Market Definition

The market comprises a variety of solutions designed to track and record temperature fluctuations across key industries such as pharmaceuticals, food and beverage, chemicals, and logistics.

It includes standalone and connected devices, along with associated software and services, used in applications like cold chain monitoring, environmental assessments, and industrial quality control processes. The report examines critical driving factors, industry trends, regional developments, and regulatory frameworks impacting market growth through the projection period.

Temperature Data Logger Market Overview

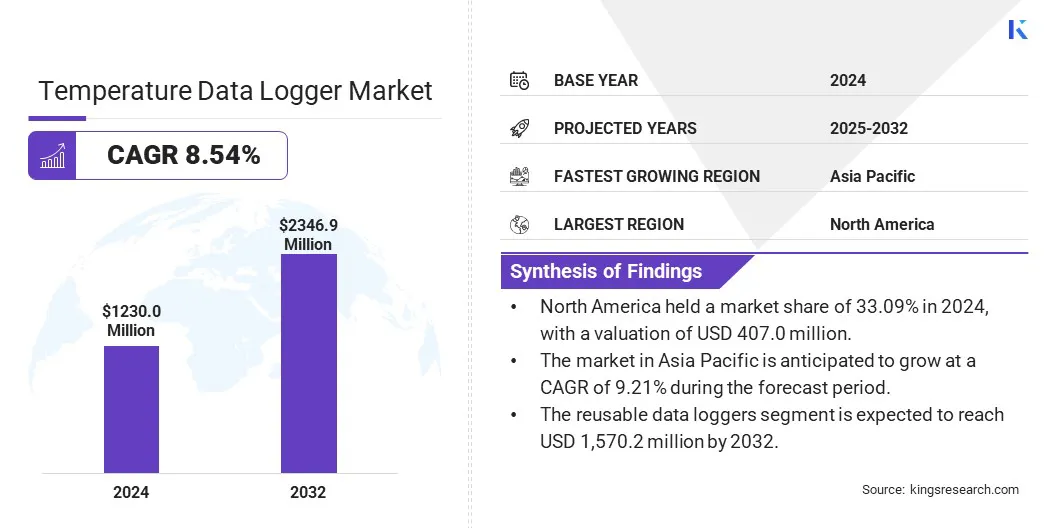

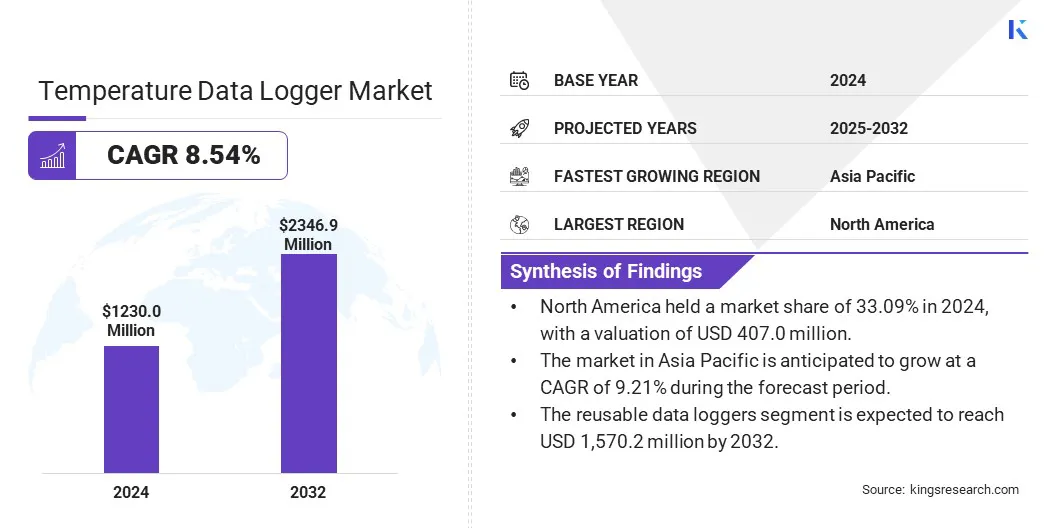

The global temperature data logger market size was valued at USD 1,230.0 million in 2024 and is projected to grow from USD 1,322.7 million in 2025 to USD 2,346.9 million by 2032, exhibiting a CAGR of 8.54% during the forecast period.

The market is undergoing steady expansion, driven by the increasing demand for continuous temperature monitoring in highly regulated sectors such as pharmaceuticals, food and beverage, and chemicals. Regulatory requirements for ensuring product safety and quality, particularly within cold chain logistics, are prompting the widespread adoption of advanced temperature data logging solutions.

Major companies operating in the temperature data logger industry are Dwyer Instruments, LLC, Cryopak, HIOKI E.E. CORPORATION, Testo SE & Co. KGaA, ROTRONIC AG, LI-COR, Inc., Lascar Electronics Limited., NOVUS Automation Inc., Amphenol Advanced Sensors, Dickson, ELPRO-BUCHS AG., Carrier, Kimo Electronic Pvt. Ltd., Thermo Fisher Scientific Inc., and Blue Maestro.

The globalization of supply chains and the demand for real-time monitoring and traceability further contributing to the growth of the market. Moreover, the integration of wireless connectivity and cloud platforms is enhancing data accessibility and operational efficiency, positioning temperature data loggers as vital tools in storage, transportation, and manufacturing processes.

- In March 2023, Onset launched its HOBO RX3000 Remote Soil Monitoring Station. The station offers continuous data logging for soil moisture, water level, temperature, and weather parameters, and is equipped with a Build-a-system configurator for customized solutions. It features wireless sensors and provides real-time data transmission via a cloud-based dashboard.

Key Highlights

- The temperature data logger market size was valued at USD 1,230.0 million in 2024.

- The market is projected to grow at a CAGR of 8.54% from 2025 to 2032.

- North America held a market share of 33.09% in 2024, with a valuation of USD 407.0 million.

- The hardware segment garnered USD 788.3 million in revenue in 2024.

- The reusable data loggers segment is expected to reach USD 1,570.2 million by 2032.

- The USB segment is expected to reach USD 893.0 million by 2032.

- The pharmaceuticals segment is expected to reach USD 730.7 million by 2032.

- The market in Asia Pacific is anticipated to grow at a CAGR of 9.21% during the forecast period.

Market Driver

Expansion of Cold Chain Logistics Drives Demand for Temperature Data Loggers

The growing emphasis on cold chain logistics in the pharmaceuticals and food industries is a key driver for the temperature data logger market. In the pharmaceutical sector, cold chains are critical for the safe storage and transport of temperature-sensitive products like vaccines and biologics.

Similarly, the food industry relies on cold chain logistics to preserve the quality of perishable goods such as produce, meat, and dairy. As these industries continue to expand, there is an increasing need for reliable monitoring solutions to ensure products remain within the required temperature ranges, thereby driving demand for temperature data loggers.

- In June 2024, BrainChild Electronics Co., Ltd. launched the XH12 Wi-Fi Temperature and Humidity Data Logger, designed to support real-time environmental monitoring in cold chain logistics, warehouses, and laboratories. The device features wireless data transmission, high-capacity data logging, and an external sensor design, enabling accurate and continuous monitoring in environments requiring multiple sensing points.

Market Challenge

Integration Challenges with Existing Infrastructure Limit Market Scalability

They are investing in designing devices and software platforms that offer greater compatibility and interoperability with existing infrastructure commonly used in pharmaceutical and food industries. This includes creating flexible APIs, modular software architectures, and universal communication protocols that enable smoother integration without extensive customization.

Additionally, many manufacturers are providing comprehensive support services, such as consulting and implementation assistance, to help businesses plan and execute integration with minimal disruption. Some are also offering scalable solutions that allow incremental upgrades rather than full system overhauls, reducing upfront costs and deployment times.

By focusing on enhanced device compatibility, streamlined integration processes, and ongoing customer support, these companies aim to reduce the technical and financial barriers to adopting advanced temperature data logging solutions, enabling more efficient and cost-effective supply chain monitoring.

Market Trend

Shift Towards Multi-Parameter Monitoring in Temperature Data Loggers

The market is evolving toward multi-parameter monitoring solutions devices capable of tracking various environmental factors such as temperature, humidity, pressure, and more. This shift is driven by industries’ increasing need for comprehensive data to ensure regulatory compliance and maintain product quality.

Multi-parameter devices consolidate several sensors into a single unit, streamlining data collection and reducing the need for multiple separate instruments.

By providing a consolidated and accurate overview of storage and transport conditions, these advanced loggers enhance operational efficiency and improve data accuracy, helping businesses better manage complex environmental monitoring requirements across their supply chains.

- In August 2024, Vaisala launched its VDL200 data logger designed for secure environmental monitoring in GxP-regulated applications. The new device supports Power over Ethernet connectivity and enables multi-parameter measurement of temperature, humidity, and CO₂. It integrates with the viewLinc Continuous Monitoring System, offering simplified installation, enhanced data integrity, and compliance with global life science regulations.

Temperature Data Logger Market Report Snapshot

|

Segmentation

|

Details

|

|

By Component

|

Hardware, Software, Services

|

|

By Product Type

|

Single-use Data Loggers, Reusable Data Loggers

|

|

By Technology

|

USB, Wireless, Bluetooth, RFID/NFC

|

|

By End-use Industry

|

Food & Beverages, Pharmaceuticals, Chemicals, Environmental Monitoring, Logistics & Warehousing, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Component (Hardware, Software, Services): The hardware segment earned USD 788.3 million in 2024 due to the increasing deployment of advanced sensors and data logging devices across cold chain applications.

- By Product Type (Single-use Data Loggers, Reusable Data Loggers): The reusable data loggers segment held 65.91% of the market in 2024, due to their cost-effectiveness, durability, and suitability for long-term monitoring applications.

- By Technology (USB, Wireless, Bluetooth, RFID/NFC): The USB segment is projected to reach USD 893.0 million by 2032, owing to its ease of use, reliability, and widespread compatibility with existing systems.

- By End-use Industry (Food & Beverages, Pharmaceuticals, Chemicals, Environmental Monitoring, Logistics & Warehousing, Others): The pharmaceuticals segment is projected to reach USD 730.7 million by 2032, owing to regulatory requirements for temperature-sensitive drug storage and transport.

Temperature Data Logger Market Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

North America accounted for 33.09% share of the temperature data logger market in 2024, with a valuation of USD 407.0 million. This dominance is largely attributed to the region's highly developed cold chain infrastructure and widespread adoption of advanced monitoring technologies across pharmaceuticals and food industries.

The presence of major pharmaceutical manufacturers and biotech firms in the U.S., along with a high volume of vaccine production and distribution activities, is significantly driving demand for real-time temperature monitoring solutions. Moreover, the region's strong emphasis on quality assurance and the presence of key market players with established supply networks are further driving market growth.

The temperature data logger industry in Asia Pacific is expected to register the fastest growth in the market, with a projected CAGR of 9.21% over the forecast period. This rapid expansion is driven by increasing industrialization, rising pharmaceutical exports, and the growing need for reliable temperature monitoring in logistics across countries such as China, India, Japan, and South Korea.

The growing footprint of multinational pharmaceutical companies setting up manufacturing and distribution hubs in the region is amplifying the demand for reusable and multi-parameter temperature data loggers. In addition, the region's expanding e-commerce and food delivery sectors are accelerating the adoption of these devices to ensure product safety during last-mile delivery and long-distance transportation.

Regulatory Frameworks

- In the U.S., the Food and Drug Administration (FDA) regulates temperature monitoring for food safety, pharmaceuticals, and medical devices. The FDA enforces temperature control standards across various sectors, including food handling, laboratory environments, and pharmaceutical cold chain management, to ensure the safety, efficacy, and quality of products throughout storage and transportation.

- In Europe, the European Commission regulates temperature monitoring for the food industry through Commission Regulation (EC), which sets the legal framework for temperature control during food storage and transportation. The European Medicines Agency (EMA) provides guidelines on temperature requirements for the storage and transportation of pharmaceutical products to ensure their safety and efficacy.

Competitive Landscape

The temperature data logger market is characterized by strategic efforts from key players to enhance technological capabilities and broaden market reach. Companies are increasingly focused on improving device durability, battery life, and data storage capacity to ensure reliable performance in demanding environments.

There is also a strong emphasis on advancing software to facilitate seamless integration with enterprise systems and support compliance reporting. Strategic collaborations, acquisitions, and geographic expansion are regularly pursued to access new customer bases and strengthen distribution networks.

Additionally, customized solutions tailored to specific industry applications are being leveraged to enhance value propositions and foster long-term client relationships.

- In October 2024, LI-COR Environmental acquired Onset Computer Corporation, a leading provider of data loggers and monitoring solutions for environmental and energy applications. This strategic acquisition aims to expand LI-COR’s environmental monitoring capabilities by integrating Onset’s advanced temperature, humidity, and multi-parameter data logging technologies.

List of Key Companies in Temperature Data Logger Market:

- Dwyer Instruments, LLC

- Cryopak

- HIOKI E.E. CORPORATION

- Testo SE & Co. KGaA

- ROTRONIC AG

- LI-COR, Inc.

- Lascar Electronics Limited.

- NOVUS Automation Inc.

- Amphenol Advanced Sensors

- Dickson

- ELPRO-BUCHS AG.

- Carrier

- Kimo Electronic Pvt. Ltd.

- Thermo Fisher Scientific Inc.

- Blue Maestro

Recent Developments (Product Launches)

- In January 2025, MadgeTech launched the NanoTemp125, the latest addition to its HiTemp140 series. Designed for precision, versatility, and compactness, the NanoTemp125 is fully submersible and operates in a wide temperature range with high accuracy. It is ideal for industries such as pharmaceuticals, food processing, and autoclave validations.

- In November 2024, HOBO Data Loggers launched the HOBO MX20L, a self-contained water level data logger with Bluetooth technology for wireless data offload. Designed for freshwater and saltwater environments, the MX20L supports temperature and water level monitoring, offering long-term deployment, enhanced data accuracy, and simplified field data collection via the HOBOconnect app.

has