Plastic Packaging Market Size

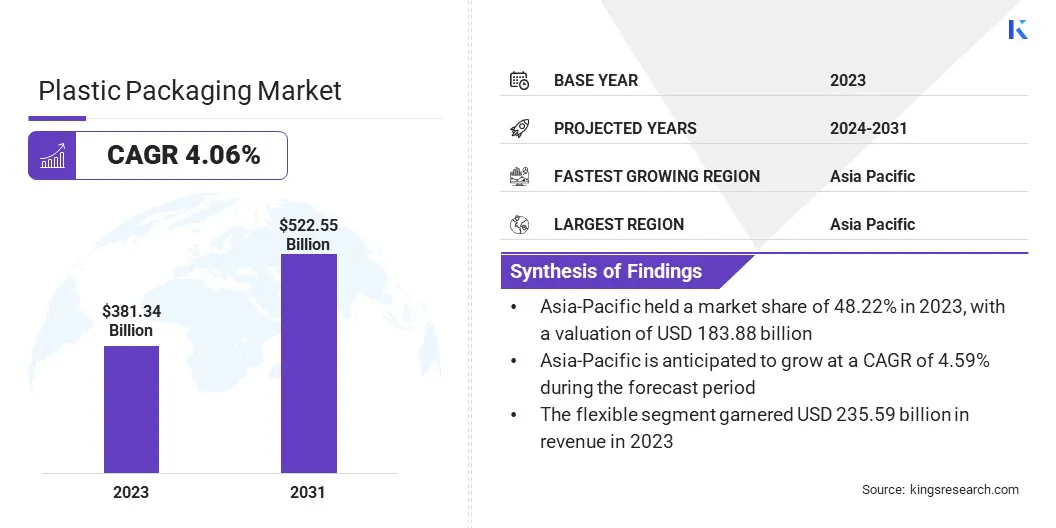

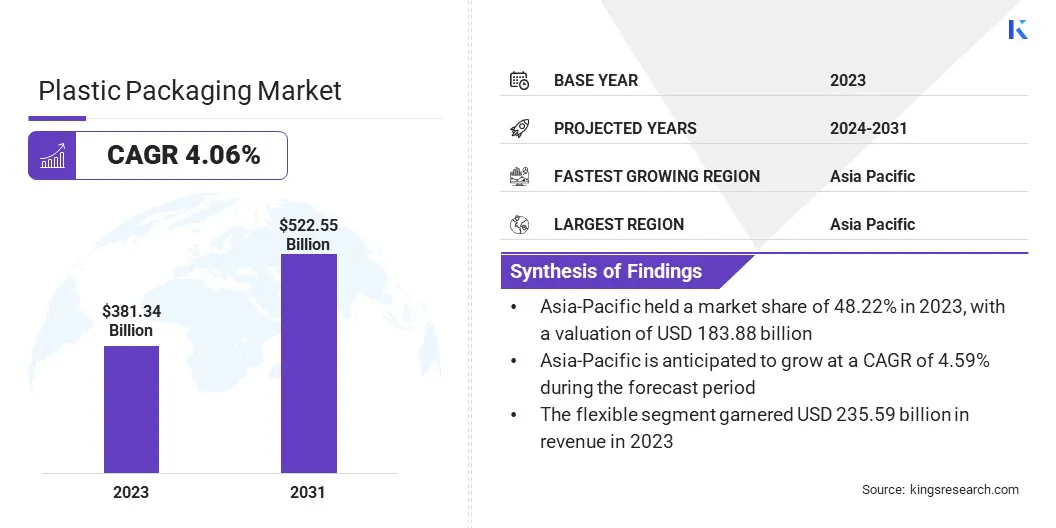

The global plastic packaging market size was valued at USD 381.34 billion in 2023 and is projected to grow from USD 395.54 billion in 2024 to USD 522.55 billion by 2031, exhibiting a CAGR of 4.06% during the forecast period. The rapid growth of e-commerce has heightened the demand for plastic packaging for product protection and secure delivery, driving increased consumption of plastic materials in the online shopping sector.

In the scope of work, the report includes products offered by companies such as Amcor plc, Sealed Air, Coveris, Berry Global Inc., Mondi, Sonoco Products Company, Winpak LTD, CCL Industries, Pactiv Evergreen Inc., Silgan Holdings Inc, and others.

The plastic packaging industry is a dynamic and essential component of the global packaging industry, characterized by its wide-ranging applications across various sectors. With its versatility, plastic packaging caters to industries such as food and beverages, pharmaceuticals, and consumer goods. It continues to evolve with innovations in materials and design, enhancing product safety, durability, and visual appeal.

The market is also influenced by consumer demand for sustainable solutions, circular economy, and ongoing advancements in recycling technologies, shaping its future trajectory.

- In October 2024, Tetra Pak and Lactalis introduced an industry-first carton package using certified recycled polymers from used beverage cartons in Spain. This innovation supports circular economy goals, reduces reliance on virgin materials, and aligns with sustainability commitments.

The plastic packaging market refers to the production and use of plastic materials for packaging products across various industries, including food, beverages, pharmaceuticals, personal care, and consumer goods. Plastic packaging is favored for its versatility, cost-effectiveness, durability, and ability to protect products during transportation and storage.

The market encompasses a wide range of plastic types, which are molded into different forms such as bottles, bags, containers, and films. It plays a crucial role in preserving product quality, extending shelf life, and offering convenient packaging solutions while moving towardpromoting sustainable alternatives.

Analyst’s Review

Urbanization and fast-paced lifestyles are driving significant demand for packaged products, particularly in developing regions, leading to increased consumption of plastic packaging. As consumers seek convenience, companies are adapting by introducing more efficient, lightweight, and durable packaging solutions.

- In May 2024, Amcor and AVON launched the AmPrima Plus refill pouch for AVON's Little Black Dress shower gels in China. This new packaging solution caters to the increasing consumer demand for convenient, efficient, and sustainable options, offering a lightweight, durable, and environmentally friendly alternative.

To meet sustainability goals, companies are forming partnerships to innovate using biodegradable plastics and recyclable materials, combining expertise to develop eco-friendly solutions and enhance the environmental impact of packaging across industries.

- In November 2024, Amcor and Kolon Industries formed a strategic partnership to co-develop sustainable polyester materials for flexible packaging. The collaboration focuses on chemically recycled PET (crPET) and polyethylene furanoate (PEF), supporting Amcor’s sustainability goals and carbon neutrality ambitions.

Plastic Packaging Market Growth Factors

Cost-effectiveness is a key growth driver for the plastic packaging market. Plastic packaging is significantly cheaper than glass or metal. This allows manufacturers to reduce production costs while maintaining product safety and quality. Its affordability, coupled with its versatility in design, makes plastic an attractive option for packaging various consumer goods across industries.

As businesses strive to minimize costs and improve profitability, plastic packaging continues to dominate due to its balance of cost-efficiency, durability, recyclability, and scalability.

- In July 2024, Mondi launched the FlexiBag Reinforced, a cost-effective, recyclable packaging solution with improved mechanical properties. By leveraging its integrated value chain, Mondi provides tailored solutions, enhancing efficiency and meeting sustainability goals, further supporting the cost-effectiveness of plastic packaging.

Environmental concerns regarding plastic waste and ocean pollution pose a significant challenge for the plastic packaging market. To address this, companies are investing in sustainable alternatives, such as biodegradable plastics and recyclability.

Furthermore, collaboration across industries to develop innovative, eco-friendly packaging solutions, along with improved waste management systems, can help reduce the environmental footprint of plastics and support the transition to a circular economy.

- In August 2024, Unilever, USAID, and EY launched the USD 21 million CIRCLE Alliance to tackle plastic pollution. This initiative supports entrepreneurs across the plastic value chain, prioritizing innovative, sustainable solutions and circular economy models

Plastic Packaging Market Trends

A key trend in the plastic packaging market is the growing emphasis on sustainability. There is an increasing demand for eco-friendly packaging solutions with recyclable and biodegradable materials, as consumers and businesses seek to reduce plastic waste. This trend reflects a high degree of awareness regarding the environmental issues and a push toward reducing plastic's ecological footprint.

Companies are exploring innovative alternatives that promote recycling, minimize waste, and contribute to a circular economy, aligning with global goals for more sustainable and responsible packaging practices.

- In November 2024, Mondelez International introduced packaging for Cadbury sharing bars in the UK and Ireland made with 80% certified recycled plastic. This innovative, circular packaging uses advanced recycling technology and ISCC PLUS certification, contributing to sustainability and compliance with EU regulations.

Another prominent trend in the plastic packaging industry is the increasing adoption of recycled materials. Companies are focusing on incorporating these materials into their packaging to reduce dependence on virgin plastics and promote a circular economy. This shift is driven by rising consumer demand for sustainable products.

By embracing recycled materials, brands are minimizing their environmental footprint and contributing to their sustainability efforts, supporting resource conservation and circular economy goals.

- In April 2023, Coca-Cola Beverages Northeast launched 100% recycled bottles for a range of its products, marking a significant step in its sustainability efforts. This initiative reduces the need for virgin plastic, supports Coca-Cola’s circular economy goals, promotes circular economy, and furthers its commitment to sustainable packaging and waste reduction.

Segmentation Analysis

The global market has been segmented based on product, technology, application, material, and geography.

By Product

Based on product, the market is bifurcated into flexible and rigid. The flexible segment led the plastic packaging industry in 2023, reaching a valuation of USD 235.59 billion. This growth is largely attributed to increasing demand for cost-effective, lightweight, and customizable packaging solutions.

Consumer demand for convenience, portability, and sustainability is further supporting this growth. Flexible packaging offers enhanced product protection, shelf appeal, and cost efficiency in storage and transportation.

As manufacturers continue to innovate with eco-friendly materials such as recyclable and biodegradable plastics, the segment is poised to expand further, meeting the needs of food, beverages, cosmetics, and healthcare sectors. Additionally, the rise of e-commerce and on-the-go consumption continues to support the growth of the segment.

By Technology

Based on technology, the plastic packaging market has been segmented into injection molding, extrusion, blow molding, thermoforming, and others. The extrusion segment secured the largest revenue share of 42.11% in 2023. Extrusion technology enables the production of a wide range of packaging materials such as films, sheets, and molded products.

This process involves forcing melted plastic through a mold to form continuous shapes, offering high efficiency and scalability for large-scale production. Extrusion is highly valued for its ability to produce lightweight, durable, and flexible packaging materials, which are crucial in food, beverages, and consumer goods applications.

Additionally, advancements in extrusion technology improve material properties, such as barrier protection, and boost the adoption of sustainable solutions such as biodegradable or recyclable films, supporting circular economy initiatives.

By Application

Based on application, the market has been classified into food & beverages, industrial packaging, pharmaceuticals, personal & household care, and others. The pharmaceuticals segment is set to grow at a CAGR of 4.85% through the forecast period.

The pharmaceutical sector is increasingly adopting plastic packaging due to its ability to offer enhanced product protection, ensuring stability and efficacy. Plastic materials provide superior barrier properties against moisture, air, and contaminants, which is essential for maintaining drug quality and extending shelf life.

Additionally, plastic packaging is lightweight, cost-effective, and versatile, allowing for easy customization to meet specific requirements. This makes it an attractive option for the pharmaceutical industry, thereby boosting the demand for plastic packaging within the sector.

- In June 2024, ALPLA expanded its ALPLApharma division by acquiring Heinlein Plastik-Technik GmbH. This acquisition strengthens ALPLA's capacity in injection molding, enabling the delivery of high-quality primary packaging solutions to addressing growing demands in the pharmaceutical industry.

Plastic Packaging Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia-Pacific, MEA, and Latin America.

The Asia-Pacific plastic packaging market accounted for a substantial share of around 48.22% in 2023, valued at USD 183.88 billion. This growth is primarily fueled by rapid industrialization, urbanization, and growing consumer demand, particularly in developing countries such as China and India. Rising disposable income and changing lifestyles are generating the demand for packaged goods.

Additionally, the region's strong manufacturing base, coupled with an expanding e-commerce sector, has contributed to the increased use of plastic packaging in various industries such as food, beverages, pharmaceuticals, and consumer goods. This trend positions Asia Pacific as a key region in the global market.

- In February 2024, AeroFlexx partnered with Dynapack Asia to deliver sustainable liquid packaging solutions made from flexible plastic in Southeast Asia. This collaboration aims to meet the rising demand for eco-friendly packaging, helping multinational corporations comply with EPR legislation and reduce plastic waste.

North America plastic packaging industry is likely to grow at a CAGR of 3.58% through the forecast period, mainly due to increasing demand across various industries, including food and beverages, pharmaceuticals, and consumer goods.

The regional market is characterized by robust technological advancements, innovation in packaging solutions, and a strong emphasis on sustainability. Consumer demand for convenient, durable, and cost-effective packaging have highlighted the need for plastic solutions.

Additionally, the region is focusing on reducing plastic waste through recycling initiatives and compliance with environmental regulations. This growing emphasis on eco-friendly practices, coupled with strong manufacturing capabilities, solidifies the position of the North America market.

Competitive Landscape

The global plastic packaging market report will provide valuable insight with an emphasis on the fragmented nature of the industry. Prominent players are focusing on several key business strategies such as partnerships, mergers and acquisitions, product innovations, and joint ventures to expand their product portfolio and increase their market shares across different regions.

Strategic initiatives, including investments in R&D activities, the establishment of new manufacturing facilities, and supply chain optimization, could create new opportunities for market growth.

List of Key Companies in Plastic Packaging Market

- Amcor plc

- Sealed Air

- Coveris

- Berry Global Inc.

- Mondi

- Sonoco Products Company

- Winpak LTD

- CCL Industries

- Pactiv Evergreen Inc.

- Silgan Holdings Inc.

Key Industry Developments

- March 2024 (Acquisition): Greif, Inc. acquired Ipackchem Group SAS, strengthening its position in high-performance small plastic containers and jerrycans. This acquisition aligns with Greif's "Build to Last" initiative, aiming to foster growth, expand market opportunities, and achieve USD 7 million in synergiesthrough seamless integration and collaboration.

The global plastic packaging market has been segmented as:

By Product

- Rigid

- Bottles & Jars

- Cans

- Trays & Containers

- Caps & Closures

- Others

- Flexible

- Wraps & Films

- Bags

- Pouches

- Others

By Technology

- Injection Molding

- Extrusion

- Blow Molding

- Thermoforming

- Others

By Application

- Food & Beverages

- Industrial Packaging

- Pharmaceuticals

- Personal & Household Care

- Others

By Material

- Polyethylene (PE)

- Polyethylene Terephthalate (PET)

- Polypropylene (PP)

- Polystyrene (PS)

- Expanded Polystyrene (EPS)

- Polyvinyl Chloride (PVC)

- Bio-based plastics

- Others

By Region

- North America

- Europe

- France

- UK

- Spain

- Germany

- Italy

- Russia

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia-Pacific

- Middle East & Africa

- GCC

- North Africa

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America