Market Definition

The market involves the design and deployment of advanced electrical transformers that use power electronic components instead of conventional magnetic cores. These transformers offer high efficiency, bidirectional power flow, and compact design, enabling intelligent power management in modern electrical systems.

The report includes segmentation based on product, voltage level, application, and region. Major end-use areas such as power grids, renewable power generation, electric vehicle charging, and traction locomotives depend on solid state transformers to improve energy conversion, grid stability, and power distribution flexibility.

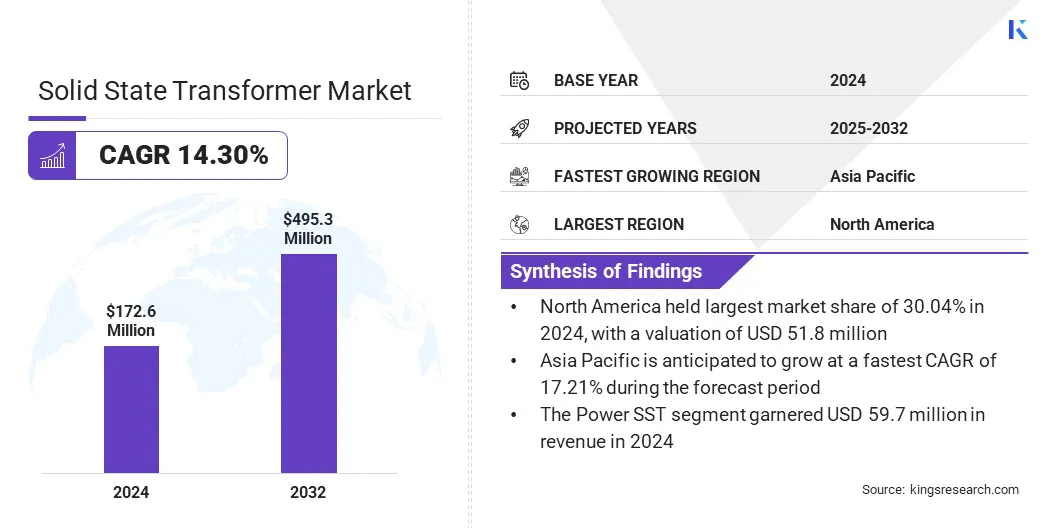

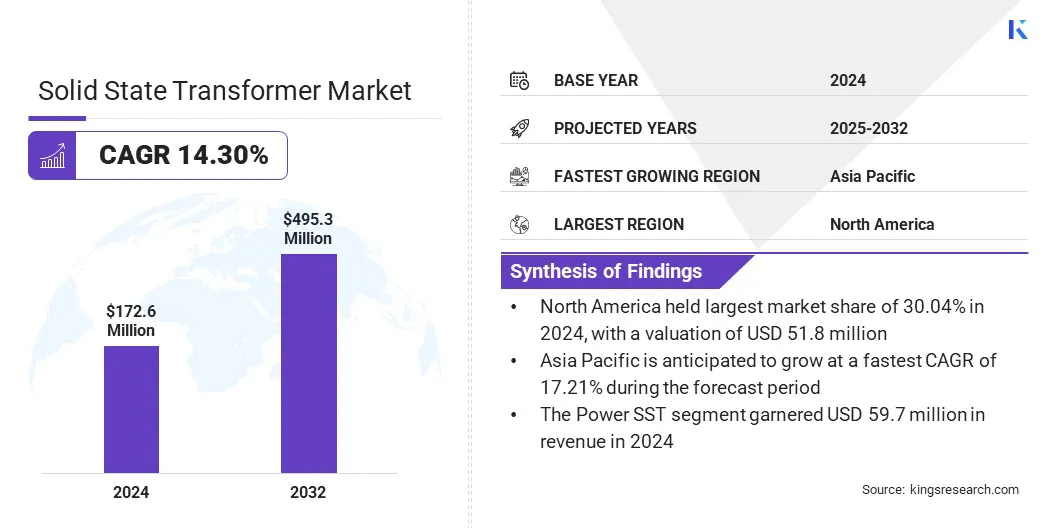

The global solid state transformer market size was valued at USD 172.60 million in 2024 and is projected to grow from USD 194.31 million in 2025 to USD 495.34 million by 2032, exhibiting a CAGR of 14.30% over the forecast period.

The market is driven by the electrification of transportation infrastructure, which increases demand for efficient and reliable high-power charging solutions. The development of hybrid and modular architectures further enhances grid integration, supporting distributed energy resources and improving power system flexibility and efficiency.

Key Highlights

- The solid state transformer industry size was valued at USD 172.60 million in 2024.

- The market is projected to grow at a CAGR of 14.30% from 2025 to 2032.

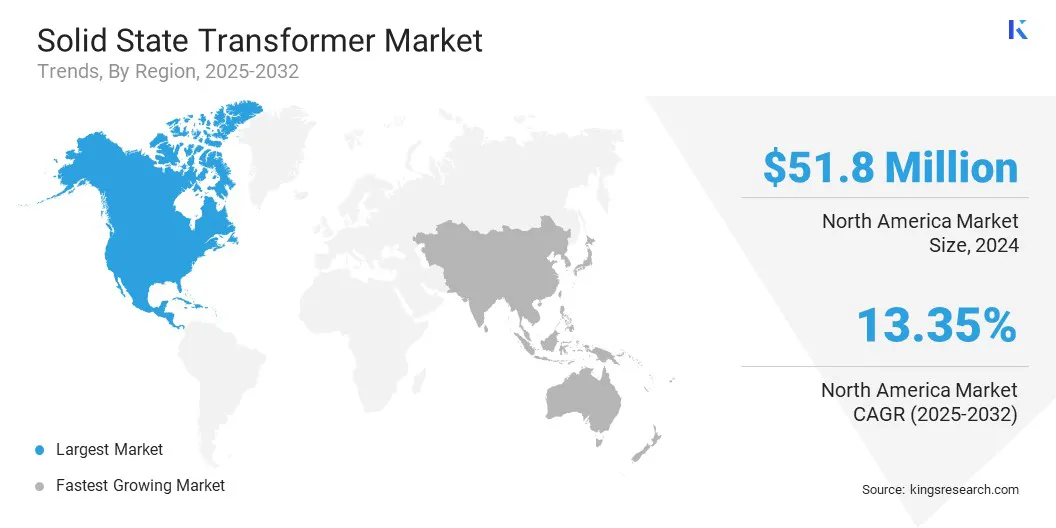

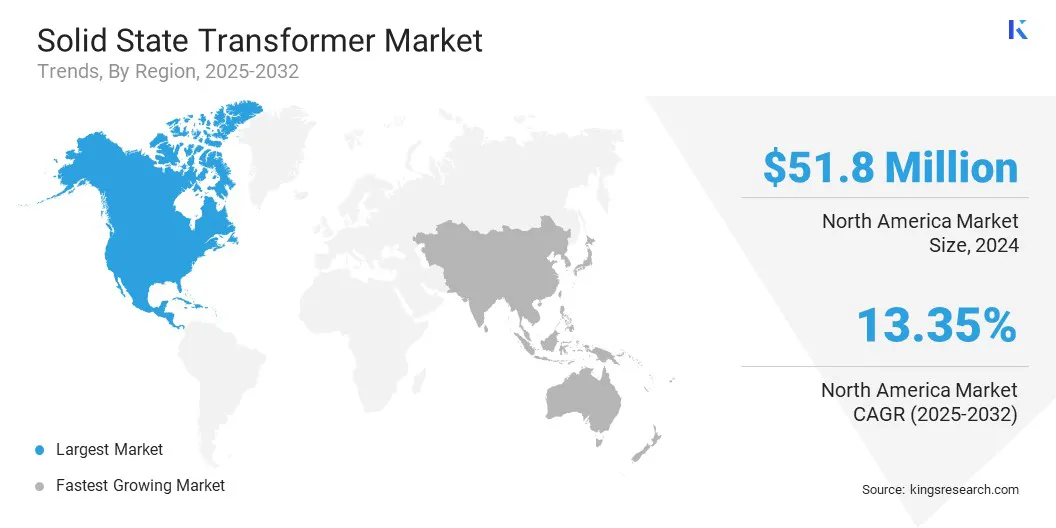

- North America held a market share of 30.04% in 2024, with a valuation of USD 51.85 million.

- The distribution SST segment garnered USD 68.73 million in revenue in 2024.

- The medium voltage (1 kV – 35 kV) segment is expected to reach USD 229.23 million by 2032.

- The power grids segment secured the largest revenue share of 33.21% in 2024.

- Asia Pacific is anticipated to grow at a CAGR of 17.21% over the forecast period.

Major companies operating in the solid state transformer market are General Electric Company, Alstom, Eaton, Hitachi Energy Ltd, Delta Electronics, Inc., ABB, Siemens, Mitsubishi Electric Corporation, Schneider Electric, GridBridge Inc., Varentec Inc., Amantys Limited, ERMCO, TOSHIBA CORPORATION, and Triad Magnetics.

Growing integration of renewable energy sources is driving the expansion of the solid-state transformer market. Increasing solar and wind power installations are creating a strong need for advanced power conversion systems capable of managing bidirectional energy flow between the grid and distributed sources.

In July 2025, Eurostat reported that renewable energy supply in the European Union increased by 3.4 % in 2024, reaching around 11.3 million terajoules (TJ). Solid-state transformers support efficient voltage regulation and frequency control, ensuring stable operation in variable renewable conditions.

Utilities such as power generation, transmission, and distribution sectors are adopting these transformers to handle fluctuations in energy generation and improve grid reliability. Their compact size and high efficiency make them ideal for renewable integration in urban and remote installations. Rising investment in smart grids and renewable infrastructure is further strengthening the deployment of solid-state transformers across global power networks.

- In June 2025, Hitachi Energy India Limited secured an order from Power Grid Corporation of India Limited to supply 30 units of 765 kV, 500 MVA single‑phase transformers as part of India’s grid expansion plans.

What factors are driving the growth of the market?

The rapid electrification of transportation infrastructure is a key factor driving the solid-state transformer market. The expansion of electric vehicle (EV) charging networks is increasing demand for compact, high-power transformers that deliver fast and efficient energy transfer. Solid-state transformers support this transition by enabling precise voltage regulation and bidirectional power flow, which helps maintain grid stability under rising EV loads.

Additionally, large-scale rail electrification projects are fueling adoption as they require reliable power conversion for traction and auxiliary systems. Utilities and transport operators are deploying SST units to enhance energy efficiency and reduce infrastructure footprint. Growing investment in sustainable mobility and smart transport systems is further boosting the integration of solid-state transformers in transportation networks.

- In October 2024, PSA International and Amperesand Pte. Ltd. initiated a pilot trial of Amperesand’s SST technology at Singapore’s port. The collaboration involves a one‑year “Proof of Value” phase beginning in mid‑2025 to validate the SST’s performance in high‑power charging infrastructure for electric vehicles.

A key challenge for the market is the elevated cost of manufacturing compared to conventional transformers. Use of advanced semiconductor materials, power electronics, and modular construction increases design complexity and production expenses. These factors make adoption challenging for utilities and industrial users seeking cost-effective upgrades.

To address this challenge, market players are optimizing power electronic designs, developing scalable modular architectures, and partnering with suppliers to reduce material costs. These strategies are enhancing affordability and enabling broader deployment of solid state transformers in modern power systems.

- In October 2025, WattEV, Inc. launched a modular solid‑state transformer designed to support megawatt‑scale heavy‑duty electric truck charging. The company notes the system intends to “cut site build time, lower costs, and scale growth” for fleet depots and charging hubs.

A key trend in the market is the development of hybrid and modular architectures to improve grid integration. Modular designs are enabling scalable deployment, allowing capacity to be expanded or reconfigured according to demand.

Hybrid architectures are enhancing fault tolerance by isolating failures and maintaining uninterrupted power flow. These designs are simplifying integration with existing electrical infrastructure, reducing downtime and installation complexity. Utilities and industrial facilities are adopting modular SSTs to support renewable energy sources and smart grid applications.

- In November 2024, Control Transformer, Inc. partnered with the University of Texas on a modular hybrid solid‑state transformer (H‑SST) project, backed by a grant from the U.S. Department of Energy. The project focuses on designing a 500 kVA H‑SST prototype that integrates modular converter modules with conventional transformer elements to enhance fault tolerance and facilitate seamless grid integration.

|

Segmentation

|

Details

|

|

By Product

|

Power SST, Distribution SST, Traction SST, Others

|

|

By Voltage Level

|

Low Voltage (≤1 kV), Medium Voltage (1 kV – 35 kV), High Voltage (>35 kV)

|

|

By Application

|

Power Grids, Automotive, Renewable Power Generation, Electric Vehicle Charging Stations, Traction Locomotives, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Product (Power SST, Distribution SST, Traction SST, and Others): The distribution SST segment earned USD 68.73 million in 2024 due to its ability to efficiently manage medium- and low-voltage power distribution while supporting integration of renewable energy and distributed energy resources.

- By Voltage Level (Low Voltage (≤1 kV), Medium Voltage (1 kV – 35 kV), and High Voltage (>35 kV)): The medium voltage (1 kV – 35 kV) segment held 47.26% of the market in 2024, due to its widespread use in distribution networks, renewable energy integration, and industrial microgrids.

- By Application (Power Grids, Automotive, Renewable Power Generation, Electric Vehicle Charging Stations, Traction Locomotives, and Others): The power grids segment is projected to reach USD 152.82 million by 2032, owing to increasing integration of renewable energy sources and the need for efficient, reliable, and flexible power distribution infrastructure.

What is the market scenario in North America and Asia-Pacific?

The North America solid state transformer market share stood around 30.04% in 2024 in the global market, with a valuation of USD 51.85 million. This growth is driven by continued investments in upgrading aging electrical grids. Utilities are replacing traditional transformers with advanced SSTs to enhance grid flexibility and manage the growing share of distributed energy resources.

Federal initiatives and pilot projects are further supporting the adoption of intelligent power electronics for real-time monitoring and control. The increasing deployment of smart grid infrastructure is also fueling demand for compact, efficient, and responsive SST solutions.

- In March 2025, Eaton Corporation announced a strategic partnership with National Grid USA to deploy solid‑state transformers across pilot smart grid projects in New York and Massachusetts. The initiative involves installing modular SST units capable of bi‑directional power flow, real-time voltage regulation, and enhanced monitoring for distributed energy resources.

Moreover, Utilities and private operators are integrating SSTs to handle peak loads and improve reliability for EV charging stations. State and federal funding programs are accelerating the rollout of charging infrastructure. The rising electricity consumption driven by the growing number of electric vehicles is increasing pressure on the grid, which is accelerating the adoption of SSTs and contributing to market growth across the region.

The solid state transformer industry in Asia Pacific is poised for a significant CAGR of 17.21% over the forecast period. This growth is due to the expansion of manufacturing, industrial parks, and technology hubs. These sectors require stable and high-quality power to maintain continuous operations and support automated systems.

Companies are increasingly adopting on-site microgrids and energy management solutions that incorporate SST technology. Rising industrial electricity demand and electrification initiatives are creating a need for modern transformer solutions.

- In September 2024, ABB Ltd. announced the deployment of modular solid‑state transformers at its new smart manufacturing facility in Shanghai, China. The SST units provide stable, high-quality power for automated production lines, enabling flexible load management and integration with on-site energy storage systems.

Regulatory Frameworks

- The U.S. Department of Energy (DOE) regulates distribution transformers under the Energy Policy and Conservation Act (EPCA) and has adopted energy‑conservation standards requiring minimum efficiencies and limiting no‑load and load losses for various types of distribution transformers.

- In the European Union (EU), the Commission Regulation (EU) No 548/2014 implementing Directive 2009/125/EC sets Ecodesign requirements for small, medium and large power transformers placed on the market or put into service in the EU, with a minimum power rating of 1 kVA used in 50 Hz transmission and distribution networks.

- In China, the national standard GB 20052‑2024 titled “Minimum Allowable Values of Energy Efficiency and the Energy Efficiency Grades for Power Transformers” took effect from 1 February 2025. It requires oil‑immersed and dry‑type distribution transformers and power transformers to meet specified minimum efficiency and energy‑grade levels, including new categories for photovoltaics, wind‑power, and energy‑storage interfacing.

- Japan’s Act on the Rational Use of Energy mandates that transformers for building and factory use above 600 V and up to 7,000 V meet “total power loss” targets under the Top Runner Programme, with the target year fiscal 2026 and an expected ~11.4 % improvement in efficiency from the FY2019 baseline.

Competitive Landscape

Market players are adopting strategies such as mergers and acquisitions, research and development, and technological advancements to remain competitive in the solid state transformer industry. Strategic collaborations allow firms to access new markets, share expertise, and accelerate the development of grid‑edge and EV‑charging technologies.

Technological advancements, including the integration of silicon‑carbide devices and high-frequency conversion systems, are being pursued to improve performance and reduce system size. These strategies help companies strengthen their product portfolios and respond to the growing demand for advanced power distribution solutions.

- In July 2025, Eaton signed an agreement to acquire Resilient Power Systems Inc., a company focused on medium‑voltage SST technology. The acquisition covers SST hardware suitable for high‑power DC applications, including EV charging and distributed energy systems. The agreement is intended to integrate SST solutions into Eaton’s existing power distribution offerings.

Key Companies in Solid State Transformer Market:

Recent Developments

- In March 2025, ABB Ltd. announced a strategic investment in DG Matrix Inc. aimed at commercialising solid‑state power electronics solutions, including SST‑based architectures. The announcement states that DG Matrix’s “Power Router” platform can replace 10‑20 electrical devices with a single system and delivers up to 98 % efficiency.

- In March 2024, Delta Electronics presented a “modular Solid‑State Transformer (SST) cabinet” and a 1OU 80 kW DC/DC power shelf aimed at enabling HVDC 800 Vdc distribution in gigawatt‑scale AI data centres.

- In February 2024, Amperesand raised US USD 12.45 million in a Series Seed financing round to scale its modular SST hardware and manufacturing capability. The company plans commercial SST units in 2MW, 4MW, and 6MW sizes, with a 22kV nominal interface announced on its website. The investment is intended to accelerate the deployment of SSTs for EV‑charging, data‑centres, and grid‑edge applications.