Market Definition

The market includes technologies that allow users to interact with digital content through touch-sensitive displays, removing the need for traditional input devices. It includes the design and integration of multi-touch interfaces, object recognition systems, and gesture-based controls. These systems are used in sectors like retail, healthcare, automotive, and education for data visualization, and interactive experiences.

Surface computing also supports advanced human-computer interaction in smart environments. The report provides a comprehensive analysis of key drivers, emerging trends, and the competitive landscape expected to influence the market over the forecast period.

Surface Computing Market Overview

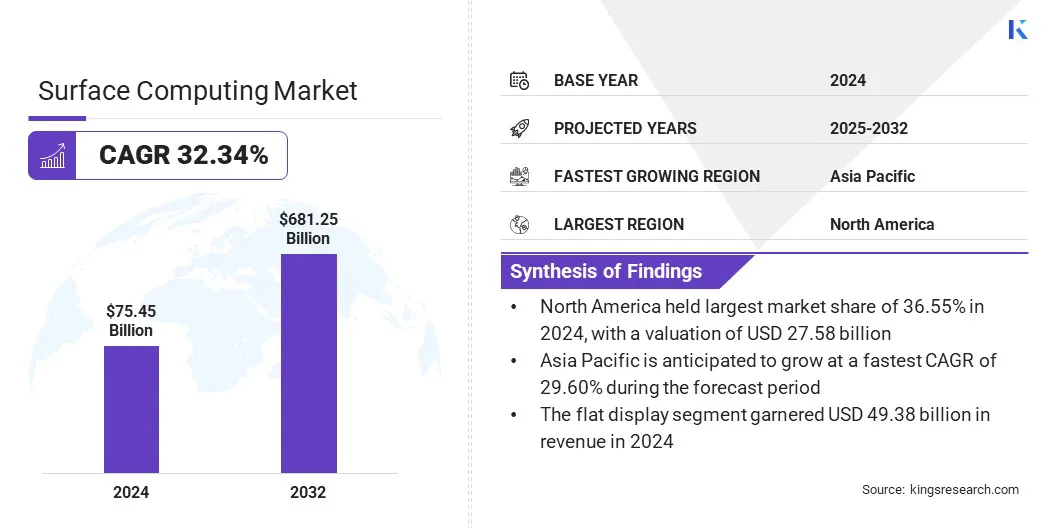

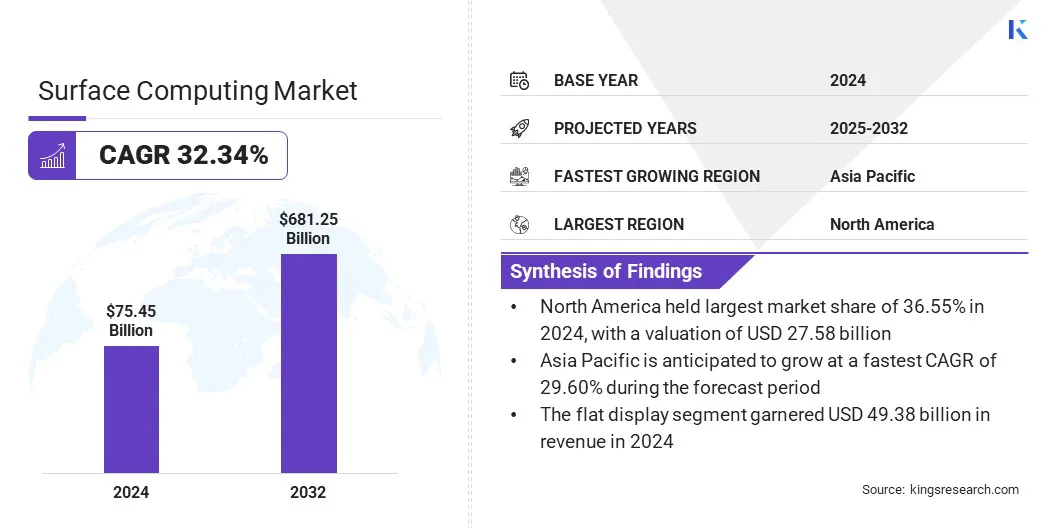

The global surface computing market size was valued at USD 75.45 billion in 2024 and is projected to grow from USD 95.80 billion in 2025 to USD 681.25 billion by 2032, exhibiting a CAGR of 32.34% during the forecast period.

The growth of the market is influenced by the expansion of smart classrooms and digital education tools, which increase the demand for interactive learning environments. Additionally, the development of multitouch and gesture recognition technologies enhances user interaction, making surface computing systems more versatile across educational and commercial applications.

Key Highlights

- The surface computing industry size was valued at USD 75.45 billion in 2024.

- The market is projected to grow at a CAGR of 32.34% from 2025 to 2032.

- North America held a market share of 36.55% in 2024, with a valuation of USD 27.58 billion.

- The flat display segment garnered USD 49.38 billion in revenue in 2024.

- The single touch segment is expected to reach USD 401.28 billion by 2032.

- The two dimensional segment secured the largest revenue share of 57.32% in 2024.

- The retail segment is poised for a robust CAGR of 37.20% through the forecast period.

- The market in Asia Pacific is anticipated to grow at a CAGR of 29.60% during the forecast period.

Major companies operating in the surface computing market are Microsoft, Apple Inc., SAMSUNG, Dell Inc., LG Electronics, Lenovo, Fujitsu, Qualcomm Technologies, Inc., IBM, Panasonic Corporation, 3M, Planar Systems, Inc., ViewSonic Corporation, TouchMagix Media Pvt. Ltd., and Ideum, Inc.

The retail and hospitality sectors are using surface computing to improve customer interaction and service efficiency. Interactive tables, digital kiosks, and touch-based check-in systems are helping brands engage customers more intuitively.

This is reshaping service experiences and boosting the demand for touch-enabled platforms. The ability to provide real-time product information and support in physical environments is contributing to the growth of the market across global retail chains and hospitality providers.

- In April 2024, ScalePad integrated Microsoft Surface PCs into its Workstation Assurance service, addressing the growing demand from Managed Service Providers (MSPs). This move enhances support for Surface devices, reflecting the increasing reliance on touch-based computing in business environments.

Market Driver

Expansion of Smart Classrooms and Digital Education Tools

Educational institutions are adopting surface computing to deliver dynamic and interactive learning experiences. Smart desks, collaborative whiteboards, and touch displays help students and teachers interact in real time.

This has made surface computing integral to the global shift toward digital education. The demand for engaging and accessible classroom tools is leading to the steady growth of surface computing in the education sector, particularly in higher education and skill-based training environments.

- In April 2024, the Uttar Pradesh government in India initiated the establishment of digital smart classrooms in 48 government schools within the Prayagraj district. The project includes the installation of interactive whiteboards, projectors, and other ICT tools to foster interactive and engaging learning experiences.

Market Challenge

High Cost of Deployment and Integration

A significant challenge limiting the growth of the surface computing market is the high cost of deploying and integrating these systems, especially in large-scale environments like schools, hospitals, and corporate offices. The expense includes advanced hardware, software customization, and ongoing maintenance.

Key market players are focusing on developing modular and scalable solutions that reduce upfront investment. Many are also introducing subscription-based models and offering cloud-based management tools to lower operational costs. Additionally, collaborations with educational institutions and public sector organizations are helping companies implement cost-effective pilot projects to demonstrate long-term value and drive broader adoption.

Market Trend

Development of Multitouch and Gesture Recognition Technologies

Advances in multitouch sensitivity, gesture detection, and user interaction design are making surface computing more responsive and versatile. These improvements allow for more natural interactions across applications, from industrial controls to public information systems. Enhanced hardware capabilities and intuitive software design are encouraging adoption. The evolution of these technologies is contributing to the growth of surface computing in both consumer and commercial sectors.

- In February 2025, BytePlus introduced advanced gesture recognition filters through its BytePlus Effects platform. These filters offer scalable solutions for developers and businesses, enabling intuitive and immersive user interactions across various industries such as entertainment and retail.

Surface Computing Market Report Snapshot

|

Segmentation

|

Details

|

|

By Type

|

Flat Display, Curved Display

|

|

By Touch

|

Single Touch, Multi-touch, Multi-user, Others

|

|

By Dimension

|

Two Dimensional, Three Dimensional

|

|

By Application

|

Education, Retail, Automotive, Commercial, Entertainment, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Type (Flat Display, Curved Display): The flat display segment earned USD 49.38 billion in 2024, due to its lower production cost, slim design, and widespread integration across commercial, educational, and retail environments.

- By Touch (Single Touch, Multi-touch, Multi-user, Others): The single touch segment held 65.45% share of the market in 2024, due to its cost-effectiveness, ease of use, and wide compatibility across various applications.

- By Dimension (Two Dimensional, Three Dimensional): The two dimensional segment is projected to reach USD 456.57 billion by 2032, owing to its widespread adoption in interactive displays and touchscreens, offering intuitive user interfaces that meet diverse commercial and educational needs efficiently.

- By Application (Education, Retail, Automotive, Commercial, Entertainment, Others): The retail segment is poised for significant growth at a CAGR of 37.20% through the forecast period, due to its growing use of interactive displays and self-service kiosks that enhance customer experience and streamline operations.

Surface Computing Market Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

North America accounted for a surface computing market share of around 36.55% in 2024, with a valuation of USD 27.58 billion. North America hosts several leading technology companies that develop and commercialize advanced surface computing solutions. This concentration of innovators accelerates product development and adoption. The presence of research hubs and startup ecosystems focused on human-computer interaction fuels continuous improvements.

This environment supports the growth of the regional market by ensuring that cutting-edge products reach industries quickly and effectively. Moreover, retailers in North America are rapidly adopting interactive displays and surface computing systems to enhance customer engagement, accelerating the growth of the market in North America.

- In January 2024, Sharp Imaging and Information Company of America introduced the Advanced AQUOS BOARD interactive displays, featuring innovative technology aimed at improving interactive learning and business presentations. These developments underscore the growing trend of integrating advanced surface computing technologies in North American institutions.

The surface computing industry in Asia Pacific is poised for significant growth at a robust CAGR of 29.60% over the forecast period. The region is increasing investment in digital learning platforms to improve education accessibility and quality.

Schools and universities are incorporating surface computing devices like interactive whiteboards and collaborative tables. These tools help create engaging learning environments and support remote education efforts, contributing to the growth of the market across Asia Pacific.

- In July 2024, the Haryana government in India announced plans to equip an additional 1,000 government primary schools with smart classrooms for the 2024-25 academic year. This initiative is part of the Sampark program, aiming to enhance digital learning environments and improve learning outcomes across the state.

Regulatory Frameworks

- In the U.S., the CHIPS and Science Act of 2022 promotes domestic semiconductor production, which supports surface computing hardware development. The Department of Commerce enforces strict export controls on advanced computing components to limit technology transfer to certain countries.

- The European Union (EU) regulates surface computing through the General Data Protection Regulation (GDPR), which imposes detailed privacy obligations on systems collecting user data. Additionally, the Restriction of Hazardous Substances (RoHS) Directive limits the use of harmful materials in electronics, directly impacting the design and manufacturing of interactive computing devices.

- China governs surface computing devices under the China Restriction of Hazardous Substances (China RoHS II), aligning closely with global environmental safety standards. The Personal Information Protection Law (PIPL), enacted in 2021, sets out strict rules for collecting, storing, and using personal data.

- In Japan, the Act on the Protection of Personal Information (APPI) governs the collection and use of personal data within surface computing platforms. Organizations must implement clear data handling policies and allow user control over their information. This is particularly relevant for systems used in healthcare, public service, and education, where user interaction is frequent. Compliance with APPI ensures trust and legal adherence in the application of surface technologies.

Competitive Landscape

Major players in the surface computing industry are adopting strategies such as integrating Artificial Intelligence (AI) into interactive display solutions, improving classroom engagement, and enhancing user experience through real-time assistance tools. These efforts are focused on making surface computing more adaptive and effective in educational settings. Companies are expanding the applications of their products by adding smart functions that support teaching and learning.

- In June 2024, Samsung introduced AI-powered features to its WAD Interactive Display at the ISTELive conference. The Samsung AI Class Assistant offers automatic transcriptions, generative class summaries, quizzes, and voice-enabled whiteboard functions, aiming to elevate classroom engagement and support educators in delivering dynamic lessons.

Top Key Companies in Surface Computing Market:

- Microsoft

- Apple Inc.

- SAMSUNG

- Dell Inc.

- LG Electronics

- Lenovo

- Fujitsu

- Qualcomm Technologies, Inc.

- IBM

- Panasonic Corporation

- 3M

- Planar Systems, Inc.

- ViewSonic Corporation

- TouchMagix Media Pvt. Ltd.

- Ideum, Inc.

Recent Developments (Expansion/Product Launch)

- In May 2025, Microsoft expanded its Surface Copilot+ PC lineup by launching two new models: a 13-inch Surface Laptop and a 12-inch Surface Pro. These devices are powered by Qualcomm Snapdragon X Plus processors, featuring dedicated Neural Processing Units for advanced AI experiences. Priced at $899 and $799 respectively, they aim to make AI-enhanced computing more accessible to a broader user base.

- In May 2025, HP launched the OmniStudio X All-in-One PC in India, featuring a 32-inch 4K display powered by Intel Core Ultra processors and Intel AI Boost technology. Designed for professionals and content creators, this AI-enhanced system offers robust multitasking and improved computing capabilities, emphasizing HP's commitment to integrating next-generation AI tools into its hardware.

- In January 2025, Microsoft announced new Surface Copilot+ PCs for Business, introducing Surface Pro and Surface Laptop models equipped with the latest Intel Core Ultra processors (Series 2). These devices offer enhanced performance, battery life, and security, catering to business needs. Additionally, Microsoft introduced the Surface USB4 Dock, providing fast charging and data transfer capabilities, and new experiences with Microsoft Teams Rooms on Surface Hub 3, enhancing collaboration in business environments.

- In February 2024, Lenovo unveiled a concept for the ThinkBook laptop, featuring a 17.3-inch micro-LED transparent display that resembles a glass pane with a thickness of less than 4 millimeters. The device substitutes the traditional keyboard with a smooth surface that can project keys or be utilized as a drawing pad. This concept showcases Lenovo's commitment to pushing the boundaries of surface computing technology.