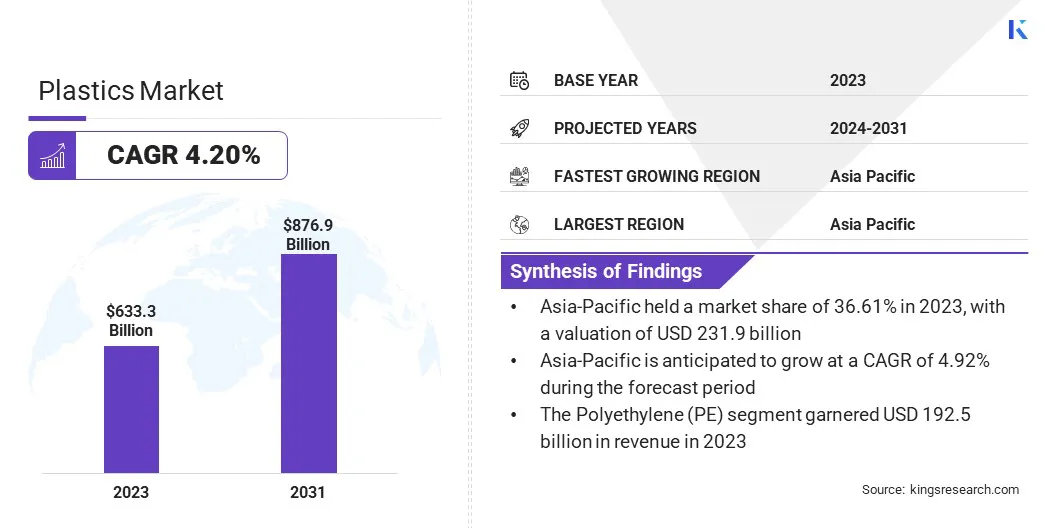

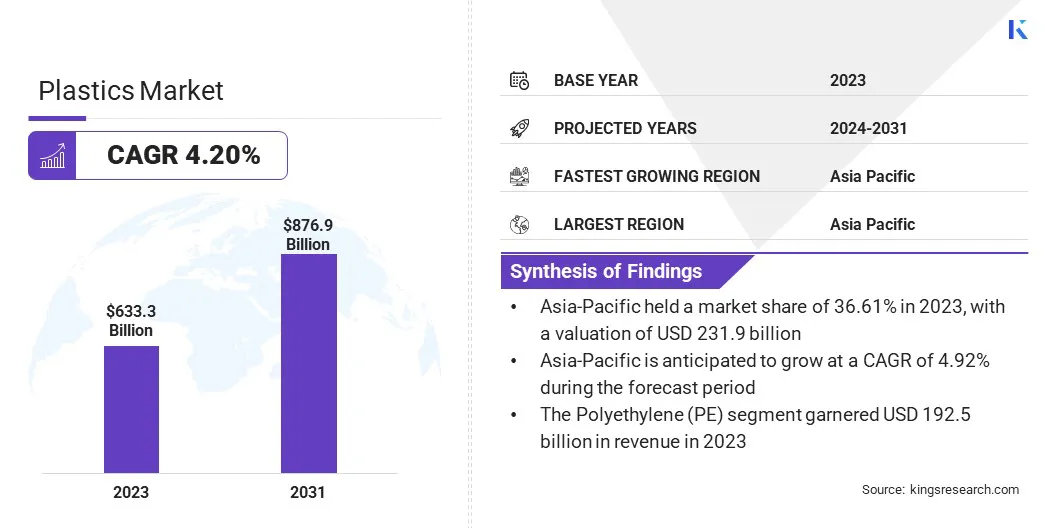

Plastics Market Size

The Global Plastics Market size was valued at USD 633.3 billion in 2023 and is projected to grow from USD 657.3 billion in 2024 to USD 876.9 billion by 2031, exhibiting a CAGR of 4.20% during the forecast period. The growing demand for plastics is driven by their wide range of applications across the automotive, packaging, construction, electrical and electronics, and healthcare industries.

In the scope of work, the report includes products offered by companies such as BASF, Chevron Phillips Chemical Company LLC, Exxon Mobil Corporation, Celanese Corporation, Sumitomo Chemical Co., Ltd., Reliance Industries Limited, LOTTE Chemical CORPORATION, Covestro AG, Braskem, Ducor Petrochemicals, and others.

The global plastics market is experiencing steady growth, driven by their increasing demand across various industries, including automotive, packaging, construction, and healthcare. As a versatile material, plastics are valued for their durability, lightweight nature, and cost-effectiveness.

Innovations in plastic formulations and production processes continue to improve material performance and sustainability. However, increasing regulations around plastic waste management and environmental impact are shaping the industry’s future.

With a significant role in both developed and emerging markets, the plastics industry is adapting to changing consumer needs while maintaining its prominence in various industrial sectors.

- The Extended Producer Responsibility (EPR) under the Plastic Waste Management Rules, 2016 in India, mandates that producers, importers, and brand owners are responsible for managing plastic packaging waste through recycling, reuse, or disposal.

The market involves the production, processing, and distribution of plastic materials, which are synthetic substances made from different types of polymers. These materials are used across various sectors, due to their versatility, durability, and cost-effectiveness.

Plastics are used to manufacture products used in daily life and across diverse industries, including automotive, construction, packaging, and healthcare. The market is segmented into two primary categories: by product type and by end-use industry. This segmentation allows for a more detailed understanding of market dynamics and demand across different product forms and industrial applications.

As the market evolves, it continues to adapt to technological innovations and regulatory changes, aiming for sustainability and efficiency in production and consumption.

- In November 2024, a breakthrough in plastic technology was announced by the RIKEN Center for Emergent Matter Science (CEMS), with the development of a durable plastic that does not contribute to microplastic pollution in oceans. This new material is as strong as conventional plastics and biodegradable; however, its key feature is its ability to break down in seawater. The innovation is expected to significantly reduce harmful microplastic pollution that accumulates in oceans and soil, ultimately preventing these particles from entering the food chain.

Analyst’s Review

The plastics market is experiencing a positive shift as it embraces sustainability and innovation. While demand for plastic products remains strong, manufacturers should focus on increasingly adopting eco-friendly practices, such as developing biodegradable materials and improving recycling technologies.

The industry is poised for long-term growth with advancements in circular economy models and growing investments in sustainable solutions. Stricter regulations on plastic waste will drive positive change, pushing for cleaner, more efficient production methods.

As the market evolves, it presents exciting opportunities for both innovation and environmental responsibility, ensuring plastics remain a valuable material in the future.

- In December 2024, the European Bioplastics concluded the 19th edition of the European Bioplastics Conference (EBC24) in Berlin and online. The event featured presentations, panel discussions, and market data analysis, covering advancements in bioplastics, their environmental impacts, sustainability milestones, and insights from major markets like Europe, the U.S., the Middle East, and China.

Plastics Market Growth Factors

The plastics market is experiencing growth driven by their increasing demand across multiple sectors. The food & beverage industry’s expansion is boosting the need for packaging, while the automotive sector’s growth is driving the demand for lightweight plastic components, particularly in electric vehicles (EVs) to improve fuel efficiency.

Additionally, plastics are replacing metals like aluminum and iron in various applications due to their superior strength, flexibility, and reliability. These factors collectively support the continued demand for plastics, as industries seek to leverage their versatility and performance benefits to meet evolving market requirements and sustainability goals.

- In May 2024, the American Chemistry Council (ACC) highlighted the growing use of plastics in EVs. The rise in EV production led to the increased demand for plastic components, with EVs incorporating significantly more plastic than traditional vehicles. Plastics not only enhance fuel efficiency but also contribute to vehicle safety through advanced materials like fiber-reinforced polymers and composites, which absorb impact and support safety technologies. The shift toward plastics in the automotive sector underscores the evolving role of plastics in modern transportation.

The plastics industry faces significant challenges, due to the growing environmental pollution caused by plastic waste. Despite the increasing global demand for plastics, a large portion of plastic waste is not recycled, leading to pollution in oceans, rivers, and landfills. This accumulation poses serious threats to ecosystems, wildlife, and human health.

To address these challenges, the industry must adopt more sustainable practices, such as improving recycling technologies, increasing the use of biodegradable materials, and enforcing stricter regulations on plastic waste management. Additionally, promoting a circular economy and public awareness can reduce the adverse effects of plastics on the environment.

Plastics Industry Trends

The plastics market is facing a growing trend toward sustainability, driven by increasing consumer and regulatory demands for eco-friendly materials. Industries are trying to reduce their environmental impact, leading to the rise of biodegradable plastics, recyclable materials, and alternatives to traditional plastic.

This shift is influencing manufacturing processes, with companies exploring more sustainable options to meet consumer expectations and comply with regulations. As sustainability becomes a key market driver, the industry is evolving to integrate greener solutions while maintaining performance and cost-efficiency.

Many companies are embracing circular economy models, which prioritize reusing, refurbishing, and recycling plastics to reduce waste and lessen environmental impact. Businesses are finding new ways to extend the life cycle of plastic products by shifting away from the traditional make and dispose model.

This approach encourages the use of recycled materials in manufacturing, reduces the need for virgin plastic, and minimizes the amount of plastic waste sent to landfills. As part of this transition, companies are also investing in innovative technologies to enhance recycling processes, promoting sustainability and contributing to a more environmentally responsible plastics industry.

- In August 2024, researchers at UC Berkeley discovered a process that vaporizes plastic bags and bottles, yielding gases that can be used to make new, recycled plastics. This innovative process efficiently reduces polymers to chemical precursors, bringing a circular economy for plastics one step closer to reality. By transforming plastic waste into valuable materials for reuse, this development supports the principles of a circular economy by minimizing waste, reducing the need for new raw materials, and promoting sustainability through recycling.

Segmentation Analysis

The global market is segmented based on product type, end-use industry, and geography.

By Product Type

Based on product type, the market has been segmented into polyethylene (PE), polypropylene (PP), polyvinyl chloride (PVC), polystyrene (PS), polycarbonate (PC), and others. The PE segment led the plastics market in 2023, reaching the valuation of USD 192.5 billion. PE is a widely used type of plastic, due to its flexibility, strength, and affordability.

It is highly resistant to moisture, chemicals, and environmental stress, making it ideal for applications like packaging, containers, pipes, and films. The market expansion of PE is largely driven by its versatility, as it can be tailored to suit a wide range of industries, including food packaging, construction, and healthcare.

Additionally, its recyclability and lightweight nature align with the growing demand for sustainable solutions. As industries focus on eco-friendly packaging and products, the use of PE continues to increase, fueling market growth.

By End-use Industry

Based on end-use industry, the market has been classified into automotive, packaging, construction, electrical & electronics, healthcare, and others. The packaging segment is poised for significant growth at a CAGR of 5.12% through the forecast period.

Use of plastics in the packaging industry has registered significant expansion, due to their versatility, cost-effectiveness, and ability to meet the growing demand for innovative, lightweight, and protective packaging solutions. Plastics such as PE and PP are widely used in food & beverage, cosmetics, and consumer goods packaging, as they offer durability, moisture resistance, and flexibility.

The increasing need for sustainable packaging alternatives has further propelled this growth, with manufacturers focusing on recyclable, biodegradable, and reusable plastics to address environmental concerns. As e-commerce and global trade continue to rise, the demand for efficient and protective packaging solutions using plastics is expected to keep expanding.

Plastics Market Regional Analysis

Based on region, the global market is classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

Asia Pacific accounted for 36.61% share of the global plastics market in 2023, with a valuation of USD 231.9 billion. Asia Pacific is the dominant region in the market, due to the robust manufacturing base, low production costs, and high demand across various industries in the region.

Countries like China, India, and Japan are the key market players, with extensive plastic production and consumption across the packaging, automotive, and construction sectors. The region also benefits from a rapidly growing middle class, increased urbanization, and expanding infrastructure.

At the same time, companies in this area should collaborate to improve plastic recycling, aiming to reduce waste and enhance sustainability. This growth is further fueled by strong economic performance and industrial expansion across the region.

- In September 2023, ExxonMobil announced its collaboration with governments, industry leaders, and technology providers in Asia Pacific to enhance waste collection & sorting and explore large-scale advanced recycling facilities. The initiative aims to prevent plastic waste from ending up in landfills or incineration by redirecting it to advanced recycling centers. These facilities, including those in Singapore, transform plastic waste into high-quality raw materials for new products, further promoting a circular economy for plastics in the region.

The plastics market in North America is poised for significant growth over the forecast period at a CAGR of 3.99%. North America is emerging as a fast-growing region for the market, driven by the increasing demand for plastics across the packaging, automotive, healthcare, and construction industries in the region.

The region benefits from advanced manufacturing capabilities, strong technological innovations, and a highly developed infrastructure. Additionally, there is a growing shift toward sustainable solutions, with companies focusing on recyclable and biodegradable plastics. As e-commerce and the demand for eco-friendly packaging rise, the market in North America continues to experience significant expansion.

Collaborations for improved recycling technologies and regulatory support can also contribute to the region's fast-paced growth, positioning it as an important player in the global market.

Competitive Landscape

The global plastics market report will provide valuable insights with an emphasis on the fragmented nature of the market. Prominent players are focusing on several key business strategies such as partnerships, mergers and acquisitions, product innovations, and joint ventures to expand their product portfolio and increase their market shares across different regions.

Strategic initiatives, including investments in R&D activities, establishment of new manufacturing facilities, and supply chain optimization, could create opportunities for market growth.

List of Key Companies in Plastics Market

- BASF

- Chevron Phillips Chemical Company LLC

- Exxon Mobil Corporation

- Celanese Corporation

- Sumitomo Chemical Co., Ltd.

- Reliance Industries Limited

- LOTTE Chemical CORPORATION

- Covestro AG

- Braskem

- Ducor Petrochemicals

Key Industry Developments

- November 2023 (Expansion): LyondellBasell (LYB) built its first industrial-scale catalytic advanced recycling plant in Wesseling, Germany. Utilizing the company's proprietary MoReTec technology, this facility will be the first commercial-scale advanced recycling plant designed to convert post-consumer plastic waste into feedstock for new plastic production. With an annual capacity of 50,000 tons, the plant will recycle the amount of plastic packaging waste generated by over 1.2 million people in Germany annually, with construction set for completion by late 2025.

- September 2023 (Acquisition): TotalEnergies has acquired Spain-based Iber Resinas, a leader in mechanical plastic recycling for sustainable applications. This acquisition will boost TotalEnergies' circular polymer production in Europe, expand its recycled product range, and improve access to feedstock through Iber Resinas’ supplier network. Iber Resinas recycles plastics such as PP, PE, and PS from household and industrial waste, serving the automotive, packaging, and construction industries. This move supports efforts to reduce carbon footprints through energy-efficient, recycled plastics.

The global plastics market is segmented as:

By Product Type

- Polyethylene (PE)

- Polypropylene (PP)

- Polyvinyl Chloride (PVC)

- Polystyrene (PS)

- Polycarbonate (PC)

- Others

By End-use Industry

- Automotive

- Packaging

- Construction

- Electrical & Electronics

- Healthcare

- Others

By Region

- North America

- Europe

- France

- UK

- Spain

- Germany

- Italy

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia Pacific

- Middle East & Africa

- GCC

- North Africa

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America