In Vitro Diagnostics Market Size

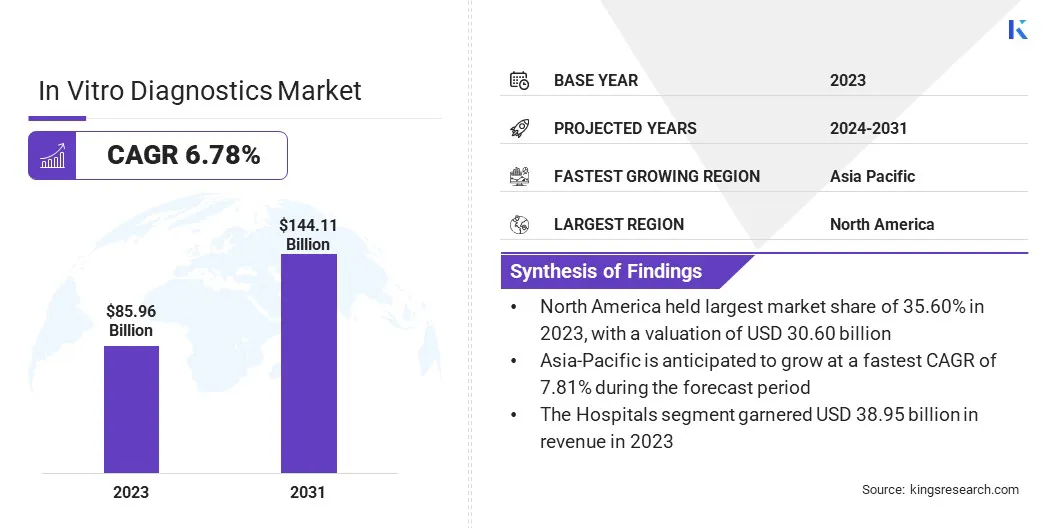

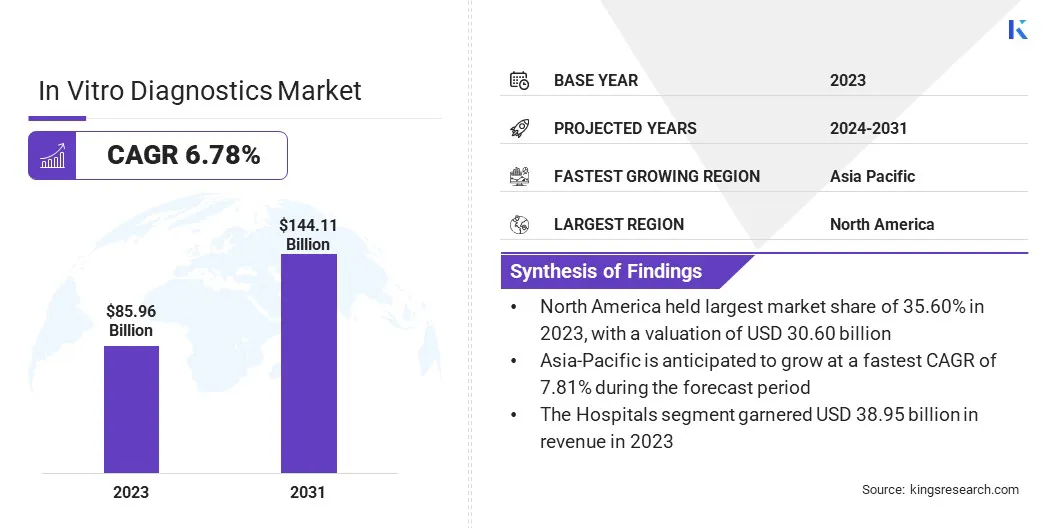

According to Kings Research, the Global In Vitro Diagnostics Market size was valued at USD 85.96 billion in 2023 and is projected to grow from USD 91.02 billion in 2024 to USD 144.11 billion by 2031, exhibiting a CAGR of 6.78% during the forecast period.

The rising prevalence of chronic diseases, such as diabetes, cardiovascular conditions, and cancer, is driving demand for in vitro diagnostics (IVD). This surge is fueled by the need for early detection, monitoring, and personalized treatment solutions for long-term health management.

In the scope of work, the report includes products and solutions offered by companies such as F. Hoffmann-La Roche Ltd, Siemens Healthcare Private Limited, Abbott, Danaher Corporation, Thermo Fisher Scientific Inc, Becton, Dickinson and Company, Bio-Rad Laboratories, Inc, SYSMEX CORPORATION, QuidelOrtho Corporation, BIOMÉRIEUX, and others.

Key Market Highlights:

- Strong Market Growth Outlook: The global in vitro diagnostics market was valued at USD 85.96 billion in 2023 and is projected to reach USD 144.11 billion by 2031, growing at a CAGR of 6.78%, driven by rising demand for early and accurate disease detection.

- Technology-Led Expansion: Immunoassays dominated the market with a 30.29% revenue share in 2023, supported by advancements in sensitivity, automation, and suitability for point-of-care diagnostic settings.

- Infectious Diseases as a Key Growth Segment: The infectious diseases application segment is expected to grow at a CAGR of 7.48%, fueled by increasing outbreaks, global health surveillance needs, and rapid diagnostic testing adoption.

- Regional Leadership and High-Growth Markets: North America accounted for approximately 35.60% of the global market in 2023, while Asia-Pacific is projected to grow at the fastest pace with a 7.81% CAGR, supported by expanding healthcare infrastructure and rising disease burden.

- Innovation and Strategic Collaborations: Market leaders are accelerating innovation through AI integration, molecular diagnostics advancements, and strategic partnerships, enhancing diagnostic accuracy, accessibility, and scalability across global healthcare systems.

The global in vitro diagnostics market is witnessing significant transformation, mainly propelled by rapid technological advancements, increasing healthcare demands, and a shift toward more personalized, preventive care. With the growing prevalence of chronic diseases and an aging population, there is a pressing need for accurate and early disease detection.

- Noncommunicable diseases (NCDs) are responsible for 74% of global deaths, with 86% of premature deaths occurring in low- and middle-income countries, according to the World Health Organization (WHO). This underscores the urgent need for accessible, early diagnostic solutions, such as in vitro diagnostics, to manage and mitigate these diseases.

This evolution presents numerous opportunities, particularly in emerging markets with improving healthcare infrastructure, thus fostering growth. Innovation and technologies are further contributing to the market's evolution, offering new avenues for both established players and newcomers.

Additionally, the development of non-invasive testing methods and more efficient diagnostic tools provide significant potential for companies to address the evolving needs of healthcare systems worldwide, improving patient outcomes and expanding market reach.

IVD refers to a range of medical tests that analyze biological samples, such as blood, urine, or tissues, outside the human body to diagnose diseases, monitor health conditions, and assess treatment efficacy. IVD products include test kits, reagents, laboratory instruments, and software systems that deliver precise, reliable results essential for informed healthcare decisions.

The applications of IVD span across various medical fields, including oncology, cardiology, infectious diseases, and genetic testing, enabling early detection of diseases, tracking progression, and optimizing treatment options. IVD plays a vital role in personalized medicine by offering detailed molecular and genetic insights to tailor healthcare solutions.

Analyst View on Global In vitro diagnostics market:

Analyst View on Global In vitro diagnostics market:

The global in vitro diagnostics market size is demonstrating consistent growth, with market value expanding from approximately USD 86 billion in 2023 and projected to exceed USD 140 billion by 2031, reflecting the rising demand for early and accurate disease detection. Increased adoption of molecular diagnostics and immunoassays, which together account for a significant share of diagnostic testing, is enhancing clinical accuracy and turnaround efficiency.

- Regulatory frameworks governed by bodies such as the U.S. FDA and European CE are reinforcing test reliability and patient safety standards. Emerging economies, particularly in Asia-Pacific, are witnessing faster adoption, supported by healthcare infrastructure investments and projected growth rates above 7% annually.

Strategic collaborations and R&D investments by leading diagnostics companies are accelerating innovation in AI-enabled and point-of-care testing solutions. As precision medicine and population health initiatives expand globally, in vitro diagnostics remains a foundational pillar of modern healthcare delivery.

- In September 2024, Owlstone Medical partnered with the FDA to enhance in vitro diagnostics (IVD) by developing methods for identifying breath biomarkers. This collaboration aims to create portable breath-based diagnostic devices, enhance disease detection, and expand the Breath Biopsy VOC Atlas to improve diagnostic accuracy and accessibility.

In Vitro Diagnostics Market Growth Factors

Technological advancements are playing a pivotal role in driving In Vitro Diagnostics Market Growth. The continuous evolution of diagnostic technologies is improving the speed, accuracy, and efficiency of testing processes, which directly contributes to better patient outcomes. These innovations support more precise disease detection, optimize laboratory workflows, and enable the advancement of personalized medicine across healthcare systems.

As technology progresses, the IVD market is expected to witness significant growth, with innovations enhancing diagnostic capabilities and global healthcare delivery.

- In November 2024, Fapon showcased its technological advancements at MEDICA 2024, presenting IVD total solutions, including CLIA, NGS, PCR, and biochemistry applications. With a focus on high-performance raw materials and innovative formats, Fapon highlights its commitment to advancing in vitro diagnostics and improving global healthcare outcomes.(Source: faponbiotech.com)

The lack of standardization in vitro diagnostics, particularly in rapid tests is presenting a significant challenge to market expansion. This leads to variability in methods and results, affecting diagnostic accuracy.

Inconsistent performance across different brands or types of tests can result in false positives or negatives, undermining trust. Establishing global standards and guidelines for test design, validation, and performance metrics, along with regular proficiency testing and certification, can enhance consistency and improve diagnostic reliability.

- In July 2024, Saphetor SA received European CE mark approval for its VarSome Clinical platform, ensuring compliance with the EU’s In-Vitro Diagnostic Medical Devices Regulation. This certification confirms the platform’s adherence to rigorous safety, performance, and reliability standards for Next Generation Sequencing data analysis in clinical genomics.

In Vitro Diagnostics Industry Trends

The integration of artificial intelligence (AI) and machine learning (ML) is a key factor shaping In Vitro Diagnostics Market Trends, as these technologies enhance diagnostic accuracy and automate complex data analysis. AI- and ML-based algorithms can efficiently process large volumes of diagnostic data, identifying patterns and anomalies that may not be easily detected through manual interpretation.

This improves test sensitivity and specificity while reducing diagnostic errors and supporting more informed clinical decision-making. Furthermore, AI-driven solutions are increasingly applied in genetic testing, medical imaging, and biomarker analysis, accelerating diagnosis and enabling more personalized treatment approaches.

- In September 2024, Roche expanded its Digital Pathology Open Environment by incorporating over 20 AI algorithms from eight new collaborators. This integration leverages AI to enhance diagnostic accuracy, facilitate precision medicine, and enable targeted treatments, thereby advancing personalized healthcare for cancer patients.

The increasing focus on global health and disease surveillance is boosting the demand for rapid, accurate diagnostic tools. The rise of infectious disease outbreaks, including pandemics, highlights the critical need for quick detection and monitoring technologies.

IVD companies are advancing diagnostic solutions that enable early diagnosis, real-time surveillance, and effective outbreak management. These advancements enhance healthcare systems’ ability to respond efficiently, facilitating disease containment and supporting global health initiatives and preparedness.

- In October 2024, Abionic received FDA clearance for its IVD CAPSULE PSP test, a rapid diagnostic tool for early sepsis detection. This breakthrough addresses the growing demand for quick, accurate diagnostics, enabling timely interventions and enhancing global health surveillance to improve patient outcomes and response to critical health threats.

Segmentation Analysis

The global market has been segmented based on product type, technology, application, end-user, and geography.

By Product Type

Based on product type, the market has been segmented into instruments, reagents & kits, software control, and products. The instruments segment led the in vitro diagnostics industry in 2023, reaching a valuation of USD 34.65 billion. This dominance is attributed to the increasing demand for precision, speed, and automation in healthcare.

Immunoassay analyzers are gaining traction for their rapid and accurate results in disease detection, particularly in areas such as infectious diseases and cancer. Similarly, molecular diagnostics instruments are seeing widespread adoption due to their ability to detect genetic variations and provide personalized treatment options.

Centrifuges continue to be essential for sample preparation, facilitating efficient processing of blood and other biological specimens. These innovations enhance diagnostic capabilities, clinical decision-making and patient outcomes.

By Technology

Based on technology, the in vitro diagnostics market has been segmented into immunoassays, molecular diagnostics, clinical chemistry, hematology, and microbiology.

The immunoassays segment secured the largest revenue share of 30.29% in 2023. This notable growth is propelled by its ability to provide rapid, accurate, and cost-effective results for a wide range of conditions. Immunoassays, including Enzyme-Linked Immunosorbent Assay (ELISA), lateral flow immunoassay, are widely used for detecting infectious diseases, cancer biomarkers, and cardiovascular conditions.

Their growing adoption is fueled by advances in sensitivity, automation, and miniaturization, making them suitable for point-of-care settings. The ability of immunoassays to deliver quick results with minimal sample requirements is enhancing patient management and fostering demand across hospitals, clinics, and diagnostic laboratories worldwide.

By Application

Based on application, the market has been classified into infectious diseases, oncology, cardiology, diabetes, and others. The infectious diseases segment is set to expand at a CAGR of 7.48% through the forecast period, primarily due to the increasing prevalence of infectious outbreaks and the pressing need for rapid, accurate detection.

Technological advancements in molecular diagnostics enable the early identification of pathogens, aiding in the containment of diseases such as COVID-19, HIV, and tuberculosis. The increasing demand for point-of-care testing, which offers quick results in remote or underserved regions, is further bolstering segmental growth.

Additionally, the growing focus on personalized medicine and global health initiatives highlights the need for efficient diagnostic solutions to combat infectious diseases and improve patient outcomes.

In Vitro Diagnostics Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia-Pacific, MEA, and Latin America.

The North America In Vitro Diagnostics Market share accounted for a significant portion of the global market, standing at approximately 35.60% in 2023 with a valuation of USD 30.60 billion. This strong position is supported by the region’s advanced healthcare infrastructure, high adoption of innovative diagnostic technologies, and substantial healthcare expenditure.

North America hosts a wide range of leading diagnostic companies and research institutions actively advancing molecular diagnostics, immunoassays, and point-of-care testing solutions. Moreover, stringent regulatory standards, including approvals from the U.S. FDA, ensure product quality and strengthen confidence in diagnostic outcomes.

The growing aging population, increasing prevalence of chronic diseases, and rising demand for personalized medicine continue to drive sustained growth across the regional IVD market.

Asia-Pacific in vitro diagnostics market is projected to witness significant growth over the forecast period at a CAGR of 7.81%. This growth is characterized by rapid economic development, improving healthcare infrastructure, and increasing healthcare expenditure.

The region’s large and diverse population, coupled with a rising prevalence of infectious and chronic diseases, fuels the demand for advanced diagnostic technologies. Additionally, growing health awareness and government investments in healthcare systems support regional market expansion.

The adoption of innovative diagnostic solutions, including point-of-care testing and molecular diagnostics, is accelerating in countries such as China, India, and Japan. These factors, along with expanding medical research, position Asia Pacific as a key market for IVD.

Competitive Landscape

The global in vitro diagnostics market report will provide valuable insight with an emphasis on the fragmented nature of the industry. Prominent players are focusing on several key business strategies such as partnerships, mergers and acquisitions, product innovations, and joint ventures to expand their product portfolio and increase their market shares across different regions.

Strategic initiatives, including investments in R&D activities, the establishment of new manufacturing facilities, and supply chain optimization, could create new opportunities for market growth.

Key Companies in In Vitro Diagnostics Market

Key Industry Developments

- August 2024 (Partnership): Unilabs and C2N Diagnostics partnered to expand access to C2N's Precivity blood tests for Alzheimer’s disease across Europe, the Gulf Region, and Latin America. This collaboration aims to advance early diagnosis and research in Alzheimer’s, enhancing precision in IVD testing for cognitive disorders and improving patient outcomes.

- July 2024 (Partnership): AB ANALITICA and SNIBE collaborated to distribute SNIBE’s Molecision R8 platform in Italy. This alliance combines AB ANALITICA’s expertise in molecular diagnostics with SNIBE’s advanced automation technology to enhance molecular testing capabilities for infectious diseases, genetics, and oncology.

Analyst View on Global In vitro diagnostics market:

Analyst View on Global In vitro diagnostics market: