Market Definition

Biologics are a class of medical products derived from living organisms, such as cells, tissues, or microorganisms, used in the prevention, treatment, or cure of various diseases. They include a wide range of products such as monoclonal antibodies, vaccines, gene therapies, and cell-based therapies.

Unlike traditional drugs, which are chemically synthesized, biologics are often produced through biological processes such as fermentation or genetic engineering.

Biologics Market Overview

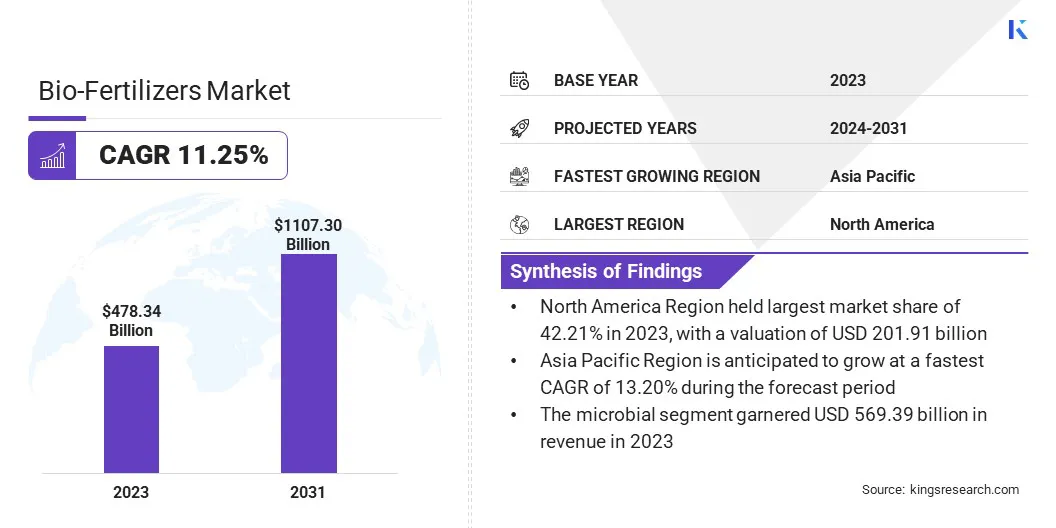

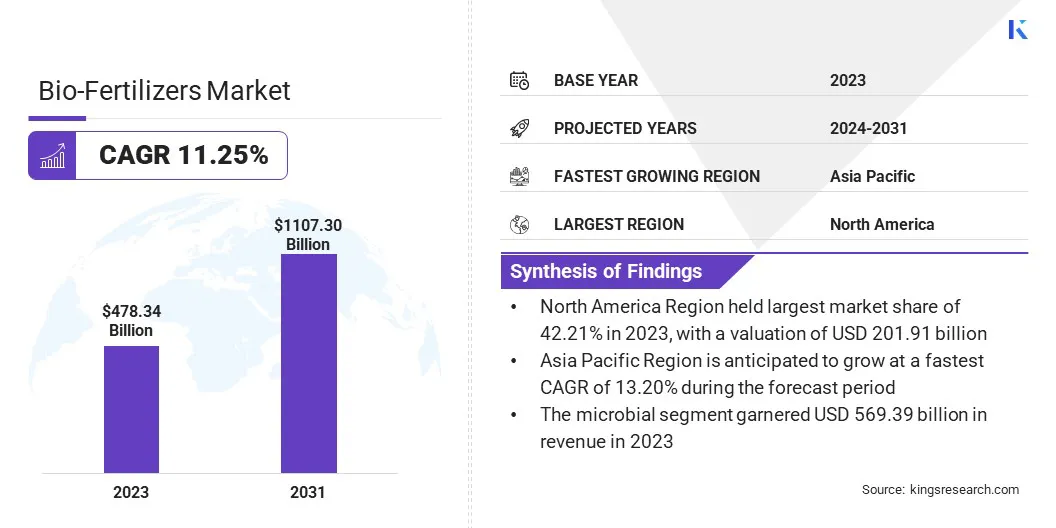

Global biologics market size was recorded at USD 478.34 billion in 2023, which is estimated to be valued at USD 525.10 billion in 2024 and reach USD 1107.30 billion by 2031, growing at a CAGR of 11.25% from 2024 to 2031.

The market is experiencing significant growth due to technological advancements, increasing demand for innovative therapies, and strategic investments in research and development.

As global demographics shift, with aging populations there are higher incidences of chronic diseases such as heart conditions, diabetes, and arthritis are on the rise, straining healthcare systems and boosting demand for drugs, and innovative treatments.

Major companies operating in the biologics market are Eli Lilly and Company, Johnson & Johnson Services, Inc., F. Hoffmann-La Roche Ltd, Pfizer Inc., Gilead Sciences, Inc., Bristol-Myers Squibb Company, Novo Nordisk A/S, Merck KGaA, AbbVie Inc., Novartis AG, GSK plc., AstraZeneca, Regeneron Pharmaceuticals Inc., Sanofi, Takeda Pharmaceutical Company Limited, and others.

The market is experiencing robust growth driven by the success of immunotherapies in oncology and autoimmune diseases. Breakthroughs in cancer treatment, such as immune checkpoint inhibitors and CAR T-cell therapies, highlight the potential of biologics to revolutionize cancer care, leading to increased research and market growth.

- In January 2025, BioMed X and Daiichi Sankyo Co., Ltd. announced a collaboration through a research initiative aimed at advancing the development of bi- and multi-specific biologics for treating solid tumors. It leverages Daiichi Sankyo’s expertise in drug development and biologics with BioMed X’s innovative research capabilities, enabling the development of cutting-edge therapies that can target multiple tumor markers simultaneously.

Key Highlights:

- The global biologics market size was recorded at USD 478.34 billion in 2023.

- The market is projected to grow at a CAGR of 11.25% from 2024 to 2031.

- North America held a share of 42.21% in 2023, valued at USD 201.91 billion.

- The microbial segment garnered a revenue of USD 259.93 billion in 2023.

- The monoclonal antibodies segment is expected to reach USD 545.31 billion by 2031.

- The oncology segment is projected to generate a value of USD 502.58 billion by 2031.

- Asia Pacific is anticipated to grow at a CAGR of 13.20% through the forecast period.

Market Driver

"Expansion of Biomanufacturing Capacity and Favorable Government Incentives"

The expansion of biomanufacturing capacity is contributing significantly to the growth of the biologics market, addressing the increasing demand for biologic therapies due to rising chronic and complex diseases. Innovations such as continuous bioprocessing and single-use technologies are enhancing production efficiency and scalability, enabling faster and more cost-effective delivery of therapies.

- For instance, in September 2024, Just-Evotec opened its second J.POD facility in Toulouse, France, aimed at overcoming vaccine manufacturing challenges. The J.POD uses continuous bioprocessing to produce a variety of biological products, offering a smaller, more flexible, and cost-effective alternative to traditional large-scale bioreactor.

Government incentives, such as the Orphan Drug Act, are also playing a pivotal role by offering financial and regulatory support for the development of treatments for rare diseases, thereby fosteringinvestment and innovation.

- For instance, in October 2024, the FDA reiterated its commitment to improving treatment options for rare diseases affecting millions in the U.S. It continues to offer incentive programs such as the Orphan Drug Designation for tax credits, user fee exemptions, and market exclusivity. The FDA also support rare pediatric diseases and medical devices for small patient populations, while funding research grants to advance treatment development.

Furthermore, advancements in biologic technologies, including gene editing, CRISPR, and monoclonal antibody engineering, are enabling the development of more precise, targeted, and personalized therapies, particularly in oncology and autoimmune diseases.

Market Challenge

"Regulatory Variability and High Development Cost"

Regulatory variability across regions presents significant challenges for companies seeking biologics market access. Differing requirements for clinical trials, manufacturing, and labeling lead to delays, higher costs, and operational complexity.

In addition, the high development costs associated with biologic therapies, mainly due to extensive research, intricate manufacturing processes, and prolonged development timelines, strain profitability and limit market access, particularly for smaller firms. To address this challenge, companies can form strategic partnerships with local regulatory experts to more efficiently navigate regional differences.

Engaging early with regulators also plays a crucial role in streamlining the process, as it allows for clearer guidance on clinical trial designs and requirements, ultimately minimizing delays.

Moreover, cold chain and logistics challenges persist, as many biologics require precise temperature control throughout distribution. This increases the complexity and cost of supply chain management, particularly in underserved regions. Any disruptions can affect timely and effective delivery of products, limiting patient access and market reach.

One solution is for companies to invest in advanced cold chain technologies, such as temperature-controlled packaging, phase change materials, and real-time monitoring systems, which help maintain the required temperature range during transit and minimize the risk of spoilage.

Market Trend

"Adoption of Synthetic Biology and Precision Medicine"

The growing adoption of synthetic biology is fueling the development of customized biological systems, enhancing scalability and cost-effectiveness of biologic drug production, and accelerating advanced therapies such as gene editing and personalized treatments.

Furthermore, precision medicine is gaining significant traction as it allows for highly targeted treatments tailored to individual genetic, environmental, and lifestyle factors, thereby improving patient outcomes and reducing side effects.

- In June 2024, Santa Ana Bio secured USD 168 million in funding to advance its precision medicines targeting inflammatory diseases. Santa Ana is developing multiple differentiated biologics, with several programs expected to enter clinical trials in 2025.

Furthermore, the integration of digital twin technology in biologics manufacturing is optimizing production workflows by creating virtual replicas of physical systems. This enables real-time monitoring and predictive insights, streamlining operations, ensuring compliance, and improving product quality.

These advancements are contributing significantly to the expansion of the biologics industry, creating opportunities for personalized healthcare and more efficient, cost-effective production.

Biologics Market Report Snapshot

| Segmentation |

Details |

| By Source |

Microbial, Mammalian |

| By Product |

Monoclonal Antibodies (mAbs), Vaccines, Recombinant Proteins, Gene Therapies |

| By Application |

Oncology, Infectious Diseases, Cardiovascular Diseases, Autoimmune Diseases, Other Applications |

| By Region |

North America: U.S., Canada, Mexico |

| Europe: France, U.K., Spain, Germany, Italy, Russia, Rest of Europe |

| Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific |

| Middle East & Africa: Turkey, UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa |

| South America: Brazil, Argentina, Rest of South America |

Market Segmentation:

- By Source (Microbial and Mammalian): The microbial segment generated a revenue of USD 259.93 billion in 2023, fueled by the increasing demand for biologic therapies and advancements in microbial-based drug production.

- By Product (Monoclonal Antibodies (mAbs), Vaccines, Recombinant Proteins, and Gene Therapies, Cell Therapies, and Others): The monoclonal antibodies (mAbs) segment held a notable share of 56.78% in 2023, mainly due to their widespread use in the treatment of various cancers, autoimmune diseases, and infectious diseases, along with their proven efficacy and targeted mechanism of action.

- By Application (Oncology, Infectious Diseases, Cardiovascular Diseases, Autoimmune Diseases, and Other Applications): The oncology segment is projected to reach USD 502.58 billion by 2031, attributed to the increasing prevalence of cancer, advancements in targeted therapies and immunotherapies, and growing investments in research and development for innovative cancer treatments.

Biologics Market Regional Analysis

North America biologics market accounted for a substantial share of 42.41% and was valued at USD 201.91 billion in 2023. This dominance is primarily reinforced by a robust healthcare infrastructure, leading pharmaceutical companies, and continuous research advancements.

The United States leads the market, supported by government initiatives such as funding for innovative biologics and regulatory policies such as the Orphan Drug Act, which promotes the development of treatments for rare diseases.

The region further boasts a high adoption of cutting-edge biologic therapies, particularly in oncology, immunology, and autoimmune diseases, thereby propelling regional market growth. Additionally, the region's growing prevalence of chronic diseases and rising demand for personalized medicine are aiding this growth.

Asia-Pacific biologics market is expected to grow at a robust CAGR of 13.20% through the projection period. Countries like China, India, and Japan are advancing in biotechnology R&D, bolstered by government initiatives and substantial investments from both public and private sectors.

These countries are prioritizing the development of biologic therapies for cancer, autoimmune disorders, and chronic diseases, with a growing focus on precision medicine and targeted treatments.

- In March 2024, Merck invested over USD 300 million in a new Bioprocessing Production Center in Daejeon, South Korea. This marks the company’s largest investment in the Asia-Pacific region, aimed at enhancing capabilities in the rapidly growing market. The center will support biotechnology and pharmaceutical companies in process development, clinical research, and the commercial manufacturing of biologics, including vaccines and gene therapies.

Regulatory Framework Also Plays a Significant Role in Shaping the Market

- In U.S., the Center for Biologics Evaluation and Research (CBER) within the FDA regulates biological products for human use under federal laws, including the Public Health Service Act and the Federal Food, Drug and Cosmetic Act.

- In the European Union, the European Medicines Agency (EMA) is the key regulatory authority for biosimilar medicines, overseeing the review and approval of applications for their approval and market entry.

- In APAC, in China, the National Medical Products Administration (NMPA) regulates drugs and medical devices, formerly known as the China Food and Drug Administration or CFDA.

- In India, Central Drugs Standard Control Organization (CDSCO), led by the Drug Controller General of India (DCGI), is the apex regulatory body under the Ministry of Health & Family Welfare (MoHFW), responsible for the approval of clinical trials and new drugs.

- In Japan, the Pharmaceuticals and Medical Devices Agency (PMDA), in collaboration with the Ministry of Health, Labour and Welfare ensures the safety, efficacy and quality of pharmaceuticals and medical devices.

Competitive Landscape:

The global biologics market is characterized by a large number of participants, including both established corporations and rising organisations. To gain a competitive edge, these companies are strengthening their positions through strategic initiatives such asg product innovations, partnerships, mergers, acquisitions, and geographic expansions.

Additionally, several firms are investing heavily in R&D to develop next-generation biologics targeting diseases such as cancer, autoimmune disorders, and rare conditions.

As the market evolves, these organizations are optimizing supply chain efficiencies and ensuring regulatory compliance. Their ongoing commitment to R&D and strategic collaborations positions them to lead in the fast-growing biologics market.

- For Instance, in October 2024, Johnson & Johnson announced a USD 2 billion investment to build a state-of-the-art biologics manufacturing facility in Wilson, North Carolina. The new facility will support the company’s portfolio expansion in oncology, immunology, and neuroscience, while enhancing manufacturing capabilities with advanced technologies. Construction is set to begin in the first half of 2025.

List of Key Companies in Biologics Market:

- Eli Lilly and Company

- Johnson & Johnson Services, Inc.

- Hoffmann-La Roche Ltd

- Pfizer Inc.

- Gilead Sciences, Inc.

- Bristol-Myers Squibb Company

- Novo Nordisk A/S

- Merck KGaA

- AbbVie Inc.

- Novartis AG

- GSK plc.

- AstraZeneca

- Regeneron Pharmaceuticals Inc.

- Sanofi

- Takeda Pharmaceutical Company Limited

- Others

Recent Developments:

- In January 2025, Cytovance Biologics and PolyPeptide announced a collaboration to offer an integrated solution for the development and manufacturing of microbial and mammalian-expressed peptide drugs. This partnership combines Cytovance's expertise in expression, process development, and cGMP manufacturing with PolyPeptide's capabilities in complex peptide development.

- In January 2025, Samsung Biologics presented updates at the J.P. Morgan Healthcare Conference, announcing the opening of Bio Campus II and the launch of ADC services. The company expanded its collaboration with LigaChem Biosciences, plans to open a Tokyo office, and is investing in pre-filled syringe capabilities to support its global client base.

- In October 2024, Eli Lilly and Company announced a USD 4.5 billion investment to establish the Lilly Medicine Foundry in Lebanon, Indiana. This new center will combine advanced manufacturing and drug development capabilities to support the production of small molecules, biologics, and nucleic acid therapies for clinical trials.

- In July 2024, BeiGene opened its flagship biologics manufacturing and clinical R&D facility in Hopewell, New Jersey, following an USD 800 million investment to support global growth and the development of innovative cancer treatments.

- In March 2024, the FDA approved ELAHERE, a first-in-class antibody-drug conjugate (ADC) targeting folate receptor alpha for the treatment of ovarian cancer. In November 2024, the European Commission granted approval, solidifying ELAHERE’s status as a breakthrough treatment for ovarian cancer.