific Inc., DH Life Sciences, LLC., Bruker, Shimadzu Corporation, PerkinElmer, LECO Corporation, Merck KGaA, Promega Corporation, Abcam Limited, Bio-Rad Laboratories, Inc., Cayman Chemical, Enzo Biochem Inc., Human Metabolome Technologies, and Sartorius AG.

Market growth in the metabolism assay sector is driven by the growing focus on mitochondrial dysfunction research, as abnormalities in mitochondrial activity are increasingly linked to neurodegenerative, metabolic, and rare diseases. This rising scientific emphasis is creating strong demand for highly sensitive assays that measure oxidative phosphorylation, ATP production, glycolytic shifts, and cellular stress responses.

Leading players are increasing R&D efforts to develop next-generation mitochondrial assay platforms, thereby enhancing real-time metabolic analyzers and expanding high-content screening capabilities.

- In November 2024, Agilent Technologies launched the Mito-rOCR Assay Kit, an end-to-end solution designed to simplify advanced mitochondrial function analysis for researchers at all skill levels. The assay is compatible with a range of fluorescent plate readers and multimode imagers, allowing wider adoption across laboratories seeking accessible tools to explore mitochondrial activity and its role in diverse disease conditions.

A key factor driving the growth of the metabolism assays market is the rising demand for advanced cell-based analysis in drug discovery. Pharmaceutical developers are increasingly prioritizing real-time evaluation of metabolic pathways to better understand compound efficacy, toxicity, and mechanism of action.

This shift is driven by the growing complexity of therapeutic pipelines, where early identification of metabolic dysfunction reduces late-stage failures and accelerates candidate selection. Research teams across biotechnology firms, pharmaceutical companies, and academic laboratories are adopting metabolism assays to monitor parameters such as mitochondrial activity, glycolysis rates, and ATP production.

The expanding reliance on precise metabolic profiling is strengthening the use of high-content, high-throughput assay platforms, supporting more accurate decision-making and enhancing overall drug development efficiency.

- In October 2025, MilliporeSigma formed a strategic partnership with Promega Corporation to co-develop advanced drug discovery technologies. The collaboration combines MilliporeSigma’s organoid expertise with Promega’s assay and reporter systems to create real-time cellular activity assays for 3D cell cultures. This initiative supports more physiologically relevant testing and strengthens next-generation screening capabilities.

A key challenge restraining the growth of the metabolism assays market is the high cost and technical complexity of advanced assay platforms and instrumentation. Developing, manufacturing, and maintaining high-performance metabolic analyzers, 3D cell culture systems, and organoid-compatible assays requires substantial investment.

In addition, the need for skilled personnel and robust data analysis capabilities further increases overall operational expenses. These factors may limit adoption, particularly among smaller research laboratories, academic institutions, and emerging markets.

To address this challenge, market players are focusing on developing cost-effective, user-friendly, and scalable assay kits and instruments, providing training and technical support programs, and forming strategic partnerships to enhance accessibility and drive broader adoption across pharmaceutical, biotechnology, and academic research settings.

A key trend influencing the metabolism assays market is the accelerating shift toward 3D cell culture and organoid-based analytical systems. Research teams and pharmaceutical developers are increasingly adopting these advanced models to replicate human tissue architecture and capture metabolic activity with greater accuracy.

Organoid-based assays enable more realistic evaluation of mitochondrial function, nutrient utilization, and drug-induced metabolic changes compared to traditional 2D cultures. These improvements strengthen predictive insights, reduce translational gaps, and support more effective screening and toxicity assessment across drug discovery and preclinical research, thereby driving market demand.

- In May 2025, Agilent Technologies introduced the Seahorse XF Flex Analyzer, a high-performance 24-well platform designed to extend real-time metabolic analysis into optimized 3D tissue and organoid workflows. The launch includes dedicated consumables and assay kits that support enhanced sensitivity for detecting subtle metabolic changes in both 2D and 3D models.

|

Segmentation

|

Details

|

|

By Product

|

Assay Kits & Reagents, Instruments & Analyzers, Software & Services

|

|

By Technology

|

Colorimetry, Fluorimetry, Spectrometry, Others

|

|

By Application

|

Diagnostics, Research

|

|

By End-User

|

Hospitals, Diagnostic Laboratories, Pharma & Biotech Companies & CROs

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation:

- By Product (Assay Kits & Reagents, Instruments & Analyzers, and Software & Services): The assay kits & reagents segment earned USD 1,003.7 million in 2024, driven by rising adoption of high-throughput and real-time metabolic assays, increasing demand for organoid- and 3D cell culture-compatible kits.

- By Technology (Colorimetry, Fluorimetry, Spectrometry, and Others): The colorimetry segment held 35.43% of the market in 2024, due to its simplicity, cost-effectiveness, wide applicability in high-throughput metabolic assays, and ease of integration with 2D and 3D cell culture models.

- By Application (Diagnostics and Research): The diagnostics segment is projected to reach USD 2,009.0 million by 2032, owing to increasing prevalence of metabolic and neurodegenerative diseases, rising demand for personalized medicine, and the need for early disease detection and therapeutic monitoring.

- By End Use (Hospitals, Diagnostic Laboratories, and Pharma & Biotech Companies & CROs): The pharma & biotech companies & CROs segment is projected to reach USD 1,357.1 billion by 2032, fueled by growing investments in drug discovery, high-throughput screening, preclinical research, and the adoption of organoid- and 3D-compatible metabolism assay platforms.

What is the market scenario in North America and Asia-Pacific region?

Based on region, the global metabolism assays market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

The North America metabolism assays market accounted for approximately 38.76 percent of the global market in 2024, with a valuation of USD 674.8 million. This dominance is driven by the region’s strong concentration of pharmaceutical and biotechnology companies and a high volume of drug discovery and biomedical research activities.

The region’s growth is further driven by investments in personalized medicine, functional genomics, and 3D organoid-based cell culture models. Rising prevalence of metabolic and neurodegenerative diseases, including diabetes, obesity, and Alzheimer’s disease, is increasing demand for high-throughput and sensitive metabolic assays in drug discovery and disease modeling. This trend is contributing to sustained market demand across the region.

- According to the Alzheimer’s Disease Association, approximately 6.2 million people in the United States are living with Alzheimer’s disease.

Asia-Pacific is poised for significant growth at a robust CAGR of 8.35% over the forecast period, driven by expanding biotechnology and pharmaceutical research, increasing government support for life sciences, and rising investments in advanced laboratory infrastructure.

Countries such as China, India, Japan, and South Korea are adopting high-throughput and real-time metabolic assay platforms across academic, clinical, and industrial research environments to support drug discovery and disease research.

Research institutions and pharmaceutical companies in the region are increasingly focusing on translational research aligned with local population needs. Moreover, the rising incidence of lifestyle-related metabolic disorders is increasing demand for metabolic assays, supporting sustained market growth across Asia-Pacific.

Regulatory Frameworks

- In the U.S., metabolism assays and related instruments are regulated by the FDA and must comply with standards for laboratory devices and clinical diagnostics, including validation for accuracy, sensitivity, and reproducibility. Laboratory-Developed Tests (LDTs) and research-use-only (RUO) assays follow CLIA and CAP guidelines, ensuring quality control and proper laboratory practices.

- The EMA oversees metabolism assay applications in the EU, particularly when used for clinical or preclinical studies. Assays intended for diagnostic or therapeutic use require CE marking and adherence to the In-Vitro Diagnostic Regulation (IVDR), with rigorous validation for safety, efficacy, and reproducibility.

- In APAC, China mandates government approvals for assays linked to clinical research and translational studies, while Japan’s PMDA regulates assay systems used in drug development, emphasizing safety and reproducibility.

- Globally, the WHO provides guidance on ethical and quality standards for research involving metabolic profiling and advanced cell-based assays. It recommends standardization, reproducibility, and global collaboration to ensure safe, scientifically robust use of metabolism assay technologies in research and clinical settings.

Competitive Landscape

Leading players in the metabolism assays industry are emphasizing technological innovation, portfolio expansion, and strategic collaborations to address growing demand for high-sensitivity, real-time metabolic analysis.

Companies are launching advanced platforms, including 4D-metabolomics mass spectrometers, XF analyzers, and organoid-compatible assay kits, to improve accuracy, throughput, and physiological relevance. These companies are conducting validation studies, pilot programs, and application testing to demonstrate performance, reliability, and reproducibility, facilitating regulatory acceptance and adoption in pharmaceutical, biotech, and academic research.

- In May 2025, Bruker Corporation launched the timsMetabo mass spectrometer at the 73rd ASMS Conference. The platform enables creation of a digital metabolome archive for each sample and provides scalable, TIMS-enabled qual-quant performance, supporting advanced 4D-Metabolomics and 4D-Lipidomics workflows with reproducible molecular collision cross sections (CCS).

Key Companies in Metabolism Assays Market:

- Agilent Technologies, Inc.

- Thermo Fisher Scientific Inc.

- DH Life Sciences, LLC.

- Bruker

- Shimadzu Corporation

- PerkinElmer

- LECO Corporation

- Merck KGaA

- Promega Corporation

- Abcam Limited.

- Bio-Rad Laboratories, Inc.

- Cayman Chemical

- Enzo Biochem Inc.

- Human Metabolome Technologies

- Sartorius AG

Recent Developments

- In July 2025, Sartorius completed the acquisition of MatTek Corp, including Visikol Inc, from BICO Group AB. The acquisition expands Sartorius’s capabilities in cell analysis instruments, reagents, and AI-enabled models, which may support integrated drug development workflows and increase the availability of organoid- and 3D cell-based metabolism assay solutions for pharmaceutical and biotechnology research.