Market Definition

An interactive display is a touchscreen-enabled digital screen that allows users to engage with content through touch, stylus, or gestures. Widely used in business, education, healthcare, retail, and public spaces, it enhances collaboration, learning, and user engagement.

These displays support real-time interaction, multimedia integration, and connectivity with various devices and platforms, transforming traditional communication and presentation methods. The report outlines the primary drivers of market growth, along with an in-depth analysis of emerging trends and evolving regulatory frameworks shaping the market's trajectory.

Interactive Display Market Overview

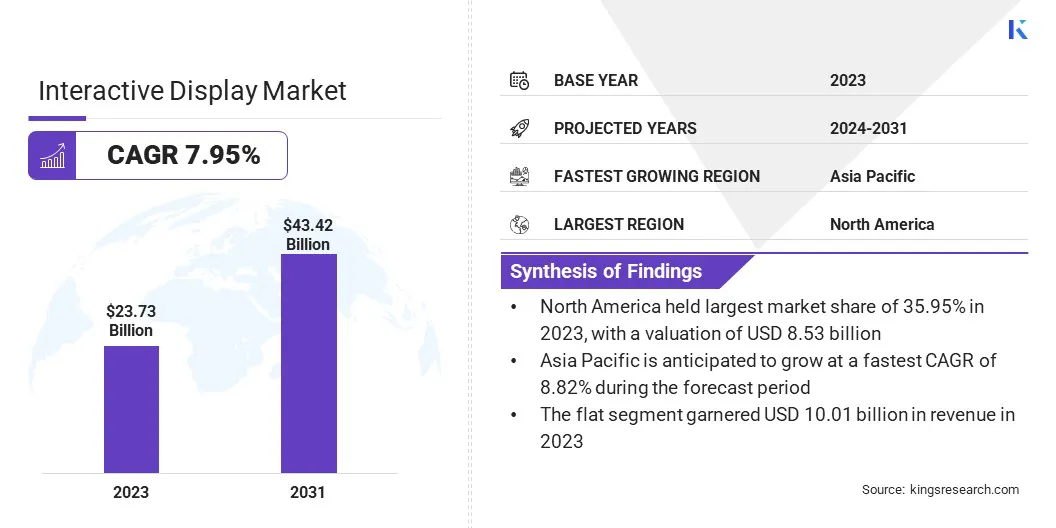

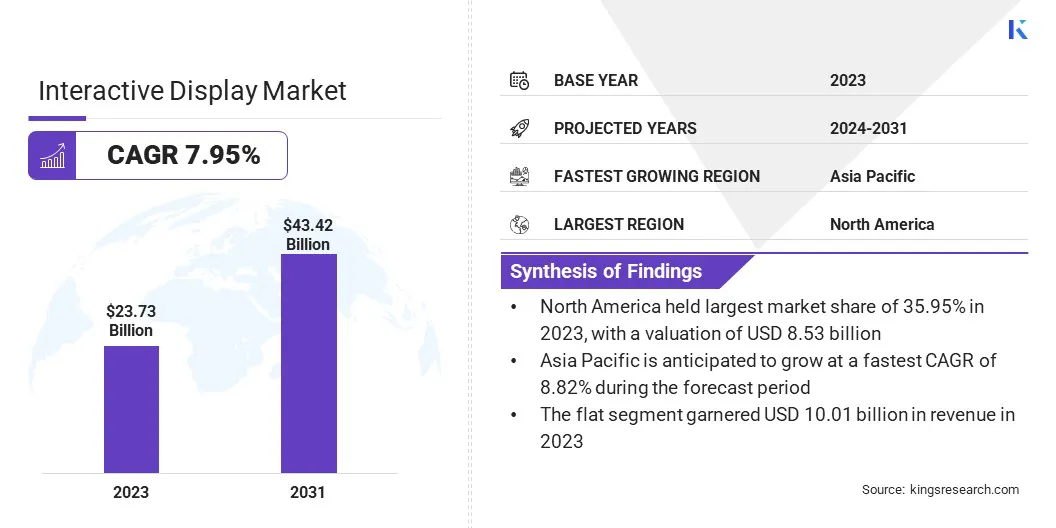

The global interactive display market size was valued at USD 23.73 billion in 2023 and is projected to grow from USD 25.42 billion in 2024 to USD 43.42 billion by 2031, exhibiting a CAGR of 7.95% during the forecast period.

The market is growing rapidly, driven by the shift toward student-centric pedagogy, telehealth, and the demand for 4K and Ultra-HD displays. These technologies enhance collaboration, patient care, and user engagement across education, healthcare, retail, and corporate sectors.

Major companies operating in the interactive display industry are SAMSUNG, Panasonic Life Solutions India Pvt. Ltd., Elo Touch Solutions Inc., LG DISPLAY CO. LTD, Leyard Europe, BOE Technology Group Co., Boxlight, eyefactive GmbH, Horion, Christie Digital Systems USA Inc, Sharp Corporation, ViewSonic Corporation, MMT GmbH & Co. KG., TableConnect GmbH, and Promethean Limited.

The market is registering significant growth, due to the increasing emphasis on student-centric pedagogy. Interactive displays address this need by facilitating real-time collaboration, multimedia integration, and adaptive learning experiences, thereby enhancing student participation and academic outcomes.

This shift aligns with the broader trend of digital transformation in education, aiming to create more dynamic and inclusive learning environments.

- In January 2025, Samsung Electronics America introduced the Wide Angle Frame (WAF) Interactive Display at the Future of Education Technology Conference (FETC) and the Texas Computer Education Association (TCEA) Powered by Android 14, this Google EDLA-certified solution enhances classroom collaboration. It offers seamless access to Google services, including Google Play and YouTube, and introduces features like instant annotation and split-screen multitasking to foster engaging and personalized learning experiences.

Key Highlights:

- The interactive display market size was valued at USD 23.73 billion in 2023.

- The market is projected to grow at a CAGR of 7.95% from 2024 to 2031.

- North America held a market share of 35.95% in 2023, with a valuation of USD 8.53 billion.

- The interactive kiosk segment garnered USD 6.48 billion in revenue in 2023.

- The flexible segment is expected to reach USD 18.12 billion by 2031.

- The OLED segment is anticipated to register a CAGR of 8.30% during the forecast period.

- The retail & hospitality segment is forecasted to hold a market share of 22.31% in 2031.

- The market in Asia Pacific is anticipated to grow at a CAGR of 8.82% during the forecast period.

Market Driver

Integration with Telehealth and Remote Monitoring

The interactive display market is registering significant growth, driven by the increasing demand for telehealth and remote monitoring solutions. These displays facilitate real-time communication and data visualization, enhancing patient engagement and enabling healthcare providers to deliver more personalized care.

By integrating with wearable devices and electronic health records, interactive displays support continuous monitoring of chronic conditions, leading to timely interventions and improved patient outcomes. This integration optimizes resource utilization and supports the growing demand for patient-centric care models.

- In September 2024, ZTE Corporation launched its AI Screen solution, integrating smart displays with AI technology to enhance senior care. The system connects to wearable devices like blood pressure monitors and glucose meters for real-time health monitoring. It offers emergency alerts, remote consultations, and daily task assistance, serving nearly 48 million users across 31 provinces in China.

Market Challenge

High initial costs and maintenance expenses

High initial costs and ongoing maintenance expenses present significant challenges to the adoption of interactive displays, particularly in developing regions. These financial barriers often deter educational institutions and small enterprises from investing in advanced technologies.

Vendors can offer scalable solutions with modular components, allowing organizations to start with essential features and expand as budgets permit. Additionally, implementing cloud-based services can reduce infrastructure costs and simplify maintenance, making interactive displays more accessible and sustainable for cost-sensitive markets.

Market Trend

Technological Advancements in Display

The market is experiencing significant transformation through advancements in display technology that enhance visual performance, touch responsiveness, and design aesthetics. Adoption of 4K and 8K resolutions, alongside organic light-emitting Diode (OLED) and microLED panels, is driving greater user engagement across key sectors.

Enterprises are favoring ultra-slim, bezel-less displays that deliver exceptional image clarity and multi-touch functionality. These innovations are enabling more immersive and productive experiences in education, corporate, and retail settings, making high-performance displays a strategic asset in accelerating digital transformation.

- In August 2024, the Consumer Technology Association (CTA) introduced new resources to educate retailers, integrators, and sales associates about 4K and 8K Ultra HD televisions. These materials include comprehensive glossaries and feature comparisons to assist professionals in understanding and conveying the benefits of advanced television technologies to consumers. This initiative aligns with the growing consumer demand for high-resolution displays and supports the industry in enhancing product knowledge and sales effectiveness.

Interactive Display Market Report Snapshot

|

Segmentation

|

Details

|

|

By Type

|

Interactive Kiosk, Interactive Videowall, Interactive Table, Interactive Monitor, Interactive Whiteboard

|

|

By Panel

|

Flat, Flexible, Transparent

|

|

By Technology

|

LED, LCD, OLED, Others

|

|

By End User

|

Retail & Hospitality, Sports & Entertainment, Transportation, BFSI, Corporate, Education, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation:

- By Type (Interactive Kiosk, Interactive Videowall, Interactive Table, Interactive Monitor, and Interactive Whiteboard): The interactive kiosk segment earned USD 6.48 billion in 2023, due to the high demand for self-service solutions in retail, healthcare, and hospitality, enhancing efficiency and customer experience.

- By Panel (Flat, Flexible, Transparent): The flay segment held 42.17% share of the market in 2023, due to cost-effectiveness, durability, and widespread use in commercial and educational interactive displays.

- By Technology (LED, LCD, OLED, and Others): The LED segment is projected to reach USD 15.68 billion by 2031, due to energy efficiency, longer lifespan, and superior brightness for interactive displays.

- By End User (Retail & Hospitality, Sports & Entertainment, Transportation, BFSI, Corporate, Education, Others): The retail & hospitality segment held 22.31% share of the market in 2031, due to the rising demand for self-service kiosks, digital signage, and enhanced customer engagement solutions.

Interactive Display Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

North America accounted for 35.95% share of the interactive display market in 2023, with a valuation of USD 8.53 billion. The region boasts advanced technological frameworks, including high-speed internet, cloud services, and widespread connectivity, which facilitate the seamless integration of interactive display solutions.

This infrastructure enables efficient deployment and scalability across various sectors, such as education, corporate, and retail. As a result, businesses and institutions in North America can easily adopt and leverage interactive display technologies, reinforcing the region's leadership in the global market.

- In June 2024, Optoma Laser unveiled its Creative Touch 5-Series Interactive Displays at InfoComm 2024. Designed for education and professional environments, these displays enhance learning and remote collaboration with features like Google Enterprise Device Licensing Agreement (EDLA) certification, built-in Android, WiFi 6e, and optional sensors for air quality and motion detection, offering seamless compatibility with major operating systems and applications.

The market in Asia Pacific is poised for significant growth at a robust CAGR of 8.82% over the forecast period. The interactive display industry in Asia Pacific is registering significant growth, driven by several key factors. Rapid urbanization and infrastructure development across countries like China, India, and Southeast Asia are increasing the demand for digital signage in public spaces.

Additionally, the growing adoption of AI technologies is enhancing the functionality of interactive displays, making them more appealing for applications in retail, education, and healthcare. Furthermore, the expansion of smart cities and government initiatives to digitize public services are further fueling the market in the region.

- In February 2025, SHARP Business Systems acquired NEC India’s display business. This integration enhances SHARP’s product portfolio, offering high-performance solutions across sectors like retail, education, aviation, manufacturing, healthcare, and smart cities. The merger strengthens SHARP’s commitment to innovation and supports industries with 24/7 operational capabilities, delivering exceptional value to partners and customers.

Regulatory Frameworks

- In the U.S., interactive displays used by firms like Interactive Brokers (IBKR) are regulated by the Securities and Exchange Commission (SEC), Financial Industry Regulatory Authority (FINRA), and securities exchanges. Rules focus on customer asset protection, proper fund segregation, and broker-dealer compliance to ensure market integrity and investor safety.

- In India, interactive displays are regulated by the Bureau of Indian Standards (BIS) for safety standards, the Telecommunication Engineering Centre (TEC) for technical compliance of telecom products, and the Ministry of Electronics and Information Technology (MeitY) for digital infrastructure policies.

- In Europe, interactive displays are regulated under the Audiovisual Media Services Directive (AVMSD) for content standards, while the Digital Services Act (DSA) and Digital Markets Act (DMA) govern platform compliance, ensuring fair competition and user protection in digital services.

Competitive Landscape

The interactive display market is characterized by a large number of participants, including both established corporations and rising organizations. Key market players are leveraging strategies such as mergers and acquisitions, along with product launches, to drive the market.

Businesses are enhancing their market position and tapping into opportunities by integrating complementary technologies and expanding their product portfolios. These strategies enable companies to innovate rapidly, address evolving customer demands, and strengthen their competitive advantage, positioning themselves for long-term success in an increasingly dynamic and interconnected marketplace.

- In January 2025, LG Electronics and BrightSign LLC announced a collaboration to launch LG Ultra High Definition (UHD) digital signage displays running BrightSignOS. Available in 49-, 55-and 65-inch models, these displays feature LG’s embedded system on a chip multi-core processor and support a range of Content Management System (CMS) solutions. Targeting vertical markets like retail, education, and healthcare, they enable real-time content management and enhanced customer engagement.

List of Key Companies in Interactive Display Market:

- SAMSUNG

- Panasonic Life Solutions India Pvt. Ltd.

- Elo Touch Solutions, Inc.

- LG DISPLAY CO., LTD

- Leyard Europe

- BOE Technology Group Co.,

- Boxlight

- eyefactive GmbH

- Horion

- Christie Digital Systems USA, Inc

- Sharp Corporation

- ViewSonic Corporation

- MMT GmbH & Co. KG.

- TableConnect GmbH

- Promethean Limited.

Recent Developments

- In April 2025, Panasonic announced the establishment of Panasonic Projector & Display Corporation, with a strategic focus on becoming a global leader in professional visual solutions. Leveraging decades of expertise and cutting-edge technology, the new entity aims to deliver innovative display solutions across diverse sectors, including entertainment, education, and public spaces, enhancing visual experiences globally.

- In January 2025, Samsung Electronics introduced its AI-powered Interactive Display (WAFX-P) at Bett 2025, designed to transform education with Samsung AI Assistant. This intelligent solution empowers educators with advanced tools such as Circle to Search, AI Summary, and Live Transcript, enabling dynamic, interactive learning environments. The display enhances engagement, streamlines lesson planning, and improves learning outcomes through real-time AI-driven functionality.

- In November 2024, ViewSonic Corp. was recognized as the top global interactive display brand for Q3 2024 by Futuresource Consulting. This achievement underscores ViewSonic's leadership in providing a comprehensive ecosystem of innovative hardware, software, and services, tailored to the evolving needs of workplaces and educational institutions.

By integrating complementary technologies and expanding their product portfolios,