Market Definition

The market focuses on unified data management architectures that integrate diverse data sources across on-premises, cloud, and hybrid environments to ensure seamless access and integration. The report covers segmentation by component, deployment type, type, application, enterprise size, industry, and region, offering insights into major trends, growth factors, and advancements in data connectivity and analytics.

Data fabric solutions enhance governance, interoperability, and real-time decision-making across enterprises. They are widely adopted in industries such as banking, healthcare, manufacturing, and retail, improving operational efficiency, data security, and agility in managing complex data ecosystems.

Data Fabric Market Overview

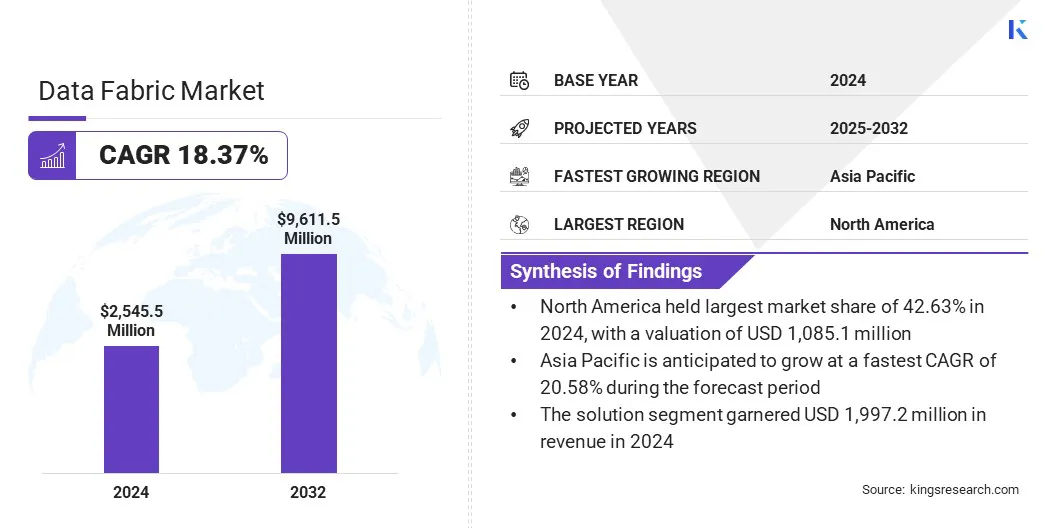

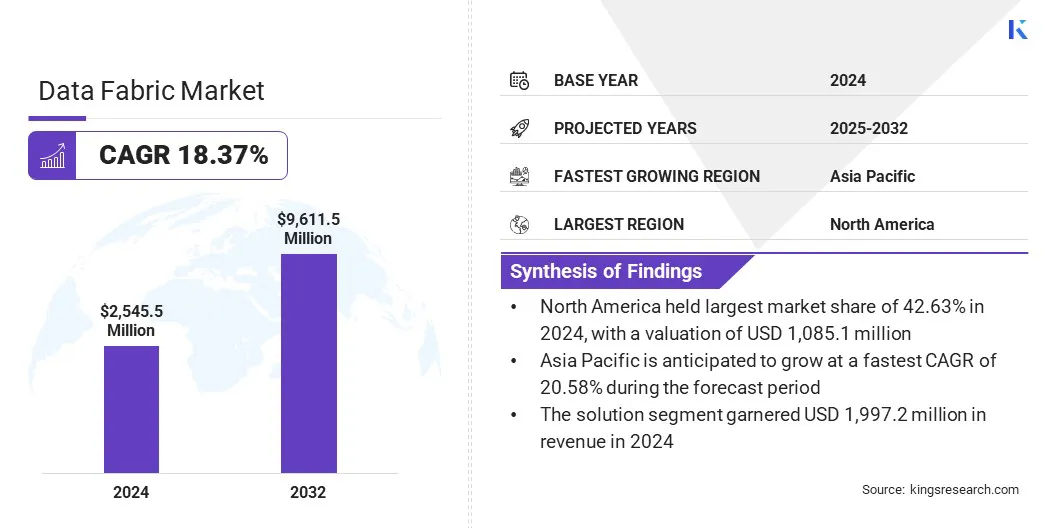

The global data fabric market size was valued at USD 2,545.5 million in 2024 and is projected to grow from USD 2,951.9 million in 2025 to USD 9,611.5 million by 2032, exhibiting a CAGR of 18.37% during the forecast period.

This growth is fueled by the rising demand for integrated data management solutions that enable seamless access, sharing, and governance across distributed environments. Increasing digital transformation initiatives and adoption of cloud and hybrid infrastructures are prompting enterprises to implement data fabric platforms for improved visibility and control.

Key Highlights

- The data fabric industry size was recorded at USD 2,545.5 million in 2024.

- The market is projected to grow at a CAGR of 18.37% from 2025 to 2032.

- North America held a share of 42.63% in 2024, valued at USD 1,085.1 million.

- The solution segment garnered USD 1,997.2 million in revenue in 2024.

- The cloud segment is expected to reach USD 4,933.7 million by 2032.

- The in-memory segment is anticipated to witness the fastest CAGR of 23.04% over the forecast period.

- The fraud detection and security management segment garnered USD 671.5 million in revenue in 2024.

- The large enterprise segment held a share of 69.82% in 2024.

- The BFSI segment is expected to reach USD 655.7 million in revenue in 2024.

- Asia Pacific is anticipated to grow at a CAGR of 20.58% over the forecast period.

Major companies operating in the data fabric market are IBM, Oracle, Informatica Inc., SAP SE, Microsoft, Talend, Inc., Hewlett Packard Enterprise Development LP, NetApp, Inc., Denodo Technologies, Teradata, Splunk LLC, Cloud Software Group, Inc., Dell Inc., Cinchy., and K2VIEW.

Expanding use of artificial intelligence and analytics tools to derive real-time insights from complex data ecosystems is positively influencing the market. Continuous advancements in automation, data virtualization, and security frameworks are enhancing the scalability and adoption of data fabric solutions worldwide.

- In October 2024, ServiceNow launched Workflow Data Fabric, a data layer integrated into the Now Platform and powered by RaptorDB Pro. The solution enables unified access to business and technology data, enhancing workflow automation and AI deployment. Additionally, the company partnered with Cognizant to facilitate enterprise adoption.

How is the growing need for unified data management influencing the adoption of data fabric solutions?

Rising demand for unified data management is significantly contributing to the growth of the data fabric market, as enterprises face challenges in handling large volumes of data distributed across diverse systems and environments. Fragmented data architectures hinder visibility, cause duplication, and delay decision-making.

Data fabric solutions address these challenges by providing a centralized and intelligent framework that integrates, governs, and delivers data consistently across on-premises and cloud platforms. The growing need for real-time, accurate, and accessible data across business functions is fueling widespread adoption of unified data management solutions globally.

- In May 2025, ServiceNow announced major updates to its Workflow Data Fabric, including the launch of the Workflow Data Network designed to enable AI agents and automate workflows using real-time data from diverse systems. The company also expanded its data ecosystem through new partnerships and announced plans to acquire data.world to enhance data cataloging and governance capabilities.

How do legacy systems impact the effective implementation of data fabric solutions?

Complex integration with legacy systems poses a significant barrier to the growth of the data fabric market. Many enterprises continue to rely on outdated infrastructure and siloed databases that are incompatible with modern data integration frameworks.

Connecting these legacy systems often requires extensive customization, middleware deployment, and complex data mapping, which increases implementation costs, timelines, and technical risk. The need to maintain uninterrupted business operations during integration further complicates deployment.

To overcome these issues, organizations are investing in system modernization, hybrid integration platforms, and skilled technical teams to ensure seamless connectivity, improved interoperability, and successful adoption of data fabric solutions.

How is the integration of artificial intelligence and machine learning capabilities enhancing the functionality of data fabric solutions?

The data fabric market is witnessing a growing shift toward the integration of artificial intelligence and machine learning capabilities within data management platforms. Rising demand for automation, real-time analytics, and intelligent data processing is prompting organizations to adopt AI-enabled data fabric solutions. These technologies streamline data discovery, integration, and governance while reducing manual intervention and improving operational accuracy.

Enterprises are increasingly leveraging intelligent automation to enhance data quality, accelerate insights, and optimize decision-making. Continuous advancements in AI-driven data orchestration and self-learning algorithms are expected to strengthen the scalability and efficiency of data fabric platforms in the coming years.

- In September 2025, Cisco Systems launched Cisco Data Fabric, a comprehensive data architecture designed to unify machine data across edge, cloud, and on-premise environments. The solution enables organizations to generate AI-ready intelligence, enhance data accessibility, and accelerate analytics-driven decisions. It supports scalable AI operations while simplifying infrastructure management and reducing overall operational costs.

Data Fabric Market Report Snapshot

|

Segmentation

|

Details

|

|

By Component

|

Solution, and Services

|

|

By Deployment Type

|

Cloud, and On-premise

|

|

By Type

|

Disk-based, and In-memory

|

|

By Application

|

Fraud Detection & Security Management, Governance, Risk & Compliance Management, Customer Experience Management, Sales & Marketing Management, Business Process Management, and Others

|

|

By Enterprise Size

|

Large Enterprise, and Small & Medium Enterprise (SME)

|

|

By Industry

|

BFSI, IT & Telecommunications, Retail & E-Commerce, Healthcare & Life Sciences, Manufacturing, Transportation & Logistics, and Media & Entertainment, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Component (Solution, and Services): The solution segment earned USD 1,997.2 million in 2024, primarily due to the growing adoption of unified data management platforms that enable seamless integration, governance, and real-time analytics across hybrid environments.

- By Deployment Type (Cloud and On-premise): The on-premise segment held a share of 55.28% in 2024, fueled by enterprises’ preference for enhanced control, security, and data customization.

- By Type (Disk-based and In-memory): The disk-based segment is projected to reach USD 6,334.8 million by 2032, owing to its cost-effectiveness, scalability, and suitability for managing large volumes of structured enterprise data.

- By Application (Fraud Detection & Security Management, Governance, Risk & Compliance Management, Customer Experience Management, Sales & Marketing Management, Business Process Management, and Others): The customer experience management segment anticipated to grow at a CAGR of 19.51% through the projection period, owing to increasing adoption of real-time analytics and personalized engagement tools to enhance customer experience and retention.

- By Enterprise Size (Large Enterprise, and Small & Medium Enterprise (SME)): The Large Enterprise segment garnered USD 1,777.3 million in 2024, mainly attributed to significant investments in advanced data integration and analytics solutions for managing complex, large-scale data environments.

- By Industry (BFSI, IT & Telecommunications, Retail & E-Commerce, Healthcare & Life Sciences, Manufacturing, Transportation & Logistics, and Media & Entertainment, and Others): The BFSI segment is projected to reach USD 2,303.5 million by 2032, propelled by the rising demand for secure, real-time data integration and analytics to support fraud detection, compliance, and customer intelligence.

What is the market scenario in North America and Asia Pacific for this market?

Based on region, the global data fabric market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

North America data fabric market share stood at 42.63% in 2024, valued at USD 1,085.1 million. This dominance is reinforced by early adoption of advanced data management technologies, strong presence of key industry players, and rapid digital transformation across major sectors such as banking, healthcare, and manufacturing. Supportive government initiatives promoting cloud adoption, cybersecurity, and data governance are further boosting regional market growth.

Rising demand for real-time analytics, automation, and hybrid cloud integration is accelerating the deployment of data fabric solutions across enterprises in North America. Organizations are increasingly investing in AI-driven data platforms to improve decision-making, ensure compliance, and optimize business operations.

In response, leading technology providers and system integrators are expanding product portfolios and partnerships to deliver scalable, secure, and intelligent data management frameworks.

- In March 2024, NTT DATA entered into a strategic partnership with Promethium to expand the deployment of data fabric solutions across North America. The collaboration enables NTT DATA to offer Promethium’s AI-driven data fabric technology, strengthening enterprise data integration, discovery, and governance capabilities.

Asia-Pacific data fabric industry is set to grow at a CAGR of 20.58% over the forecast period. This growth is propelled by digital transformation, expanding cloud adoption, and increasing implementation of data-driven strategies across enterprises. Rising demand for real-time analytics, automation, and intelligent data integration is prompting organizations to adopt advanced data fabric solutions.

Additionally, government-led initiatives promoting smart infrastructure, cybersecurity, and digital innovation are supporting regional market expansion. Continuous focus on artificial intelligence, Internet of Things (IoT), and 5G technologies is further accelerating data connectivity, scalability, and analytics capabilities, aiding regional market expansion.

Regulatory Frameworks

- In the European Union, the General Data Protection Regulation (GDPR) regulates the collection, processing, and storage of personal data. It ensures that organizations using data fabric platforms implement strong privacy, consent, and data governance controls, influencing the management and distribution of data across multiple environments.

- In the U.S., the California Consumer Privacy Act (CCPA) governs the use, sharing, and protection of consumer information. It requires companies deploying data fabric solutions to maintain transparent data practices, enable user control, and ensure compliance with privacy and security standards across digital ecosystems.

- In Singapore, the Personal Data Protection Act (PDPA) monitors the responsible collection, use, and disclosure of personal data. It guides organizations implementing data fabric systems to maintain accountability, user consent, and secure data flows in connected enterprise environments.

- In India, the Digital Personal Data Protection Act (DPDPA) oversees the processing and management of digital personal data. It emphasizes lawful data handling, user consent, and privacy protection.

- In China, the Personal Information Protection Law (PIPL) regulates the collection, storage, and cross-border transfer of personal information. It mandates that enterprises using data fabric solutions ensure data localization, transparency, and security, directly influencing the implementation of integrated data management frameworks.

Competitive Landscape

Companies operating in the data fabric industry are strengthening their competitive position through investments in AI–driven automation, cloud integration capabilities, and strategic partnerships or acquisitions. They are focusing on developing unified platforms that enhance data connectivity, governance, and real-time analytics across hybrid and multi-cloud environments.

- In September 2024, ARPA-H launched the Biomedical Data Fabric (BDF) Toolbox initiative to develop a unified data system integrating biomedical research data across domains. The program aims to eliminate data silos, improve real-time data accessibility, and accelerate medical research and innovation to improve patient outcomes.

Market players are expanding their product portfolios with advanced metadata management, data virtualization, and security capabilities to address evolving enterprise requirements. Additionally, they are enhancing scalability, interoperability, and customer reach through collaborations with cloud service providers, system integrators, and analytics technology firms to deliver more intelligent and agile data management solutions.

- In October 2025, CafeX Communications launched the CaféX Data Fabric for AI, a secure and real-time data framework that enables AI agents to access enterprise systems with governance and control. The solution integrates metadata engine and data gateway technologies to support compliant, auditable, and scalable data interactions across business environments.

Key Companies in Data Fabric Market:

- IBM

- Oracle

- Informatica Inc.

- SAP SE

- Microsoft

- Talend, Inc.

- Hewlett Packard Enterprise Development LP

- NetApp, Inc.

- Denodo Technologies

- Teradata

- Splunk LLC

- Cloud Software Group, Inc.

- Dell Inc.

- Cinchy.

- K2VIEW

Recent Developments

- In March 2025, Hewlett Packard Enterprise introduced an intelligent unified data layer for AI to help organizations connect structured, unstructured, and streaming data across hybrid and multi-vendor environments. Developed in collaboration with NVIDIA, the solution enhances AI workflow performance and scalability through the HPE Data Fabric platform.

- In March 2025, Reltio announced its integration with Microsoft Fabric to enable real-time, zero-copy data sharing for AI and analytics applications. The partnership allows enterprises to access and analyze data directly without duplication, improving operational efficiency, data governance, and scalability. This integration strengthens unified data management and supports faster, insight-driven decision-making across cloud environments.

- In December 2023, CloudFabrix launched its Data Fabric for Observability solution at Cisco Live 2023 in Melbourne. The platform is designed to streamline data ingestion, automation, and analysis across hybrid cloud environments. Integrated with the Cisco Observability Platform, it enhances telemetry processing speed and improves the delivery of actionable operational insights.