Wind Turbine Installation Vessel Market Size

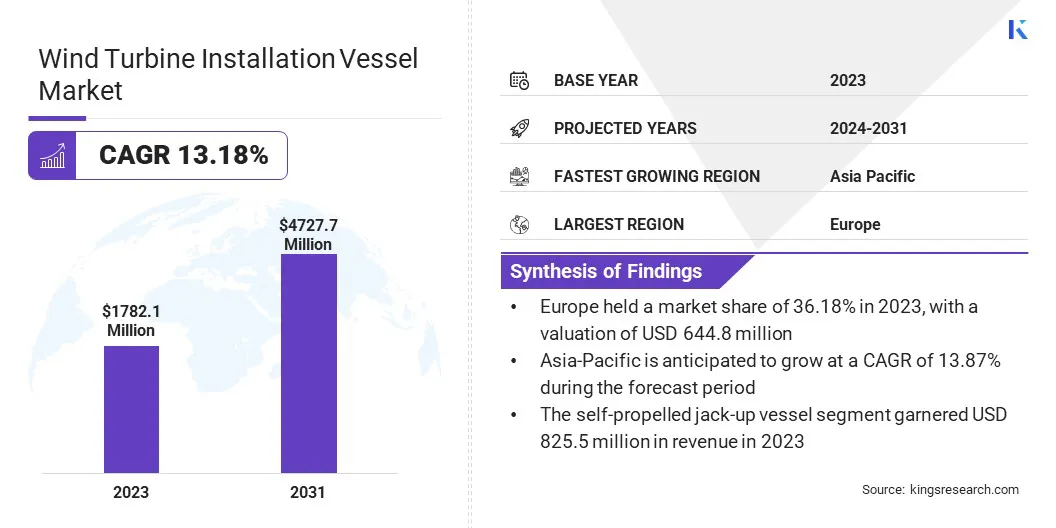

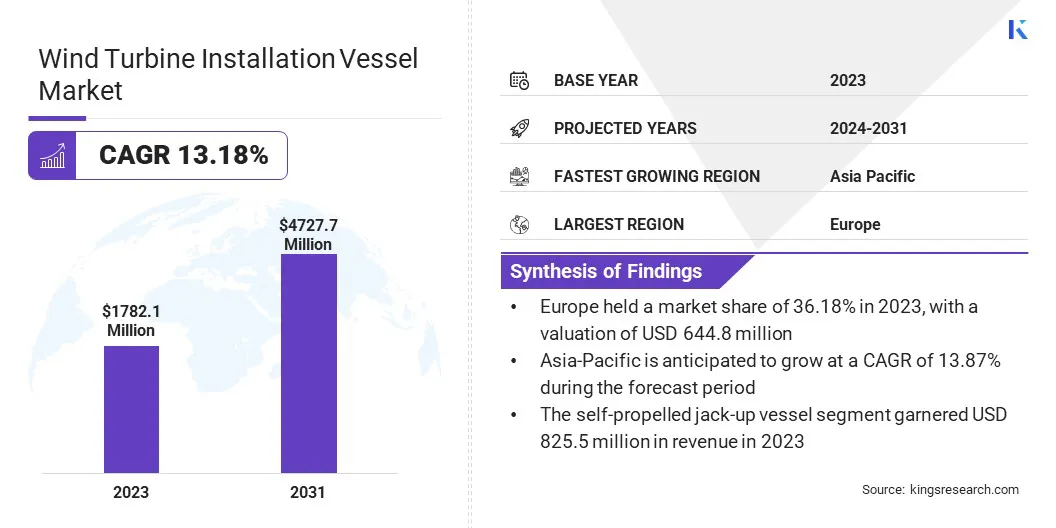

The global Wind Turbine Installation Vessel Market size was valued at USD 1,782.1 million in 2023 and is projected to grow from USD 1,987.7 million in 2024 to USD 4,727.7 million by 2031, exhibiting a CAGR of 13.18% during the forecast period.

The growth of the market is driven by the increasing demand for renewable energy, continual technological advancements in wind turbines, and supportive government policies that promote offshore wind projects.

In the scope of work, the report includes solutions offered by companies such as A-2-Sea Solutions Limited, Cadeler, Fred. Olsen Windcarrier, Jan De Nul Group, MPI Offshore, Seafox, Swire Pacific Limited., Van Es Group, Van Oord, DEME, and others.

The wind turbine installation vessel (WTIV) market is growing substantially due to the increasing demand for renewable energy and the growing investments in offshore wind projects. Governments worldwide are implementing supportive policies and offering incentives to promote clean energy, which boosts the need for efficient installation vessels.

- In 2021, the U.S. administration set a target to achieve an offshore wind energy capacity of 30 gigawatts by 2030. The Wind Vision Report by the U.S. Department of Energy (DoE) anticipated benefits from installing up to 22 gigawatts of offshore wind by 2030 and 86 gigawatts by 2050. The report suggested that, by 2050, offshore wind energy could be accessible nationwide, thereby fostering substantial growth and expanding the domestic supply chain and workforce.

Technological advancements in wind turbines, such as larger blades and higher capacity, require the use of specialized vessels for their transportation and installation. Additionally, the rise in energy consumption and the global shift toward sustainable energy sources further propel market expansion. The pressing need to reduce carbon emissions and combat climate change further plays a crucial role in the expansion of the WTIV market.

The wind turbine installation vessel market is experiencing significant growth due to the expanding offshore wind energy sector. The market is characterized by the presence of both established players and new entrants striving to capitalize on the increasing demand.

Europe dominates the market due to its extensive offshore wind projects, followed by Asia-Pacific and North America. Continuous advancements in vessel design and technology enhance efficiency, thereby boosting market expansion.

Wind turbine installation vessels are specialized ships designed specifically to transport, lift, and install wind turbines in offshore locations. These vessels are equipped with advanced cranes and dynamic positioning systems to handle the heavy and complex components of wind turbines.

WTIVs are capable of operating in harsh marine environments, thereby ensuring the safe and efficient installation of turbines offshore. They are essential for the construction of offshore wind farms, which are increasingly preferred due to their higher wind speeds and lower visual impact compared to onshore sites.

Analyst’s Review

The wind turbine installation vessel market landscape is shaped by strategic initiatives undertaken by manufacturers and advancements in technology. These efforts include the development of specialized vessels capable of handling larger and more complex offshore wind turbine components.

Manufacturers are further focusing on improving vessel efficiency through advanced propulsion systems and dynamic positioning capabilities. To maintain a competitive advantage, manufacturers are advised to prioritize investments in sustainable technologies and operational efficiency improvements. Collaboration with renewable energy developers to understand evolving project requirements is crucial.

- In September 2023, Ecowende and Van Oord announced a collaboration to construct an ecologically advanced offshore wind farm at Hollandse Kust (west) lot VI. This project aims to minimize the impact on birds, bats, and marine mammals, while fostering a thriving underwater ecosystem. Van Oord, as the contractor, is likely to be responsible for transporting and installing the foundations, designing and laying the connecting cables, and handling the offshore installation of wind turbines.

Moreover, navigating regulatory landscapes effectively and ensuring compliance with environmental standards are anticipated to be essential for gaining competitive edge. By focusing on innovation, sustainability, and strategic partnerships, manufacturers are estimated to capitalize on the growing opportunities in the market.

Wind Turbine Installation Vessel Market Growth Factors

The increasing global focus on renewable energy is impacting the market. Countries are continuously implementing policies and regulations to reduce carbon emissions and promote clean energy sources. Offshore wind farms are a crucial part of this strategy due to their higher energy output compared to onshore wind farms.

These vessels play a vital role in efficiently transporting and installing these turbines. Additionally, technological advancements in turbine design, which include larger and more efficient turbines, require specialized vessels for installation. This focus on sustainable energy solutions is ensuring a steady demand for wind turbine installation vessels.

The limited availability of suitable vessels acts as a significant challenge to the expansion of the wind turbine installation vessel market. The growing number of offshore wind projects is increasing demand, leading to potential delays and higher costs due to vessel shortages. To overcome this challenge, industry participants are continuously investing in the construction of new WTIVs and upgrading existing fleets to handle larger turbines.

Innovation in vessel design, such as modular construction techniques, is speeding up the production process. Additionally, fostering international collaborations helps optimize vessel utilization across different regions, ensuring more efficient allocation and reducing downtime. This approach effectively addresses the issue of limited vessel availability.

Wind Turbine Installation Vessel Industry Trends

The market is influenced by the increasing size of offshore wind turbines. Manufacturers are producing larger turbines to capture more wind energy, which requires vessels with higher lifting capacities and advanced stability features. This trend is fostering innovation in vessel design, with companies developing new WTIVs capable of handling these massive components.

Moreover, the industry is witnessing a notable shift toward multi-functional vessels that are capable of performing various tasks, such as installation, maintenance, and transportation, thus enhancing operational efficiency. This focus on accommodating larger turbines is shaping the landscape of WTIVs and boosting demand for more advanced and versatile vessels.

Another prominent trend in the market is the widespread adoption of automation and digitalization. Companies are increasingly integrating advanced technologies, such as remote monitoring systems, autonomous operation capabilities, and digital twins, to enhance efficiency and safety. These technologies allow for precise positioning, real-time data analysis, and predictive maintenance, thereby reducing downtime and operational costs.

The shift toward digitalization further includes the use of sophisticated software for route optimization and project management. This trend is revolutionizing the dynamics of the WTIV market by improving productivity, minimizing risks, and ensuring the timely completion of offshore wind projects.

Segmentation Analysis

The global market is segmented based on vessel type, application, and geography.

By Vessel Type

Based on vessel type, the market is categorized into self-propelled jack-up vessel, normal jack-up vessel, and heavy lift vessel. The self-propelled jack-up vessel segment led the wind turbine installation vessel market in 2023, reaching a valuation of USD 825.5 million. The segment is expanding due to its superior operational efficiency and versatility.

These vessels, capable of operating independently without the need for external tugboats, offer significant time and cost savings during wind turbine installation. Their advanced positioning systems and stability allow for precise operations even in challenging offshore environments.

The ability to quickly relocate and perform multiple installations in different locations is leading to their increased demand. Furthermore, technological advancements in self-propelled jack-up vessels are enhancing their load capacity and operational capabilities.

Wind Turbine Installation Vessel Market Regional Analysis

Based on region, the global market is classified into North America, Europe, Asia Pacific, MEA, and Latin America.

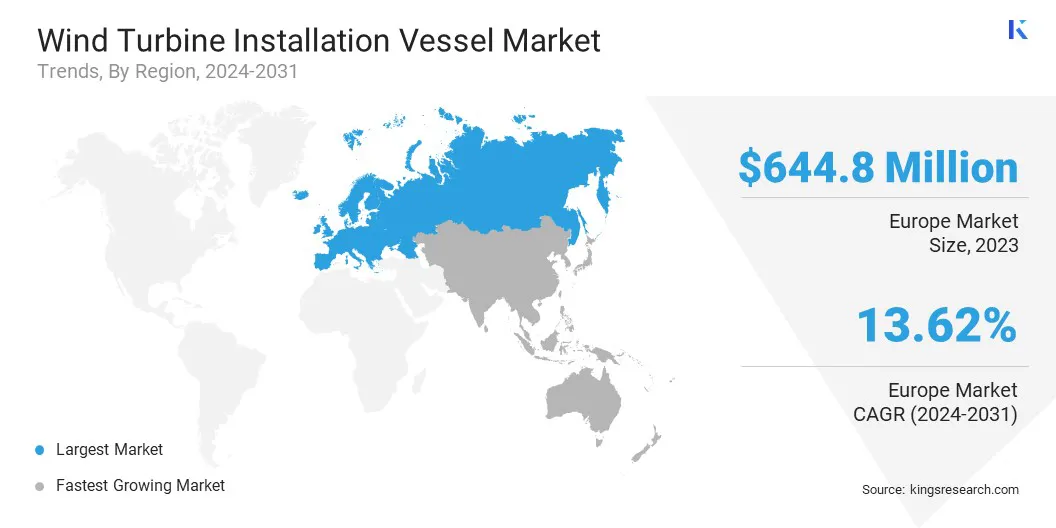

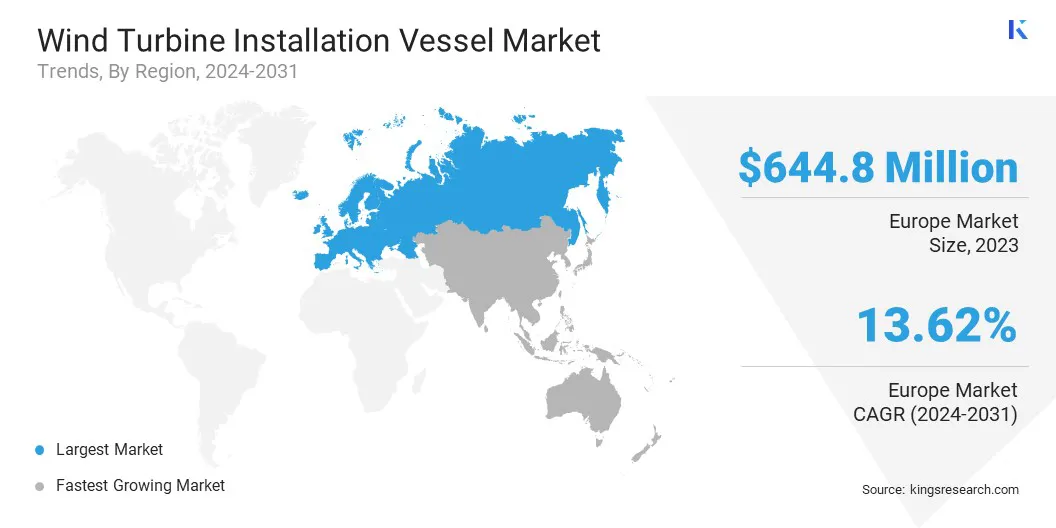

Europe wind turbine installation vessel market share stood around 36.18% in 2023 in the global market, with a valuation of USD 644.8 million. This notable expansion is stimulated by the region's extensive offshore wind energy projects and supportive regulatory environment.

Countries such as the UK, Germany, and the Netherlands are investing heavily in offshore wind farms to meet their renewable energy targets.

The European Union's commitment to reducing carbon emissions and promoting sustainable energy further facilitates regional market growth. Additionally, Europe's well-developed maritime infrastructure and technological expertise in offshore wind energy contribute to the high demand for installation vessels in the region.

Asia-Pacific is poised to experience significant growth at a robust CAGR of 13.87% through the estimated timeframe. This growth is largely attributed to increasing investments in renewable energy and expanding offshore wind projects. Countries such as China, Japan, and Taiwan are prioritizing offshore wind energy to diversify their energy sources and reduce dependence on fossil fuels.

The region's favorable government policies, financial incentives, and ambitious renewable energy targets are aiding regional market expansion. Additionally, Asia-Pacific's growing energy demand and economic development are contributing to the rapid adoption of offshore wind technology.

Competitive Landscape

The wind turbine installation vessel market report will provide valuable insight with an emphasis on the fragmented nature of the industry. Prominent players are focusing on several key business strategies such as partnerships, mergers and acquisitions, product innovations, and joint ventures to expand their product portfolio and increase their market shares across different regions.

Manufacturers are adopting a range of strategic initiatives, including investments in R&D activities, the establishment of new manufacturing facilities, and supply chain optimization, to strengthen their market standing.

List of Key Companies in Wind Turbine Installation Vessel Market

- A-2-Sea Solutions Limited

- Cadeler

- Olsen Windcarrier

- Jan De Nul Group

- MPI Offshore

- Seafox

- Swire Pacific Limited.

- Van Es Group

- Van Oord

- DEME

Key Industry Developments

- June 2024 (Partnership): Cadeler A/S secured a contract to install wind turbines at the Inch Cape Offshore Wind Farm. The project, valued between USD 123.3 million and EUR 140.7 million, is scheduled to begin installation in late 2026.

- June 2024 (Partnership): Olsen Windcarrier (FOWIC) secured a contract to work with Shimizu for transporting and installing monopile foundations at the Yunlin offshore windfarm in Taiwan. Operations for this project commenced in February 2024, with the project spanning 200 days. The jack-up vessel Blue Wind was utilized for this project, which aims to generate 640 MW of green energy,sufficient to power over 600,000 Taiwan households. This project marks a significant step toward Taiwan's transition to green energy.

The global wind turbine installation vessel market is segmented as:

By Vessel Type

- Self-Propelled Jack-up Vessel

- Normal Jack-up Vessel

- Heavy Lift Vessel

By Region

- North America

- Europe

- France

- U.K.

- Spain

- Germany

- Italy

- Russia

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia-Pacific

- Middle East & Africa

- GCC

- North Africa

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America