Market Definition

The market encompasses a range of oils, greases, and fluids specifically formulated to meet the performance, safety, and environmental requirements of aircraft engines and components.

These lubricants are essential for reducing friction, preventing wear and corrosion, ensuring thermal stability, and enhancing the overall efficiency and reliability of commercial and military aircraft. The market includes products used in engines, hydraulic systems, landing gear, and auxiliary power units.

The report outlines the primary drivers of market growth, along with an in-depth analysis of emerging trends and evolving regulatory frameworks shaping the industry in the forecast period.

Aviation Lubricants Market Overview

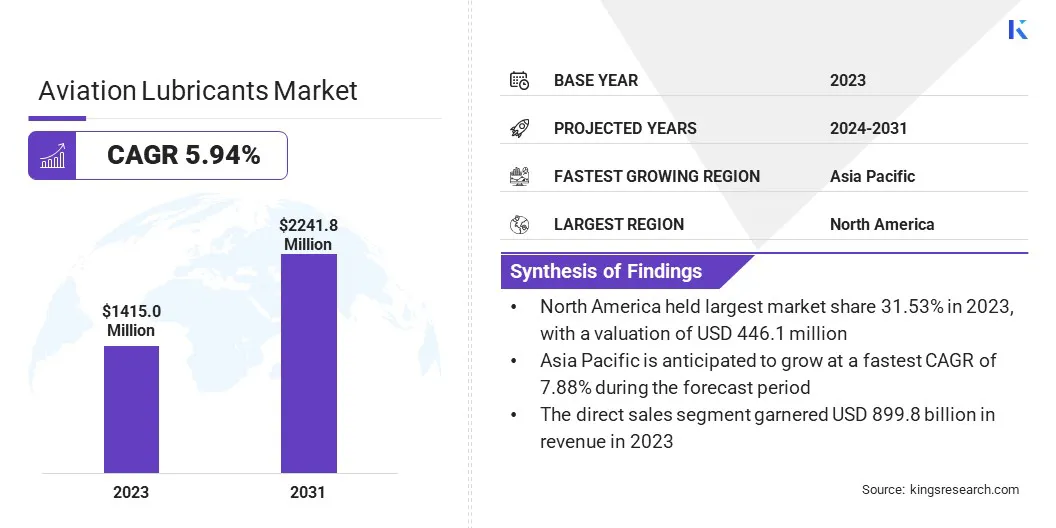

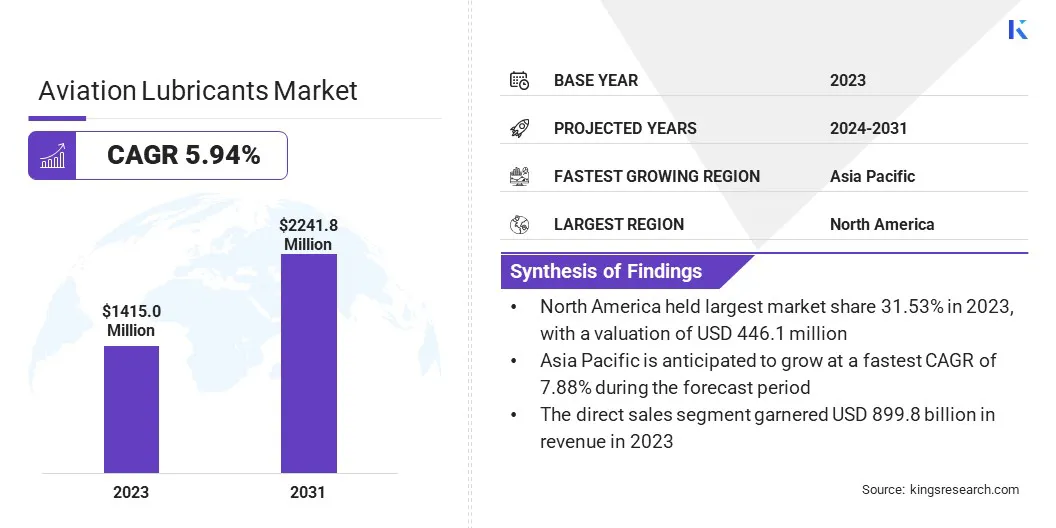

The global aviation lubricants market size was valued at USD 1415.0 million in 2023 and is projected to grow from USD 1497.0 million in 2024 to USD 2241.8 million by 2031, exhibiting a CAGR of 5.94% during the forecast period.

The rising frequency of flights and continued fleet additions are elevating the demand for high-performance lubricants to ensure optimal engine and component performance. Additionally, advancements in lubricant formulations are improving durability, efficiency, and resistance to extreme conditions, further supporting their adoption across both commercial and defense aviation sectors.

Key Market Highlights

- The aviation lubricants industry size was recorded at USD 1415.0 million in 2023.

- The market is projected to grow at a CAGR of 5.94% from 2024 to 2031.

- North America held a market share of 31.53% in 2023, with a valuation of USD 446.1 million.

- The engine oils segment garnered USD 796.4 million in revenue in 2023.

- The mineral-based lubricants segment is expected to reach USD 1350.4 million by 2031.

- The unmanned aerial vehicles segment is anticipated to witness a CAGR of 10.59% during the forecast period.

- The engine segment is forecasted to have a market share of 55.44% in 2031.

- The airlines segment held a market share of 52.44% in 2023

- The direct sales segment is expected to reach USD 1367.5 million by 2031

- Asia Pacific is anticipated to grow at a CAGR of 7.88% during the forecast period.

Major companies operating in the aviation lubricants market are Aerospace Lubricants Inc., IKV Tribology Ltd, Nye Lubricants Inc., Santie Oil Company, Idemitsu Kosan Co., FUCHS, Castrol Limited, Eastman Chemical Company, Shell, Exxon Mobil Corporation, The Chemours Company, Phillips 66 Company, NYCO, LUKOIL, and TotalEnergies.

The market is experiencing growth driven by the rise in global air passenger traffic, which is boosting demand for commercial aircraft and maintenance services. Increased flight frequencies and fleet expansion require more frequent maintenance, thereby elevating the need for high-quality lubricants.

Airlines are focusing on maximizing fleet performance and minimizing downtime, creating a higher reliance on advanced lubricants to ensure engine efficiency, durability, and reliability across growing fleets and increased maintenance schedules.

- According to a report published by the International Air Transport Association (IATA) in January 2025, total global traffic measured in revenue passenger kilometers (RPKs) increased by 10.4% and international traffic rose by 13.6%. This surge in air travel, alongside a record-high load factor of 83.5%, is driving greater aircraft utilization and increased demand for high-performance lubricants that ensure engine efficiency and reliability, supporting frequent maintenance cycles.

Expansion of military aviation

The market is driven by the continued expansion of global military aviation fleets, which is generating sustained demand for high-performance lubricants.

As defense forces modernize and scale their aircraft operations, there is a growing need for advanced lubrication solutions that ensure engine durability, thermal stability, and operational efficiency under extreme conditions. This is driving innovation in synthetic lubricants tailored for high-stress military aviation environments and extended operational readiness.

- In July 2024, Boeing announced that its range of defense aircraft is approved to operate on up to a 50% blend of Sustainable Aviation Fuel (SAF) with conventional jet fuel. This advancement supports broader SAF adoption across military fleets and is expected to drive increased demand in the aviation lubricants market. As a result, there is a growing need for lubricant formulations compatible with synthetic turbine fuels ensuring optimal performance, seal integrity, and engine protection under evolving operational and environmental conditions.

Environmental Compliance

Environmental compliance is emerging as a key challenge in the market due to increasingly strict regulations limiting the use of certain chemical compounds with high environmental impact.

These regulatory constraints are compelling manufacturers to reformulate lubricants while maintaining high performance and reliability. To address this, companies are investing in research and development of eco-friendly alternatives, including bio-based and low-toxicity lubricants.

As sustainability becomes a priority, the demand for environmentally friendly products is rising, prompting manufacturers to innovate and meet both regulatory standards and consumer expectations. Additionally, compliance with international environmental standards is becoming critical for market competitiveness

Technological Advancements

The market is experiencing a significant transformation driven by ongoing technological advancements. New developments in lubricant formulations are delivering enhanced thermal stability, longer oil drain intervals, and stronger resistance to wear and corrosion.

Advanced synthetic lubricants are also being tailored to meet the demanding requirements of next-generation engines and high-performance aircraft systems. These innovations contribute to reduced maintenance costs and align with the aviation industry's growing focus on operational efficiency and sustainability.

- In July 2023, Shell became one of the first aviation lubricant suppliers to implement a lifecycle sustainability strategy across its AeroShell portfolio. This approach focuses on avoiding, reducing, and offsetting carbon emissions throughout the product lifecycle. It supports enhanced aircraft performance while enabling customers to align with their net-zero carbon or greenhouse gas (GHG) emissions goals.

Aviation Lubricants Market Report Snapshot

|

Segmentation

|

Details

|

|

By Product Type

|

Engine Oils, Hydraulic Fluids, Greases, Specialty Lubricants

|

|

By Technology

|

Mineral-based Lubricants, Synthetic Lubricants, Semi-synthetic Lubricants, Bio-based Lubricants

|

|

By Aircraft Type

|

Commercial Aviation, Military Aviation, Business and General Aviation, Helicopters, Unmanned Aerial Vehicles (UAVs)

|

|

By Application

|

Engine, Hydraulic Systems, Landing Gear, Airframe, Turbine Components, Avionics Cooling Systems

|

|

By End-User

|

OEMs, MRO, Airlines, Military Organizations, Private Aircraft Operators

|

|

By Distribution Channel

|

Direct Sales, Distributors and Dealers, Online Sales

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Product Type (Engine Oils, Hydraulic Fluids, Greases, Specialty Lubricants): The engine oils segment earned USD 796.4 million in 2023 due to the rising demand for high-performance lubricants that ensure engine efficiency, durability, and reliability in commercial and military aviation applications.

- By Technology (Mineral-based Lubricants, Synthetic Lubricants, Semi-synthetic Lubricants, and Bio-based Lubricants): The mineral-based lubricants held 62.45% of the market in 2023, due to their cost-effectiveness, widespread availability, and suitability for a broad range of aircraft applications, making them a preferred choice for many commercial and military aviation operations.

- By Aircraft Type (Commercial Aviation, Military Aviation, Business and General Aviation, and Helicopters): The commercial aviation segment is projected to reach USD 1389.1 million by 2031, owing to the continued growth in global air travel, increased fleet sizes, and the rising demand for efficient maintenance solutions to ensure optimal aircraft performance and reduced operational downtime.

- By Application (Engine, Hydraulic Systems, Landing Gear, Airframe, Turbine Components, Avionics Cooling Systems): The engine segment held 55.44% market in 2031, due to the critical role engine lubrication plays in enhancing performance, reducing wear, and ensuring the longevity and efficiency of aircraft engines in both commercial and military aviation sectors.

- By End-User (OEMs, MRO, Airlines, Military Organizations, Private Aircraft Operators): The airlines segment held a market share of 52.44% in 2023, due to the large-scale adoption of advanced lubricants to support high-frequency flight operations, maximize fleet performance, and meet rigorous maintenance and safety standards across commercial aviation fleets.

- By Distribution Channel (Direct Sales, Distributors and Dealers, Online Sales): The direct sales segment is expected to reach USD 1367.5 million by 2031, due to the growing preference for personalized customer service, direct access to product expertise, and tailored solutions for large-scale aviation operators and maintenance organizations.

Aviation Lubricants Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

North America aviation lubricants market share stood around 31.53% in 2023 in the global market, with a valuation of USD 446.1 million. North America holds a leading position in the market, supported by its well-established aerospace industry and the presence of major lubricant manufacturers.

The region benefits from consistent investments in advanced technologies and a strong regulatory framework that ensures safety and quality standards. Additionally, companies in the region actively pursuing strategic partnerships and product innovations to strengthen their market position. These factors are driving the market in North America.

- In April 2025, Eastman Aviation Solutions launched EastmanTurbo Oil 2330 (ETO 2330), which received MIL-PRF-7808 Grade 3 specification approval from the U.S. Air Force.ETO 2330 offers superior lubrication, thermal stability, and wear performance, making it ideal for demanding applications while improving cabin air quality, reflecting Eastman’s dedication to advancing aviation lubricant technology.

Asia Pacific is poised for significant growth at a robust CAGR of 7.88% over the forecast period. A key factor driving the growth of the aviation lubricants industry in Asia Pacific is the increasing collaboration between global and regional industry players to enhance distribution networks and expand access to high-performance lubrication solutions.

This strategic partnership enhances distribution networks, ensuring broader access to advanced, high-performance lubrication solutions. As demand for reliable aviation lubricants escalates in the region, these collaborations enable seamless supply chains, improving market penetration and providing airlines and aviation operators with effective, cost-efficient lubrication options to meet stringent operational demands.

- In April 2025, Quaker Houghton and PETRONAS Lubricants International (PLI) formed a strategic partnership in India to enhance their industrial solutions offering. By leveraging each other’s product portfolios and market presence, Quaker Houghton will distribute PLI’s high-performancelubricants., This will strengthening their joint commitment to delivering proven products and value-driven services across key industrial sectors.

Regulatory Frameworks

- In the U.S., the Federal Aviation Administration (FAA) oversees aviation lubricant regulations to ensure civil aviation safety, performance, and compliance with industry standards.

- In India, the Directorate General of Civil Aviation (DGCA) regulates aviation lubricants, ensuring compliance with airworthiness and safety standards. DGCA approval is mandatory for organizations involved in the storage, compounding, blending, and supply of aviation lubricants.

- In Europe, aviation lubricants are regulated by the European Union Aviation Safety Agency (EASA). EASA is responsible for establishing safety standards for aviation products, including lubricants, ensuring they meet stringent performance and environmental requirements for commercial and military aviation operations.

Competitive Landscape

The global market is characterized by a number of participants, including both established corporations and rising organizations. Key players are employing various strategies to drive the growth of the aviation lubricants market, including mergers and acquisitions to expand their market presence and enhance technological capabilities.

New product launches are also playing a crucial role in meeting evolving customer demands for high-performance, eco-friendly lubricants.

- In January 2024, Shell signed a long-term agreement with Air Europa to supply aerospace lubricants, including AeroShell engine oils, greases, and hydraulic fluids for Boeing 737 and 787 Dreamliners.

Key Companies in Aviation Lubricants Market:

- Aerospace Lubricants, Inc.

- IKV Tribology Ltd

- Nye Lubricants, Inc.

- Santie Oil Company

- Idemitsu Kosan Co.

- FUCHS

- Castrol Limited

- Eastman Chemical Company

- Shell

- Exxon Mobil Corporation

- The Chemours Company

- Phillips 66 Company

- NYCO

- LUKOIL

- TotalEnergies

Recent Developments (M&A/New Product Launch)

- In July 2024, AMSOIL INC. acquired Aerospace Lubricants, a company specialized in greases for automotive, industrial, military, and aerospace sectors. The acquisition strengthens AMSOIL’s portfolio, with Aerospace continuing as an independent subsidiary.

- In April 2024, FUCHS completed the acquisition of LUBCON Group, enhancing its global competitiveness and expanding its portfolio in specialty lubricants and greases. This strategic move strengthens FUCHS’ presence in key markets, enables entry into new sales regions, and adds a highly skilled team with advanced technological expertise. LUBCON will continue operations from its base in Maintal, Hesse

These strategic initiatives enable companies to strengthen their competitive positioning, access new customer segments, and capitalize on emerging trends, ultimately accelerating growth in the increasingly dynamic aviation lubricants industry.