Sensor Fusion Market Size

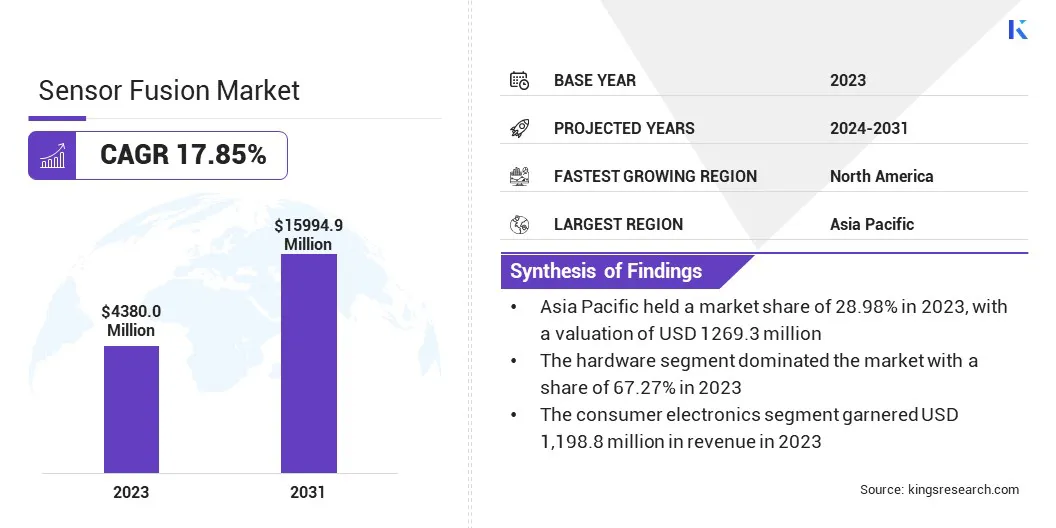

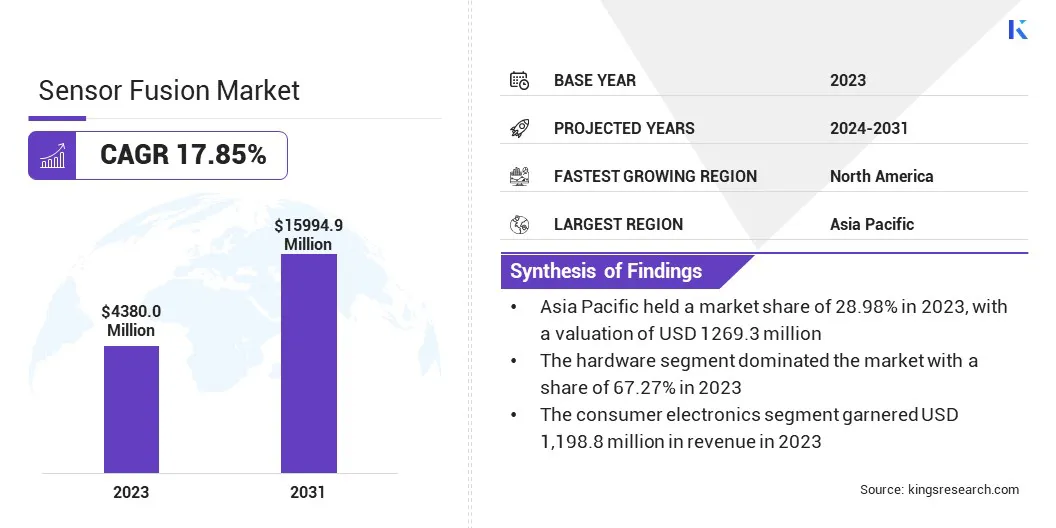

The global Sensor Fusion Market size was valued at USD 4,380.0 million in 2023 and is projected to reach USD 15,994.9 million by 2031, growing at a CAGR of 17.85% from 2024 to 2031. In the scope of work, the report includes solutions offered by companies such as NXP Semiconductors, STMicroelectronics, Bosch Sensortec GmbH, Infineon Technologies AG, Renesas Electronics, TDK Corporation, Murata Manufacturing Co., Ltd., Analog Devices, Inc., ROHM Co., Ltd., BASELABS GmbH and Others.

The sensor fusion market is experiencing robust growth, driven by the increasing demand for integrated solutions across various industries. Currently, the market is characterized by a surge in adoption across the automotive, consumer electronics, healthcare, aerospace, and defense sectors. The automotive industry, in particular, is witnessing significant traction with the integration of sensor fusion technology in advanced driver assistance systems (ADAS) and autonomous vehicles.

Moreover, the proliferation of IoT devices and wearable technology is expanding the application scope of sensor fusion, thereby driving market growth. The market is poised to witness continued expansion in the near future, fueled by technological advancements, rising investments in research and development, and the growing need for data-driven decision-making processes.

Analyst’s Review

The growing demand for miniaturization in the automotive industry is a vital trend shaping the sensor fusion market outlook for the forecast years. As vehicles become increasingly connected and autonomous, the need for compact and lightweight sensor fusion solutions is gaining prominence. Miniaturization enables the integration of multiple sensors seamlessly into vehicles, facilitating advanced functionalities such as collision avoidance, lane departure warning, and pedestrian detection.

Additionally, miniaturized sensor fusion systems contribute to improving fuel efficiency and overall vehicle performance. With automakers increasingly focusing on enhancing safety and efficiency while reducing the footprint of onboard electronics, the demand for miniaturized sensor fusion solutions is expected to surge in the forthcoming years.

Market Definition

Sensor fusion refers to the process of combining data from multiple sensors to obtain a more accurate and comprehensive understanding of a system or environment. This technology typically involves algorithms that integrate data from numerous sensors such as cameras, radars, LiDAR, GPS receivers, accelerometers, gyroscopes, and magnetometers. The fusion algorithm analyzes and synthesizes the data to provide actionable insights, enhancing decision-making processes across various applications.

Key applications of sensor fusion include ADAS and autonomous driving systems, industrial automation, healthcare monitoring, environmental sensing, virtual reality, augmented reality, and robotics. By leveraging data fusion techniques, sensor fusion enables improved perception, navigation, object detection, motion tracking, and situational awareness, which drives efficiency, safety, and innovation across industries.

Sensor Fusion Market Dynamics

Increasing demand for ADAS systems and autonomous vehicles is a key factor propelling the growth of the sensor fusion market. ADAS systems rely extensively on sensor fusion technology to perceive the vehicle's surroundings accurately and make real-time decisions to enhance safety and driving comfort. By integrating data from cameras, radars, LiDAR, and other sensors, sensor fusion enables features such as adaptive cruise control, lane-keeping assist, automatic emergency braking, and blind-spot detection.

Similarly, autonomous vehicles heavily depend on sensor fusion for precise localization, mapping, path planning, and obstacle detection to navigate safely and efficiently without human intervention. As the automotive industry continues to prioritize advancements in vehicle automation and safety, the demand for sensor fusion solutions is expected to rise, thereby contributing significantly to sensor fusion market development.

The absence of standardization in sensor fusion systems poses a significant restraint to market growth. With the proliferation of sensors and the integration of heterogeneous sensor types in various applications, ensuring interoperability and compatibility among different sensor fusion systems becomes challenging. The lack of standardized protocols, interfaces, and data formats complicates integration efforts, impeding seamless communication and data exchange between different sensor modules and processing units.

Additionally, divergent methodologies and algorithms employed by different sensor fusion solutions hinder interoperability and limit scalability across diverse applications and platforms. Addressing standardization challenges is essential to unlock the full potential of sensor fusion technology and facilitate broader adoption across industries, thereby supporting market expansion.

Segmentation Analysis

The global sensor fusion market is segmented based on component, technology, application, and geography.

By Component

Based on component, the sensor fusion market is bifurcated into hardware and software. The hardware segment dominated the market with a share of 67.27% in 2023, fostered by the widespread adoption of sensor fusion technology across various industries. Hardware components such as sensors, processors, microcontrollers, and memory modules play a critical role in capturing, processing, and transmitting data for sensor fusion applications. The increasing demand for integrated sensor solutions, advancements in sensor technologies, and the growing need for real-time data processing capabilities have propelled the adoption of sensor fusion hardware components.

Moreover, the automotive sector's growing emphasis on safety, efficiency, and automation has driven substantial investments in sensor fusion hardware, thereby fueling the growth of the segment. As industries continue to leverage sensor fusion technology for diverse applications, the demand for hardware components is expected to remain robust, contributing to the segment's dominance in the market.

By Technology

Based on technology, the sensor fusion market is divided into MEMS and non-MEMS. The non-MEMS segment is expected to grow at the fastest CAGR of 18.57% over the forecast period due to the increasing adoption of sensor fusion technology in diverse applications. Non-MEMS (Micro-Electro-Mechanical Systems) components include cameras, radars, LiDAR, GPS receivers, and other sensors that are crucial for capturing environmental data. These sensors provide essential inputs for sensor fusion algorithms to generate accurate and reliable insights for decision-making processes.

With the proliferation of IoT devices, autonomous systems, and smart technologies, the demand for non-MEMS sensors is on the rise across the automotive, consumer electronics, industrial automation, healthcare, and aerospace sectors. Additionally, advancements in sensor technologies, such as higher resolution, improved accuracy, and reduced power consumption, are driving the adoption of non-MEMS sensors, fueling the segment's rapid growth in the market.

By Application

By application, the sensor fusion market is categorized into consumer electronics, automotive, healthcare, military, and others. The consumer electronics segment garnered the highest valuation of USD 1,198.8 million in 2023, mainly propelled by the increasing integration of sensor fusion technology in smartphones, wearables, and other portable devices. Consumer electronics manufacturers are leveraging sensor fusion to enhance user experiences, enable new functionalities, and improve device performance. Features such as gesture recognition, activity tracking, augmented reality, and virtual reality rely heavily on sensor fusion algorithms to fuse data from multiple sensors and deliver immersive and intuitive interactions.

Additionally, the rising demand for smartwatches, fitness trackers, and other wearable devices equipped with sensor fusion capabilities is supporting the expansion of the consumer electronics segment. As consumer preferences shift towards connected and intelligent devices, the adoption of sensor fusion technology is expected to accelerate, further propelling the segment's valuation in the forthcoming years.

Sensor Fusion Market Regional Analysis

Based on region, the global sensor fusion market is classified into North America, Europe, Asia Pacific, MEA, and Latin America.

The Asia Pacific Sensor Fusion Market share stood around 28.98% in 2023 in the global market, with a valuation of USD 1269.3 million, primarily driven by rapid industrialization, urbanization, and technological advancements in countries such as China, Japan, South Korea, and India. The region's automotive sector is experiencing significant growth, with increasing investments in ADAS, autonomous vehicles, and electric vehicles.

Moreover, the adoption of sensor fusion technology is gaining momentum across diverse industries such as consumer electronics, healthcare, aerospace, and defense, fueled by the region's growing population, rising disposable income, and expanding middle-class demographic. Government initiatives to promote technological innovation, smart city development, and infrastructure modernization are further boosting sensor fusion market growth in Asia Pacific.

Competitive Landscape

The global sensor fusion market report will provide valuable insight with an emphasis on the fragmented nature of the industry. Prominent players are focusing on several key business strategies such as partnerships, mergers and acquisitions, product innovations, and joint ventures to expand their product portfolio and increase their market shares across different regions. Expansion & investments are the major strategic initiatives adopted by companies in this sector. Industry players are investing extensively in R&D activities, building new manufacturing facilities, and supply chain optimization.

List of Key Companies in Sensor Fusion Market

- NXP Semiconductors

- STMicroelectronics

- Bosch Sensortec GmbH

- Infineon Technologies AG

- Renesas Electronics

- TDK Corporation

- Murata Manufacturing Co., Ltd.

- Analog Devices, Inc.

- ROHM Co., Ltd.

- BASELABS GmbH

Key Industry Developments

- January 2024 (Launch): TDK Corporation unveiled its newest addition, the KLZ2012-A series inductor, tailored specifically for automotive audio bus (A2B) applications. These multilayer inductors promise a broad operational range, robust durability, and exceptional inductance tolerance.

- January 2024 (Launch): NXP Semiconductors expanded its automotive radar one-chip family with the introduction of the SAF86xx. This new chip features an integrated radar transceiver, multi-core radar processor, and MACsec hardware engine for advanced secure automotive Ethernet communication.

- January 2023 (Collaboration): TDK Corporation introduced the TDK i3 Micro Module, a groundbreaking product featuring integrated edge AI and wireless mesh connectivity, developed in collaboration with Texas Instruments.

- November 2022 (Launch): STMicroelectronics introduced the LSM6DSV16X, a leading-edge 6-axis inertial measurement unit (IMU) integrating ST’s Sensor Fusion Low Power (SFLP) technology, Artificial Intelligence, and adaptive-self-configuration (ASC) to deliver exceptional power optimization.

- August 2022 (Acquisition): Renesas Electronics Corporation finalized a definitive agreement for the acquisition of Steradian Semiconductors Private Limited, an Indian fabless semiconductor company specializing in 4D imaging radar solutions.

The Global Sensor Fusion Market is Segmented as:

By Component

By Technology

By Algorithm

- Kalman Filter

- Bayesian Filter

- Central Limit Theorem

- Convolutional Neural Networks

By Application

- Consumer Electronics

- Automotive

- Healthcare

- Military

- Others

By Region

- North America

- Europe

- France

- UK

- Spain

- Germany

- Italy

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia Pacific

- Middle East & Africa

- GCC

- North Africa

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America