Market Definition

The business process management (BPM) market encompasses software, tools, and services designed to streamline and optimize organizational processes. This includes process automation, monitoring, and improvement to enhance efficiency, reduce costs, and align with strategic goals. The growth of the market is driven by the demand for increased operational agility and productivity.

Business Process Management Market Overview

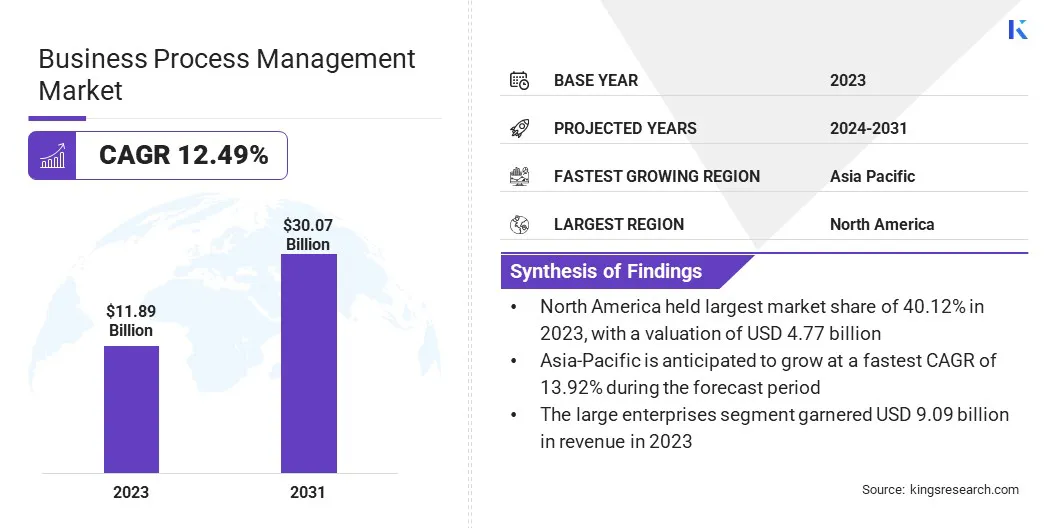

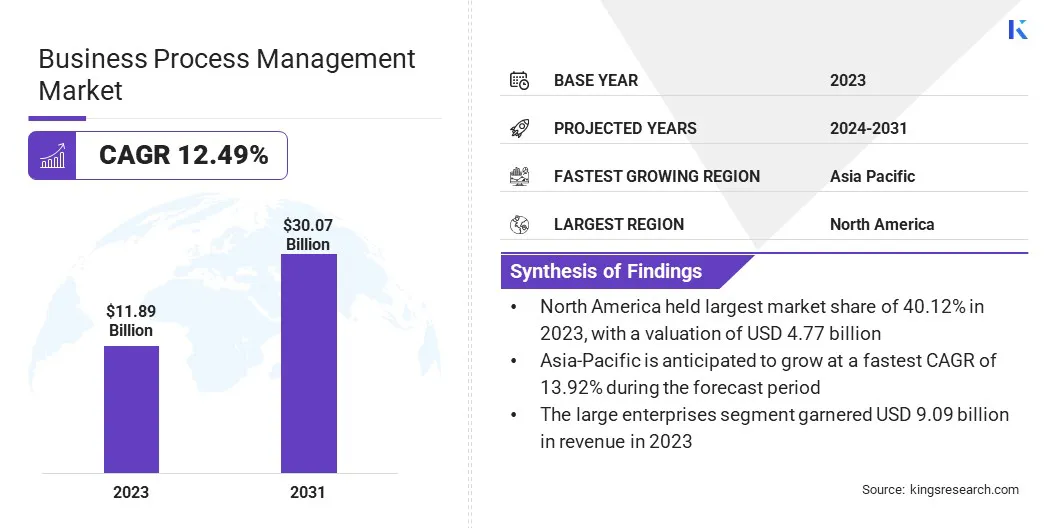

Global business process management market size was USD 11.89 billion in 2023, which is estimated to be valued at USD 13.19 billion in 2024 and reach USD 30.07 billion by 2031, growing at a CAGR of 12.49% from 2024 to 2031.

The increasing demand for operational efficiency is prompting businesses to streamline workflows, reduce redundancies, and lower costs. This has led to a growing need for BPM solutions that can automate processes and enhance overall productivity.

Major companies operating in the business process management industry are Pegasystems Inc., Appian, IBM Corporation, Oracle, Software GmbH, Nintex, Open Text Corporation, Newgen Software Technologies Limited, Cloud Software Group, Inc, Bizagi, ProcessMaker, Creatio, AgilePoint Inc, Ricoh USA Inc, Infosys Limited, and others.

The business process management (BPM) market is characterized by a strong focus on enhancing organizational efficiency through the optimization of workflows and processes. It aims to integrate business functions, foster agility, and enable continuous improvement.

BPM solutions align strategies with operations, streamlining communication and decision-making. This results in improved resource utilization, faster response times, and overall operational excellence, which are crucial for businesses aiming to remain competitive in a dynamic market environment.

- In November 2024, Kaiser Group, adopted digital transformation with SAP Signavio to standardize processes, improve transparency, and drive operational efficiency. The initiative aims to fostered collaboration, aligning departments across subsidiaries and enhancing performance with data-driven insights.

Key Highlights:

- The business process management industry size was recorded at USD 11.89 billion in 2023.

- The market is projected to grow at a CAGR of 12.49% from 2024 to 2031.

- North America held a share of 40.12% in 2023, valued at USD 4.77 billion.

- The BFSI (Banking, Financial Services, and Insurance) segment garnered USD 3.05 billion in revenue in 2023.

- The finance & accounting segment is expected to reach USD 7.86 billion by 2031.

- The cloud-based BPM segment captured a substantial share of 50.12% in 2023.

- The services segment is anticipated to grow at a CAGR of 13.50% through the forecast period.

- The large enterprises segment is anticipated to register a notable share of 71.29% in 2031.

- Asia Pacific is anticipated to grow at a CAGR of 13.92% over the projection period.

Market Driver

"Rise of Automation Technologies"

The rise of automation technologies, such as AI, is significantly driving the growth of the business process management market. Automating routine, repetitive tasks enable companies to streamline operations, reduce manual errors, and allocate resources to strategic activities.

BPM tools are increasingly being adopted to integrate RPA into business processes, creating more efficient workflows. This shift toward automation enhances productivity, accelerates decision-making, and fosters better alignment of business processes with organizational goals, boosting the demand for BPM solutions.

- In May 2024, Camunda enhanced its process orchestration platform with AI capabilities, allowing businesses to seamlessly integrate AI into automation. This enhancement strengthens the BPM market by enabling organizations to streamline operations, boost productivity, and quickly adapt quickly to market changes, driving greater efficiency and value.

Market Challenge

"Integration Complexity with Legacy Systems"

A key challenge impeding the growth of the business process management market is the complexity of integrating BPM solutions with legacy systems. Many organizations rely on outdated infrastructure, making it difficult to seamlessly implement modern BPM tools. This can lead to delays, increased costs, and inefficiencies.

This challenge can be addressed through the adoption of middleware or API-based integration tools, which facilitate smoother connections between legacy systems and modern BPM solutions, ensuring a more efficient and cost-effective transition with minimal disruptions to business operations.

- In January 2025, o9 successfully deployed its Integrated Business Planning (IBP) and Supply Planning (SP) solutions at Li Auto, overcoming integration challenges with legacy systems. This achievement highlights the importance of seamless system integration for enhancing operational efficiency and aligning departmental strategies, supporting the BPM market's focus on more cohesive, automated workflows.

Market Trend

"Growing Adoption of Process Mining Tools"

A significant trend influencing the business process management market is the growing adoption of process mining tools. These tools enable organizations to gain deeper insights into their operations by analyzing existing workflows and identifying inefficiencies or bottlenecks.

With process mining, companies can visualize actual process flows, detect areas for improvement, and optimize their operations more effectively. This trend is empowering businesses to shift from reactive to proactive process management, leading to improved decision-making, increased process efficiency, and enhanced overall business performance.

- In November 2023, Celonis acquired Symbio, enhancing its process mining capabilities with AI-driven BPM software. This acquisition highlights the trend of leveraging process mining to provide real-time insights, streamline operations, and optimize processes, empowering organizations with data-driven decision-making and continuous improvement.

Business Process Management Market Report Snapshot

| Segmentation |

Details |

| By Industry Vertical |

BFSI, Healthcare & Life Sciences, Retail & E-commerce, IT & Telecom, Manufacturing, Government & Public Sector, Others |

| By Business Function |

Human Resource Management, Finance & Accounting, Sales & Marketing, Supply Chain Management, IT Operations & Governance |

| By Deployment Mode |

On-Premises BPM, Cloud-Based BPM, Hybrid BPM Solutions |

| By Component |

Software, Services |

| By Enterprise Size |

Large Enterprises, Small & Medium Enterprises (SMEs) |

| By Region |

North America: U.S., Canada, Mexico |

| Europe: France, U.K., Spain, Germany, Italy, Russia, Rest of Europe |

| Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific |

| Middle East & Africa: Turkey, UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa |

| South America: Brazil, Argentina, Rest of South America |

Market Segmentation:

- By Industry Vertical (BFSI, Healthcare & Life Sciences, Retail & E-commerce, IT & Telecom, Manufacturing, Government & Public Sector, and Others): The BFSI segment earned USD 3.05 billion in 2023 due to increasing demand for process automation, regulatory compliance, and risk management solutions within financial institutions.

- By Business Function (Human Resource Management, Finance & Accounting, Sales & Marketing, Supply Chain Management, and IT Operations & Governance): The finance & accounting segment held a share of 28.80% in 2023, mainly fueled by the growing demand for automation in invoicing, expense management, and financial reporting processes.

- By Deployment Mode (On-Premises BPM, Cloud-Based BPM, and Hybrid BPM Solutions): The cloud-based BPM segment is projected to reach USD 15.92 billion by 2031, lagely attributed to increased adoption of flexible, scalable solutions and the growing need for remote accessibility across organizations.

- By Component (Software and Services): The software segment is anticipated to secure a major share of 59.03% in 2031, propelled by the increasing demand for BPM tools that streamline operations, automate workflows, and improve overall efficiency.

- By Enterprise Size (Large Enterprises, Small & Medium Enterprises (SMEs)): The SME segment is anticipated to grow at a CAGR of 15.47% thorugh the forecast period, as a result of growing accessibility to affordable BPM tools and the need for agile, cost-effective business operations.

Business Process Management Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

North America business process management market captured a substantial share of around 40.12% in 2023, valued at USD 4.77 billion. This dominance is reinforced by the region's well-established IT infrastructure, rapid adoption of advanced technologies, and a strong presence of key market players.

The regional market benefits from advanced digital transformation across industries such as BFSI, healthcare, and manufacturing, creating a robust demand for BPM solutions.

Additionally, North American businesses prioritize process optimization, compliance, and cost reduction, which further fuels the adoption of BPM. The presence of leading technology providers and continuous innovation solidifies the region’s leading position.

- In January 2025, OPEXUS, a leading provider of government process management solutions in the U.S. and Canada, merged with Casepoint, a specialist in data discovery. This partnership, supported by investment from Thoma Bravo, aims to enhance digital solutions for government agencies, strenghthening compliance, efficiency, and security in public sector operations.

Asia Pacific business process management industry is set to grow at a robust CAGR of 13.92% over the forecast period. This growth is propelled by rapid digital transformation across industries and increasing investments in automation technologies.

Businesses in countries such as India, China, and Japan are adopting BPM solutions to streamline operations, reduce costs, and improve customer experiences. The region’s growing focus on AI, cloud computing, and data analytics further boosts the use of BPM, making it a crucial hub for innovation and business process optimization across sectors.

- In April 2024, Fujifilm Business Innovation launched IT Expert Services to support SMEs in Asia Pacific, addressing the rising demand for efficient IT solutions. This initiative reflects the region's growing need for BPM as businesses strive to optimize processes and enhance productivity.

Regulatory Framework

- The General Data Protection Regulation (GDPR) outlines strict requirements for companies and organizations regarding the collection, storage, and management of personal data. It applies to both European organizations processing EU residents' data and non-EU organizations targeting individuals within the EU.

- The Digital Markets Act establishes a set of clearly defined objective criteria to designate large online platforma as a “gatekeeper” and ensures ensures fair market behavior, fostering competition. It is akey component of the European digital strategy.

- The Personal Data Protection Act (PDPA) sets the standard for personal data protection in Singapore, governing its collection, use, disclosure and security.

- In the UAE, the Personal Data Protection Law provides a comprehensive framework to ensure the data confidentiality and individual privacy, defining governance structures and the rights and responsibilities of all stakeholders.

Competitive Landscape

The business process management market is characterized by a large number of participants, including both established corporations andemerging players. Key market participants are forming strategic partnerships to enhance their offerings.

These collaborations focus on integrating advanced technologies such as AI, process automation, and analytics, enabling better process optimization and creating innovative solutions. Partnerships help expand market reach, improve product features, and drive digital transformation.

- In October 2024, Camunda partnered with Rabobank to optimize customer experience and internal operations by integrating advanced workflow capabilities. This collaboration focuses on enhancing compliance, improving process orchestration, and fostering seamless collaboration between business and IT teams for digital transformation.

List of Key Companies in Business Process Management Market:

- Pegasystems Inc.

- Appian

- IBM Corporation

- Oracle

- Software GmbH

- Nintex

- Open Text Corporation

- Newgen Software Technologies Limited

- Cloud Software Group, Inc

- Bizagi

- ProcessMaker

- Creatio

- AgilePoint Inc

- Ricoh USA Inc

- Infosys Limited

Recent Developments (Expansion/Acquisition/Launch/Partnership)

- In June 2024, Infosys BPM inaugurated its second facility at Montana Industrial Park in Aguadilla, Puerto Rico, with a USD 200,000 investment. The expansion will create 325 new jobs, boosting local employment and enabling the company to serve clients in aerospace, healthcare, insurance, financial services, and telecommunications.

- In November 2024, Red Hat announced the general availability of Red Hat Enterprise Linux 9.5, enhancing security, automation, and hybrid cloud operations. The update offers new system roles, confidential computing support, and Podman 5.0 for container-native innovation, helping organizations efficiently manage workloads and accelerate IT innovation across industries.

- In September 2024, SAP SE acquired WalkMe Ltd., a leading digital adoption platform, for approximately USD 1.5 billion. The acquisition integrates WalkMeX's technology with SAP’s AI-driven copilot Joule, boosting user productivity and business transformation.

- In May 2023, Pegasystems launched Pega Process Mining, a tool designed to help businesses identify and fix process inefficiencies. Integrated with Pega Platform, it offers AI-driven insights and easy-to-use features, enabling all users to optimize workflows, reduce bottlenecks, and improve customer and employee experiences continuously.

- In May 2023, IBM unveiled IBM Hybrid Cloud Mesh at ONUG, a SaaS offering for hybrid multicloud infrastructure management. It automates application connectivity while providing visibility, control, and security across cloud environments. Integration witjh NS1 integration further optimizes performance, cost, and availability, supporting enterprise digital transformation.

- In August 2023, OpenText expanded its partnership with Google Cloud to deliver AI-powered integrations, enhancing data utilization for businesses. New capabilities include generative AI applications, OpenText Core for Google Workspace, and solutions for cloud migration. This collaboration aims to accelerate business transformation, improve productivity, and streamline enterprise processes.