Paints and Coatings Market Size

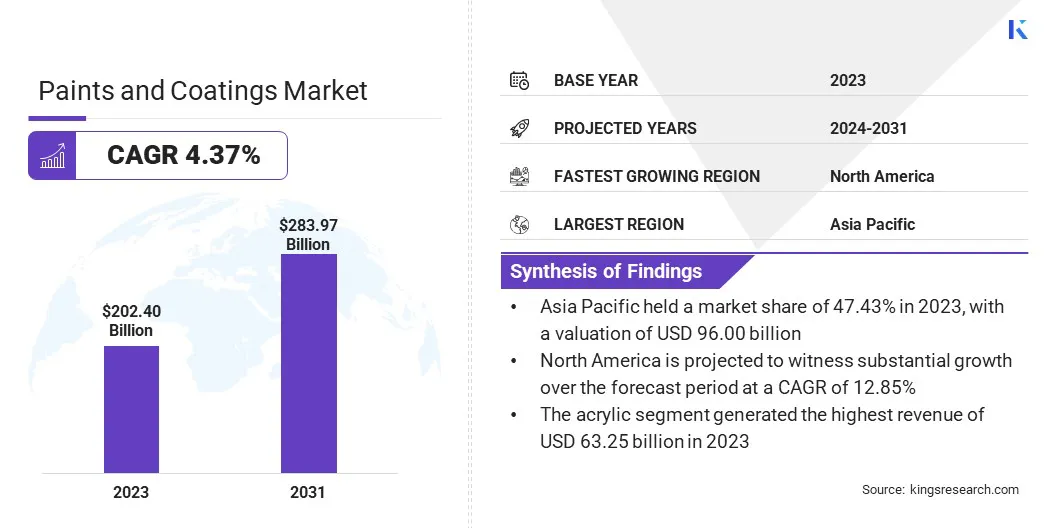

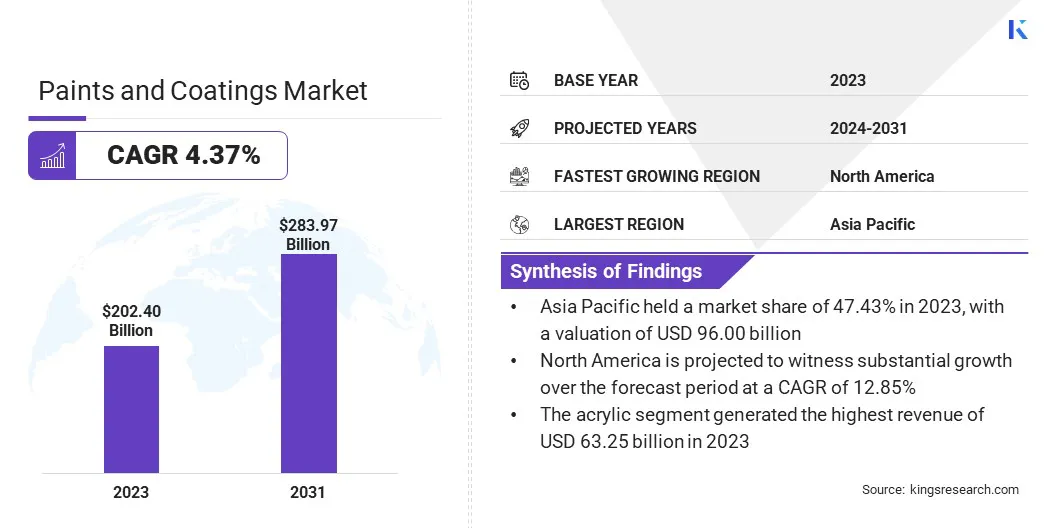

The global Paints and Coatings Market size was valued at USD 202.40 billion in 2023 and is projected to reach USD 283.97 billion by 2031, growing at a CAGR of 4.37% from 2024 to 2031. In the scope of work, the report includes products offered by companies such as Akzo Nobel N.V., PPG Industries, Inc., Sherwin-Williams Company, BASF SE, Axalta Coating Systems Ltd., Nippon Paint Holdings Co., Ltd., RPM International Inc., Asian Paints Limited, Kansai Paint Co., Ltd., Hempel A/S and others.

The market encompasses a diverse range of products used for surface protection, decoration, and enhancement across various industries. With growing urbanization and industrialization, the market growth is driven by rising demand for advanced coatings that offer superior performance, durability, and sustainability.

Moreover, the robust global economic growth is propelling the expansion of the paints and coatings market. Urbanization leads to increased construction activities that boost the demand for architectural coatings such as paints and varnishes used in residential, commercial, and infrastructure projects.

As cities expand, there is a growing need for durable coatings to protect and enhance buildings. This robust economic growth stimulates investment in the automotive and industrial sectors, driving the demand for coatings used in various applications.

The rising purchasing power of consumers leads to increased vehicle production and the need for automotive coatings. Similarly, industrial growth necessitates coatings for machinery, pipelines, and infrastructure, thereby fueling product uptake.

Paints and coatings encompass a broad category of materials used to protect, decorate, or enhance surfaces across various industries, including construction, automotive, aerospace, and marine sectors. In construction, they are essential for protecting buildings from environmental factors and enhancing aesthetics. In the automotive industry, coatings provide aesthetic appeal, corrosion resistance, and protection against wear and tear.

Technological advancements lead to the increased production of coatings that are tailored to specific needs, such as high-performance coatings for extreme conditions. However, the industry faces stringent environmental regulations to reduce harmful emissions such as volatile organic compounds (VOCs). This has led to a growing demand for eco-friendly coatings, thereby driving the adoption of waterborne and powder coatings.

Analyst’s Review

Manufacturers in the paints and coatings market aim to invest in research and development to innovate new products and technologies to maintain a competitive edge and meet evolving customer demands. Additionally, key players are focusing on establishing strong partnerships and collaborations with suppliers, distributors, and customers to expand market reach and facilitate access to new markets.

Moreover, manufacturers are developing eco-friendly solutions that align with regulatory trends. They are adopting digitalization and automation in manufacturing processes to improve efficiency, reduce costs, and enhance product quality. These strategies are helping companies adapt to changing market dynamics and consumer preferences.

Paints and Coatings Market Growth Factors

Stringent environmental regulations are prompting manufacturers across the paints and coatings industry to reduce harmful emissions and adopt eco-friendly alternatives. Regulatory initiatives aimed at curbing emissions of volatile organic compounds (VOCs) are boosting the demand for waterborne and powder coatings.

Waterborne coatings, with low VOC emissions, offer improved safety for both workers and consumers. Similarly, powder coatings eliminate VOCs and provide superior durability and corrosion resistance.

As governments tighten environmental standards, manufacturers aim to reformulate products and invest in sustainable technologies to comply with regulations. This shift toward eco-friendly coatings addresses environmental concerns and presents opportunities for innovation and growth in the paints and coatings industry.

However, fluctuations in raw material prices, especially those derived from oil, pose significant challenges for manufacturers in the industry. Price volatility disrupts supply chains, increases production costs, and impacts profit margins. To mitigate these challenges, companies are diversifying suppliers, hedging raw material purchases, and investing in inventory management systems.

Additionally, research and development efforts focused on alternative raw materials or formulations reduce dependency on volatile commodities. Collaborating with suppliers to negotiate long-term contracts or explore cost-saving measures helps stabilize the prices. Key players in the market are working on implementing proactive management strategies to navigate market uncertainties and maintain competitiveness in the industry.

Paints and Coatings Market Trends

The market is experiencing a shift towards waterborne and powder coatings, driven by increasing environmental awareness and regulatory pressures. Waterborne coatings, characterized by low VOC emissions and environmental sustainability, are gaining traction across various applications, including architectural, automotive, and industrial coatings.

Similarly, powder coatings, which offer zero VOC emissions and enhanced durability, are increasingly preferred for their eco-friendly properties and superior performance. Additionally, customization and personalization have emerged as key trends in the sector, fueled by architectural and automotive design preferences. Consumers seek coatings offering a wide range of colors, textures, and special effects to meet their unique aesthetic requirements.

Manufacturers are offering customizable solutions catering to diverse consumer preferences, driving innovation and market growth. These trends are anticipated to shape the paints and coatings market over the forecast years, with sustainability and customization remaining key factors driving the paints and coatings industry growth.

Segmentation Analysis

The global market is segmented based on resin type, technology, application, and geography.

By Resin Type

Based on resin type, the market is segmented into acrylic, alkyd, polyurethane, epoxy, polyester, vinyl (PVC), and others. The acrylic segment led the paints and coatings market in 2023, reaching a valuation of USD 63.25 billion.

The acrylic segment refers to products formulated with acrylic resin, known for versatility, durability, and excellent weather resistance. Acrylic-based coatings find wide application in architectural, automotive, industrial, and decorative fields due to their fast-drying nature, color retention, and resistance to UV radiation and weathering.

The widespread adoption of acrylic coatings in construction, automotive, and industrial applications is one of the key factors propelling segmental growth. Additionally, technological advancements and innovations in acrylic formulations have enhanced performance and expanded application scope, driving market growth and revenue generation.

By Technology

Based on technology, the paints and coatings market is classified into waterborne, solvent-borne, powder coatings, high solids, UV-cured, and others. The waterborne segment secured the largest revenue share of 25.15% in 2023.

The waterborne segment comprises products formulated with water as the primary solvent, replacing traditional solvent-based formulations. Waterborne coatings offer advantages such as low VOC emissions, improved worker safety, and environmental sustainability.

The segment’s dominance is attributed to increasing regulatory pressures to reduce VOC emissions, growing awareness of environmental sustainability, and advancements in waterborne technology.

Governments worldwide have implemented stringent regulations to limit VOC emissions, driving the adoption of waterborne formulations. Additionally, consumer preferences for eco-friendly products and the need for safer working environments have propelled demand for waterborne coatings across various sectors.

By Application

Based on application, the paints and coatings industry is divided into construction, general industrial, automotive, furniture, marine, packaging, and aerospace. The automotive segment is poised for significant growth at a robust CAGR of 5.44% through the forecast period.

The automotive segment includes coatings used in vehicle manufacturing and refinishing, encompassing cars, trucks, buses, and motorcycles. The expansion of the automotive industry, increasing vehicle production, and rising demand for advanced coatings are the factors that contribute to this anticipated growth.

As the automotive sector evolves with technological advancements such as electric vehicles and autonomous driving, the demand for specialized coatings for new materials and components is expected to rise. Additionally, consumer preferences for customization in vehicle design are bolstering the demand for specialty coatings with unique colors and finishes.

Paints and Coatings Market Regional Analysis

Based on region, the global market is classified into North America, Europe, Asia-Pacific, MEA, and Latin America.

The Asia-Pacific Paints and Coatings Market share stood around 47.43% in 2023 in the global market, with a valuation of USD 96.00 billion. This dominance is driven by robust product demand across sectors such as construction, automotive, and general industrial applications. Rapid urbanization and industrialization in countries such as China, India, and Southeast Asian nations are fueling the need for architectural, automotive, and industrial coatings.

Additionally, the construction boom in the region, driven by infrastructure projects and urban expansion, significantly contributes to increased demand for paints and coatings. Favorable government initiatives, such as investments in infrastructure, are playing a key role in boosting regional market growth.

North America is poised to observe significant growth at a CAGR of 12.85% over the forecast period. The region's robust construction industry, fueled by residential, commercial, and infrastructure projects, drives demand for architectural coatings. The automotive sector in the region is experiencing steady growth, supported by innovation and technological advancements in vehicle manufacturing, leading to increased demand for automotive coatings.

Additionally, stringent environmental regulations are driving the adoption of eco-friendly coatings in the region. Investments in research and development to innovate new products and technologies enhance the region's market standing. Favorable economic conditions, evolving consumer preferences, and regulatory trends are set to fortify North America's position in the paints and coatings industry.

Competitive Landscape

The global paints and coatings market report will provide valuable insight with an emphasis on the fragmented nature of the industry. Prominent players are focusing on several key business strategies such as partnerships, mergers and acquisitions, product innovations, and joint ventures to expand their product portfolio and increase their market shares across different regions.

Strategic initiatives, including investments in R&D activities, the establishment of new manufacturing facilities, and supply chain optimization, could create new opportunities for market growth.

List of Key Companies in Paints and Coatings Market

Key Industry Developments

- February 2024 (Partnership): BASF, a leading chemical company, announced its plan to expand its production capacity for high-quality automotive coatings at its Munster site in Germany. The investment was intended to meet growing customer demand for sustainable coatings solutions and strengthen BASF's position as a key player in the global automotive coatings market.

- January 2024 (Partnership): Uncountable, a leading provider of AI-driven solutions for materials R&D, partnered with Jotun, a global leader in paints and coatings. This collaboration aimed to enhance Jotun's research capabilities by leveraging Uncountable's advanced technology, accelerating innovation and product development in the paints and coatings industry.

The Global Paints and Coatings Market is Segmented as:

By Resin Type

- Acrylic

- Alkyd

- Polyurethane

- Epoxy

- Polyester

- Vinyl (PVC)

- Others

By Technology

- Waterborne

- Solvent-borne

- Powder Coatings

- High Solids

- UV-cured

- Others

By Application

- Construction

- General Industrial

- Automotive

- Furniture

- Marine

- Packaging

- Aerospace

By Region

- North America

- Europe

- France

- U.K.

- Spain

- Germany

- Italy

- Russia

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia-Pacific

- Middle East & Africa

- GCC

- North Africa

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America