Market Definition

The market focuses on technologies and solutions that enable precise positioning and navigation of objects using visual data. This includes hardware, software, and integrated systems deployed across sectors such as robotics, drones, automotive, and industrial automation.

The market covers a wide range of applications requiring spatial awareness, obstacle detection, and accurate real-time localization. The report offers a thorough assessment of the main factors driving market expansion, along with detailed regional analysis and the competitive landscape influencing industry dynamics.

Vision Positioning System Market Overview

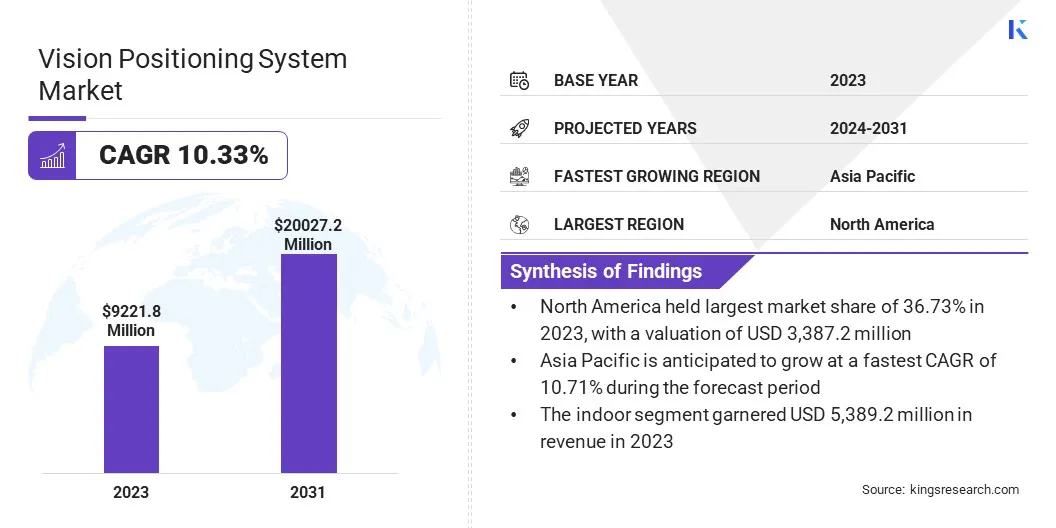

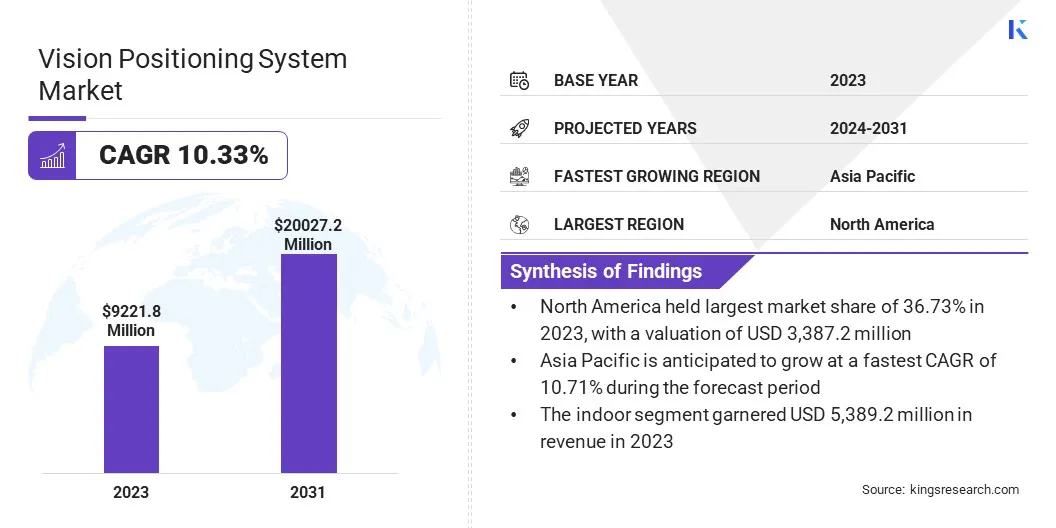

The global vision positioning system market size was valued at USD 9,221.8 million in 2023 and is projected to grow from USD 10,061.5 million in 2024 to USD 20,027.2 million by 2031, exhibiting a CAGR of 10.33% during the forecast period.

Market growth is driven by increasing adoption across autonomous vehicles, drones, and industrial automation. As industries prioritize precision and real-time spatial awareness, demand for vision-based navigation technologies is increasing.

In the automotive sector, the integration of advanced driver-assistance systems (ADAS) and autonomous driving capabilities is boosting the need for accurate positioning solutions. Moreover, the expansion of the drone market, particularly in delivery services, surveillance, and agriculture, is fueling investments in vision-based navigation.

Major companies operating in the vision positioning system industry are ABB, Cognex Corporation, DJI, OMRON Corporation, SICK AG, FANUC CORPORATION, Qualcomm Technologies, Inc., Sony Corporation, Seegrid, Parrot Drone SAS, Pepperl+Fuchs SE, KEYENCE CORPORATION, Resonon Inc., Zebra Technologies Corporation, and Niantic.

In manufacturing and logistics, vision positioning systems are enhancing operational efficiency through improved robotics and automated guided vehicles (AGVs). The growing focus on smart infrastructure and digital transformation is further supporting market growth, with vision-based solutions playing a key role in enabling intelligent decision-making and safety enhancements.

Technological advancements in image processing, AI, and sensor fusion are contributing to the development of more reliable and cost-effective vision positioning systems across diverse applications.

- In February 2025, Realbotix Corp. unveiled its proprietary Robotic AI Vision System. The system integrates human recognition, object identification, and real-time scene awareness to enhance user interaction and situational awareness in humanoid robots.

Key Highlights

- The vision positioning system industry size was valued at USD 9,221.8 million in 2023.

- The market is projected to grow at a CAGR of 10.33% from 2024 to 2031.

- North America held a market share of 36.73% in 2023, valued at USD 3,387.2 million.

- The cameras segment garnered USD 3,975.5 million in revenue in 2023.

- The indoor segment is expected to reach USD 12,129.1 million by 2031.

- The automated guided vehicles (AGVs) segment is projected to generate a revenue of USD 8,433.7 million by 2031.

- The industrial segment is expected to reach USD 6,867.2 million by 2031.

- Asia Pacific is anticipated to grow at a CAGR of 10.71% over the forecast period.

Market Driver

"Advancements in AI and ML"

The vision positioning system market is experiencing significant growth, primarily fueled by advancements in artificial intelligence (AI) and machine learning, as well as the increasing demand for autonomous vehicles.

AI and machine learning technologies have revolutionized the capabilities of vision-based positioning systems by enabling them to process vast amounts of data in real-time. These technologies enhance a system's ability to identify, classify, and track objects with a level of precision that was previously unachievable.

For instance, machine learning algorithms can analyze visual data from cameras and sensors to detect features such as road signs, pedestrians, and obstacles, improving the system’s accuracy and reliability.

- In March 2025, oToBrite Electronics, Inc. showcased its Multi-camera Vision-AI Positioning System, oToSLAM, at Embedded World 2025. The VSLAM-based system enables high-precision indoor and outdoor mapping for autonomous robots and unmanned vehicles without relying on HD maps, LiDAR, or GNSS/RTK. The solution integrates object classification, 3D feature mapping, and edge AI computing, and has been deployed in XPENG’s Automated Parking Assist and other OEM AVP applications.

Market Challenge

"Accuracy Issues in Complex and Dynamic Environments"

A major challenge hindering the expansion of the vision positioning system market is the difficulty in maintaining consistent accuracy in complex and dynamic environments. Vision-based systems, such as cameras and optical sensors, rely on clear visual data to determine positioning.

However, environmental factors such as poor lighting, adverse weather conditions, or even temporary obstructions can significantly hinder a system's ability to gather accurate data.

In addition, vision systems face challenges in dynamic environments with rapid changes, such as dense crowds, sudden movements, or high noise levels. This leads to potential inaccuracies in position tracking, particularly in real-time scenarios where precise navigation is critical.

To address these challenges, companies are increasingly turning to sensor fusion technology, which combines visual data from cameras with data from other sensors, such as LiDAR, radar, and ultrasonic sensors. This fusion approach helps compensate for the weaknesses of each individual sensor, improving the overall robustness of the system.

Market Trend

"Integration with Sensors"

The vision positioning system market is experiencing significant growth, particularly sensor integration and miniaturization. Integrating complementary sensors such as LiDAR, radar, and GPS is improving the robustness, accuracy, and adaptability of navigation systems, particularly in challenging environments such as low-light or extreme weather conditions.

This trend is crucial for enhancing autonomous vehicles, robotics, and drones, where precise location tracking is essential in GPS-denied areas.

- In February 2025, ADASI and VentureOne partnered to integrate Perceptra, a GPS-less vision-based navigation system, and Saluki, a secure flight control technology developed by the Technology Innovation Institute, into autonomous UAV platforms. Unveiled at IDEX 2025, these technologies aim to enhance autonomous flight operations with high precision, resilience, and security in GNSS-denied environments.

Vision Positioning System Market Report Snapshot

|

Segmentation

|

Details

|

|

By Component

|

Cameras, Sensors, Markers, Others

|

|

By Location

|

Indoor, Outdoor

|

|

By Platform

|

Unmanned Aerial Vehicles (UAVs)/Drones, Automated Guided Vehicles (AGVs), Autonomous Underwater Vehicles (AUVs), Others

|

|

By End User

|

Retail, Industrial, Defense, Transportation and Logistics, Healthcare, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Component (Cameras, Sensors, Markers, and Others): The cameras segment earned USD 3,975.5 million in 2023, mainly due to their critical role in capturing high-resolution visual data essential for accurate positioning and navigation.

- By Location (Indoor and Outdoor): The indoor segment held a share of 58.44% in 2023, fueled by increasing deployment of vision positioning systems in warehouses, manufacturing plants, and retail environments.

- By Platform (Unmanned Aerial Vehicles (UAVs)/Drones, Automated Guided Vehicles (AGVs), Autonomous Underwater Vehicles (AUVs), and Others): The automated guided vehicles (AGVs) segment is projected to reach USD 8,433.7 million by 2031, attributed to rising automation in logistics and manufacturing operations requiring precise indoor navigation.

- By End User (Retail, Industrial, Defense, Transportation and Logistics, Healthcare, and Others): The industrial segment is projected to reach USD 6,867.2 million by 2031, propelled by the growing adoption of vision-based systems for process optimization, safety, and quality control in smart factories.

Vision Positioning System Market Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

North America vision positioning system market accounted for a substantial share of 36.73% in 2023, valued at USD 3,387.2 million. This dominance is largely attributed to the region’s early adoption of advanced technologies in autonomous systems and industrial automation.

The presence of major players in the fields of robotics, aerospace, and logistics, particularly in the United States, has accelerated the integration of vision positioning systems across key applications.

Additionally, the demand for warehouse automation and autonomous delivery systems from major e-commerce and retail companies has significantly contributed to regional market expansion.

North America's strong R&D infrastructure and rapid adoption of computer vision and AI technologies in sectors such as automotive and defense have reinforced its leading position.

Moreover, significant investments in autonomous vehicle development and advanced manufacturing facilities further support the growth of vision positioning solutions across both indoor and outdoor applications.

Asia Pacific vision positioning system industry is expected to register the fastest CAGR of 10.71% over the forecast period. This rapid growth is propelled by the surge in manufacturing automation across China, Japan, and South Korea, where vision positioning systems are being extensively integrated into industrial robots and AGVs.

In China, the expanding e-commerce sector and smart logistics infrastructure have led to increased investments in warehouse automation, while Japan’s focus on robotics innovation has supported widespread adoption of visual navigation technologies.

Additionally, South Korea’s advancements in semiconductor and electronics manufacturing are promoting the use of high-precision vision systems in assembly and inspection processes.

Furthermore, India is emerging as a key market, supported by the growth of tech startups and increased investment in drone-based services for agriculture and infrastructure monitoring.

The region's emphasis on localized production, export-driven industrial output, and strategic focus on digital transformation across diverse sectors further supports regional market growth.

- In September 2024, Air India introduced ‘AEYE Vision’ on its mobile app, a feature powered by AI-based computer vision technology. It enables passengers to scan codes on tickets, boarding passes, and baggage tags to access real-time trip details, improving the mobile app experience for seamless navigation and updates.

Regulatory Frameworks

- In the United States, vision positioning systems are regulated under the Federal Aviation Administration (FAA) regulations for unmanned aerial systems and the National Highway Traffic Safety Administration (NHTSA) guidelines for advanced driver-assistance systems (ADAS). Additionally, the Federal Communications Commission (FCC) oversees spectrum usage for systems with wireless communication.

- In the European Union, vision positioning systems must comply with the Radio Equipment Directive (RED) for wireless components and the General Product Safety Directive (GPSD). For automotive applications, UNECE regulations for Advanced Emergency Braking Systems (AEBS) may also apply.

- In China, the Ministry of Industry and Information Technology (MIIT) and the Civil Aviation Administration of China (CAAC) regulate vision-based systems in industrial robots and unmanned aerial vehicles (UAVs), along with mandatory GB/T technical standards for intelligent connected vehicles.

- In Japan, the Ministry of Land, Infrastructure, Transport and Tourism (MLIT) enforces regulations for vehicle-integrated vision systems under the Road Transport Vehicle Act, while the Civil Aviation Bureau manages UAV-related vision technologies.

- In India, the Directorate General of Civil Aviation (DGCA) oversees vision systems in drones under the Drone Rules 2021, and the Ministry of Road Transport and Highways (MoRTH) regulates automotive applications via Automotive Industry Standards (AIS) for ADAS components.

Competitive Landscape

Major participants in the vision positioning system industry are investing heavily in R&D to enhance the precision, speed, and adaptability of vision-based navigation technologies.

Companies are focusing on developing proprietary algorithms and software platforms that integrate artificial intelligence and machine learning to improve object detection, obstacle avoidance, and spatial mapping capabilities.

Strategic partnerships and collaborations with drone manufacturers, robotics firms, and industrial automation providers are enabling players to integrate their solutions across a wide range of platforms and applications.

Several players are expanding their product portfolios with modular and customizable solutions to cater to diverse end-user requirements across warehouse automation, autonomous vehicles, and UAVs. Additionally, they are entering emerging markets capitalize on growth in industrial and logistics sectors.

Mergers and acquisitions are being leveraged to gain access to advanced technologies, skilled talent, and established customer bases, strengthening their competitive position in a rapidly evolving landscape.

- In February 2025, Topcon Agriculture and Bonsai Robotics launched a joint initiative to advance agricultural automation in permanent crops. The collaboration integrates Bonsai Robotics’ vision-based autonomous navigation with Topcon Agriculture’s precision sensors, connectivity, and smart implement technology to enhance efficiency and productivity in orchards.

List of Key Companies in Vision Positioning System Market:

- ABB

- Cognex Corporation

- DJI

- OMRON Corporation

- SICK AG

- FANUC CORPORATION

- Qualcomm Technologies, Inc.

- Sony Corporation

- Seegrid

- Parrot Drone SAS

- Pepperl+Fuchs SE

- KEYENCE CORPORATION

- Resonon Inc.

- Zebra Technologies Corporation

- Niantic

Recent Developments (Acquisition/ Product Launches)

- In March 2025, Maxar Intelligence launched Raptor, a software suite designed to enable autonomous drones to navigate and extract accurate ground coordinates in GPS-denied environments. The Raptor suite utilizes Maxar’s 3D global terrain data to deliver vision-based positioning for unmanned systems, enhancing autonomy across defense, commercial, and humanitarian sectors.

- In February 2025, NewSpace Research & Technologies unveiled its Visual Navigation System (VNS), a vision-based navigation solution designed for operations in GNSS-denied environments. The system enables drones to navigate without relying on GPS or radio signals, using onboard intelligence and visual cues for autonomous operation.

- In July 2024, onsemi acquired SWIR Vision Systems, a leading provider of CQD short wavelength infrared (SWIR) technology. The acquisition aims to enhance onsemi’s intelligent sensing product portfolio by integrating SWIR technology with its CMOS sensors, expanding capabilities in industrial, automotive, and defense applications.

- In May 2024, Nikon Corporation announced its plan to launchindustrial robot vision system designed for robot arms. Utilizing high-speed cameras and image processing, the system enables dynamic vision and object recognition for applications such as bin picking and vision tracking. With measurement speeds of up to 250fps, it enhances productivity in industrial environments by enabling flexible, accurate, and user-friendly robotic operations without external positioning infrastructure.