Market Definition

The market is a segment of the aerospace and defense industry focused on the design, manufacture, and supply of electronic systems and components used for managing and converting electrical power in space-based applications such as satellites, spacecraft, space stations, and launch vehicles.

The report highlights key market drivers, major trends, regulatory frameworks, and the competitive landscape shaping the industry’s growth.

Space Power Electronics Market Overview

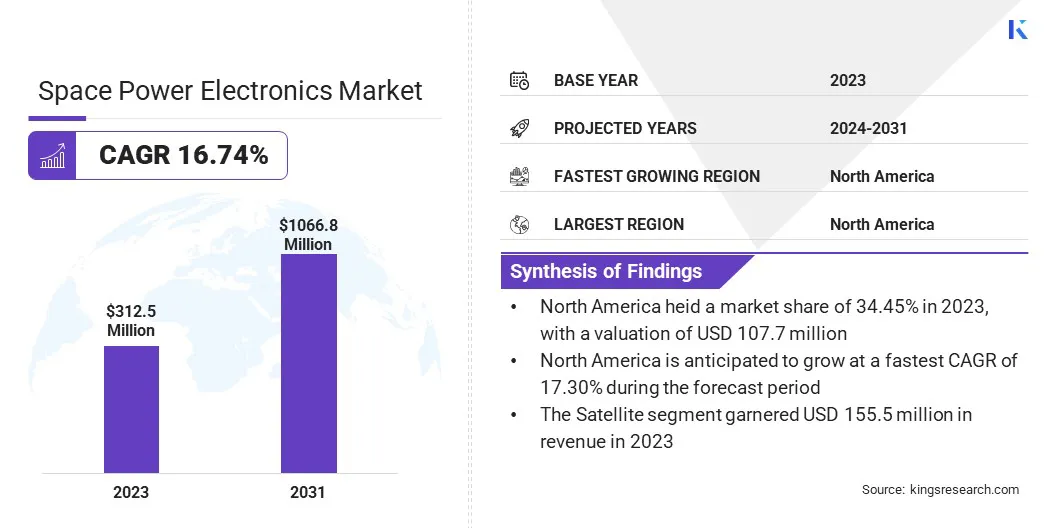

The global space power electronics market size was valued at USD 312.5 million in 2023 and is projected to grow from USD 361.1 million in 2024 to USD 1066.8 million by 2031, exhibiting a CAGR of 16.74% during the forecast period.

The rising number of satellite deployments for communications, surveillance, and Earth observation is boosting demand for high-performance power electronics. Government space agencies and private aerospace companies are investing heavily in satellite launches, deep space missions, and commercial space ventures, which is highlighting a need for advanced, space-resilient power electronics.

Major companies operating in the space power electronics industry are BAE Systems, Texas Instruments, Infineon Technologies, STMicroelectronics, Microchip Technology, Analog Devices, Teledyne Advanced Electronic Solutions, Jenoptik, Renesas Electronics Corporation, Honeywell Aerospace, Space Micro Devices, Orbital Power, Cobham, Ruag Group, TT Electronics, and others.

Companies are acquiring advanced electronic components to expand their portfolios, It enable companies to offer a wider range of high value technologies with positioning themselves for long term growth and strengthening their competitive advantage.

- In June 2024, TransDigm Group Incorporated acquired the Electron Device Business of Communications & Power Industries for approximately USD 1.385 billion. The collaboration includes adding highly-engineered, proprietary electronic components with significant aftermarket value. The deal aligns with TransDigm’s strategy to expand its portfolio of missioncritical technologies across major aerospace platforms.

Key Highlights

- The space power electronics market size was recorded at USD 312.5 million in 2023.

- The market is projected to grow at a CAGR of 16.74% from 2024 to 2031.

- North America held a market share of 34.45% in 2023, valued at USD 107.7 million.

- The power discrete segment garnered USD 125.6 million in revenue in 2023.

- The command and data handling segment is expected to reach USD 292.5 million by 2031.

- The high voltage segment is projected to generate a revenue of USD 417.4 million by 2031.

- The over 50 A segment is likely to reach USD 421.2 million by 2031.

- The satellite segment is estimated to reach USD 5543.9 million by 2031.

- Asia Pacific is anticipated to grow at a CAGR of 16.36% over the forecast period.

Market Driver

Rising Demand for Cost Effective Rad Tolerant Power Solutions

The growing need for cost-effective, radiation-tolerant power solutions is driving innovation in the market. As the number of space missions in the commercial sector continues to rise, there is an increasing demand for components that can operate reliably in the harsh radiation environments of space while keeping costs manageable.

Rad-tolerant components, which are designed to withstand certain levels of radiation exposure, provide a viable alternative to more expensive radiation-hardened systems.

- In January 2023, Microchip Technology introduced the MIC69303RT, a commercial-off-the-shelf (COTS) rad-tolerant power device for low-Earth orbit (LEO) satellites and space applications. Operating from a supply of 1.65 to 5.5 volts and delivering output voltages as low as 0.5 volts, it enables high-current, low-voltage power management in extreme environments, supporting next-generation space systems.

Market Challenge

Achieving High Power Density and Reliability in Extreme Environments

A major challenge influencing the space power electronics market is achieving high power density and reliability in extreme environments, due to the limited availability of radiation-hardened components and the harsh thermal, vibrational, and corrosive conditions of deep space.

These challenges are particularly prominent in missions such as NASA’s Dragonfly rotorcraft for Titan and proposed lunar surface power grids, where systems must withstand prolonged exposure to intense radiation, temperature fluctuations, and mechanical stress.

To address these challenges, engineers are exploring the use of wide bandgap (WBG) materials such as GaN and SiC, which offer higher efficiency, thermal stability, and radiation tolerance, making them ideal for space applications.

Market Trend

New Space Electronics Standard

The emerging trend in the space power electronics industry is the standardization of radiation-hardened plastic packaging for space-qualified components. the trend is gaining momentum following the development of the qualified manufacturers list class P (QML Class P).

The rise of this trend is driven by the need to reduce costs and accelerate production cycles in response to the growing number of satellite launches in the commercial sector. The standard for plastic-packaged space electronics opens the door to a broader supplier base and accelerates the deployment of new space systems.

- In February 2024, Texas Instruments, in collaboration with NASA and other industry experts, led the development of the Qualified Manufacturers List Class P (QML Class P) standard for space electronics. This standard enables the use of radiation-hardened plastic packaging for critical space applications, including power management, processors, communications, and high-speed integrated circuits in satellites and spacecraft.

Space Power Electronics Market Report Snapshot

|

Segmentation

|

Details

|

|

By Device Type

|

Power Discrete, Power Module, Power IC

|

|

By Platform Type

|

Power, Command and Data Handling, ADCS, Propulsion, TT&C, Structure, Thermal system

|

|

By Voltage

|

Low Voltage, Medium Voltage, High Voltage

|

|

By Current

|

Upto 25A, 25-50A, Over 50A

|

|

By Application

|

Satellite, Spacecraft & Launch Vehicle, Rovers, Space Stations

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Device Type (Power Discrete, Power Module, and Power IC): The power discrete segment earned USD 125.6 million in 2023 due to increasing demand for compact and efficient power switching components in space applications.

- By Platform Type (Power, Command and Data Handling, ADCS, Propulsion, TT&C, Structure, and Thermal system): The command and data handling segment held a share of 25.58% in 2023, mainly fueled by the critical need for reliable onboard data processing and control systems in satellite missions.

- By Voltage (Low Voltage, Medium Voltage, and High Voltage): The high voltage segment is projected to reach USD 417.4 million by 2031, propelled by its usage in high-power space propulsion and deep-space communication systems.

- By Current (Up to 25A, 25-50A, and Over 50A): The over 50A segment is expected to reach USD 421.2 million by 2031, stimulated byincreasing requirements for high-current capacity in advanced satellite power systems.

- By Applications (Satellite, Spacecraft & Launch Vehicle, Rovers, and Space Stations): The satellite segment is set to grow at a robust CAGR of 17.09% through the forecast period due to rising commercial satellite deployments and demand for Earth observation and communication services.

Space Power Electronics Market Regional Analysis

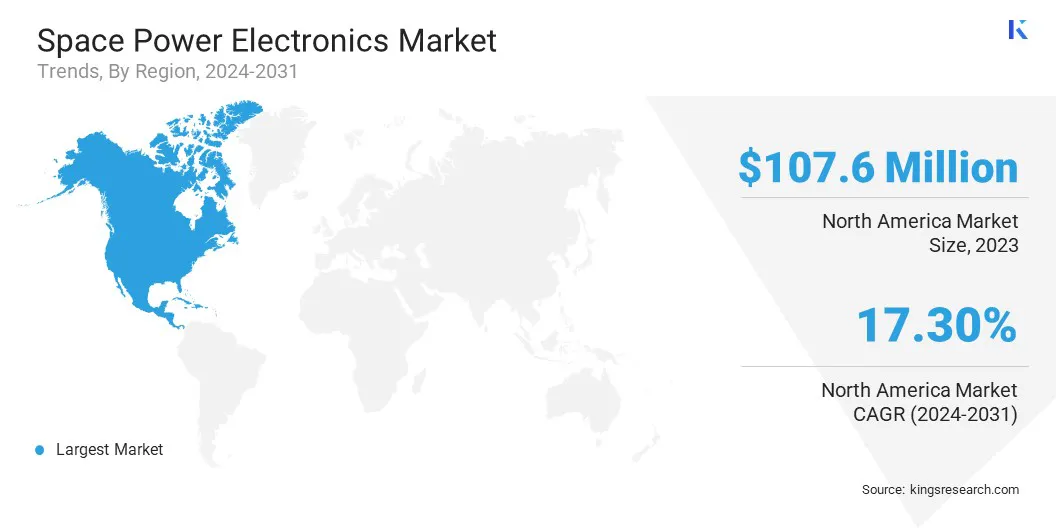

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

North America space power electronics market accounted for a share of around 34.45% in 2023, valued at USD 107.7 million. This dominance is fueled by the presence of prominent space agencies such as NASA, established aerospace firms, and influential private players such as SpaceX.

These entities are leading projects, ranging from satellite constellations and interplanetary missions to space-based defense systems, all requiring highly efficient, lightweight, and radiation-hardened power electronics.

The regional market further benefits from a well-established semiconductor manufacturing ecosystem, strong government support through initiatives such as the CHIPS Act, and strategic partnerships. These factors position North America at the forefront of innovation and deployment in the global market.

Asia Pacific space power electronics industry is poised to grow at a CAGR of 16.99% over the forecast period. This rapid growth is fueled by increasing government investments in space programs, the emergence of private space startups, and the expanding demand for satellite-based services such as communication, navigation, and Earth observation.

- In December 2024, Mitsubishi Electric Corporation signed a memorandum of understanding (MoU) with India’s Bharat Electronics Limited (BEL) and MEMCO Associates to explore joint business opportunities in the defense and space sectors. The collaboration focuses on manufacturing and supplying components for shipborne and airborne radars, electronic warfare systems, and space situational awareness technologies. This partnership aims to support strategic goals in defense and space innovation for both countries.

Regulatory Frameworks

- In the U.S., the Bureau of Industry and Security (BIS) under the Department of Commerce introduced updated space-related export control regulations in April 2024, removing license requirements for select spacecraft and components when exported to key allies such as Australia, Canada, the UK, and over 40 other partner nations. The reforms aim to reduce trade barriers, support commercial innovation, strengthen NASA partnerships, and transfer non-critical space technologies from the U.S. Munitions List to the more flexible Commerce Control List, promoting global collaboration while maintaining national security standards.

- In China, the Ministry of Commerce (MOC), the General Administration of Customs, and the Equipment Development Department of the Central Military Commission introduced new export controls starting July 1, 2024, on certain aviation and aerospace components, including structural parts, gas turbine technologies, and spacesuit helmet visors. These measures are designed to protect national security, ensure compliance with non-proliferation obligations, and support international trade regulations while maintaining global stability and safeguarding supply chains.

Competitive Landscape

Key players are investing heavily in research and development to enhance the performance and reliability of power electronics in the challenging space environment. Companies are also adopting cutting-edge semiconductor materials such as Gallium Nitride (GaN) and Silicon Carbide (SiC), as these technologies offer higher efficiency, better power density, and improved thermal performance compared to traditional silicon devices.

Additionally, they are pursuing strategic mergers and acquisitions to expand their technology portfolios, improve production capabilities, and increase market share. These strategic implementations reflect the industry's emphasis on long-term growth, operational efficiency, and the ability to adapt to emerging technologies.

- In September 2024, Honeywell acquired CAES Systems Holdings LLC from Advent International for approximately USD 1.9 billion. This strategic move expands Honeywell’s defense and space technology portfolio, enhancing capabilities across key military platforms and space applications. TIt supports Honeywell's goal of delivering advanced, scalable solutions aligned with trends in automation, future aviation, and space defense technologies.

List of Key Companies in Space Power Electronics Market:

- BAE Systems

- Texas Instruments

- Infineon Technologies

- STMicroelectronics

- Microchip Technology

- Analog Devices

- Teledyne Advanced Electronic Solutions

- Jenoptik

- Renesas Electronics Corporation

- Honeywell Aerospace

- Space Micro Devices

- Orbital Power

- Cobham

- Ruag Group

- TT Electronics

Recent Developments (M&A/New Product Launch)

- In June 2024, Renesas Electronics Corporation acquired Transphorm, Inc., a global leader in GaN power semiconductors. This strategic move expands Renesas’ wide bandgap portfolio, enabling the delivery of high-efficiency GaN-based power products and reference designs. It strengthens the company's growth strategy and positions it to meet rising demand in automotive, industrial, and space applications.

- In May 2024, Eta Space introduced the Flight Power Inverter (FPI-240-LEO), designed to support cryocooler operations in Low Earth Orbit science missions. The inverter, capable of delivering up to 240 watts of programmable power, was engineered to meet rigorous launch vibration and EMI standards.