Market Definition

The silicon carbide (SiC) market encompasses the global demand and supply of silicon carbide, a durable material used in electronics, automotive, and manufacturing.

It includes the production, distribution, and consumption of SiC, valued for its high heat resistance, hardness, and electrical conductivity. The growth of the market is driven by industries requiring advanced materials for high-performance components.

Silicon Carbide Market Overview

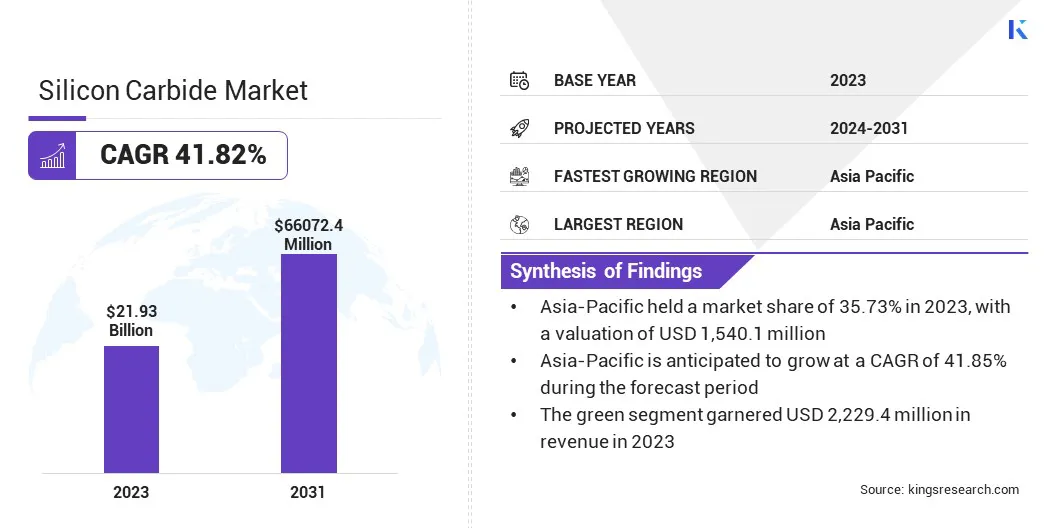

Global silicon carbide market size was USD 4,310.0 million in 2023, which is estimated to be valued at USD 5,726.2 million in 2024 and reach USD 66,072.4 million by 2031, growing at a CAGR of 41.82% from 2024 to 2031.

The growth of the market is fueled by the rapid adoption of electric vehicles (EVs), as SiC-based power semiconductors enhance efficiency, reduce charging times, and improve overall performance, making them ideal for high-voltage EV systems and supporting decarbonization efforts.

Major companies operating in the global silicon carbide market are STMicroelectronics, Infineon Technologies AG, Wolfspeed, Inc., ROHM Co., Ltd, AGSCO Corp, Carborundum Universal Limited, Washington Mills, CoorsTek Inc., Entegris, ESD-SIC bv, Snam Abrasives Pvt. Ltd., Morgan Advanced Materials plc, Microchip Technology Inc, Bruckewell Technology Co., Ltd., Fuji Electric Corp., and others.

The expansion of the market is fueled by the demand for a material that excels in extreme conditions, offering exceptional hardness, thermal stability, and electrical conductivity. This versatile substance is utilized across a wide range of applications, including electronics and manufacturing, where reliability and performance are essential.

As the industry evolves, innovations in production techniques and material applications continue to enhance its role in modern technology and industrial practices.

- In July 2024, onsemi introduced its EliteSiC M3e MOSFETs, advancing silicon carbide technology for power semiconductors. These devices enhance performance and reliability in electrification applications, including electric vehicles, solar inverters, and energy storage.

Key Highlights:

- The silicon carbide industry size was recorded at USD 4,310.0 million in 2023.

- The market is projected to grow at a CAGR of 41.82% from 2024 to 2031.

- Asia Pacific held a share of 35.73% in 2023, valued at USD 1,540.1 million and is anticipated to grow at a CAGR of 41.85% over the forecast period.

- The green technology segment garnered USD 2,229.4 million in revenue in 2023.

- The electricals & electronics segment is expected to reach USD 14,357.5 million by 2031.

Market Driver

"Rising Demand for Electric Vehicles (EVs)"

The rising demand for electric vehicles (EVs) is contributing significantly to the growth of the silicon carbide market.

- According to the International Energy Agency (IEA), approximately 14 million new electric cars were registered worldwide in 2023, increasing the total number of electric vehicles on the road to 40 million.

Silicon carbide is crucial in EV powertrains due to its high efficiency, thermal conductivity, and ability to handle high voltages, making it an ideal material for power devices. As the automotive industry shifts toward electrification, the need for more efficient, durable components grows, further boosting the demand for silicon carbide in power electronics to enhance EV performance and energy efficiency.

- In September 2024, STMicroelectronics introduced its fourth-generation STPOWER silicon carbide MOSFET technology, enhancing efficiency and power density. Designed for electric vehicle traction inverters and industrial applications, this innovation supports ST's commitment to advancing sustainable, high-performance power solutions through 2027.

Market Challenge

"Lack of Awareness Regarding Advantages of Adopting Silicon Carbide"

A significant challenge faced by the silicon carbide market is the lack of awareness regarding its advantages, such as improved efficiency, durability, and heat resistance. This knowledge gap can hinder adoption in sectors such as automotive and renewable energy.

To overcome this challenge, industry players are investing in educational campaigns, partnerships, and demonstrations that highlight SiC’s capabilities. Increased collaboration with key stakeholders and real-world case studies may further promote its benefits and support wider market acceptance.

- In May 2023, onsemi and Penn State established a strategic collaboration worth USD 8 million, leading to the creation of the onsemi Silicon Carbide Crystal Center (SiC3) at Penn State’s Materials Research Institute. This partnership aims to advance silicon carbide research, enhance workforce development, and support the U.S. semiconductor industry.

Market Trend

"Ongoing Technological Innovations"

A key trend in the silicon carbide market is the continuous technological innovation in SiC materials and manufacturing processes. Advancements in material purity, crystal growth techniques, and device design are significantly enhancing SiC’s performance, allowing for higher efficiency and power density.

These innovations are fostering the wider adoption of SiC components across industries such as automotive, energy, and electronics, as they become more reliable and cost-effective. As manufacturers advance SiC technology, it’s positioning itself as a critical material for next-generation power systems and sustainable solutions.

- In January 2025, Wolfspeed introduced its Gen 4 silicon carbide technology platform, which enhances system durability, efficiency, and cost-efficiency. Designed for high-power applications such as EV powertrains and renewable energy, Gen 4 enhances performance, reduces development times, and lowers system costs across multiple voltage classes.

Silicon Carbide Market Report Snapshot

|

Segmentation

|

Details

|

|

By Product

|

Black, Green

|

|

By Application

|

Automotive, Electricals & Electronics, Aerospace, Military & Defense, Healthcare, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, U.K., Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation:

- By Product (Black and Green): The green segment earned USD 2,229.4 million in 2023 due to its high efficiency, superior thermal conductivity, and increasing demand in electric vehicle powertrains and renewable energy applications.

- By Application (Automotive, Electricals & Electronics, Aerospace, Military & Defense, Healthcare, and Others): The electricals & electronics segment held a share of 21.77% in 2023, attributed to the rising need for energy-efficient semiconductors in power devices, consumer electronics, and communication systems.

Silicon Carbide Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

Asia Pacific silicon carbide market captured a notable share of around 35.73% in 2023, valued at USD 1,540.1 million. This dominance is reinforced by rapid industrialization, the growing automotive sector, and increasing demand for renewable energy. This growth is further supported by the surging adoption of SiC in electric vehicle manufacturing, power electronics, and energy infrastructure.

The region's strong semiconductor production capabilities, coupled with supportive government initiatives and increased investments in advanced technologies, further position Asia Pacific as a key market for silicon carbide.

- In August 2024, Infineon Technologies inaugurated the first phase of its groundbreaking SiC power semiconductor facility in Malaysia, which is expected to become the world’s largest. With a USD 2.10 billion investment, the facility is designed to support advancements in electric vehicles, renewable energy systems, and AI data centers.

Europe silicon carbide industry is poised to grow at a robust CAGR of 41.83% over the forecast period. This rapid growth is fueled by the region's strong shift toward sustainability and electrification.

With increasing investments in electric vehicle (EV) production, renewable energy systems, and energy-efficient technologies, European countries are increasingly adopting silicon carbide for its high efficiency and power density. Strong government policies aimed at reducing carbon emissions and enhancing green energy solutions are further fueling demand.

Additionally, leading automotive and industrial manufacturers in Europe are fostering innovation, supporting regional market growth.

- In June 2024, onsemi announced plans to establish a vertically integrated SiC manufacturing facility in the Czech Republic. The facility will produce advanced power semiconductors for electric vehicles, renewable energy, and AI data centers, aligning with the EU’s decarbonization goals.

Region’s Regulatory Framework Also Plays a Significant Role in Shaping the Market

- The Occupational Safety and Health Administration (OSHA), part of the United States Department of Labor, ensures safe and healthy working conditions for American workers, free from unlawful retaliation. OSHA achieves this through setting and enforcing standards, upholding anti-retaliation provisions, providing training and assistance, and collaborating with state OSHA programs.

- Bureau of Indian Standards, established in the year 1947, promotes the development of standardization, marking and quality certification of goods, including agriculture equipment

- The European Union's REACH Regulation governs the registration, evaluation, authorization and restriction of chemicals to protect human health and the environment from chemical risks.

Competitive Landscape:

The silicon carbide industry is characterized by a number of participants, including both established corporations and rising organizations. Competitors in the market are actively expanding their operations globally, focusing on increasing production capacity and enhancing supply chain resilience.

This expansion strategy involves significant investments in advanced manufacturing facilities, strategic collaborations, and innovation in SiC technologies to meet the growing demand across various industries such as automotive, energy, and electronics.

- In May 2024, STMicroelectronics announced plans to build a high-volume 200mm silicon carbide manufacturing facility in Catania, Italy. This facility, part of the Silicon Carbide Campus, will support mass production of SiC devices for automotive, industrial, and cloud applications, enhancing energy efficiency and decarbonization efforts.

List of Key Companies in Silicon Carbide Market:

- STMicroelectronics

- Infineon Technologies AG

- Wolfspeed, Inc.

- ROHM Co., Ltd

- AGSCO Corp

- Carborundum Universal Limited

- Washington Mills

- CoorsTek Inc.

- Entegris

- ESD-SIC bv

- Snam Abrasives Pvt. Ltd.

- Morgan Advanced Materials plc

- Microchip Technology Inc

- Bruckewell Technology Co., Ltd.

- Fuji Electric Corp.

Recent Developments:

- In April 2024, ROHM and STMicroelectronics expanded their long-term agreement with SiCrystal to supply larger volumes of 150mm silicon carbide wafers, valued at USD 230 million. This intitiaitve aims to strengthen STMicroelectronics' SiC manufacturing capacity, supporting automotive and industrial applications for sustainable electrification.

- In December 2024, onsemi acquired Qorvo's Silicon Carbide Junction Field-Effect Transistor (SiC JFET) technology, including its United Silicon Carbide subsidiary, for USD 115 million. This acquisition seeks to enhance onsemi’s power portfolio, supporting energy efficiency in AI data centers and emerging markets such as EV battery disconnects.

- In December 2023, STMicroelectronics signed a long-term silicon carbide (SiC) supply agreement with Li Auto to provide SiC MOSFETs for the company's high-voltage battery electric vehicles (BEVs). This partnership supports Li Auto’s goal of enhancing performance, efficiency, and range in future BEV models.

- In January 2024, Infineon Technologies and Wolfspeed renewed and extended their long-term 150mm silicon carbide wafer supply. This partnership enhances Infineon’s supply chain resilience to meet the growing demand for SiC-based solutions in automotive, solar, EV, and energy storage applications.

- In June 2023, onsemi and BorgWarner expanded their strategic collaboration in silicon carbide (SiC) valued at over $1 billion. BorgWarner will integrate onsemi’s EliteSiC power devices into VIPER power modules, boosting EV performance with increased efficiency and range.

- In July 2023, Renesas Electronics and Wolfspeed signed a decade-long , $2 billion wafer supply agreement. Wolfspeed will provide high-quality silicon carbide wafers to Renesas, supporting its expansion in power semiconductors for automotive and industrial sectors.