Market Definition

Titanium dioxide is a naturally occurring oxide of titanium, commonly used as a white pigment due to its brightness and high refractive index. It is widely utilized in various products such as paints, coatings, sunscreens, and food additives. Titanium dioxide is valued for its UV-blocking properties, and chemical stability, which enhance the appearance and durability of products.

Titanium Dioxide Market Overview

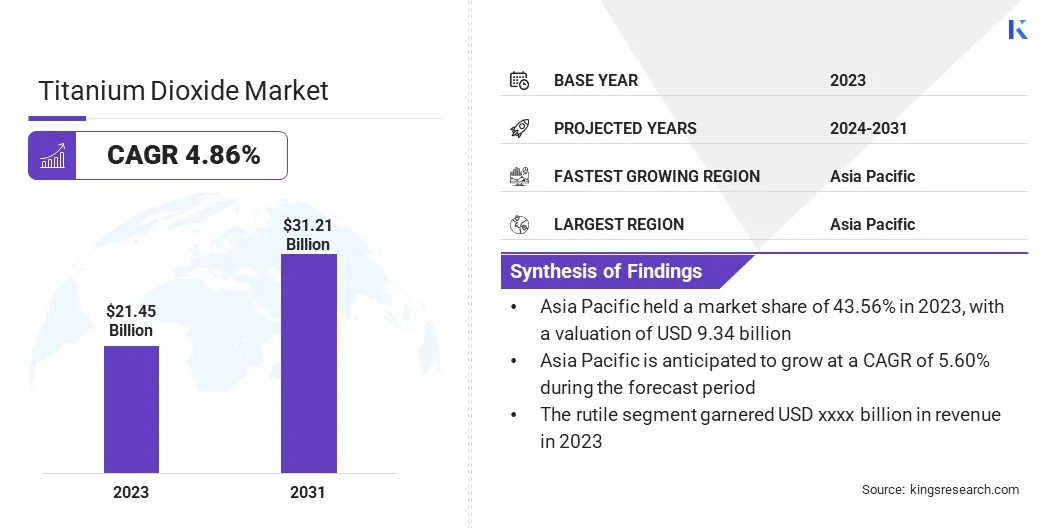

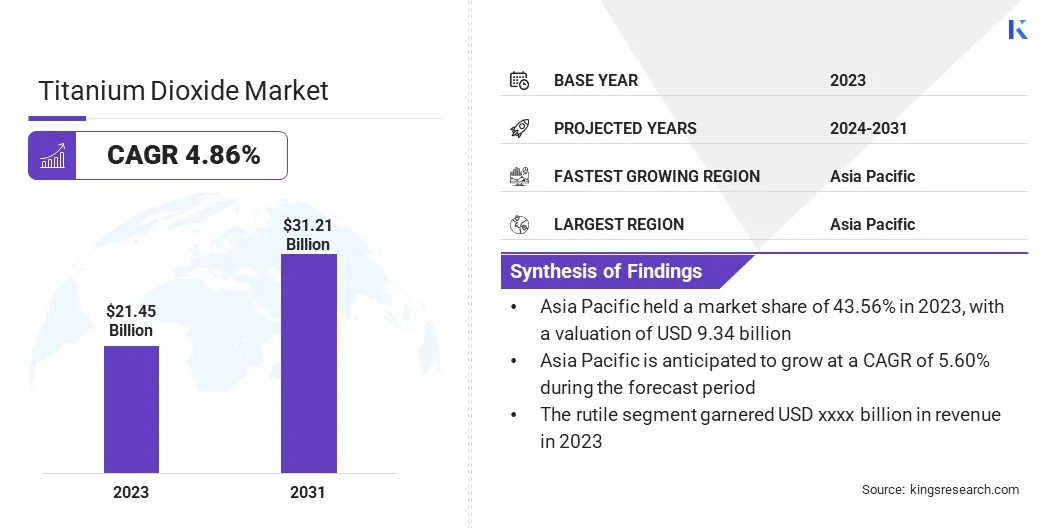

Global titanium dioxide market size was valued at USD 21.45 billion in 2023 and is projected to grow from USD 22.39 billion in 2024 to USD 31.21 billion by 2031, exhibiting a CAGR of 4.86% during the forecast period.

The growth of the market is driven by its widespread use as a white pigment in a range of applications, including paints and coatings, plastics, paper, and cosmetics. As a versatile material, titanium dioxide is highly preferred for its brightness, high opacity, and UV filtering properties, making it ideal for use in products such as sunscreens and paints.

Major companies operating in the titanium dioxide industry are The Chemours Company, Tronox Holdings Plc, Venator Materials PLC, Kronos Worldwide, Inc., TAYCA Co., Ltd., INEOS Capital Limited., LB Group, ISHIHARA SANGYO KAISHA, LTD., Brenntag SE, Grupa Azoty S.A., Cinkarna Celje, AGROFERT, a.s., Iluka Resources Limited, C&G Pigment, American Elements, and others.

The demand for titanium dioxide is largely influenced by the growth of the construction, automotive, and consumer goods industries, as these sectors increasingly rely on high-quality coatings and materials.

Additionally, the rising demand for eco-friendly and sustainable products has fueled the adoption of titanium dioxide in applications such as solar energy and water purification, mainly due to its photocatalytic properties.

Key Highlights:

- The titanium dioxide industry size was recorded at USD 21.45 billion in 2023.

- The market is projected to grow at a CAGR of 4.86% from 2024 to 2031.

- Asia Pacific held a share of 43.56% in 2023, valued at USD 9.34 billion and is anticipated to grow at a CAGR of 5.60% through the forecast period.

- The rutile segment garnered USD 16.30 billion in revenue in 2023.

- The sulfate process segment is expected to reach USD 15.97 billion by 2031.

- The paints and coatings segment is projected to generate a revenue of USD 18.53 billion by 2031.

Market Driver

"Rising Demand for Paints and Coatings"

The increasing demand for paints and coatings, particularly in the construction and automotive sectors, boosts the use of titanium dioxide, which is integral to opacity, whiteness, and durability. This demand is particularly prominent in emerging markets due to rapid urbanization and infrastructure development.

In addition,growing use in the plastics industry is fueling the growth of the titanium dioxide market, as it enhances product performance by improving their opacity, UV resistance, and overall longevity. As industries focus on sustainability, titanium dioxide is increasingly used in eco-friendly applications, including solar cells and energy-efficient coatings.

Its non-toxic properties and ability to improve product lifespan make it an attractive option for companies seeking environmentally conscious solutions.

- In January 2023, Chemours introduced Ti-Pure TS-1510, a rutile titanium dioxide pigment for plastics that reduces carbon footprint by up to 6%. This innovation boosts processing efficiency, cuts energy use, increases productivity, and offers smaller packaging, supporting sustainability and cost savings for masterbatch producers.

Market Challenge

"Rising Environmental Concerns and Volatile Prices of Raw Materials"

The volatility in the prices of key raw materials, such as ilmenite and rutile, is increasing production costs, which is hampering the growth of the titanium dioxide industry. Fluctuating raw material prices, driven by factors like supply chain disruptions and limited availability, create unpredictability for manufacturers, making cost management more difficult.

To mitigate this, manufacturers are investing in more efficient extraction and processing techniques to reduce dependency on unstable raw material supplies. Additionally, stringent environmental regulations on emissions and waste disposal are adding pressure, as companies must adopt cleaner production methods and invest in waste management solutions to comply with evolving standards.

The growing demand for sustainable products is also challenging manufacturers to develop eco-friendly alternatives, including lower-carbon-footprint pigments and recycled materials, while balancing costs and product performance.

Market Trend

"Integration in Cosmetics and High Demand in Coatings"

The growing demand for durable, high-quality coatings in the automotive and aerospace sectors is emerging as a notable trend in the titanium dioxide market.

This trend is further fueled by the need for coatings that offer superior protection against harsh environmental conditions, enhancing the longevity and appearance of vehicles and aircraft. This has led to the development of TiO2 grades that offer improved adhesion, corrosion resistance, and durability, further boosting their application in these industries.

The growing use of TiO2 in the cosmetics and personal care industry, particularly in sunscreens and skincare products, is bolstering market growth as consumers are becoming more conscious of the ingredients in their daily products.

TiO2’s natural UV-blocking properties are fostering innovation in sun protection, enhancing skin compatibility and safer formulations. Additionally, the use of nano-sized TiO2 is expanding, supported by its unique properties such as enhanced photoreactivity, self-cleaning abilities, and superior coverage.

Nano TiO2 is being increasingly utilized in a variety of applications, including advanced coatings, solar cells, and even medical products, due to its ability to provide improved functionality and performance across high-tech industries.

Titanium Dioxide Market Report Snapshot

| Segmentation |

Details |

| By Grade |

Anatase, Rutile |

| By Process |

Sulfate Process, Chloride Process |

| By Application |

Paints and Coatings, Plastics, Paper & Pulp, Cosmetics, Others |

| By Region |

North America: U.S., Canada, Mexico |

| Europe: France, U.K., Spain, Germany, Italy, Russia, Rest of Europe |

| Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific |

| Middle East & Africa: Turkey, UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa |

| South America: Brazil, Argentina, Rest of South America |

Market Segmentation:

- By Grade (Anatase and Rutile): The rutile segment earned USD 16.30 billion in 2023, mainly due to its high demand in the production of high-performance coatings, pigments, and plastics.

- By Process (Sulfate Process and Chloride Process): The chloride process segment held a notable share of 52.37% in 2023, fueled by its ability to produce high-purity titanium dioxide with lower environmental impact and reduced production costs.

- By Application (Paints and Coatings, Plastics, Paper & Pulp, Cosmetics, and Others): The paints and coatings segment is projected to reach USD 18.53 billion by 2031, attributed to the increasing demand for high-quality and durable coatings in construction, automotive, and industrial sectors.

Titanium Dioxide Market Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

Asia Pacific titanium dioxide market accounted for a substantial share of 43.56% and was valued at USD 9.34 billion in 2023. This dominance is attributed to the strong industrial base in countries such as China and India, supported by the growing demand for titanium dioxide in sectors such as paints and coatings, plastics, and paper & pulp.

The rapid expansion of the construction and automotive industries in the region, coupled with rising consumer demand for high-quality products, further contributes to this growth. Moreover, the increasing adoption of eco-friendly and sustainable solutions is expected to fuel regional market growth in the coming years.

Europe titanium dioxide industry is expected to grow at the fastest CAGR of 4.98% through the projection period. This growth is mainly propelled by the robust demand for titanium dioxide in the automotive, construction, and packaging industries, particularly in major countries such as Germany and France.

Regulatory initiatives promoting the use of sustainable and low-VOC (volatile organic compound) products are boosting the demand for high-quality titanium dioxide in paints and coatings.

Additionally, the presence of major players and increased investments in research and development to improve production processes and product quality are stimulating regional market expansion.

Regulatory Framework Also Plays a Significant Role in Shaping the Market

- The U.S. the FDA regulates titanium dioxide as a food additive, ensuring compliance with strict limits on particle size and purity. In industrial applications, the Occupational Safety and Health Administration (OSHA) oversee workplace exposure limits, while the Environmental Protection Agency (EPA) monitors environmental emissions under the Clean Air Act and Toxic Substances Control Act.

- In Europe, the European Food Safety Authority (EFSA) reassessed titanium dioxide safety, leading to a European Union-wide ban on its use as a food additive (E171) in 2022. Industrial applications fall under the Registration, Evaluation, Authorisation and Restriction of Chemicals (REACH) regulation, with certain forms classified as potentially carcinogenic via inhalation by the European Chemicals Agency (ECHA). Its environmental impact is managed under the EU Waste Framework Directive (WFD).

- In China, the National Medical Products Administration (NMPA) regulates the use of titanium dioxide in pharmaceuticals and cosmetics, with increasing scrutiny on nano-sized particles due to potential health risks. The Ministry of Ecology and Environment (MEE) oversees emissions and waste management from titanium dioxide production.

- In Japan, the Pharmaceuticals and Medical Devices Agency (PMDA) regulates the use of titanium dioxide in pharmaceuticals, ensuring adherence to international safety standards. Industrial exposure limits are managed by the Japan Industrial Safety and Health Association (JISHA), while cosmetic applications follow guidelines set by the Ministry of Health, Labour and Welfare (MHLW).

- On the international stage, the WHO and the Food and Agriculture Organization (FAO) Codex Alimentarius provide general guidelines on food safety, recommending precautionary approaches regarding titanium dioxide exposure. The Organisation for Economic Co-operation and Development (OECD) is developing standardized testing protocols for titanium dioxide nanoparticles, focusing on health and environmental risks.

Competitive Landscape

The titanium dioxide industry is characterized by a number of participants, including both established corporations and rising organizations. The market is highly competitive, with key players leveraging extensive production capabilities, advanced technological innovations, and global distribution networks.

Companies are focusing on enhancing product quality, improving manufacturing processes, and meeting the increasing demand for sustainable and eco-friendly solutions.

Companies are investing in new facilities and upgrading existing ones to boost production capacity and improve efficiency. By enhancing their manufacturing infrastructure, these companies aim to achieve economies of scale, reduce costs, and meet the needs of diverse industries

- In June 2024, The Chemours Company resumed production at its titanium dioxide (TiO2) manufacturing facility in Altamira, Mexico, following the Mexican government's removal of previous water intake restrictions, restoring normal operations.

List of Key Companies in Titanium Dioxide Market:

- The Chemours Company

- Tronox Holdings Plc

- Venator Materials PLC

- Kronos Worldwide, Inc.

- TAYCA Co., Ltd.

- INEOS Capital Limited.

- LB Group

- ISHIHARA SANGYO KAISHA, LTD.

- Brenntag SE

- Grupa Azoty S.A.

- Cinkarna Celje

- AGROFERT, a.s.

- Iluka Resources Limited

- C&G Pigment

- American Elements