Cell Analysis Market Size

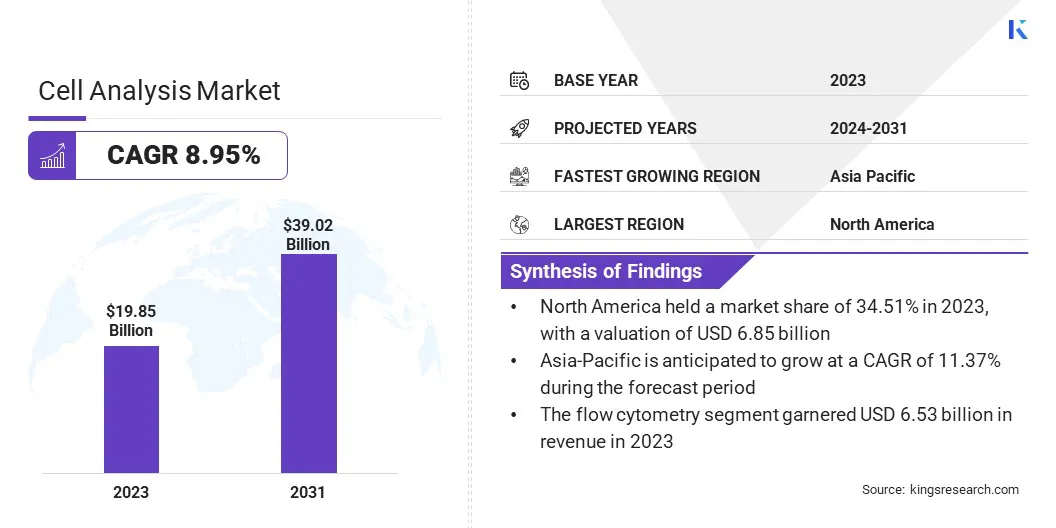

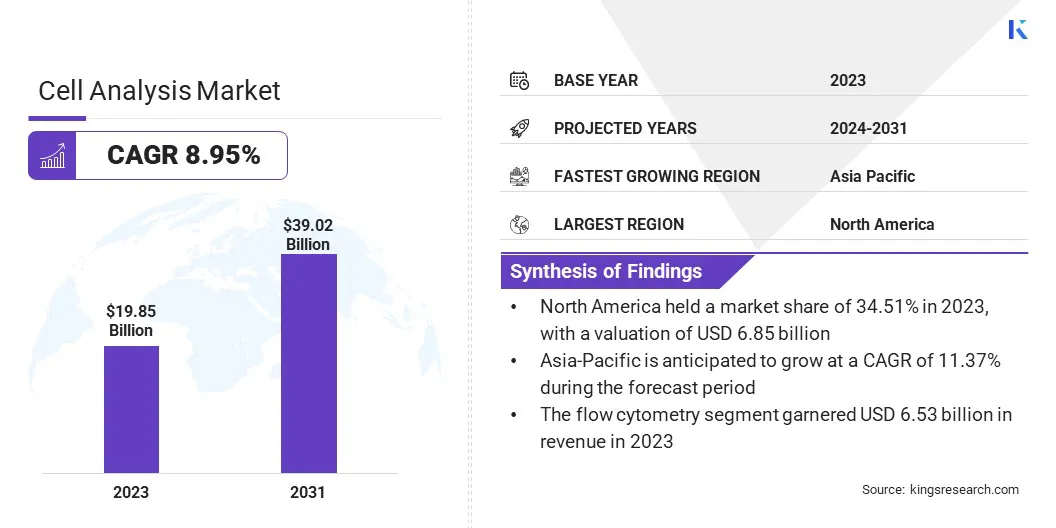

The Global Cell Analysis Market was valued at USD 19.85 billion in 2023 and is projected to reach USD 39.02 billion by 2031, growing at a CAGR of 8.95% from 2024 to 2031. The cell analysis market is poised to witness steady growth over the forecast period, driven by various factors, including the rising adoption of personalized medicine and ongoing innovation in various fields such as agriculture, and biotechnology, among others. Moreover, the increasing governmental initiatives and funding in the healthcare sector are expected to contribute to market growth.

The cell analysis market is experiencing robust growth, majorly propelled by advancements in biomedical research, drug discovery, and personalized medicine. This growth is further propelled by the increasing prevalence of chronic diseases, which are expected to increase the demand for innovative therapies and targeted treatments. Moreover, the integration of technologies such as genomics, proteomics, and bioinformatics is anticipated to stimulate the development of innovative cell analysis tools capable of examining cellular functions.

Moreover, the rising investments in drug discovery and development, coupled with a growing trend of precision medicine, highlight the increasing importance of advanced cell analysis technologies. The cell analysis market is set to experience continuous expansion, largely attributed to ongoing technological innovations, rising healthcare demands, and the growing novel therapeutic solutions.

The cell analysis market encompasses technologies, products, and services dedicated to the study and manipulation of cells for biomedical research and therapeutic applications. Furthermore, the market consists of an array of instruments utilized in the process of cell analysis for different applications.

For instance, instruments such as microscopes, flow cytometers, and high-content screening systems enable visualization and analysis of cellular properties at various levels of detail. In addition, consumables such as cell culture media, reagents, and assay kits support cell-based experiments and analyses.

The applications of cell analysis are found across diverse fields, including basic research, drug screening, diagnostic testing, and regenerative medicine, serving academic institutions, pharmaceutical companies, diagnostic laboratories, and research organizations worldwide. The cell analysis market is expected to grow significantly in the near future, fostered by advancements in technology, automation, and the integration of multi-omics approaches, contributing to advancements in biomedical research and personalized medicine.

Analyst’s Review

The cell analysis market is experiencing significant growth due to growing initiatives from key market players. These players, comprising established companies and innovative startups, are actively shaping market dynamics by strategically investing in research and development efforts.

By focusing on technological innovation, particularly in advanced cell analysis tools such as flow cytometry, microscopy, and single-cell analysis platforms, market players are enhancing the capabilities of researchers and clinicians in studying cellular behavior and function.

Moreover, the market is benefiting from the growing focus on precision medicine and personalized healthcare, which necessitates precise cellular analysis for tailored diagnostics and therapies.

Biopharmaceutical research and development activities significantly contribute to market growth, with companies developing sophisticated cell analysis solutions for drug discovery and development processes. Furthermore, the increasing applications of cell analysis in regenerative medicine, stem cell research, and tissue engineering are driving the demand for specialized tools and technologies.

Cell Analysis Market Growth Factors

The cell analysis market is experiencing significant growth as a result of advancements in cell biology, molecular technologies, and genomics, which are producing vast amounts of complex data that necessitate sophisticated analytical tools for drug development.

Additionally, the expansion of the drug target due to initiatives such as the Human Genome Project has increased the demand for efficient screening methods, with cell-based assays emerging as key tools for drug discovery workflows. The rapid growth of drug targets further highlights the need for robust screening platforms that can handle high-throughput evaluations.

As the focus on precision medicine increases, there is a growing emphasis on understanding cellular mechanisms at a molecular level, leading to the widespread adoption of cell analysis technologies to demonstrate disease pathways and assess drug efficacy. This demand for high-throughput screening solutions to efficiently evaluate large compound libraries is propelling the growth of the cell analysis market.

The rising demand for advanced analytical tools in research, coupled with increased funding, has spurred the development of high-throughput equipment featuring innovative capabilities such as automation, high sensitivity, and accuracy, which facilitate the analysis of limited or rare samples.

Notably, companies such as Deepcell Inc., based in the U.S., secured substantial funding of USD 73 million in March 2022, to advance and commercialize their AI-powered single cell analysis platform. This investment highlights a broader trend where key industry players are heavily investing in the development of cutting-edge solutions.

The market for cell analysis is poised to witness significant growth in the coming years, propelled by ongoing innovation and increased scrutiny in advancing research capabilities. The cell analysis market faces several challenges, including high equipment costs, technical complexity, data management difficulties, regulatory hurdles, and others.

Addressing these challenges requires strategic initiatives such as cost reduction through technological innovation and economies of scale, enhanced training programs to build operational expertise, and the development of advanced bioinformatics tools for efficient data management.

Streamlining regulatory processes and fostering industry-academic collaborations are likely to mitigate compliance costs while standardizing protocols can improve reproducibility. Promoting the integration of cell analysis with genomics and proteomics, addressing ethical concerns through stringent guidelines, and encouraging market differentiation are anticipated to further boost market growth.

Cell Analysis Market Trends

The integration of artificial intelligence (AI) capabilities into modern high-content screening (HCS) systems is transforming live-cell analysis. For instance, the scanR HCS station’s software by Olympus Corporation utilizes AI to enable label-free quantification of living cells by accurately determining nuclei positions in microwell plates using bright field transmitted-light imaging. This innovative approach offers comparable accuracy to fluorescence imaging, showcasing the efficacy of AI in streamlining and augmenting HCS applications.

By leveraging AI for label-free cell quantification, researchers are achieving reliable and efficient analysis of cellular behaviors and responses, thereby facilitating more effective drug discovery and biological research. The surging adoption of AI in live-cell analysis is reshaping the landscape of high-content screening, fostering innovation, and fueling the demand for AI-enabled solutions in the life sciences sector. A significant trend in the cell analysis market is the widespread adoption of single-cell analysis, bolstered by its ability to uncover insights into cellular diversity and heterogeneity.

Researchers are increasingly shifting towards studying individual cells instead of bulk populations, which has amplified the adoption of single-cell analysis techniques. This trend reflects a growing recognition of the importance of understanding cellular behavior at a granular level, enabling researchers to identify rare cell types, characterize cellular states, and explore intra-cellular variability.

The rise of single-cell analysis is reshaping the landscape of cellular research and diagnostics, fueling the development of innovative technologies and analytical tools tailored for studying individual cells with unprecedented resolution and depth. As the demand for comprehensive cellular profiling continues to grow, single-cell analysis remains a pivotal focus area that propels advancements in the field of cell analysis and biology.

Segmentation Analysis

The global cell analysis market is segmented based on technique, application, product, end-user, and region.

By Technique

Based on technique, the market is segmented into flow cytometry, mass spectrometry, next, generation sequencing (NGS), polymerase chain reaction (PCR) and others. The flow cytometry segment led the market in 2023, reaching a valuation of USD 6.53 billion due to its various applications, particularly in single-cell analysis.

Flow cytometry's ability to measure multiple characteristics of individual cells in fluid samples propels its widespread adoption across diverse fields such as immunology, oncology, and clinical diagnostics. This technique provides invaluable insights into cellular composition and function, thereby augmenting advancements in research and drug development.

Its high-throughput capabilities and accuracy make it indispensable for analyzing large cell populations rapidly. As the demand for personalized medicine and deeper insights into cellular biology increases, flow cytometry is poised to maintain its dominance in the market.

By Application

Based on application, the market is segmented into oncology, immunology, cardiology, genetic disease, stem cells and others. The oncology segment is expected to register a valuation of 12.68 billion by 2031. This growth is majorly attributed to the crucial need for advanced tools to support cancer research, diagnosis, and treatment.

In addition, the integration of cell analysis technologies in oncology has revolutionized cancer diagnostics and therapeutic development. Liquid biopsy methods utilizing microscopy, microfluidics, and molecular analysis provide non-invasive options for monitoring disease progression and treatment response through the analysis of CTCs and cell-free DNA.

Additionally, single-cell analysis platforms, including single-cell RNA sequencing (scRNA-seq) and multiplex immunofluorescence imaging, enable researchers to interpret tumor heterogeneity and immune cell interactions within the tumor microenvironment, aiding in the development of personalized treatment strategies. The continuous development in the field of oncology due to cell analysis is contributing to the growth of the segment.

By End User

Based on end user, the market is classified biotechnology & pharmaceuticals, hospitals & diagnostics, and academic & research. The biotechnology & pharmaceuticals segment is set to witness significant growth, recording a robust CAGR of 9.84% through the forecast period. This notable expansion is attributed to ongoing advancements in single-cell analysis and flow cytometry techniques.

This has led to an increase in the number of emerging companies entering the cell analysis industry. These emerging companies are focused on developing innovative software solutions tailored to the needs of researchers and clinicians. Their contributions have played a key role in supporting the growth of the segment. By providing sophisticated analytical tools and user-friendly interfaces, these software solutions enhance the efficiency and accuracy of cell analysis, thereby facilitating segmental expansion.

Cell Analysis Market Regional Analysis

Based on region, the global cell analysis market is classified into North America, Europe, Asia-Pacific, MEA, and Latin America.

The North America Cell Analysis Market share stood around 34.51% in 2023 in the global market, with a valuation of USD 6.85 billion. The region benefits from the presence of major companies making significant investments in research and development within the biotechnology sector. This robust R&D activity has led to continuous innovation and the introduction of new products and technologies thereby boosting regional market expansion.

Furthermore, North America is known for its established healthcare infrastructure due to the presence strong ecosystem for biotechnology and life sciences, characterized by leading academic and research institutions, advanced healthcare facilities, and a supportive regulatory environment. These factors present an opportunity for collaboration between industry stakeholders and research organizations, thereby facilitating the development and commercialization of advanced and innovative cell analysis technologies.

Asia-Pacific is projected to experience significant growth, depicting a CAGR of 11.37% over the forecast period. The region's burgeoning biotechnology and life sciences sector, coupled with rapid technological advancements, are key factors bolstering regional market expansion. With a large and diverse population, Asia Pacific presents a vast market potential for cell analysis products and services.

Several countries in the region, such as China, Japan, South Korea, and India, are investing heavily in biotechnology research and development. This investment is likely to result in the emergence of innovative technologies and products in the field of cell analysis. Additionally, the presence of a growing number of academic and research institutions, along with increasing government initiatives to promote biotechnology, propels regional market growth.

Competitive Landscape

The global cell analysis market report will provide valuable insight with an emphasis on the fragmented nature of the industry. Prominent players are focusing on several key business strategies such as partnerships, mergers and acquisitions, product innovations, and joint ventures to expand their product portfolio and increase their market shares across different regions.

Strategic initiatives, including investments in R&D activities, the establishment of new manufacturing facilities, and supply chain optimization, could create new opportunities for market growth.

List of Key Companies in Cell Analysis Market

- DH Life Sciences

- Thermo Fisher Scientific Inc.

- Agilent Technologies,

- Merck KGaA,

- Olympus Corporation

- Promega Corporation

- PerkinElmer Inc.

- Miltenyi Biotec

- Bio-Rad Laboratories, Inc

- Sysmex

Key Industry Developments

- March 2023 (Acquisition): Agilent Technologies Inc. acquired the start-up business e-MSion, well-known for its advanced electron capture dissociation (ECD) technology, the ExD cell. With this acquisition, biological researchers may now create biotherapeutic medicines to treat diseases faster, facilitated by the ExD cell, a tiny mass spectrometer equipment. This allowed researchers to extract more comprehensive, accurate, and detailed structural information from complicated proteins by breaking their chemical connections more thoroughly and precisely.

- February 2024 (Partnership): In order to enhance hematology solutions, Sysmex Corporation and CellaVision entered into a strategic alliance arrangement. The goal of this partnership was to expand Sysmex's product line and produce state-of-the-art cell morphology analyzers. Through their collaboration, Sysmex and CellaVision improved the accuracy of cell morphology categorization, standardized testing workflows in hematology, and offered crucial support for diagnostic procedures.

The Global Cell Analysis Market is Segmented as:

By Technique

- Flow Cytometry

- Mass Spectrometry

- Next Generation Sequencing (NGS)

- Polymerase Chain Reaction (PCR)

- Others

By Application

- Oncology

- Immunology

- Cardiology

- Genetic Disease

- Stem Cells

- Others

By Product

- Consumables

- Services

- Instruments

- Software

By End User

- Biotechnology & Pharmaceuticals

- Hospitals & Diagnostics

- Academic & Research

By Region

- North America

- Europe

- France

- U.K.

- Spain

- Germany

- Italy

- Russia

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia-Pacific

- Middle East & Africa

- GCC

- North Africa

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America