Market Definition

The market encompasses a broad ecosystem of solutions designed to enable users to independently access services or information without direct human assistance. It spans multiple types of kiosks including information, transaction, ticketing, check-in, self-order, and other specialized units.

The report presents a comprehensive analysis of the key market drivers, emerging trends, and the competitive landscape, which are expected to determine the growth dynamics throughout the forecast period.

Self-Service Kiosk Market Overview

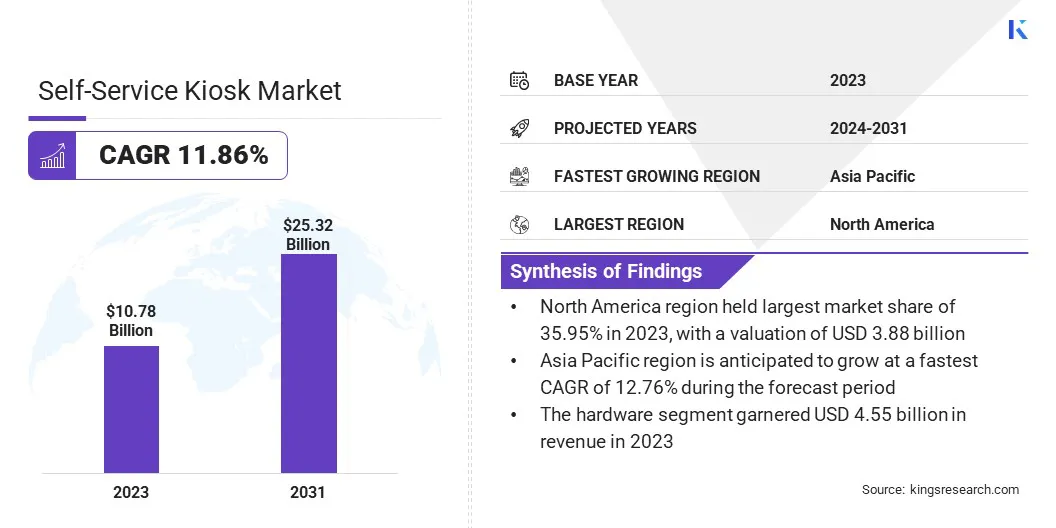

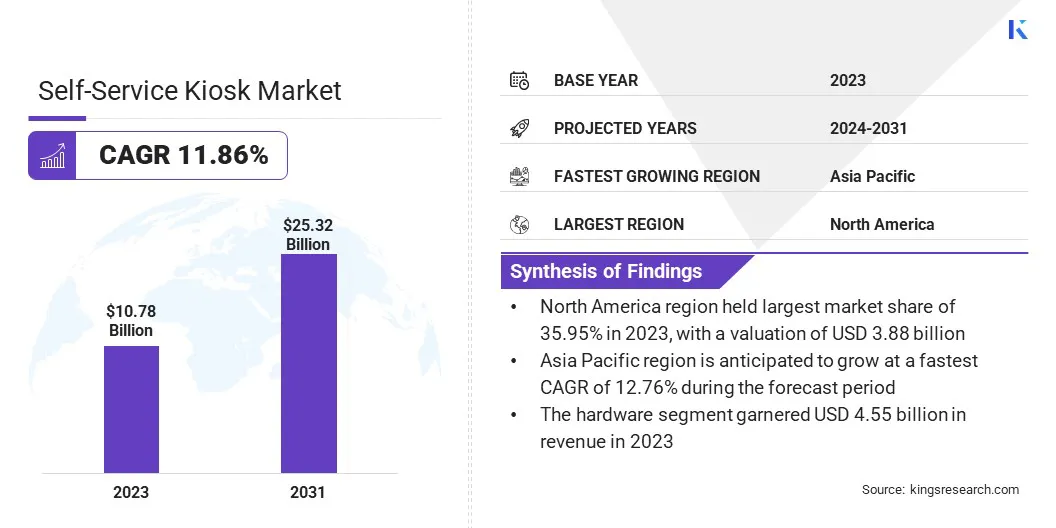

The global self-service kiosk market size was valued at USD 10.78 billion in 2023 and is projected to grow from USD 11.56 billion in 2024 to USD 25.32 billion by 2031, exhibiting a CAGR of 11.86% during the forecast period.

The growing need for reducing labor costs and enhancing operational productivity across the retail, hospitality, transportation, and healthcare sectors is driving the market.

These sectors are increasingly adopting self-service kiosks to automate repetitive functions, minimize human involvement, and deliver faster services. These kiosks help businesses reduce operating costs while maintaining high service quality, especially in areas such as retail, financial services, and hospitality.

Major companies operating in the self-service kiosk industry are Lilitab llc, Slabb Kiosks, DynaTouch Corporation, Pyramid Computer GmbH, ADVANTECH Group, Dongguan Tcang Electronics Co., Ltd., TEAMSable Inc, Kiosk Group, Parabit, KIOSK Information Systems, Zebra Technologies Corp., Self-Service Networks, Armodilo Display Solutions Inc., Nanonation, and ACRELEC.

In addition, the integration of artificial intelligence (AI) and data analytics in kiosks to offer tailored customer interactions through features like facial recognition, smart suggestions, and voice-based commands is further driving the growth of the market. Integrated analytics tools allow businesses to monitor performance, analyze user behavior, and refine services in real-time.

- In July 2023, 365 Retail Markets introduced the MM6 Mini, a compact and versatile point-of-sale kiosk designed for micro markets and dining cafeterias. The MM6 Mini features a 15.6-inch display with flexible mounting options and is designed to enhance service speed and boost digital advertising revenue.

Key Highlights

- The self-service kiosk industry size was recorded at USD 10.78 billion in 2023.

- The market is projected to grow at a CAGR of 11.86% from 2024 to 2031.

- North America held a market share of 35.95% in 2023, with a valuation of USD 3.88 billion.

- The hardware segment garnered USD 4.55 billion in revenue in 2023.

- The information segment is expected to reach USD 7.58 billion by 2031.

- The BFSI segment is expected to reach USD 6.22 billion by 2031.

- Asia Pacific is anticipated to grow at a CAGR of 12.76% during the forecast period.

Market Driver

"Labor Cost Optimization and Operational Efficiency"

The self-service kiosk market is driven by the increasing need for labor cost optimization and enhanced operational efficiency across various industries. As businesses face rising wage pressures and workforce shortages, particularly in sectors like retail, quick-service restaurants, and transportation, self-service kiosks offer a practical solution to reduce dependence on manual labor.

These kiosks can handle repetitive tasks such as order placement, ticketing, and check-ins with minimal supervision, allowing businesses to reallocate human resources as needed. Additionally, kiosks operate continuously without breaks, contributing to improved service speed and consistency.

This drive toward automation reduces operational costs and enhances customer satisfaction by reducing wait times and improving service accuracy. As a result, more organizations are investing in kiosk technologies as part of their broader digital transformation and cost-efficiency strategies, in turn driving the growth of the market.

- In February 2025, SumUp, a global financial services company, launched its Kiosk solution in the United States. This self-service kiosk enables customers to browse menus, place orders, and make payments without cashier assistance, helping businesses reduce labor costs and increase average order value. Targeted at small restaurants and large venues like stadiums, this new solution aims to enhance operational efficiency and minimize wait times to boost overall profitability.

Market Challenge

High Initial Investment and Maintenance Costs

A major challenge facing the self-service kiosk market is the high initial investment associated with deployment, particularly for small and medium-sized enterprises (SMEs). Installing kiosks requires significant upfront expenditure on hardware, software integration, site preparation, and compliance with accessibility and data security standards.

This makes it difficult for smaller businesses to adopt these solutions at scale. To address this challenge, key players are adopting Kiosk-as-a-Service (KaaS) model, to offer kiosks on a subscription or leasing basis.

This approach allows businesses to spread costs over time, access the latest technology without heavy capital expenditure, and benefit from bundled services such as maintenance and analytics, making kiosk deployment more financially viable and scalable.

Market Trend

Integration of AI and Advanced Analytics

The self-service kiosk market is witnessing a significant shift driven by the integration of artificial intelligence (AI) and advanced analytics, emerging as one of the most impactful trends shaping the industry.

AI-powered kiosks are enabling more intelligent customer interactions by offering personalized recommendations based on user behavior, purchase history, or location data.

For example, in retail settings, kiosks equipped with AI can suggest products or services tailored to individual preferences, enhancing the shopping experience and driving higher customer engagement.

Additionally, the incorporation of real-time analytics allows businesses to monitor usage patterns and optimize kiosk performance, leading to improved efficiency and uptime.

- In February 2025, Partner Tech USA Inc. introduced Paula, an AI-powered self-checkout and kiosk solution designed to enhance efficiency and customer experience in retail and quick-service restaurants. The Paula Kiosk and Paula SCO models offer tailored features such as AI-powered item recognition, visual status indicators, security enhancements, and real-time analytics to streamline self-ordering and self-checkout processes.

Self-Service Kiosk Market Report Snapshot

|

Segmentation

|

Details

|

|

By Component

|

Hardware, Software, Services

|

|

By Type

|

Information, Transaction, Ticketing, Check-In, Self-Order, Others

|

|

By Vertical

|

BFSI, Government, Transportation, Travel, & Hospitality, Retail & Quick-service Restaurants, Entertainment, Healthcare, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation:

- By Component (Hardware, Software, Services): The hardware segment earned USD 4.55 billion in 2023 due to increased adoption of interactive screens and advanced payment modules across high-traffic service points.

- By Type (Information, Transaction, Ticketing, and Check-In): The information held 29.90% of the market in 2023, due to rising demand for real-time assistance and digital wayfinding solutions in public spaces.

- By Vertical (BFSI, Government, Transportation, Travel, & Hospitality, and Retail & Quick-service Restaurants): The BFSI segment is projected to reach USD 6.22 billion by 2031, owing to the growing implementation of self-service kiosks for automated banking services and queue management.

Self-Service Kiosk Market Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

North America self-service kiosk market share stood at around 35.95% in 2023 in the global market, with a valuation of USD 3.88 billion. The region’s dominance is attributed to the widespread adoption of advanced digital technologies and a well-established infrastructure across key sectors such as retail, BFSI, healthcare, transportation, and hospitality.

In the retail and quick-service restaurant (QSR) industries, major chains such as McDonald’s, Walmart, and Taco Bell have aggressively implemented kiosks to streamline ordering processes, reduce wait times, and enhance customer experience.

Additionally, banks and financial institutions in North America have heavily invested in self-service solutions for account inquiries, cash deposits, and check processing, minimizing the need for physical teller services.

Furthermore, airports and transit hubs across the U.S. and Canada have widely integrated check-in and ticketing kiosks to manage increasing passenger volumes efficiently. The presence of leading technology providers and system integrators in the region is further contributing to the growth of the market in this region.

- In November 2024, IDEMIA Public Security North America, in partnership with the Tennessee Department of Safety and Homeland Security (TDOSHS), introduced SMART-E self-service kiosks at Tennessee Driver Service Centers. Designed to streamline service delivery and minimize wait times, the kiosks allow residents to independently complete a range of driver's license-related transactions. Equipped with ADA-compliant features, ICAO-compliant photo capture, and configurable operation modes, the SMART-E kiosks integrate seamlessly with the state’s backend systems via a secure cloud-based platform, enhancing both accessibility and operational efficiency.

Asia Pacific self-service kiosk industry is poised to grow at a significant growth at a CAGR of 12.76% over the forecast period, driven by several key factors, including rapid urbanization, the expansion of organized retail, and the increasing demand for digitized services across China, India, and Southeast Asian countries.

As cities modernize and consumer expectations shift toward faster and more personalized service, businesses and public service providers are turning to self-service kiosks to improve operational efficiency and reduce human dependency.

In countries like China, significant investments in smart city development and automated public infrastructure have led to a surge in demand for kiosks in transportation, ticketing, and government service applications.

Regulatory Frameworks

- In the U.S., self-service kiosks are subject to the Americans with Disabilities Act (ADA), which mandates that kiosks must be accessible to individuals with disabilities. This includes requirements for reach range, screen readability, tactile input, audio output for the visually impaired, and physical accessibility for wheelchair users. Additionally, the U.S. Access Board mandates technical standards that kiosk manufacturers must follow to ensure compliance.

- In India, the Reserve Bank of India (RBI) regulates the deployment and operation of self-service kiosks in the banking sector through its guidelines on electronic banking, customer service, and cybersecurity. The RBI mandates that banks ensure the security and integrity of transactions conducted via kiosks, especially for services such as cash deposit, passbook printing, and account inquiries in the banking sector.

Competitive Landscape

The self-service kiosk industry is marked by a highly dynamic and evolving competitive environment, with major players adopting various strategic approaches to reinforce their market presence and capture a broader customer base.

A key focus area is innovation through sustained research and development, aimed at launching feature-rich kiosks equipped with intuitive interfaces, advanced security elements, contactless payment integration, and AI-driven functionality.

Companies are also engaging in strategic alliances to offer comprehensive, industry-specific solutions that address the diverse needs of sectors like healthcare, banking, travel, and retail.

To strengthen their global reach, vendors are pursuing geographic diversification, setting up regional manufacturing units and expanding service infrastructure to support faster deployment.

Additionally, there is a growing trend toward offering subscription-based models and full-service kiosk management, enabling clients to scale efficiently without heavy capital expenditure.

- In October 2024, Hyosung Americas, in partnership with eGlobal, a Grant Victor company, initiated a pilot program for its Hyosung Pay solution. The program features the Pivot ATM, a retail cash-recycling ATM designed to support cash-in transactions, streamline cash management, and generate additional transaction-based revenue.

List of Key Companies in Self-Service Kiosk Market:

- Lilitab llc

- Slabb Kiosks

- DynaTouch Corporation

- Pyramid Computer GmbH

- ADVANTECH Group

- Dongguan Tcang Electronics Co., Ltd.

- TEAMSable Inc

- Kiosk Group

- Parabit

- KIOSK Information Systems

- Zebra Technologies Corp.

- Self-Service Networks

- Armodilo Display Solutions Inc.

- Nanonation

- ACRELEC

Recent Developments (Product Launch)

- In April 2024, Fiserv, Inc. launched the Clover Kiosk along with an enhanced 24-inch Clover Kitchen Display System to support end-to-end order management for quick- and full-service restaurants. The integrated solutions aim to streamline restaurant operations and improve customer experience with a lower total cost of ownership.

- In August 2023, Samsung Electronics launched the KMC-W, a Microsoft Windows-based version of its Samsung Kiosk. The updated 24-inch interactive display offers expanded software compatibility and is designed to support self-service applications across industries such as retail, food and beverage, travel, and healthcare.