Market Definition

The market encompasses technologies that automate retail operations using digital tools, machines, and software. It includes solutions that streamline processes, reduce manual labor, enhance customer experience, and improve efficiency.

The report provides a comprehensive analysis of key drivers, emerging trends, and the competitive landscape expected to influence the market over the forecast period.

Retail Automation Market Overview

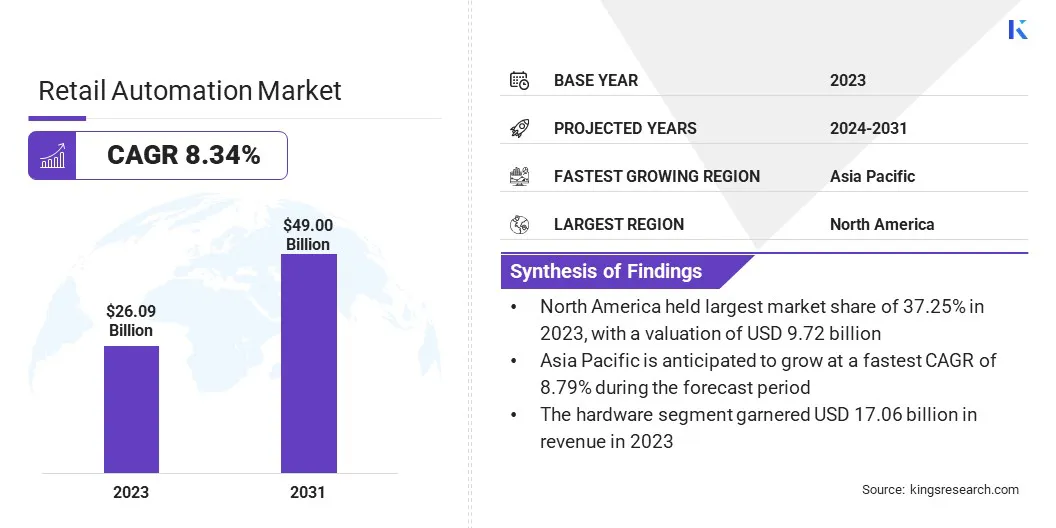

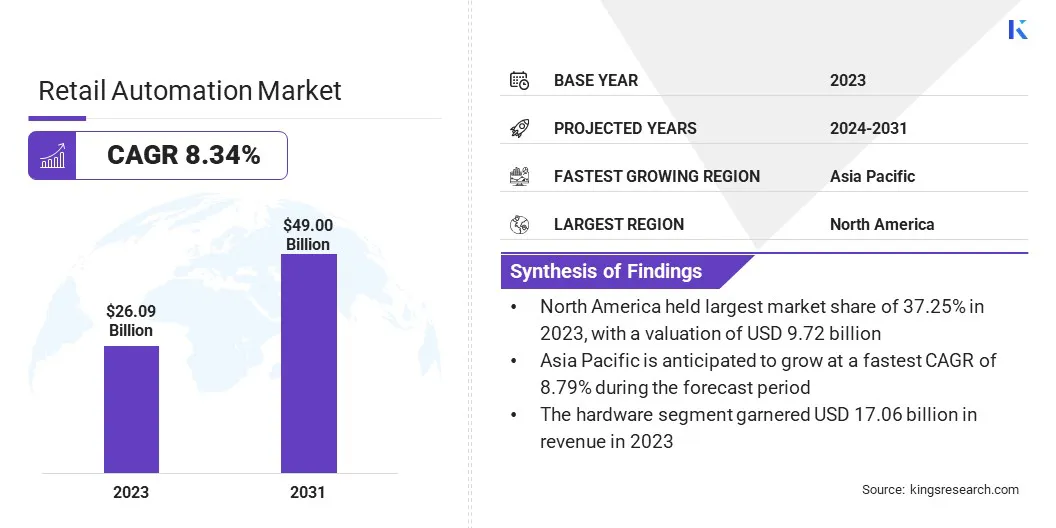

Global retail automation Market size was USD 26.09 billion in 2023, which is estimated to be valued at USD 27.98 billion in 2024 and reach USD 49.00 billion by 2031, growing at a CAGR of 8.34% from 2024 to 2031.

Automation drives retail growth by enhancing personalization, speeding service, and improving product availability, resulting in a seamless, efficient shopping experience that boosts customer satisfaction and loyalty.

Major companies operating in the retail automation industry are Honeywell International Inc, Zebra Technologies Corp., NCR Voyix Corporation, Hangzhou Hikvision Digital Technology Co., Ltd., Ocado Group plc., Amazon Web Services, Inc., Datalogic S.p.A., Diebold Nixdorf, Incorporated, ECR Software Corporation. , KUKA AG, Pricer, TOSHIBA CORPORATION, IBM, UiPath, Inc., Jabil Inc., and others.

The market is experiencing strong demand as retailers increasingly adopt intelligent technologies to enhance efficiency, security, and customer service. Rising labor costs, demand for real-time data, and the need for streamlined operations are boosting market expansion.

Automation solutions help reduce manual tasks, improve inventory accuracy, and accelerate service delivery. Advancements in AI, IoT, and machine learning are making retail environments more responsive and data-driven, enabling smarter and more agile store operations globally.

- In March 2025, x‑hoppers expanded its AI-powered smart retail communication suite, enhancing theft detection, team productivity, and task automation. These innovations, showcased at ExCeL London, promise faster service, reduced shrinkage, and real-time, hands-free coordination across store operations.

Key Highlights:

- The retail automation market size was recorded at USD 26.09 billion in 2023.

- The market is projected to grow at a CAGR of 8.34% from 2024 to 2031.

- North America held a market share of 37.25% in 2023, with a valuation of USD 9.72 billion.

- The point of sale (POS) segment garnered USD 8.11 billion in revenue in 2023.

- The hardware segment is expected to reach USD 29.57 billion by 2031.

- The convenience stores segment is anticipated to witness the fastest CAGR of 11.81% over the forecast period

- Asia Pacific is anticipated to grow at a CAGR of 8.79% through the proejction period.

Market Driver

Enhanced Operational Efficiency by Retail Automation

Enhanced operational efficiency is a significant growth driver for the market. Automation technologies streamline key processes such as inventory management, product recommendations, and checkout systems, reducing manual labor and operational costs.

By improving the speed and accuracy of tasks, retailers can quickly respond to consumer demand, optimize stock levels, and ensure a seamless shopping experience. These efficiencies contribute to faster market adaptation, improved resource utilization, and a more agile retail environment, driving growth and competitiveness in the market.

- In September 2024, Perfect Corp. launched its AI Skincare Product Recommendation tool, streamlining product setup for skincare retailers and brands. The tool automates concern-matching using product data, reducing configuration time and enabling faster market launches, while improving accuracy and operational efficiency across skincare catalogues.

Market Challenge

Job Displacement Concerns

Job displacement concerns present a significant challenge to the expansion of the retail automation market, as employees fear losing their roles to machines. This often leads to resistance and low morale within teams.

To address this challnege, retailers should focus on reskilling and upskilling staff, positioning automation as a tool to handle repetitive tasks while empowering employees for higher-value, customer-facing roles. Clear communication, training programs, and role redefinition can ease the transition and foster a positive work culture.

- In May 2023, ABB launched a robotics education package to address the automation skills gap. The package includes a GoFa cobot, 56 hours of training, and global STEM certification, providng students with industry-relevant robotic education and programming tools for the future workforce.

Market Trend

Rise of Agentic AI

The rise of agentic AI marks a significant trend in the market, where intelligent systems are evolving beyond task automation to autonomous decision-making. These AI agents can perceive their environment, analyze real-time data, and take proactive actions to achieve specific goals without human intervention.

This shift empowers retailers to deliver more responsive, efficient, and personalized customer experiences. It also reduces operational burdens, enabling businesses to handle complex workflows with greater agility, accuracy, and scalability across digital and physical retail environments.

- In January 2025, Talkdesk launched AI Agents for Retail, delivering agentic AI to autonomously manage complex retail processes. These intelligent agents enable hyper-personalized, continuous customer service, reducing human intervention while enhancing efficiency, decision-making, and engagement across both digital and in-store retail experiences.

Retail Automation Market Report Snapshot

|

Segmentation

|

Details

|

|

By Product Type

|

Point of Sale (POS) Barcode & RFID Systems, Self-Checkout Systems, Vending Machines, Electronic Shelf Labels, Others

|

|

By Component

|

Hardware, Software

|

|

By End-Use

|

Supermarkets/Hypermarkets, Convenience Stores, Specialty Stores, E-Commerce & Warehousing, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Product Type [Point of Sale (POS), Barcode & RFID Systems, Self-Checkout Systems, Vending Machines, Electronic Shelf Labels, and Others]: The point of sale (POS) segment earned USD 8.11 billion in 2023, propelled by increasing demand for seamless transactions, inventory accuracy, and faster checkouts in automated retail environments.

- By Component (Hardware and Software): The hardware segment held a share of 65.40% in 2023, fueled by rising adoption of automation devices such as scanners, kiosks, and robotics, enhancing operational efficiency and reducing manual intervention.

- By End-Use (Supermarkets/Hypermarkets, Convenience Stores, Specialty Stores, E-Commerce & Warehousing, and Others): The supermarkets/hypermarkets segment is projected to reach USD 14.32 billion by 2031, as large-scale retailers increasingly invest in automation to improve stock management, customer experience, and workforce productivity.

Retail Automation Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

North America retail automation market share stood at around 37.25% in 2023, valued at USD 9.72 billion. This leadership is reinforced by advanced technological infrastructure, high adoption of automation solutions, and a competitive retail landscape.

The region’s focus on innovation, coupled with significant investments from major retailers and tech companies, has spurred the growth of automation technologies such as AI, robotics, and self-checkout systems. Additionally, a strong demand for enhanced customer experiences and operational efficiency continues to fuel regional market growth.

Asia Pacific retail automation industry is estimated to grow at a CAGR of 8.79% over the forecast period. This growth is bolstered by rapid digital transformation, increasing adoption of AI technologies, and a growing focus on enhancing customer experiences.

The region's strong e-commerce growth, coupled with rising demand for automation to optimize retail operations, is further stimulating this expansion. Additionally, the region's large consumer base and technological advancements make it a key market for retailers looking to implement innovative solutions that improve efficiency and drive revenue.

- In August 2023, Fujitsu deployed an AI customer service solution for field trials at a Japanese supermarket chain. The solution generates AI avatars and tailored promotional content based on in-store consumer behavior, addressing labor shortages and enhancing customer experience with dynamic, personalized interactions.

Regulatory Frameworks

- In the U.S., the NIST Cybersecurity Framework helps businesses of all sizes better understand, manage, and reduce their cybersecurity risk and protect their networks and data

- With the General Data Protection Regulation (GDPR) Europe is signaling its firm stance on data privacy and security at a time when more people are entrusting their personal data with cloud services and breaches are a daily occurrence.

- The EU Cybersecurity Act introduces an EU-wide cybersecurity certification framework for ICT products, services and processes. Companies doing business in the EU will benefit from having to certify their ICT products, processes and services only once and see their certificates recognised across the European Union.

Competitive Landscape

Companies in the retail automation market are prioritizing operational efficiency by integrating advanced technologies such as AI, IoT, and 5G connectivity. These innovations streamline procurement processes, improve customer experiences through personalized interactions, and optimize supply chains.

Additionally, several companies are are adopting solutions for real-time data analysis, seamless platform integration, and scalable systems, allowing businesses to reduce costs, increase productivity, and future-proof operations amid evolving market demands.

- In January 2025, Honeywell and Verizon launched a transformative solution to streamline the retail lifecycle. The collaboration combines Honeywell's hardware, software, and services with Verizon's 5G connectivity, simplifying procurement, reducing costs, and improving operational resilience. This bundled solution enables retailers to enhance connectivity, scalability, and efficiency, allowing them to focus on business outcomes while minimizing disruptions.

List of Key Companies in Retail Automation Market:

- Honeywell International Inc

- Zebra Technologies Corp.

- NCR Voyix Corporation

- Hangzhou Hikvision Digital Technology Co., Ltd.

- Ocado Group plc.

- Amazon Web Services, Inc.

- Datalogic S.p.A.

- Diebold Nixdorf, Incorporated

- ECR Software Corporation.

- KUKA AG

- Pricer

- TOSHIBA CORPORATION

- IBM

- UiPath, Inc.

- Jabil Inc.

Recent Developments (Partnerships/Product Launch)

- In February 2025, NCR Voyix partnered with Worldpay to integrate advanced payment processing solutions into its digital commerce platform. This collaboration combines NCR Voyix's cloud-based software with Worldpay’s global payment processing capabilities, offering retailers and restaurants an efficient, seamless, and omnichannel payment solution designed to streamline transactions and improve customer experiences across all touchpoints.

- In February 2025, EDITED partnered with Fynd, India’s leading omnichannel retail technology company, to enhance its retail intelligence offerings. By leveraging EDITED's real-time market insights, Fynd aims to refine its design strategy and accelerate time to market. This collaboration will equip Fynd with actionable data to better understand market trends and consumer preferences, thereby boosting competitiveness and customer engagement.

- In January 2025, Zebra Technologies introduced new AI solutions aimed at enhancing retail frontline operations. Unveiled at the National Retail Federation (NRF) 2025, the Mobile Computing AI Suite and Zebra Companion are designed to improve productivity and customer experiences. These tools integrate AI-powered features for task management, troubleshooting, merchandising, and sales, providing retail workers with real-time support.