Market Definition

The market encompasses the licensing and sale of pre-designed, reusable circuit layouts and functional blocks used in the development of integrated circuits and system-on-chips (SoCs).

This market includes IP cores for processors, memory, interfaces, and other components, and serves industries such as consumer electronics, automotive, telecommunications, industrial, and healthcare. The report highlights key market drivers, trends, regulatory frameworks, and the competitive landscape shaping the industry’s growth.

Semiconductor IP Market Overview

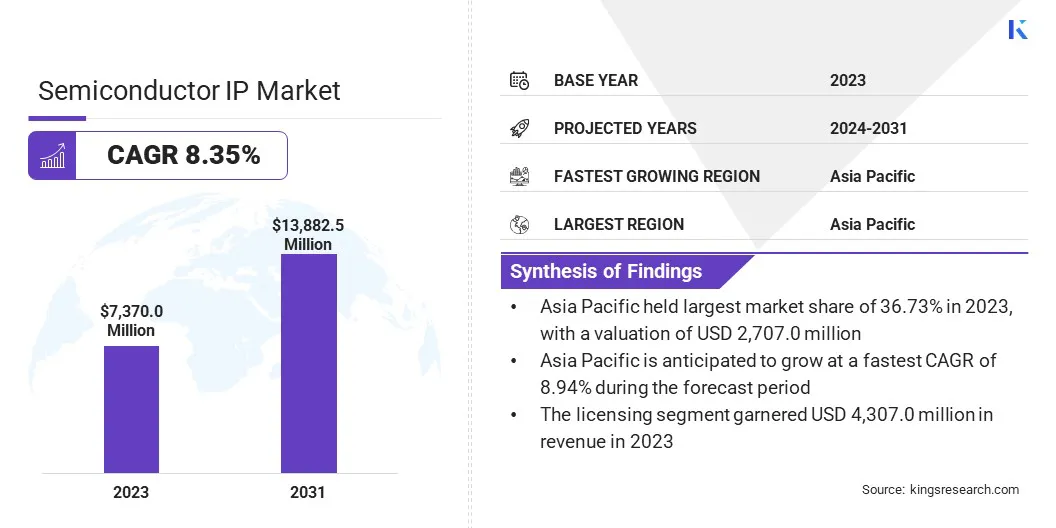

The global semiconductor IP market size was valued at USD 7,370.0 million in 2023 and is projected to grow from USD 7,920.9 million in 2024 to USD 13,882.5 million by 2031, exhibiting a CAGR of 8.35% during the forecast period.

This market is experiencing robust growth, driven by the rising complexity of chip designs and the increasing adoption of system-on-chip (SoC) solutions across a wide range of applications.

As technology nodes continue to shrink, semiconductor companies are increasingly relying on third-party IP to accelerate design cycles and reduce development costs. The proliferation of connected devices, including smartphones, tablets, and smart appliances, is fueling the demand for specialized IP cores for processors, memory, and interfaces.

Major companies operating in the semiconductor IP industry are Arm Limited, Synopsys, Inc., Cadence Design Systems, Inc., Ceva Inc., Siemens, Analog Devices, Inc., Broadcom, Marvell, MediaTek Inc., Qualcomm Technologies, Inc., Advanced Micro Devices, Inc., Intel Corporation, Rambus, MIPS, and Silicon Hub.

Additionally, the rapid expansion of emerging technologies such as 5G, artificial intelligence (AI), and Internet of Things (IoT) is creating a surge in demand for high-performance, low-power IP solutions. Automotive applications, particularly in advanced driver-assistance systems (ADAS) and electric vehicles (EVs) are further contributing to market growth.

- In May 2024, Infosys acquired InSemi, a leading semiconductor design and embedded services provider. Through this acquisition Infosys aims to enhance it's expertise in semiconductor design and Engineering R&D services.

Key Highlights

- The semiconductor IP industry size was valued at USD 7,370.0 million in 2023.

- The market is projected to grow at a CAGR of 8.35% from 2024 to 2031.

- Asia Pacific held a market share of 36.73% in 2023, with a valuation of USD 2,707.0 million.

- The licensing segment garnered USD 4,307.0 million in revenue in 2023.

- The hard IP segment is expected to reach USD 7,897.1 million by 2031.

- The consumer electronics segment is expected to reach USD 5,115.8 million by 2031.

- The market in Europe is anticipated to grow at a CAGR of 8.49% during the forecast period.

Market Driver

"Rising Demand for High-Performance and Secure SoC Designs"

The semiconductor IP market is witnessing robust growth driven by the increasing need for enhanced performance and energy efficiency in chip designs. The growing complexity of modern applications such as machine learning, 5G, and autonomous systems demands greater processing capabilities with reduced power consumption.

To meet these requirements, manufacturers are integrating advanced IP cores that support real-time data processing, secure computing, and low-latency performance. This demand is accelerating the adoption of semiconductor IP as a key enabler of next-generation chip architectures.

- In March 2025, Marvell Technology, Inc. and TSMC collaborated to develop Marvell’s 2nm silicon platform for next-generation AI and cloud infrastructure. The partnership focused on advancing custom XPUs, switches, and other technologies by leveraging advanced semiconductor IP, including high-speed 3D I/O and die-to-die interconnects for 2D and 3D devices.

As more devices become connected, from smartphones to factory machines, cybersecurity is becoming a bigger concern. Modern chips, especially System on Chip (SoC) designs, now combine many features into one chip. This makes them more likely to be targeted by hackers.

To keep these chips safe, manufacturers are adding built-in security features like encryption, secure boot, and protected areas for sensitive data. As a result, there is growing demand for semiconductor IP that focuses on security. Companies need these secure designs to protect data and follow strict security rules.

Market Challenge

"IP Integration Complexity"

A major challenge in the semiconductor IP market is increasing IP integration complexity in advanced SoC designs. As chip designs scale down to cutting-edge process nodes like 5nm and 3nm, SoCs are required to support more features, higher performance, and lower power consumption.

This leads to the integration of a high number of heterogeneous IP blocks, including processor cores, memory interfaces, security modules, and connectivity solutions, often sourced from multiple third-party vendors. Each of these IP blocks may follow different design standards, verification methodologies, or timing requirements.

As a result, integrating them into a cohesive SoC architecture becomes a highly complex task. Moreover, mismatch or incompatibility can lead to functional failures, necessitating costly and time-consuming design rework. Moreover, the verification burden increases exponentially with each new IP addition, further complicating time-to-market expectations.

To address this integration complexity, semiconductor companies are increasingly turning to pre-verified IP subsystems and platform-based IP solutions, which bundle multiple IP blocks that are already optimized and tested to work together. These solutions significantly reduce integration effort and risk by providing known-good configurations.

Market Trend

"Customization and Process Innovation"

The semiconductor IP market is being shaped by the increasing demand for customizable chip solutions and the industry’s shift toward advanced process nodes. As applications across AI, automotive, and IoT grow more specialized, companies seek IP solutions tailored to their unique design needs.

Customizable IP blocks enable more efficient integration and optimization in terms of performance, power, and area, allowing for faster development cycles and differentiated products. In addition, the adoption of advanced process nodes is changing manufacturing approaches.

These nodes support higher transistor densities, enabling greater performance and energy efficiency while reducing chip size. Their adoption is essential for keeping pace with the processing demands of next-generation technologies such as cloud computing, edge devices, and high-speed networks.

- In February 2025, Silicon Creations completed the tape-out of a chip on TSMC’s N2P process, featuring a novel temperature sensor and an expanded clocking IP portfolio. The new IP offerings, including jitter-optimized phase-locked loop (PLLs), oscillators, and SoC-friendly temperature sensors, are designed to support next-generation semiconductor products, reinforcing the company’s leadership in advanced analog and mixed-signal IP development.

Semiconductor IP Market Report Snapshot

|

Segmentation

|

Details

|

|

By IP Source

|

Licensing, Royalty

|

|

By IP Core

|

Soft IP, Hard IP

|

|

By Application

|

Consumer Electronics, Automotive, Industrial, Telecommunications, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By IP Source (Licensing, Royalty): The licensing segment earned USD 4,307.0 million in 2023 due to growing demand for customizable and cost-effective design solutions that accelerate time-to-market.

- By IP Core (Soft IP, Hard IP): The hard IP held 57.89% of the market in 2023, due to its superior performance, reliability, and optimized power efficiency in advanced semiconductor applications.

- By Application (Consumer Electronics, Automotive, Industrial, Telecommunications, Others): The consumer electronics segment is projected to reach USD 5,115.8 million by 2031, owing to the rising integration of advanced features in smartphones, tablets, and smart home devices.

Semiconductor IP Market Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

Asia Pacific semiconductor IP market share stood at around 36.73% in 2023, with a valuation of USD 2,707.0 million. This dominance is primarily attributed to the region's strong semiconductor manufacturing ecosystem, led by countries such as Taiwan, South Korea, and China.

The presence of leading global foundries such as TSMC and Samsung is driving the demand for advanced semiconductor IP to support advanced chip designs. Additionally, the rapid growth of consumer electronics manufacturing in China and Southeast Asia, along with rising investments in AI, 5G, and automotive electronics, is further accelerating the adoption of IP cores to support faster and more efficient chip development.

The semiconductor IP industry in Europe is expected to register the fastest growth in the market, with a projected CAGR of 8.49% over the forecast period. This growth is fueled by the region’s strategic push toward semiconductor self-sufficiency and innovation in automotive technologies, particularly in Germany and France.

The increasing demand for IP in electric vehicles, autonomous driving systems, and industrial automation is driving partnerships between European semiconductor firms and IP vendors. Moreover, Europe’s focus on high-performance computing and edge AI is boosting a strong demand for advanced processor and interface IPs tailored to these specialized applications.

- In April 2025, the Government of India approved semiconductor manufacturing projects and talent development initiatives under the Semicon India Programme, with a total outlay of USD 8 billion. The program includes fiscal incentives for setting up semiconductor fabs, ATMP/OSAT facilities, and chip design, along with R&D support and global partnerships to boost a domestic semiconductor and IP ecosystem.

Regulatory Frameworks

- In the United States, semiconductor IP is regulated under intellectual property laws, including the Patent Act which governs patent protection for semiconductor inventions. The U.S. Patent and Trademark Office (USPTO) handles the granting of semiconductor patents, and the Federal Trade Commission (FTC) enforces regulations related to antitrust issues, ensuring fair competition in the market.

- In Europe, semiconductor IP is regulated under the European Patent Convention (EPC), which allows for patent protection in all member states of the European Patent Organisation (EPO). The European Commission also addresses antitrust issues related to semiconductor IP under the EU competition law, ensuring that semiconductor companies do not engage in anti-competitive practices.

- In China, semiconductor IP is governed by the Patent Law of the People's Republic of China, which is enforced by the China National Intellectual Property Administration (CNIPA). The Chinese government has also implemented various measures to promote indigenous innovation, including regulations on the licensing and protection of semiconductor IP.

- In Japan, semiconductor IP is governed by the Patent Act, with the Japan Patent Office (JPO) responsible for granting patents. Japan also adheres to international IP treaties like the TRIPS Agreement, ensuring global IP protection. The Japan Fair Trade Commission (JFTC) oversees the enforcement of antitrust regulations regarding semiconductor IP to prevent monopolistic practices.

Competitive Landscape

The semiconductor IP industry is characterized by several players competing for technological leadership and market share through strategic innovation, portfolio expansion, and partnerships.

Companies in this space are increasingly focusing on developing highly specialized and application specific IP cores to cater to the growing complexity of semiconductor designs across diverse end-use industries.

A key strategy adopted by market players is the expansion of IP portfolios to include advanced processor architectures, AI accelerators, high-speed interfaces, and low-power designs. They are investing heavily in R&D to stay ahead in emerging technologies such as AI and 5G.

Moreover, key players are acquiring niche IP firms to strengthen domain expertise and expand their geographic footprint. Participation in industry standardization bodies ensures compatibility and accelerates market acceptance of new IP offerings.

- In November 2024, Achronix Semiconductor Corporation entered a strategic partnership with BigCat Wireless to integrate DSP IP with Achronix’s Speedster7t FPGAs for advanced 5G and future 6G applications. The collaboration leverages BigCat’s optimized DSP kernels and Achronix’s machine learning processors to enhance 5G lower PHY performance, enabling high-speed beamforming and MIMO processing through scalable, high-frequency signal processing solutions.

List of Key Companies in Semiconductor IP Market:

- Arm Limited

- Synopsys, Inc.

- Cadence Design Systems, Inc.

- Ceva Inc.

- Siemens

- Analog Devices, Inc.

- Broadcom

- Marvell

- MediaTek Inc.

- Qualcomm Technologies, Inc.

- Advanced Micro Devices, Inc.

- Intel Corporation

- Rambus

- MIPS

- Silicon Hub

Recent Developments (Acquisition/Partnership/Agreement/Product Launch)

- In March 2025, Sofics and Dolphin Semiconductor formed a strategic partnership to enhance integrated circuit (IC) designs for IoT, wireless, and automotive applications. The collaboration focused on combining Sofics' specialty I/O and ESD protection IP with Dolphin Semiconductor's expertise in power management, audio, and design robustness to offer optimized solutions for faster time-to-market and increased design performance.

- In February 2025, Arteris, Inc. introduced FlexGen, a smart network-on-chip (NoC) interconnect IP. The technology is focused on accelerating chip development by optimizing performance efficiency, reducing design iterations, and improving power efficiency through AI-driven automation.

- In February 2025, Siemens Digital Industries Software signed an exclusive OEM agreement with Alphawave Semi to bring Alphawave’s high-speed interconnect silicon IP to market. The partnership focused on offering advanced IP platforms for connectivity and memory protocols like Ethernet, PCIe, CXL, HBM, and UCIe, supporting next-generation SoC and chiplet-based designs in high-growth markets like AI, 5G, and autonomous vehicles.

- In January 2025, Cadence acquired Secure-IC, a leading embedded security IP platform provider. The acquisition focused on enhancing Cadence’s portfolio with Secure-IC’s embedded security IP, security solutions, evaluation tools, and services to address growing complexities in embedded cybersecurity for SoC designs.