Cold Chain Market Size

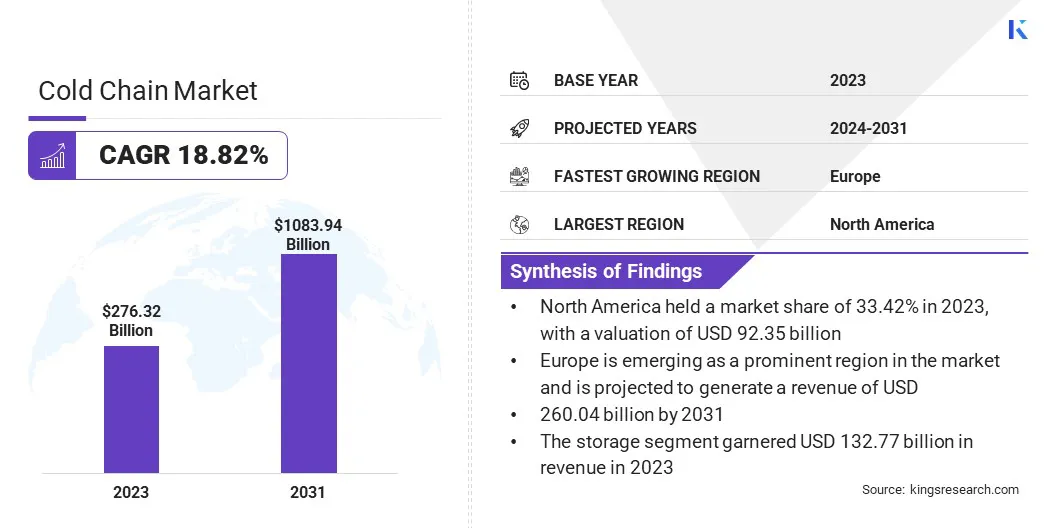

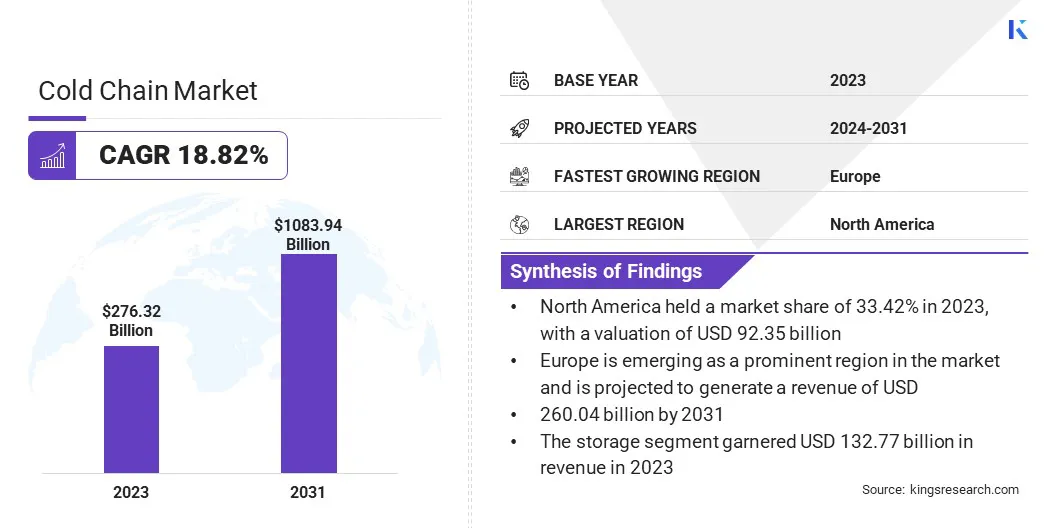

The global Cold Chain Market size was valued at USD 276.32 billion in 2023 and is projected to reach USD 1,083.94 billion by 2031, growing at a CAGR of 18.82% from 2024 to 2031. In the scope of work, the report includes solutions offered by companies such as Americold Logistics, Inc., Lineage, Inc., VersaCold Logistics Services, United Parcel Service of America, Inc., Cold Creek Solutions LP, P. Moller – Maersk, Emergent Cold LatAm Management LLC, DHL International GmbH, CEVA Logistics, NICHIREI CORPORATION and Others. Shifting consumer preferences for fresh, perishable goods and the increasing adoption of advanced technologies for efficient temperature control throughout the supply chain is fostering the market growth.

With consumers increasingly prioritizing health, convenience, and sustainability, there has been a notable surge in demand for fresh, organic, and ready-to-eat meals. This evolving consumer behavior necessitates a robust cold chain infrastructure capable of preserving the nutritional quality and integrity of perishable products.

Moreover, the rise of health-conscious consumers has fueled the demand for fresh produce, dairy, and protein-rich foods, driving the need for efficient cold storage and transportation solutions. Additionally, the growing preference for organic and natural products underscores the importance of maintaining strict temperature controls to prevent contamination and spoilage.

Furthermore, the market is witnessing significant growth due to increasing demand for pharmaceutical applications. The pharmaceutical industry heavily relies on cold chain logistics to maintain the efficacy and safety of temperature-sensitive drugs and vaccines throughout the supply chain, thereby driving the growth of cold chain market. With advancements in healthcare infrastructure and increasing investments in biologics and specialty medicines, there is a growing need for temperature-controlled storage and transportation solutions in pharmaceutical cold chain logistics.

The global market involves a network of temperature-controlled facilities, equipment, and transportation systems designed to maintain the integrity and freshness of perishable products, including food, pharmaceuticals, and other temperature-sensitive goods, throughout the supply chain. It encompasses refrigerated storage warehouses, refrigerated transportation vehicles, temperature monitoring devices, and associated logistics services. The primary objective of the cold chain is to preserve the quality, safety, and shelf-life of perishable products by controlling temperature, humidity, and other environmental conditions. The market caters to various industries, including food and beverage, healthcare, pharmaceuticals, and agriculture.

Analyst’s Review

The cold chain market is experiencing substantial growth, fueled by the increasing purchasing capabilities of consumers and rapid urbanization, thereby driving demand for fresh produce, pharmaceuticals, and other temperature-sensitive goods. Stringent regulations and growing consumer focus on food safety are further underscoring the imperative for robust cold chain infrastructure. Advancements in technologies such as IoT and self-cooling packaging enhance the efficiency and sustainability of perishable goods, pharmaceuticals, and other products. However, challenges remain, including skilled labor shortages and ensuring cold chain visibility across complex logistics networks. (reframe)

Cold Chain Market Growth Factors

Advancements in cold chain technology are fostering market growth. Integration of Internet of Things (IoT) technology is enabling real-time temperature monitoring and data tracking throughout the supply chain. For instance, sensors installed in refrigerated trucks and storage facilities offer continuous monitoring, thereby enhancing efficiency and minimizing the risk of spoilage. Moreover, the development of sustainable and energy-efficient refrigeration solutions addresses environmental concerns while reducing operational costs, thus driving the adoption of cold chain technologies.

Moreover, the evolving logistics landscape is shaping the cold chain market dynamics. The emergence of cold chain logistics startups is introducing innovative solutions such as on-demand warehousing and delivery services, catering to changing consumer needs. These startups leverage technology to optimize efficiency and enhance customer experience. Integration of cold chain with existing transportation networks optimizes resource utilization and enables seamless movement of temperature-sensitive goods across different modes of transport.

Additionally, the adoption of multi-modal cold chain solutions combining air, sea, and land transportation enhances flexibility and reduces transit times, thereby boosting the efficiency of cold chain logistics.

Despite significant factors propelling market growth, the cold chain industry faces challenges related to skilled workforce shortage, requiring specialized expertise to operate and maintain sophisticated technologies. Addressing this challenge is crucial to ensure seamless operations and prevent disruptions in temperature-controlled logistics. Additionally, achieving cold chain visibility and effective data management poses a challenge, as integrating data from various sensors and monitoring systems across the supply chain is essential for informed decision-making.

- Key companies are investing in training programs to develop a skilled workforce capable of meeting the demands, alongside implementing advanced data analytics solutions to enhance visibility and optimize cold chain operations.

Cold Chain Market Trends

The emergence of cold chain as a service (CCaaS), is marking a shift from traditional ownership of cold chain infrastructure to a pay-as-you-go service model. This trend is enabling key companies to access temperature-controlled storage and transportation facilities without the burden of upfront capital investment, thereby enhancing flexibility and scalability in managing perishable goods.

Furthermore, there is a growing focus on automation and robotics within cold storage facilities. This is reflected in improved efficiency and safety.(rewrite) Automation streamlines operations, reduces human error and enhances productivity, particularly in tasks such as inventory management, picking, and packing. Robotics play a crucial role in handling perishable goods with precision and speed, minimizing the risk of damage, and ensuring compliance with stringent quality standards.

Additionally, the adoption of blockchain technology for supply chain transparency is growing. Blockchain offers a decentralized and immutable ledger system that enables stakeholders to track and verify product origin, temperature conditions, and movement throughout the supply chain. By providing greater visibility and traceability, blockchain enhances trust and accountability, thus mitigating potential risks associated with food safety, counterfeit products, and supply chain disruptions.

Segmentation Analysis

The global market is segmented based on product type, application, and geography.

By Type

Based on type, the market is categorized into storage, transportation, packaging, and monitoring components. The storage segment garnered the highest revenue of USD 132.77 billion in 2023. The dominance of the segment in the cold chain market is attributed to its fundamental role in preserving perishable goods throughout the supply chain. Storage facilities are essential for maintaining optimal temperature conditions and ensuring the quality and safety of products during transit and distribution.

Moreover, the increasing demand for temperature-controlled storage solutions, driven by the growing consumption of perishable food products and pharmaceuticals, has propelled the growth of this segment. Additionally, advancements in cold storage technologies, such as modular and automated storage systems, have enhanced efficiency and scalability, further bolstering the dominance of the storage segment in the market.

By Temperature

Based on temperature, the cold chain market is divided into chilled (0 to 15 deg. cel.), frozen (-18 to -25 deg. cel.), and deep-frozen (below -25 deg. cel.). The frozen (-18 to -25 deg. cel.) segment secured the highest market share of 60.79% in 2023. The stability and prolonged shelf life offered by freezing temperatures make it an ideal preservation method for perishable products, thus driving its widespread adoption.

Additionally, the increasing popularity of frozen food products and the expansion of cold chain infrastructure in emerging markets contribute to the dominance of the frozen segment. As consumer preferences continue to evolve, with a growing inclination toward convenience and quality in frozen food products, this segment is poised to witness sustained growth over 2024-2031.

By Application

Based on application, the market is classified into food & beverages, pharmaceuticals, and others. The food & beverages segment is anticipated to generate revenue of USD 738.38 billion by 2031. The dominance of the segment underscores the critical role of temperature-controlled logistics in ensuring the safety and quality of perishable food products. With the rising global population and changing dietary preferences, there is a growing demand for fresh and frozen food items, which is driving the need for efficient cold chain solutions. Moreover, stringent food safety regulations and the increasing focus on quality assurance have propelled investments in cold chain infrastructure within the food and beverage industry.

Cold Chain Market Regional Analysis

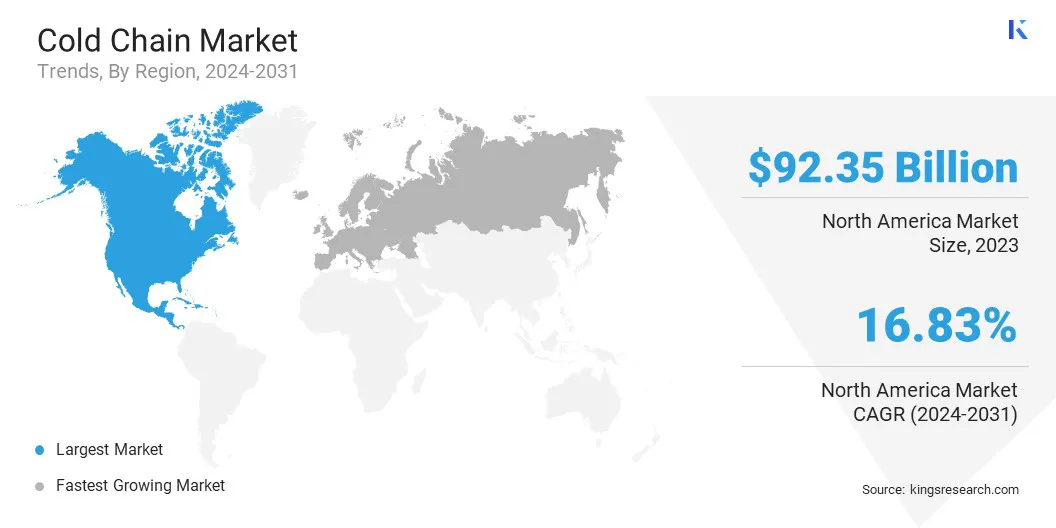

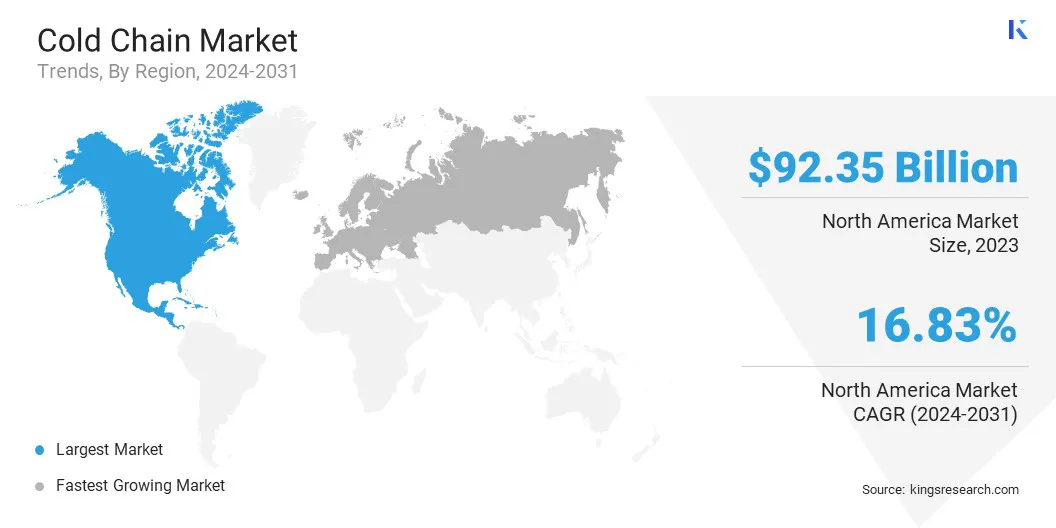

Based on region, the global market is classified into North America, Europe, Asia-Pacific, MEA, and Latin America.

The North America Cold Chain Market share stood around 33.42% in 2023 in the global market, with a valuation of USD 92.35 billion. With a focus on healthy eating trends, North American consumers' increasing preference for organic produce and prepared meals fuels the demand for robust cold chain logistics to ensure the freshness and quality of perishable goods. Moreover, the region's early adoption of automation technologies in cold storage facilities enhances efficiency and labor productivity, thereby bolstering its dominance in the global marketplace.

Additionally, the evolving regulatory landscape, characterized by stricter regulations concerning food safety and traceability, has spurred increased investments in advanced cold chain solutions to ensure compliance, positioning North America as the leading region in the cold chain market.

Europe is emerging as a prominent region in the market and is projected to generate a revenue of USD 260.04 billion by 2031. The rise in chronic healthcare needs in Europe, attributed to its aging population is driving the demand for temperature-controlled pharmaceuticals. This demographic trend underscores the importance of efficient cold chain logistics to preserve the efficacy and safety of medical supplies and medications. Moreover, there is a significant emphasis on food waste reduction in Europe, fueled by government initiatives and increasing consumer awareness. Investments in efficient cold chain solutions aim to minimize food spoilage and enhance sustainability across the food supply chain.

Additionally, Europe benefits from its interconnected transportation network, leveraging existing well-developed infrastructure for multi-modal cold chain solutions. This approach optimizes efficiency in the transportation of temperature-sensitive goods across borders, thereby contributing to Europe's prominence in the global cold chain industry.

Competitive Landscape

The cold chain market report will provide valuable insight with an emphasis on the fragmented nature of the industry. Prominent players are focusing on several key business strategies such as partnerships, mergers and acquisitions, product innovations, and joint ventures to expand their product portfolio and increase their market shares across different regions. Companies are undertaking effective strategic initiatives involving expansions & investments, including investments in R&D activities, the establishment of new manufacturing facilities, and supply chain optimization, which could pose new opportunities for market growth.

List of Key Companies in Cold Chain Market

The global Cold Chain Market is segmented as:

By Type

- Storage

- Transportation

- Packaging

- Monitoring Components

By Temperature

- Chilled (0 to 15 deg. Cel.)

- Frozen (-18 to -25 deg. Cel.)

- Deep-frozen (Below -25 deg. Cel.)

By Application

- Food & Beverages

- Pharmaceuticals

- Others

By Region

- North America

- Europe

- France

- U.K.

- Spain

- Germany

- Italy

- Russia

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia-Pacific

- Middle East & Africa

- GCC

- North Africa

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America