Market Definition

Polyester film is a strong, flexible, and transparent material produced from polyethylene terephthalate through extrusion and stretching processes. It is known for its excellent mechanical strength, chemical resistance, and dimensional stability, making it suitable for demanding environments.

The market covers packaging, electrical insulation, imaging, and industrial applications. Its use extends across food and beverage packaging, consumer electronics, solar panels, labeling, and protective coatings, where durability, clarity, and barrier properties are essential.

Polyester Film Market Overview

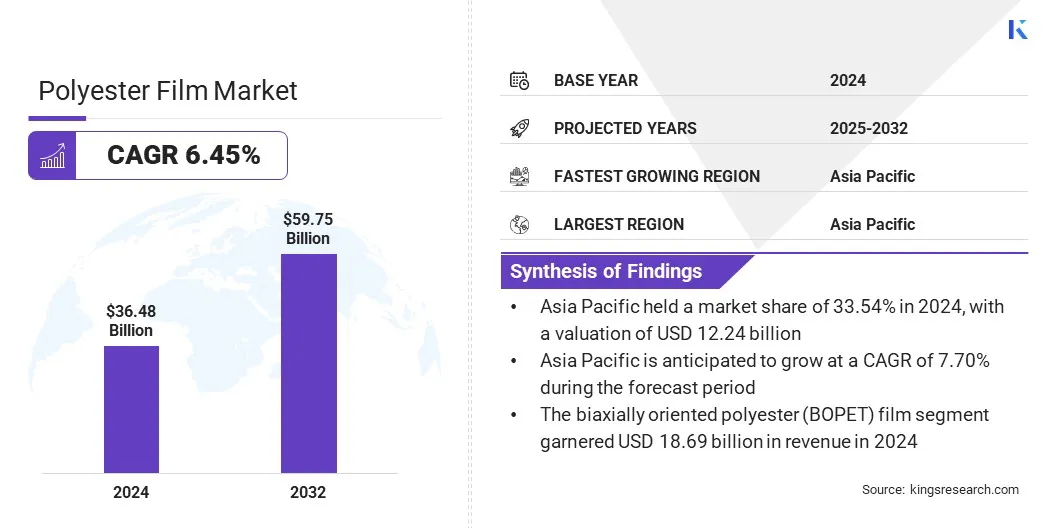

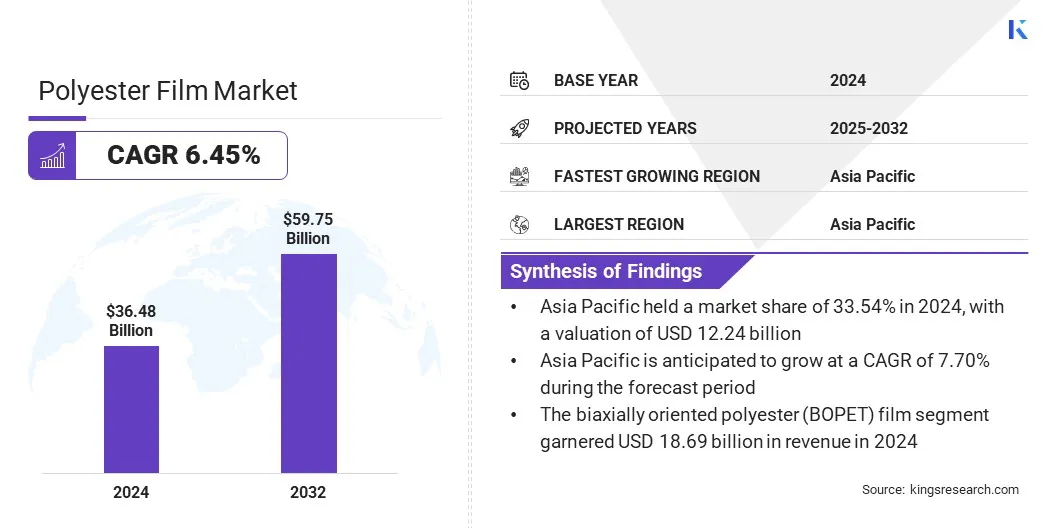

The global polyester film market size was valued at USD 36.48 billion in 2024 and is projected to grow from USD 38.58 billion in 2025 to USD 59.75 billion by 2032, exhibiting a CAGR of 6.45% during the forecast period.

This growth is attributed to the increasing demand for high-performance packaging materials that offer superior strength, clarity, and barrier properties across the food, beverage, and consumer goods industries. Expanding applications in electronics, solar panels, and industrial insulation are further supporting widespread use of polyester film, enhancing durability and operational efficiency in critical environments.

Key Highlights

- The polyester film industry size was USD 36.48 billion in 2024.

- The market is projected to grow at a CAGR of 6.45% from 2025 to 2032.

- Asia Pacific held a share of 33.54% in 2024, valued at USD 12.24 billion.

- The biaxially oriented polyester (BOPET) film segment garnered USD 18.69 billion in revenue in 2024.

- The packaging segment is expected to reach USD 27.60 billion by 2032.

- The electrical & electronics segment is anticipated to witness the fastest CAGR of 7.04% over the forecast period.

- North America is anticipated to grow at a CAGR of 6.12% through the projection period.

Major companies operating in the polyester film market are TEIJIN LIMITED., Mitsubishi Polyester Film GmbH, Esterindustries.com, Jindal Poly Films Limited, Terphane, TOYOBO CO., LTD, Filmquest Group Inc., The Griff Network, PANAC Corporaiton, Hengli Group Co., Ltd., Jiangsu Yuxing Film Technology Co., Ltd., Hefei Lucky Science and Technology Industry Co., Ltd., SKC, Polyplex, and SRF LIMITED.

The rising focus on sustainable and recyclable materials is fostering innovation in film production, aligning with environmental and regulatory requirements. Additionally, continuous advancements in polyester film technology, combined with expanding industrial applications, are boosting widespread adoption.

- In September 2023, Terphane showcased its latest polyester (BOPET) film innovations at Pack Expo Las Vegas, featuring the Sealphane line with Resealphane resealable lidding films and the Ecophane line with sustainable, FDA-approved, recycled, and biodegradable options. The display highlighted convenience, safety, and sustainability in modern packaging solutions.

Market Driver

Surging Demand for Polyester Film in Packaging Applications

The growth of the polyester film market is fueled by rising demand for high-performance packaging solutions that offer superior barrier properties, clarity, and durability. These films enable protection against moisture, oxygen, and contamination, ensuring product safety and extended shelf life.

Industries such as food and beverage, consumer goods, electronics, and solar energy are increasingly adopting polyester films to enhance packaging performance, operational efficiency, and product appeal. Adoption is being reinforced by surging consumer preference for lightweight, sustainable materials and regulatory emphasis on recyclable packaging. This shift is strengthening manufacturers’ ability to meet performance, safety, and environmental objectives.

- In June 2025, UFlex introduced a single-pellet solution containing 30% recycled PET and virgin PET for food and beverage packaging. The product complies with FSSAI and USFDA standards, meets India’s 30% recycled content mandate for rigid plastic packaging, and is compatible with existing PET manufacturing lines.

Market Challenge

Recycling and End-of-Life Management Issues

Recycling and end-of-life management issues create a significant barrier to the growth of the polyester film market. Many polyester films are used in multilayer or laminated structures that are difficult to separate and process for recycling. Recovering high-quality polyethylene terephthalate from these films often requires specialized technologies, complex processing, and significant investment, which increases operational costs and limits recycling efficiency.

Smaller manufacturers or converters with limited technical resources may find it particularly challenging to implement effective recycling solutions, creating a disparity with larger, better-equipped competitors.

Industries across food and beverage, electronics, and packaging face additional hurdles, as recycled films must meet performance, clarity, and safety standards for reuse. Regulatory pressure to comply with circular economy and sustainability requirements further intensifies the need for innovative recycling strategies.

To address these constraints, companies are increasingly exploring mono-material films, advanced separation technologies, and partnerships with specialized recyclers. These approaches aim to improve recyclability, reduce environmental impact, and support sustainable growth.

Market Trend

Surging Adoption Across Electrical & Electronics Sectors

The polyester film market is experiencing a notable shift toward increased adoption across the electrical and electronics sectors. This is further fueled by the increasing need for high-performance films that provide dielectric strength, thermal stability, and mechanical durability.

These films are widely used in capacitors, flexible printed circuits, electric motors, and insulation for wiring, supporting reliable performance in demanding environments. This capability is particularly valuable for consumer electronics manufacturers, industrial automation providers, and renewable energy companies, where precise and durable materials are critical.

Organizations are increasingly adopting polyester films in advanced electrical and electronic applications to enhance product performance, operational efficiency, and reliability. Innovations in thin-film coatings and high-performance variants further enable specialized applications, reduce material limitations, and support broader technological adoption.

The growing integration of polyester films in the electrical and electronics industries is establishing them as essential materials for innovation, efficiency, and long-term market growth.

Polyester Film Market Report Snapshot

|

Segmentation

|

Details

|

|

By Product Type

|

Biaxially Oriented Polyester (BOPET) Film, Metallized Polyester Film, Holographic Polyester Film, and Others

|

|

By Application

|

Packaging, Imaging & Printing, Industrial & Electrical, and Others

|

|

By End Use Industry

|

Food & Beverage, Pharmaceuticals & Healthcare, Electrical & Electronics, Industrial & Construction, Automotive, and Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Product Type (Biaxially Oriented Polyester (BOPET) Film, Metallized Polyester Film, Holographic Polyester Film, and Others): The biaxially oriented polyester (BOPET) film segment earned USD 18.69 billion in 2024, mainly due to its superior strength, clarity, and barrier properties that support extensive use in packaging, electronics, and industrial applications.

- By Application (Packaging, Imaging & Printing, Industrial & Electrical, and Others): The packaging segment held a share of 45.18% in 2024, propelled by the growing demand for durable, high-clarity films that provide excellent barrier protection and extended shelf life for food, beverage, and consumer goods products.

- By End Use Industry (Food & Beverage, Pharmaceuticals & Healthcare, Electrical & Electronics, Industrial & Construction, Automotive, and Others): The electrical & electronics segment is projected to reach USD 16.22 billion by 2032, owing to the increasing use of polyester films in capacitors, flexible circuits, electric motors, and insulation applications that demand high thermal stability, dielectric strength, and mechanical durability.

Polyester Film Market Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

Asia Pacific polyester film market share stood at 33.54% in 2024, valued at USD 12.24 billion. This prominence is attributed to rapid industrialization, growing manufacturing activities, and rising demand for packaging, electronics, and industrial applications.

Government initiatives promoting renewable energy, electronics manufacturing, and sustainable packaging are further supporting regional market growth. Additionally, increasing adoption of recyclable and high-performance polyester films, coupled with advancements in production technologies, enhances operational efficiency and product performance, positioning Asia Pacific as a leading market for polyester films.

- In September 2025, Ester Industries’ joint venture, ELITe, acquired land in Surat, Gujarat, to establish India’s first Infinite Loop chemical recycling plant. The facility is planned to process 70,000 metric tons of polyester waste annually, with potential expansion to 170,000 metric tons, producing virgin-quality PET resin. Designed to operate primarily on renewable energy, the plant is expected to reduce carbon emissions by up to 80% compared to conventional PET production.

The North America polyester film industry is projected to grow at a CAGR of 6.12% over the forecast period. This growth is fostered by rising demand for high-performance packaging, electrical insulation, and industrial films across industries such as food and beverage, electronics, and automotive.

Expanding adoption of recyclable and advanced polyester films, along with innovations in thin-film coatings, is enhancing product performance, operational efficiency, and sustainability. Additionally, investment in industrial infrastructure, renewable energy projects, and consumer electronics manufacturing is supporting regional market expansion.

Furthermore, manufacturers are focusing on quality enhancement, technological upgrades, and environmentally friendly production processes to meet evolving regulatory standards and customer demands. Increasing need for durable, versatile, and high-clarity films further propels domestic market progress.

Regulatory Frameworks

- In the U.S., the Environmental Protection Agency (EPA) regulates chemicals used in polyester film production under environmental and safety statutes. It ensures that manufacturing processes minimize environmental impact, comply with chemical safety standards, and support sustainable production practices.

- In the European Union, Regulation (EC) No. 1935/2004 regulates materials in contact with food, requiring polyester films in food packaging to meet safety standards and prevent harmful substance transfer.

- In India, the Bureau of Indian Standards (BIS) sets certification and quality standards for polyester films, ensuring adherence to prescribed specifications for safety, performance, and consumer protection.

Competitive Landscape

Companies operating in the polyester film industry are maintaining competitiveness through investments in advanced manufacturing technologies, sustainable film solutions, and strategic partnerships and acquisitions. They are producing polyester films for applications in packaging, electronics, industrial insulation, and automotive sectors to meet performance, durability, and regulatory requirements.

Market players are expanding their offerings with high-performance, recyclable, and coated film variants to address evolving industry demands and specialized applications.

Moreover, they are establishing regional production facilities and collaborating with technology providers and converters to enhance supply chain efficiency and market reach. Additionally, companies are providing technical support, product development services, and application guidance to improve operational efficiency and sustain competitive positioning.

- In June 2025, Cosmo First commissioned a new BOPP (Biaxially Oriented Polypropylene) film manufacturing line at its Aurangabad facility in Maharashtra, India, with a capital expenditure exceeding USD 44.8 million. The line adds 81,200 metric tons of annual capacity, increasing the company’s total BOPP output to 277,000 metric tons, supporting specialty film production and addressing domestic demand.

Top Key Companies in Polyester Film Market:

- TEIJIN LIMITED.

- Mitsubishi Polyester Film GmbH

- Esterindustries.com

- Jindal Poly Films Limited

- Terphane

- TOYOBO CO., LTD

- Filmquest Group Inc.

- The Griff Network

- PANAC Corporaiton

- Hengli Group Co., Ltd.

- Jiangsu Yuxing Film Technology Co., Ltd.

- Hefei Lucky Science and Technology Industry Co., Ltd.

- SKC

- Polyplex

- SRF LIMITED

- Sumilon Polyester Ltd

- Polinas

- CCL Industries

Recent Developments (M&A)

- In November 2024, Oben Group finalized the acquisition of Terphane, a producer of high-performance polyester films operating in Brazil and the U.S. The acquisition expands Oben Group’s manufacturing capacity and presence in global markets. The initiative aims to support ongoing operations and the delivery of polyester film solutions across various industrial applications.