Military Aviation Market Size

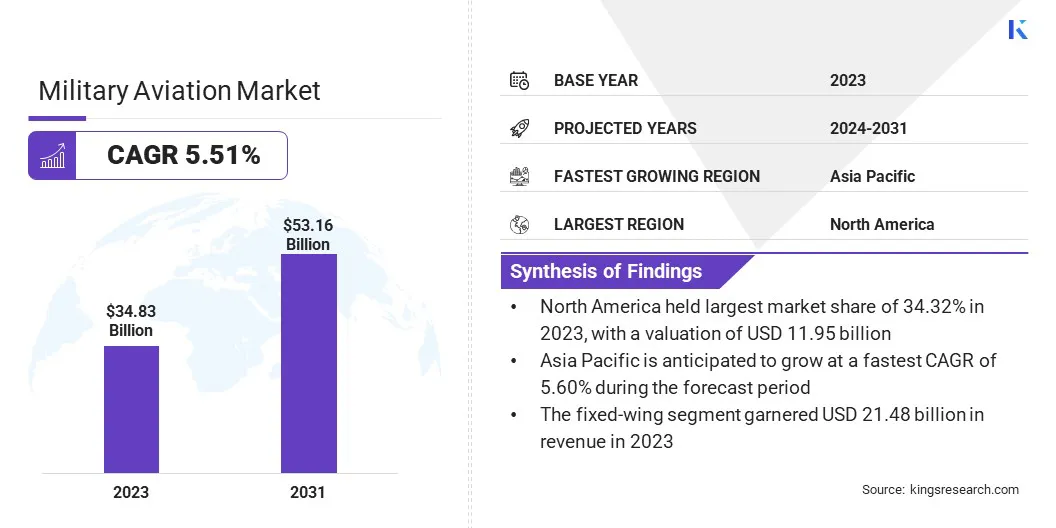

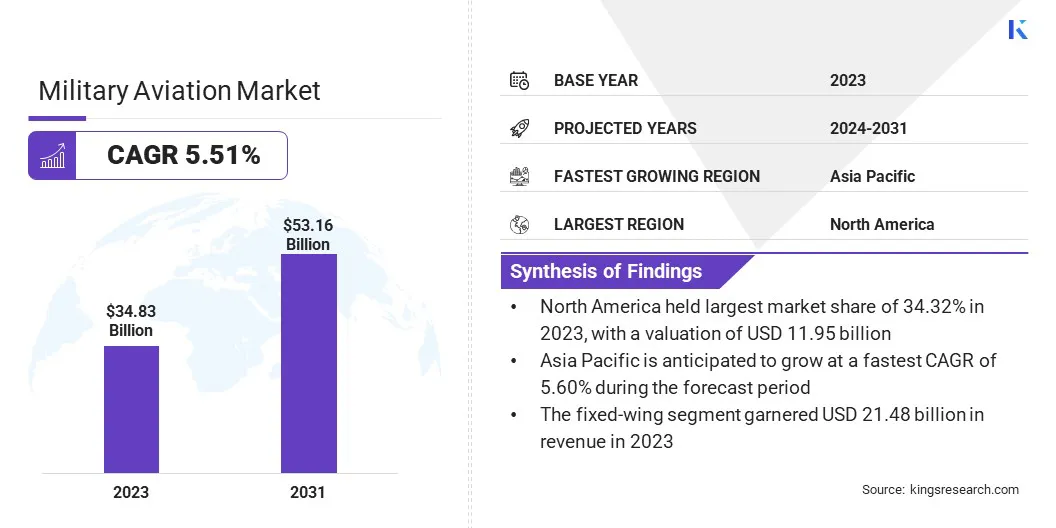

The global Military Aviation Market size was valued at USD 34.83 billion in 2023 and is projected to grow from USD 36.51 billion in 2024 to USD 53.16 billion by 2031, exhibiting a CAGR of 5.51% during the forecast period. Increasing defense budgets and rising demand for military helicopters are propelling the growth of the market.

In the scope of work, the report includes services offered by companies such as AIRBUS, Dassault Aviation, Lockheed Martin Corporation, Textron Inc., Boeing, Leonardo S.p.A., Northrop Grumman, PILATUS AIRCRAFT LTD, Saab AB, Embraer S.A., and others.

The development of autonomous systems in the global military aviation market represents a transformative opportunity to enhance operational efficiency, reduce human risk, and bolster mission success rates.

Autonomous systems, including drones and unmanned combat aerial vehicles (UCAVs), are increasingly integrated with artificial intelligence, advanced sensors, and data analytics for precision targeting, reconnaissance, and real-time decision-making. These systems reduce reliance on human pilots, allowing militaries to deploy assets in high-risk environments without endangering lives.

- For instance, in November 2024, Grupo Oesía inaugurated a high-tech center in Madrid, strengthening its position in the market. The facility, equipped with advanced design and flight-testing labs, enhances UAV Navigation's capabilities in guidance, navigation, and control systems for UAS. This strategic move underscores the company’s commitment to innovation and positions it for sustained leadership UAS technology.

Furthermore, they enable continuous operations beyond human endurance, offering strategic advantages during prolonged missions. Opportunities exist in collaboration between defense contractors and technology innovators to improve AI-based navigation, sensor fusion, and secure communication networks.

As geopolitical tensions and asymmetric warfare increase, nations are investing heavily in autonomous capabilities, fueling demand for advanced, interoperable systems. This development supports the integration of autonomous systems with legacy platforms, ensuring cost efficiency and operational adaptability in the evolving military landscape.

Military aviation involves the use of aircraft and other airborne systems in defense operations, including combat, reconnaissance, transport, and support. It encompasses a wide array of aircraft types, such as fighter jets, bombers, reconnaissance planes, and transport aircraft, each designed for specific functions. Fighter jets are optimized for air-to-air combat and offensive strikes, while bombers deliver heavy payloads to strategic targets.

Reconnaissance aircraft are designed for intelligence gathering, surveillance, and monitoring, while transport planes move troops, equipment, and supplies. Additionally, military aviation includes specialized aircraft such as tanker planes for in-flight refueling, and airborne early warning and control systems (AEW&C) for battlefield command and control.

Military aviation plays a crucial role in air superiority, counterterrorism, and border patrol, humanitarian aid, and disaster relief. Its versatility of military aviation makes it a core element in modern defense strategies and global security operations.

Analyst’s Review

The global military aviation market is evolving as key players adopt growth strategies to address the rising demand for advanced aerial capabilities. Companies are emphasizing innovation through heavy investments in autonomous technologies, cybersecurity measures, and AI-powered systems to develop next-generation aircraft and infrastructure.

Collaboration with governments and cross-sector alliances is critical for advancing R&D in cutting-edge solutions, including stealth technologies and enhanced propulsion systems.

- For instance, in November 2024, JSW Defence Pvt. Ltd. and Shield AI formed a strategic partnership to localize the production of Shield AI's "V-BAT" UAS in India. This collaboration includes setting up advanced manufacturing facilities to cater to Indian defense needs and establish a global production hub. The initiative demonstrates a significant boost to India's defense capabilities and promotes self-reliance in advanced unmanned systems technology.

The growth trajectory of the military aviation market is fueled by the increasing acquisition of unmanned systems and multi-role aircraft that offer versatility in combat, surveillance, and logistics. Key imperatives include expanding into emerging markets, diversifying product portfolios to address hybrid warfare, and maintaining competitive cost structures to cater to budget-constrained defense sectors.

Moreover, manufacturers are leveraging modular designs and interoperability to seamlessly integrate new systems into existing fleets, reflecting a robust market adaptability and foresight. These approaches are crucial for sustaining long-term competitiveness and responding effectively to dynamic geopolitical challenges.

Military Aviation Market Growth Factors

Rising global defense budgets are contributing significantly to the growth of the military aviation market, enabling governments to invest in advanced aircraft, sophisticated technologies, and modernization programs. This trend is largely fueled by increasing geopolitical tensions, regional conflicts, and emerging threats such as cyber warfare and terrorism.

Nations are prioritizing the acquisition of multi-role fighter aircraft, unmanned systems, and intelligence-gathering platforms to strengthen their defense capabilities. For instance, major economies such as the U.S., China, and India have notably increased their defense allocations, focusing on modernizing air combat fleets, enhancing logistics capabilities, and integrating cutting-edge technologies such as artificial intelligence and quantum computing.

- For instance, in April 2024, Global military spending reached USD 2,443 billion in 2023, marking a ninth consecutive year of growth, according to Stockholm International Peace Research Institute (SIPRI). The surge is driven by the Ukraine conflict and rising geopolitical tensions in Asia, Oceania, and the Middle East. Spending increased across all regions, with Europe and Asia leading the rise, reflecting the global focus on strengthening defense capabilities amid escalating threats.

This driving factor facilitates domestic manufacturing, fostering international partnerships and defense trade agreements. Additionally, emerging economies are increasing spending to bolster regional security, creating lucrative opportunities for market players. The rising budgets ensure consistent funding for R&D, enabling continuous innovation and the development of next-generation military aviation solutions to address dynamic security challenges.

Economic slowdowns and fiscal constraints present significant challenges to the development of the military aviation market, limiting procurement budgets and delaying modernization programs. Economic pressures often lead governments to prioritize essential services, limiting funds for large-scale defense projects. This challenge is particularly pronounced in emerging economies, where competing priorities such as healthcare and infrastructure strain defense spending.

The delay in acquiring new aircraft and upgrading existing fleets can impede military readiness and operational efficiency. To mitigate these constraints, defense stakeholders are adopting strategies such as public-private partnerships, and phased procurement to distribute costs over longer periods. Modular systems enable incremental upgrades, reducing upfront investments and allowing governments to optimize limited budgets.

Market players are emphasizing cost-effective solutions and collaborating with financial institutions to offer innovative funding options. These approaches ensure that fiscal challenges do not halt military aviation progress, balancing financial limitations with security needs.

Military Aviation Market Trends

Companies operating in the global military aviation market are prioritizing the development and procurement of next-generation fighter aircraft to maintain air superiority amid advanced threats and evolving combat scenarios. These aircraft feature stealth capabilities, advanced avionics, and network-centric warfare systems, offering unparalleled precision and survivability in modern conflict zones.

Key features include integrated artificial intelligence for real-time decision-making, enhanced sensor fusion for situational awareness, and hypersonic weapon compatibility.

- For instance, in August 2024, India aims to unveil the first prototype of its 5.5-generation fighter jet by 2028, as per a roadmap reviewed by the Indian Air Force and DRDO. This ambitious project reflects India’s commitment to indigenous defense development, technological advancement, and strategic autonomy in next-generation military aviation.

This focus is further propelled by increasing investments in research and development from defense contractors and governments seeking to outpace adversaries in technological advancements. Collaborative programs, such as joint fighter development projects between allied nations, are becoming a common to share costs and accelerate innovation.

Additionally, the shift toward sustainability is leading to the exploration of hybrid propulsion systems and materials to reduce environmental impact. This trend underscores the strategic importance of technological superiority in ensuring national security and global military influence.

Segmentation Analysis

The global market has been segmented on the basis of aircraft, system, and geography.

By Aircraft

Based on aircraft, the market has been bifurcated into fixed-wing and rotory-wing. The fixed-wing segment dominated the military aviation market in 2023, capturing a share of 61.67%. This growth is primarily attributed to its unparalleled versatility, operational range, and strategic importance in modern defense systems.

Fixed-wing aircraft, including fighter jets, bombers, and surveillance planes are essential to air force operations, providing critical capabilities such as air dominance, precision strike, and intelligence-gathering. Their ability to operate at high speeds, cover long distances, and function in diverse environments makes them indispensable for modern military strategies.

The increased procurement of multi-role fighter jets with advanced stealth, avionics, and weapons systems has contributed significantly to segmental expansion. Additionally, rising geopolitical tensions and the need for force projection in contested regions have bolstered demand.

Moreover, fixed-wing aircraft are pivotal in humanitarian missions, troop transport, and disaster relief, highlighting their significance. The ongoing modernization of aging fleets and investments in next-generation platforms such as hypersonic jets and drones are expected to support the expansion of the segment.

By System

Based on system, the market has been classified into airframe, engine, avionics, landing gear system, and weapon system. The avionics segment is projected to experience remarkable growth, recording a staggering CAGR of 5.88% over the forecast period. This expansion is largely propelled by technological advancements and the increasing importance of mission-critical systems.

Avionics, encompassing navigation, communication, surveillance, and flight control systems, are fundamental to modern military aviation. The growing demand for enhanced situational awareness, electronic warfare capabilities, and AI-integrated systems has led to significant investments in avionics development.

Additionally, governments and defense organizations are prioritizing the upgrade of legacy systems to ensure compatibility with emerging threats and operational requirements.

The growing adoption of unmanned aerial vehicles (UAVs) boosts the demand for sophisticated avionics to enable precise navigation and autonomous mission execution. This growth is further facilitated by the integration of avionics with network-centric warfare systems, enhancing coordination across multiple platforms. As global militaries shift to data-driven operations, avionics is anticipated to play central crucial role in the near future.

By Application

Based on application, the market has been divided into combat, military transport, maritime patrol, tanker, reconnaissance & surveillance, and others. The military transport segment generated the highest revenue of USD 9.92 billion in 2023, primarily due to the growing need for strategic airlift capabilities and logistical support in global defense operations.

Military transport aircraft are essential for transporting troops, equipment, and supplies over long distances, often to remote or conflict-affected regions. The growth of the segment is further propelled by an increase in multinational exercises, rapid response requirements, and humanitarian aid missions, all of which rely on efficient and versatile transport solutions.

The acquisition of new-generation transport aircraft featuring higher payload capacities, longer operational ranges, and advanced avionics systems has significantly contributed to the segmental expansion. Additionally, the global focus on upgrading existing fleets to meet modern mission demands has led to increased investments in retrofitting and maintenance.

Moreover, emerging geopolitical tensions and natural disaster relief operations have highlighted the critical importance of military transport capabilities. Innovations in fuel efficiency, cargo handling, and modular designs are likely to further aid the development of the segmenting the coming years.

Military Aviation Market Regional Analysis

Based on region, the global market has been segmented into North America, Europe, Asia-Pacific, MEA, and Latin America.

North America military aviation market accounted for a substantial share of 34.32% and was valued at USD 11.95 billion in 2023. This dominance is largely attributed to the substantial defense budgets of the United States and Canada, which prioritize advanced aircraft procurement, fleet modernization, and technological innovation.

The region leads in developing and deploying next-generation platforms, including fifth- and sixth-generation fighter jets, unmanned aerial vehicles (UAVs), and advanced intelligence, surveillance, and reconnaissance (ISR) systems. U.S. military aviation expenditures driven by significant investments in stealth technologies, hypersonic missiles, and autonomous systems.

- For instance, in May 2023, the U.S. State Department approved a USD 8.5 billion Foreign Military Sale to Germany for CH-47F Chinook helicopters and related equipment. This deal enhances NATO's defense readiness and strengthens the U.S.-Germany alliance, and supports political and economic stability in Europe, advancing U.S. strategic interests in global security.

Moreover, robust collaboration between defense contractors and government agencies, such as the Department of Defense (DoD), fosters innovation and operational readiness. Regional market further benefits from a strong industrial base, extensive R&D activities, and international defense partnerships.

Asia-Pacific military aviation market is projected to grow at the highest CAGR of 5.60% in the forthcoming years, propelled by the region’s increasing focus on defense modernization and strategic deterrence. Rising geopolitical tensions, particularly in the South China Sea, Taiwan Strait, and along India-China borders, have prompted China, India, Japan, and South Korea to enhance their air combat capabilities.

Governments in the region are investing heavily in acquiring advanced fighter jets, drones, and multi-role aircraft to bolster both defensive and offensive operations. The emergence of domestic defense industries, such as India’s "Make in India" initiative and China’s indigenously developed aircraft programs, further supports regional industry growth.

Additionally, rising defense budgets and a focus on technological self-reliance are increasing demand for next-generation platforms and associated systems. Cross-border collaborations and joint military exercises in the region underscore the importance of interoperability and modernized fleets. This dynamic environment positions Asia-Pacific as a lucrative market for military aviation advancements, attracting significant investments and innovation.

Competitive Landscape

The global military aviation market report provides valuable insights, highlighting the fragmented nature of the industry. Prominent players are focusing on several key business strategies, such as partnerships, mergers and acquisitions, product innovations, and joint ventures, to expand their product portfolio and increase their market shares across different regions.

Companies are implementing impactful strategic initiatives, such as expansion of services, investments in research and development (R&D), establishment of new service delivery centers, and optimization of their service delivery processes, which are likely to create new opportunities for market growth.

List of Key Companies in Military Aviation Market

- AIRBUS

- Dassault Aviation

- Lockheed Martin Corporation

- Textron Inc.

- Boeing

- Leonardo S.p.A.

- Northrop Grumman

- PILATUS AIRCRAFT LTD

- Saab AB

- Embraer S.A.

Key Industry Developments

- November 2024 (Expansion): Airbus Helicopters delivered the first of up to 82 H145Ms to the German Armed Forces at its Donauwörth facility. The "Leichter Kampfhubschrauber" (LKH), or light combat helicopter, is a multi-role platform designed for training, reconnaissance, special operations, and light attack missions. Its versatility enhances Germany's defense readiness and operational efficiency.

The global military aviation market has been segmented:

By Aircraft

By System

- Airframe

- Engine

- Avionics

- Landing Gear System

- Weapon System

By Application

- Combat

- Military Transport

- Maritime Patrol

- Tanker

- Reconnaissance & Surveillance

- Others

By Region

- North America

- Europe

- France

- UK

- Spain

- Germany

- Italy

- Russia

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia-Pacific

- Middle East & Africa

- GCC

- North Africa

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America