Market Definition

The market involves the production, distribution, and consumption of chemically formulated lubricants designed to outperform natural oil-based alternatives. These lubricants offer superior stability, improved resistance to temperature fluctuations, and reduced wear and tear in machinery and engines.

The report provides a comprehensive analysis of key drivers, emerging trends, and the competitive landscape expected to influence the market over the forecast period.

Synthetic Lubricants Market Overview

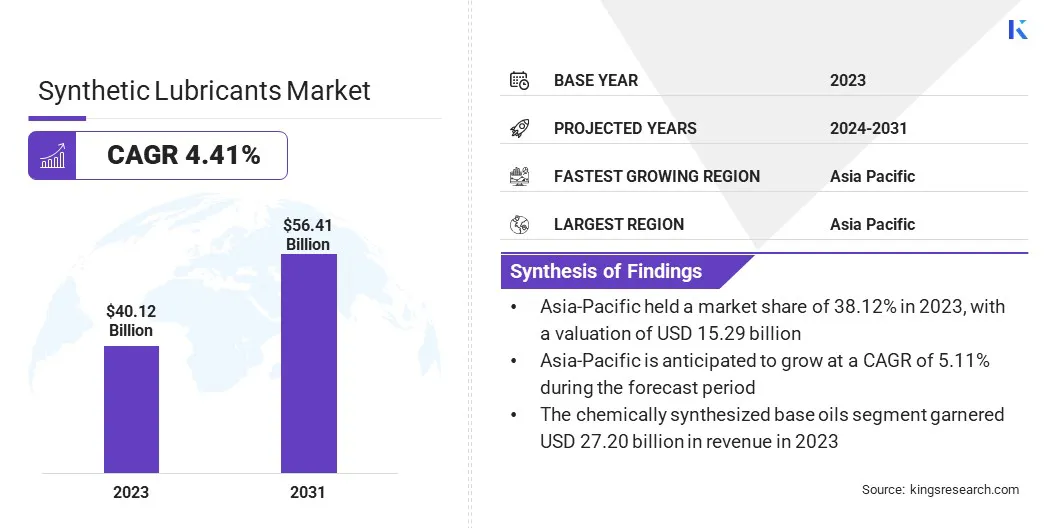

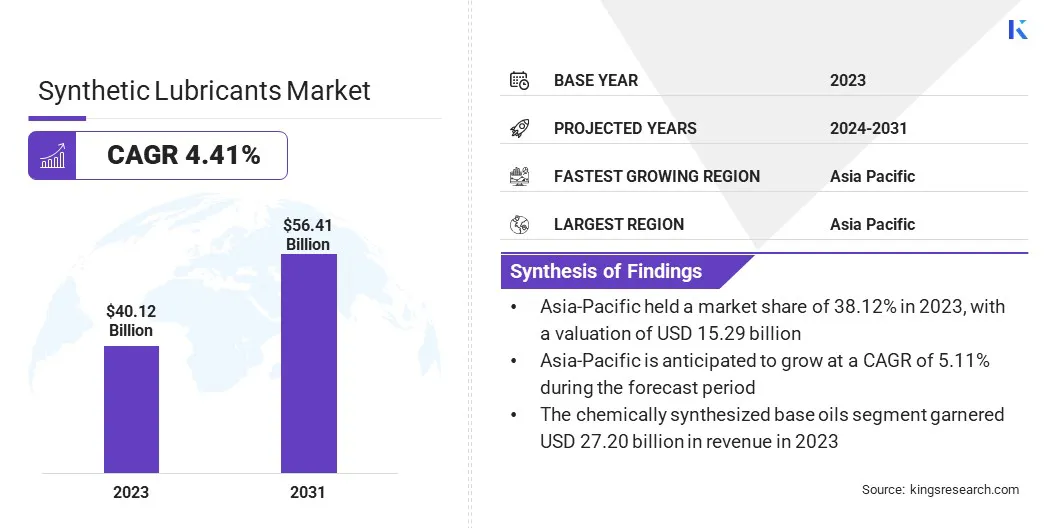

The global synthetic lubricants market size was valued at USD 40.12 billion in 2023 and is projected to grow from USD 41.71 billion in 2024 to USD 56.41 billion by 2031, exhibiting a CAGR of 4.41% during the forecast period.

The market is growing due to the increasing demand for high-performance lubricants, advancements in lubricant technology, and the rising need for environmentally sustainable solutions.

These factors enhance the efficiency, longevity, and fuel economy of machinery and engines, leading to the widespread adoption of synthetic lubricants across automotive, industrial, and aerospace applications.

Major companies operating in the synthetic lubricants industry are Exxon Mobil Corporation, Chevron Inc, TotalEnergies, FUCHS, AMSOIL INC, Shell, Idemitsu Kosan Co., Ltd., Valvoline Global Operations, Phillips 66 Company, Castrol Limited, Red Line Synthetic Oil, LUKOIL, LANXESS, Calumet, Inc., and BP LLC.

Additionally, the growing adoption of electric vehicles (EVs) and stringent environmental regulations are expected to contribute to the rising demand for synthetic lubricants that offer reduced emissions and better performance at lower operating temperatures.

- In March 2025, Shell launched Shell Advance Ultra with the API SP standard at the MotoGP event in Buriram, Thailand. This advanced full-synthetic oil enhances engine performance, fuel efficiency, and longevity, offering up to 20,000 km of horsepower retention and 79% lower evaporation.

Key Highlights

Key Highlights

- The synthetic lubricants industry size was valued at USD 40.12 billion in 2023.

- The market is projected to grow at a CAGR of 4.41% from 2024 to 2031.

- Asia-Pacific held a market share of 38.12% in 2023, with a valuation of USD 15.29 billion.

- The polyalphaolefin (PAO) segment garnered USD 16.10 billion in revenue in 2023.

- The chemically synthesized base oils segment is expected to reach USD 36.19 billion by 2031.

- The marine segment is anticipated to witness the fastest CAGR of 5.48% over the forecast period.

- The engine oils segment garnered USD 17.69 billion in revenue in 2023.

- Europe is anticipated to grow at a CAGR of 4.56% through the forecast period.

Market Driver

"Rising Demand for High-Performance Lubricants"

The market is experiencing strong growth due to the rising demand for high-performance lubricants across the automotive, industrial, and aerospace sectors. As equipment evolves to operate under higher stress and temperature conditions, the need for lubricants with superior thermal stability, oxidation resistance, and longer service life is increasing.

Synthetic lubricants, particularly those based on PAO and esters, are favored for their ability to maintain performance in extreme environments, reduce maintenance frequency, and enhance energy efficiency. With industries prioritizing reliability and operational efficiency, there is a growing adoption of high-performance synthetic lubricants, boosting market expansion.

- In May 2024, Castrol launched a refreshed branding and enhanced performance claims for its full synthetic motor oil range. Its premium product, Castrol EDGE Extended Performance, now supports up to 25,000 miles between oil changes. Rigorous testing shows it provides 50x better high-temperature performance, 6x better wear protection, and 3x stronger resistance to viscosity breakdown compared to industry standards.

Market Challenge

"High Production and Raw Material Costs"

High production and raw material costs remain a key challenge to the growth of the synthetic lubricants market, particularly in cost-sensitive and emerging economies.

The production of synthetic lubricants involves complex chemical synthesis and the use of high-purity base stocks such as PAO, esters, and PAG, which are significantly more expensive than conventional mineral oils.

Volatility in the prices of crude oil and specialty chemicals further exacerbates the issue, affecting profit margins and pricing stability. These factors make synthetic lubricants less accessible for budget-conscious consumers and industries, despite their superior performance and long-term cost benefits.

To address this challenge, manufacturers are investing in process optimization, energy-efficient technologies, and alternative raw materials, including bio-based feedstock, to reduce production costs. Strategic sourcing and partnerships are being leveraged to improve supply chain efficiency and secure raw materials at competitive rates.

Moreover, increasing awareness of lifecycle savings, such as reduced maintenance, lower consumption rates, and improved equipment life, is shifting customer focus from upfront cost to overall value, supporting broader adoption of synthetic lubricants.

Market Trend

"Dominance of Polyalphaolefins (PAOs)"

Polyalphaolefins (PAOs) are gaining significant traction in the synthetic lubricants market due to their superior performance over other base stocks.

Advancements in PAO production technology have led to better control over molecular structure, resulting in lubricants with exceptional thermal stability, oxidation resistance, and low-temperature fluidity. These improvements make PAO-based lubricants highly effective in critical applications across automotive, aerospace, and industrial sectors.

Additionally, PAOs provide extended drain intervals, improved fuel efficiency, and enhanced protection under extreme conditions, aligning with the growing demand for high-performance, energy-efficient lubricants. These advantages are strenghthening their position as the preferred base stock in premium formulations.

Synthetic Lubricants Market Report Snapshot

|

Segmentation

|

Details

|

|

By Product Type

|

Polyalphaolefin (PAO), Esters (Diester, Polyolester), Group III (Hydrocracked synthetics), Polyalkylene Glycol (PAG), and Others

|

|

By Base Oil Source

|

Chemically Synthesized Base Oils, Hydrocracked Group III Oils

|

|

By End Use Industry

|

Automotive, Industrial, Aerospace, Marine, Power Generation

|

|

By Application

|

Engine Oils, Transmission Fluids, Hydraulic Fluids, Compressor Oils, and Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Product Type (Polyalphaolefin (PAO), Esters (Diester, Polyolester), Group III (Hydrocracked synthetics), Polyalkylene Glycol (PAG), and Others): The polyalphaolefin (PAO) segment earned USD 16.10 billion in 2023 due to its widespread use in high-performance automotive and industrial applications, offering superior oxidation stability and low-temperature fluidity.

- By Base Oil Source (Chemically Synthesized Base Oils and Hydrocracked Group III Oils): The chemically synthesized base oils segment held a share of 67.80% in 2023, fueled by their enhanced thermal stability, longer oil life, and improved oxidation resistance.

- By End Use Industry (Automotive, Industrial, Aerospace, Marine, and Power Generation): The automotive segment is projected to reach USD 24.52 billion by 2031, propelled by the growing demand for high-performance lubricants in modern vehicles and the rise of electric vehicles.

- By Application (Engine Oils, Transmission Fluids, Hydraulic Fluids, Compressor Oils, and Others): The compressor oils segment is anticipated to grow at a CAGR of 7.56% over the forecast period, fueled by the increasing demand for efficient, high-performance oils in industrial and commercial applications.

Synthetic Lubricants Market Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

Asia Pacific synthetic lubricants market share stood at around 38.12% in 2023, with a valuation of USD 15.29 billion. This dominance is reinforced by rapid industrialization, a growing automotive sector, and a strong emphasis on energy efficiency.

Asia Pacific synthetic lubricants market share stood at around 38.12% in 2023, with a valuation of USD 15.29 billion. This dominance is reinforced by rapid industrialization, a growing automotive sector, and a strong emphasis on energy efficiency.

The region’s focus on reducing emissions and enhancing fuel economy is creating a strong demand for high-performance lubricants in automotive, industrial, and power generation applications. Additionally, the adoption of stricter environmental regulations and government initiatives promoting sustainable practices support the shift toward synthetic lubricants.

The ongoing expansion of key markets such as China, India, and Japan, coupled with efforts to modernize industrial equipment and vehicle fleets, supports regional market expansion.

- In June 2023, IndianOil launched two new products under its SERVO brand: the SERVO Hypersport F5 fully synthetic 4T engine oil and SERVO Grease Miracle. The Hypersport F5 is designed for all motorcycle types, including BS VI-2 models, offering exceptional performance in both cold and hot climates.

The Europe synthetic lubricants industry is estimated to grow at a CAGR of 4.56% over the forecast period. This growth is fostered by the increasing demand for high-performance lubricants across various sectors, including automotive, industrial, and aerospace.

Europe's strong industrial base, along with stringent environmental regulations and a shift toward energy-efficient solutions, is expected to boost the adoption of synthetic lubricants.

Additionally, the growing focus on electric vehicles and the transition to cleaner, more efficient manufacturing processes is projected to support this expansion. The region's commitment to innovation and sustainability in both automotive and industrial applications further highlights the need for synthetic lubricants.

- In January 2024, Shell U.K. finalized the acquisition of MIDEL and MIVOLT from M&IMaterialsLtd., integrating these ester-based fluid brands into its global lubricants portfolio. This move enables Shell to offer synthetic and natural ester-based transformer fluids, aimed at improving fire safety and environmental sustainability for its customers.

Regulatory Frameworks

- In the European Union, the REACH Regulation (EC 1907/2006) governs chemicals, including synthetic lubricants, to protect human health and the environment. It mandates that manufacturers and importers register chemicals, assess their risks, and provide safety information.

- In the U.S., the Environmental Protection Agency (EPA) regulates non-petroleum oils under the Clean Water Act, requiring facilities to implement Spill Prevention, Control, and Countermeasure (SPCC) plans to prevent discharges and minimize environmental impact.

- In Australia, the National Industrial Chemicals Notification and Assessment Scheme (NICNAS) regulates synthetic lubricants under the Industrial Chemicals (Notification and Assessment) Act 1989.

Competitive Landscape

Companies in the synthetic lubricants industry are focusing on product innovations to improve the performance, efficiency, and environmental sustainability of their offerings.

They are investing in the development of high-performance formulations that cater to specific industries, including automotive, aerospace, and industrial sectors, while also ensuring compliance with stringent environmental regulations.

Additionally, companies are expanding their portfolios to include eco-friendlier and energy-efficient lubricants, which align with the growing consumer demand for sustainable products.

- In April 2023, Henkel AG & Co. KGaA launched Bonderite L-FG F 605, a graphite-free, non-pigmented forging lubricant for automotive applications. It reduces metal-to-metal contact, extends die life, and improves air quality by eliminating ammonia emissions. This sustainable solution also makes workspaces easier to clean and reduces lubricant consumption by maintaining stability at high dilution rates.

Strategic partnerships, acquisitions, and collaborations with technology providers are being employed to enhance R&D capabilities, improve production processes, and stay ahead of market trends. These efforts enable companies to address the evolving customer needs, maintain competitiveness, and strengthen market positions.

List of Key Companies in Synthetic Lubricants Market:

- Exxon Mobil Corporation

- Chevron Inc

- TotalEnergies

- FUCHS

- AMSOIL INC

- Shell

- Idemitsu Kosan Co., Ltd.

- Valvoline Global Operations

- Phillips 66 Company

- Castrol Limited

- Red Line Synthetic Oil

- LUKOIL

- LANXESS

- Calumet, Inc.

- BP LLC

Recent Developments (Partnerships/New Product Launch)

- In February 2025, Motul launched the GP Ultimate 4T, fully synthetic oil developed using technology technology from its partnership with MotoGP. The product offers high-temperature stability, durability, and friction reduction for high-performance environments.

- In January 2025, FS-ELLIOTT Co., LLC expanded its FSE-TurboCool line of advanced lubricants and additives to improve centrifugal compressor performance. The new range includes FSE-TurboCool 32 & 46, FSE-TurboCool PG, FSE-TurboCool FG, and FSE-TurboCool CC, all designed to enhance lubrication, minimize downtime, and extend equipment life.

- In November 2024, LANXESS introduced Everest ESR 220, a sustainable synthetic ester-based lubricant designed for HVAC and refrigeration systems utilizing the low-GWP refrigerant R-1234ze. Created in collaboration with a major OEM and supported by a U.S. Department of Energy grant, the lubricant enhances thermal stability, minimizes maintenance needs, and prolongs system life.

- In October 2023, Gulf Oil Lubricants India partnered with S-Oil Corporation to produce, distribute, and promote S-Oil's SEVEN range of synthetic and semi-synthetic in India. This marks the production of S-Oil products outside South Korea, utilizing Gulf Oil's Chennai facilities.

- In January 2023, McLaren Automotive extended its collaboration with Gulf Oil International, continuing its use of Gulf Formula Elite, a high-performance synthetic engine oil with Thermoshield Technology for enhanced engine protection and wear resistance.

Key Highlights

Key Highlights Asia Pacific synthetic lubricants market share stood at around 38.12% in 2023, with a valuation of USD 15.29 billion. This dominance is reinforced by rapid industrialization, a growing automotive sector, and a strong emphasis on energy efficiency.

Asia Pacific synthetic lubricants market share stood at around 38.12% in 2023, with a valuation of USD 15.29 billion. This dominance is reinforced by rapid industrialization, a growing automotive sector, and a strong emphasis on energy efficiency.