Market Definition

The market encompasses technologies, instruments, reagents, and software used to rapidly conduct millions of chemical, genetic, or pharmacological tests. It includes automation systems, detection methods, assay development, and data analysis tools. HTS is integral to drug discovery, toxicology, and biochemical research.

The market covers services and consumables facilitating compound screening, target validation, and lead identification across pharmaceutical, biotechnology, and academic research sectors.

High Throughput Screening Market Overview

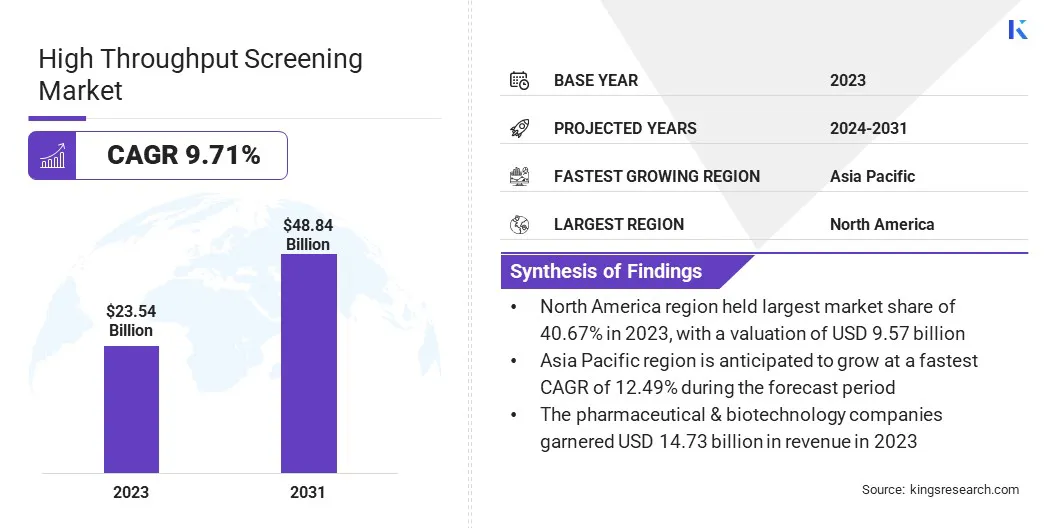

The global high throughput screening market size was valued at USD 23.54 billion in 2023 and is projected to grow from USD 25.52 billion in 2024 to USD 48.84 billion by 2031, exhibiting a CAGR of 9.71% during the forecast period.

Rising chronic diseases and increased automation are driving the market, enabling faster, more accurate drug discovery through scalable, efficient, and precise compound screening technologies.

Major companies operating in the high throughput screening industry are Thermo Fisher Scientific Inc., Merck KGaA, Bio-Rad Laboratories, Inc., METTLER TOLEDO., Aurora Biomed Inc., HighRes Biosolutions., Agilent Technologies, Inc, Sartorius AG, ILIFE BIOTECH, Prior Scientific., and BD.

The market is propelled by increased R&D investments in drug discovery, intensifying the demand for HTS technologies. Pharmaceutical and biotechnology companies are channeling funds into advanced platforms that optimize compound screening, expedite lead identification, and compress development cycles. This financial focus drives the integration of automated, data-intensive systems, solidifying the role of HTS in contemporary drug development strategies.

Key Highlights:

- The high throughput screening market size was valued at USD 23.54 billion in 2023.

- The market is projected to grow at a CAGR of 9.71% from 2024 to 2031.

- North America held a market share of 40.67% in 2023, with a valuation of USD 9.57 billion.

- The pharmaceutical & biotechnology companies segment garnered USD 14.73 billion in revenue in 2023.

- The drug discovery segment is expected to reach USD 29.46 billion by 2031.

- The pharmaceutical & biotechnology companies segment secured the largest revenue share of 62.56% in 2023.

- The software segment is poised for a robust CAGR of 15.19% through the forecast period.

- The market in Asia Pacific is anticipated to grow at a CAGR of 12.49% during the forecast period.

Market Driver

Rising Burden of Chronic Diseases Accelerates High Throughput Screening Adoption

The global market is registering growth, due to the rising incidence of chronic conditions such as cancer, diabetes, and cardiovascular diseases.

HTS technologies facilitate swift identification of bioactive compounds, streamlining drug discovery workflows. Growing healthcare demands and the pursuit of advanced therapeutic strategies underscore HTS as an essential component in managing intricate disease landscapes.

- In April 2025, the National Institute for Health Care Management (NIHCM) highlighted the growing burden of chronic diseases, noting that 90% of the USD 4.5 trillion spent on U.S. healthcare in 2022 was allocated to treating individuals with chronic physical and mental health conditions.

Market Challenge

Data Integration and Workflow Efficiency

The high throughput screening market faces a significant challenge in terms of managing data complexity and integration, due to the increasing volume and diversity of screening assays. This complexity hampers efficiency and slows decision-making in drug discovery pipelines.

Manufacturers are investing in advanced automation systems, Artificial Intelligence (AI), and integrated data management platforms. These technologies enable streamlined workflows, enhanced data analysis, and real-time decision support.

Additionally, strategic partnerships with bioinformatics firms are being pursued to develop scalable, interoperable solutions that align with evolving R&D requirements and regulatory standards.

Market Trend

Automation and Robotics Fuel Growth

The market is registering growth, due to the integration of automation and robotics. These technologies enhance assay precision, reduce human error, and significantly increase processing speed, enabling rapid compound screening.

Pharmaceutical and biotech companies prioritize efficiency and scalability, boosting the demand for automated HTS platforms and positioning automation as a key market catalyst.

- In October 2024, BD (Becton, Dickinson and Company) introduced the first in a series of high-throughput, robotics-compatible reagent kits designed to automate large-scale, single-cell discovery studies, improving consistency and efficiency.

High Throughput Screening Market Report Snapshot

|

Segmentation

|

Details

|

|

By Offering

|

Consumables (Reagents & Assay Kits, Laboratory Consumables), Instruments (Liquid Handling Systems, Detection Systems, Imaging Instruments, Other Instruments), Services, Software

|

|

By Application

|

Drug Discovery, Biochemical Screening, Life Science Research, Other Application

|

|

By Technology

|

Cell-based Assays (2D Cell Cultures, 3D Cell Cultures, Reporter Based Assays, Perfusion Cell Cultures) Lab on a Chip

|

|

By End User

|

Pharmaceutical & Biotechnology Companies, Academic & Research Institutes, Contract Research Organizations (CROs), Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation:

- By Offering (Consumables, Instruments, Services, Software, and Sub1_Seg5): The consumables segment earned USD 9.07 billion in 2023, due to the continuous need for reagents, plates, and other essential items in HTS workflows, driving recurring demand and market growth.

- By Application (Drug Discovery, Biochemical Screening, Life Science Research, and Other Applications): The drug discovery segment held 58.99% share of the market in 2023, due to the increasing demand for efficient and scalable solutions to identify potential drug candidates, accelerating the research and development process in pharmaceutical industries.

- By Technology (Cell-based Assays, Lab on a Chip, Label Free Technology): The Cell-based Assays segment is projected to reach USD 21.40 billion by 2031, owing to their ability to provide more physiologically relevant data by mimicking real biological environments, enhancing the accuracy and reliability of screening results for drug discovery.

- By End User (Pharmaceutical & Biotechnology Companies, Academic & Research Institutes, Contract Research Organizations (CROs), Others): The contract research organizations (CROs) segment is poised for significant growth at a CAGR of 12.72% through the forecast period, due to their ability to offer specialized, cost-effective, and scalable screening services to pharmaceutical and biotechnology companies, driving increased adoption of HTS technologies.

High Throughput Screening Market Regional Analysis

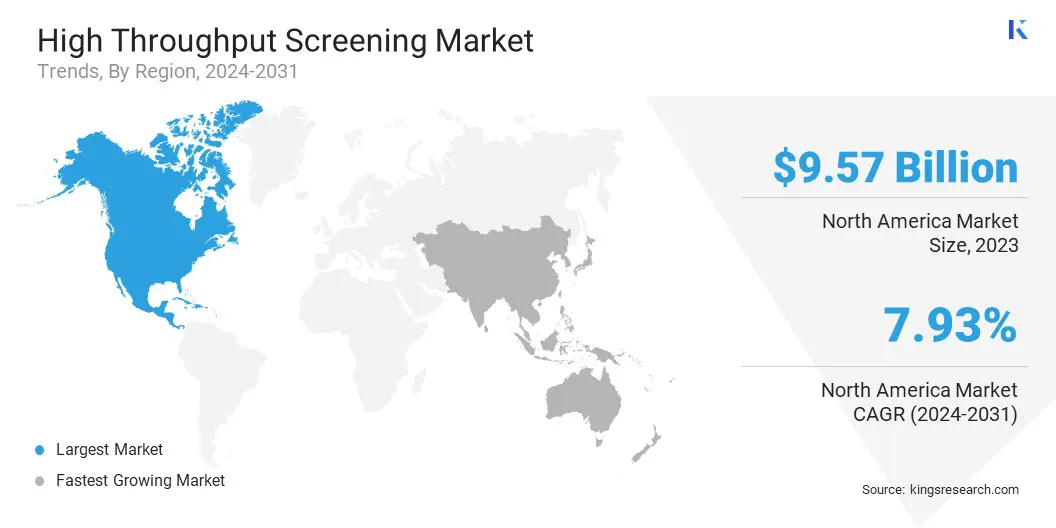

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

North America accounted for 40.67% share of the high throughput screening market in 2023, with a valuation of USD 9.57 billion. The market dominance is attributed to substantial healthcare investments. The region has registered continuous funding from both government and private sectors focused on advancing healthcare infrastructure, particularly in drug discovery and diagnostics.

This continuous investment in research and development has driven the widespread adoption of HTS technologies, establishing North America as the leading market in terms of innovation, infrastructure, and overall growth.

- According to the National Health Expenditure Accounts (NHEA) published by the Centers for Medicare and Medicaid Services (CMS.gov), healthcare spending in the U.S. rose by 7.5% in 2023, totaling USD 4.9 trillion, or USD 14,570 per person. This spending accounted for 17.6% of the country’s Gross Domestic Product (GDP).

The high throughput screening industry in Asia Pacific is poised for significant growth at a robust CAGR of 12.49% over the forecast period. The market is driven by significant investments in pharmaceutical research and development.

Pharmaceutical companies are increasingly adopting HTS technologies to accelerate drug discovery processes. This surge in innovation and the demand for efficient screening solutions are propelling the market in Asia Pacific, positioning it as a global leader in HTS.

Regulatory Frameworks

- In the U.S., the Food and Drug Administration (FDA) regulates the use of HTS in drug discovery and safety assessment. It ensures adherence to Good Laboratory Practice (GLP) standards under 21 CFR Part 58, which are designed to maintain the quality and reliability of nonclinical laboratory studies submitted in support of research or marketing applications for FDA-regulated products.

- In China, the National Medical Products Administration (NMPA) regulates drugs, medical devices, and cosmetics, overseeing the approval of clinical trials and conducting market surveillance.

Competitive Landscape

The high throughput screening market has registered significant activity, with key players strategically pursuing acquisitions and product launches to enhance their market positions. These initiatives aim to expand product portfolios, integrate advanced technologies, and strengthen capabilities in drug discovery & biomedical research.

The increasing demand for innovative solutions has driven competition, with companies focusing on optimizing screening processes, improving automation, and integrating AI and ML to accelerate research and development outcomes.

- In April 2025, Metrion Biosciences, a leading preclinical CRO specializing in ion channel services, launched a validated high-throughput NaV1.9 screening assay. Backed by over ten years of electrophysiology expertise, this assay enhances pain therapeutic discovery by delivering reproducible, decision-ready data and addressing limitations in traditional NaV1.9 screening through tailored assays and services.

List of Key Companies in High Throughput Screening Market:

- Thermo Fisher Scientific Inc.

- Merck KGaA

- Bio-Rad Laboratories, Inc.

- METTLER TOLEDO

- Aurora Biomed Inc.

- HighRes Biosolutions

- Agilent Technologies, Inc

- Sartorius AG

- ILIFE BIOTECH

- Prior Scientific

- BD.

Recent Developments (M&A)

- In October 2023, Thermo Fisher announced its acquisition of Olink, enhancing its proteomics capabilities. Olink’s Proximity Extension Assay (PEA) enables high-throughput protein analysis, supporting over 5,300 biomarker targets and contributing to 1,400+ scientific publications in disease research.