Automotive Electronics Market Size

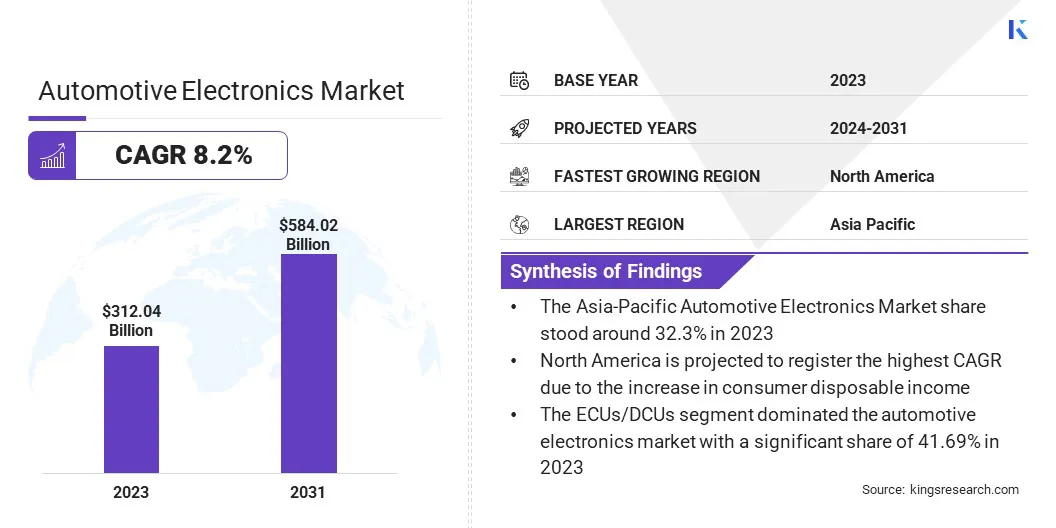

The global Automotive Electronics Market size was valued at USD 312.04 billion in 2023 and is projected to reach USD 584.02 billion by 2031, growing at a CAGR of 8.2% from 2024 to 2031. In the scope of work, the report includes products offered by companies such as Continental AG, DENSO CORPORATION, HELLA GmbH & Co. KGaA, Hitachi Automotive Systems Americas, Inc. , Infineon Technologies AG, Robert Bosch GmbH, VALEO, Visteon Corporation, Xilinx, Inc., ZF Friedrichshafen AG and others.

The automotive electronics sector is experiencing significant growth and transformation, propelled by technological advancements and rising consumer demand for connectivity and autonomous driving features. This trend is prompting automobile manufacturers to increasingly incorporate sophisticated electronics into their vehicles, signaling a robust expansion of the automotive electronics market. Furthermore, the transition toward electric and hybrid vehicles is stimulating demand for innovative electronic components designed to enhance vehicle performance and efficiency.

Moreover, the automotive electronics market offers substantial opportunities for manufacturers and suppliers to tap into the growing demand for advanced automotive technologies. The integration of artificial intelligence and the Internet of Things within automotive applications is further fueling market growth, as it improves the driving experience by enhancing safety, connectivity, and convenience.

As urban environments evolve toward smarter ecosystems, the necessity for advanced electronic components is anticipated to surge. This trend underscores the importance for manufacturers and suppliers to innovate and align with these shifts for success in this dynamic market landscape. Vehicles are becoming increasingly sophisticated, efficient, and intelligent, heralding an era of autonomous and interconnected vehicles that can interact with each other and the broader infrastructure. The automotive electronics market is poised to witness significant growth in the near future, mainly driven by the need to meet increasing consumer demand.

Analyst’s Review

The automotive electronics sector is witnessing substantial expansion, driven by rising demands for enhanced safety attributes, connectivity features, and entertainment systems within vehicles. A pivotal factor propelling this growth is the advent of electric vehicles, which require more complex electronic components compared to traditional internal combustion engine models. Furthermore, the adoption of artificial intelligence and machine learning technologies within automotive electronics is transforming vehicle functionality and their interaction with the environment.

Moreover, a notable development in the market is the increased focus on cybersecurity measures to safeguard connected vehicles against potential cyber threats. As vehicles progress towards greater autonomy and connectivity, there is a rising need for sophisticated sensors, processors, and communication mechanisms. This transition to intelligent vehicles is spurring innovation within the automotive electronics market, prompting firms to significantly invest in research and development to maintain competitive advantage. With the proliferation of electric and autonomous vehicles, along with the growing imperative for data security, the automotive electronics market is anticipated to experience notable growth in the foreseeable future.

Market Definition

Automotive electronics encompass the array of electronic systems and components deployed in vehicles to bolster safety, enhance performance, and elevate the driving experience. This sector includes fundamental components such as engine control units and airbag sensors, along with sophisticated technologies such as GPS navigation, adaptive cruise control, and comprehensive infotainment systems. The growth of the automotive electronics market is propelled by growing consumer interest in connected and autonomous vehicles, coupled with an increasing emphasis on vehicle electrification and sustainability initiatives.

- To guarantee the integrity and safety of these complex systems, rigorous regulatory standards are enforced, including ISO 26262 for functional safety and ECE R10 for electromagnetic compatibility.

Furthermore, automotive electronics are pivotal in facilitating cutting-edge technologies such as vehicle-to-everything (V2X) communication, advanced driver assistance systems (ADAS), and sophisticated in-vehicle networking protocols, including CAN and Ethernet. As the automotive sector undergoes rapid transformation, the incorporation of advanced electronics is critical in advancing vehicle capabilities and functionality. These innovations enhance the driving experience and facilitate future advancements within the industry.

Market Dynamics

The surging interest in electric vehicles (EVs) is boosting the growth of the automotive electronics market. With an increasing number of consumers shifting toward eco-friendly transportation solutions, automobile manufacturers are increasingly focusing on the development of electric vehicles equipped with sophisticated electronic systems. These advancements necessitate the deployment of complex electronic components, ranging from battery management systems to advanced infotainment setups.

In response to this rising demand, electronics manufacturers are actively focusing on innovation, developing state-of-the-art technologies tailored to the burgeoning electric vehicle market. This dynamic is not merely transforming the trajectory of the transportation sector but also stimulating substantial growth within the automotive electronics industry. As the consumer shift toward electric vehicles gains momentum, the need for these advanced electronic components is expected to increase, presenting electronics manufacturers with substantial opportunities to augment their market presence and secure a competitive position in the automotive sector.

Moreover, the push toward eco-conscious transportation is propelling advancements in electronic systems, thereby contributing to the development of more efficient and sustainable vehicles. As a result, the collaborative initiatives between automotive manufacturers and electronics producers are laying the foundational groundwork for a transformative shift in transportation dynamics fostering market growth through a combination of environmental sustainability and technological sophistication.

However, the substantial investment required for the incorporation of advanced electronic systems in vehicles presents a significant barrier impeding the expansion of the automotive electronics market. The development and integration costs of leading-edge technologies, including autonomous driving capabilities and connected car systems, are notably high, rendering them financially burdensome for numerous manufacturers. This financial hurdle restricts the adoption rate of vehicles equipped with such sophisticated electronic systems, thereby impeding the broader market penetration of automotive electronics.

Moreover, the expenses associated with the maintenance and repair of these complex electronic systems pose an additional challenge for consumers, thereby reducing the adoption rate of these technologies within the automotive sector.

Segmentation Analysis

The global automotive electronics market is segmented based on type, application, vehicle types, and geography.

Based on type, the market is bifurcated into ECUs/DCUs, sensors, power electronics, and other electronics components. The ECUs/DCUs segment dominated the automotive electronics market with a significant share of 41.69% in 2023. This growth is mainly driven by its critical role in managing various vehicle functionalities, thereby contributing significantly to improved engine performance, increased fuel efficiency, and enhanced vehicle safety.

The integration of advanced technologies, including artificial intelligence and machine learning, has reinforced the significance of ECUs/DCUs in the automotive industry. Their ability to adapt to fluctuating driving conditions and ensure smooth communication with various vehicle systems establishes them as essential components in modern automotive design.

Moreover, as technology progresses, ECUs/DCUs are undergoing further development to incorporate advanced features such as real-time data analytics and predictive maintenance. These advancements enhance the driving experience for consumers and provide manufacturers with the tools to preemptively detect and rectify potential issues. This underscores the evolving sophistication and critical importance of ECUs/DCUs in driving both innovation and safety in the automotive sector.

Based on application, the market is bifurcated into body & energy, chassis & powertrain, infotainment, and ADAS/AD. Chassis & powertrain acquired the largest market share of 32.8% in 2023, due to its deployment of innovative technologies and superior performance metrics. Additionally, the strategic emphasis of body & energy on sustainability and energy efficiency aligns with the growing consumer trend towards environmental consciousness. This alignment with eco-friendly practices distinguishes them from competitors and emphasizes their leadership status within the industry.

Additionally, the commitment of body & energy to continuous research and development positions them at the forefront of technological progress within the automotive electronics sector. Consequently, this has fostered a robust reputation for reliability and advanced performance, establishing them as the preferred choice among consumers and manufacturers in the automotive electronics sphere.

Based on vehicle types, the market is bifurcated into passenger vehicles, and commercial vehicles. The passenger vehicles segment accounted for a significant market share of 38.33% in 2023, mainly driven by extensive adoption and consumer demand. Additionally, technological advancements have equipped modern vehicles with an array of electronic functionalities that elevate safety, comfort, and convenience for both drivers and passengers.

The incorporation of features such as infotainment systems, GPS navigation, and driver-assist technologies has notably enhanced the appeal and functionality of passenger vehicles. Furthermore, the growing shift toward electric and autonomous vehicles is highlighting the significance of automotive electronics within the passenger vehicle segment.

Automotive Electronics Market Regional Analysis

Based on region, the global automotive electronics market is classified into North America, Europe, Asia Pacific, MEA, and Latin America.

The Asia-Pacific Automotive Electronics Market share stood around 32.3% in 2023 in the global market, with a valuation of USD 98.59 billion, majorly attributed to the significant presence of leading automotive manufacturers, including General Motors, Ford, and Tesla, renowned for their pioneering advancements in vehicular technology.

Moreover, Asia-Pacific benefits from a well-established infrastructure for research and development, facilitating companies' ability to swiftly respond to evolving consumer preferences and technological breakthroughs. This dynamic ecosystem promotes collaboration among industry participants, thereby expediting the introduction of advanced electronic systems in vehicles. Additionally, the growing emphasis on adhering to regulatory standards and safety norms ensures that automotive electronics conform to the highest criteria of quality and performance. This dedication to compliance and excellence provides Asian enterprises with a strategic advantage in the global market landscape.

North America is projected to register the highest CAGR over the forecast period due to the increase in consumer disposable income. Due to the increased financial capability among residents in these regions, there is a notable inclination toward purchasing vehicles equipped with sophisticated electronic features.

Furthermore, the well-established infrastructure development & urban population efforts in the region are boosting demand for these vehicles, thereby propelling market growth. Additionally, technological advancements, coupled with an increasing awareness of the benefits associated with automotive electronics, are supporting regional market expansion. In response, manufacturers are innovating and introducing advanced electronic features in vehicles to cater to this growing demand.

Competitive Landscape

The global automotive electronics market study will provide valuable insights with an emphasis on the fragmented nature of the industry. Prominent players are focusing on several key business strategies, such as partnerships, mergers & acquisitions, product innovations, and joint ventures to expand their product portfolio and increase their market shares across different regions. Strategic initiatives, including investments in R&D activities, the establishment of new manufacturing facilities, and supply chain optimization, could create new opportunities for market growth.

List of Key Companies in Automotive Electronics Market

- Continental AG

- DENSO CORPORATION

- HELLA GmbH & Co. KGaA

- Hitachi Automotive Systems Americas, Inc.

- Infineon Technologies AG

- Robert Bosch GmbH

- VALEO

- Visteon Corporation

- Xilinx, Inc.

- ZF Friedrichshafen AG

Key Industry Developments

- March 2023 (Partnership): Infineon Technologies AG partnered with Delta Electronics, Inc., an energy, and power management company, aimed at enhancing their innovative efforts to provide higher density and more efficient solutions for the growing electric vehicles market.

- January 2023 (Product Launch): ZF Friedrichshafen AG launched Smart Camera 6, a next-generation camera for automated driving and safety systems. The main focus of Smart Camera 6 is to fulfill the demand for 3D surround view and interior monitoring systems with the support of Image processing module systems.

The Global Automotive Electronics Market is Segmented as:

By Type

- ECUs/DCUs

- Sensors

- Power Electronics

- Other Electronics Components

By Application

- Body & Energy

- Chassis & Powertrain

- Infotainment

- ADAS/AD

By Vehicles Types

- Passenger Vehicles

- Commercial Vehicles

By Region

- North America

- Europe

- France

- U.K.

- Spain

- Germany

- Italy

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia Pacific

- Middle East & Africa

- GCC

- North Africa

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America