Market Definition

Polyethylene Terephthalate (PET) is a durable, lightweight, transparent thermoplastic polymer made by combining ethylene glycol and terephthalic acid. Widely used in packaging and textiles, PET is a key part of the global plastics market,, particularly in packaging and textiles. Market growth is driven by rising demand across industries, sustainability initiatives, recycling efforts, and innovations in plastic manufacturing.

Polyethylene Terephthalate Market Overview

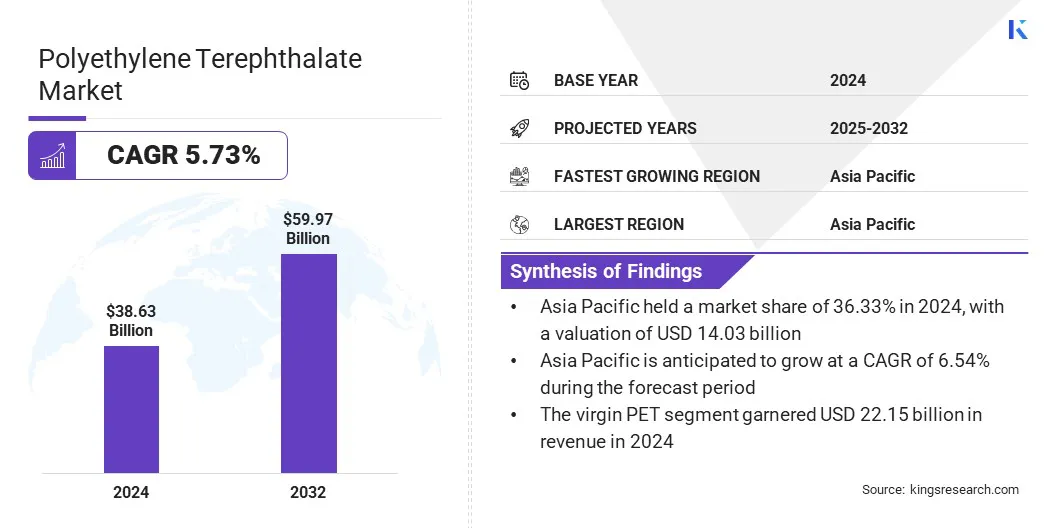

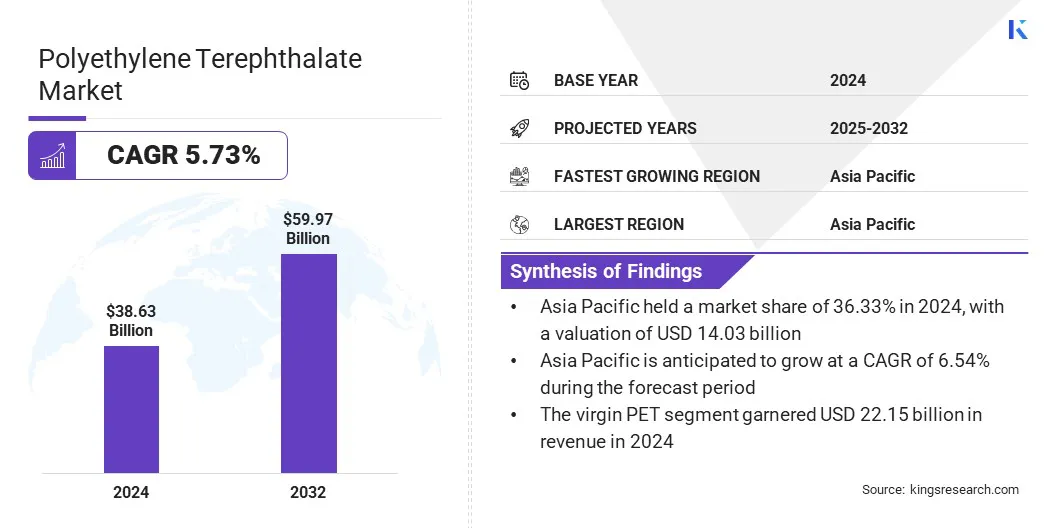

Global polyethylene terephthalate market size was valued at USD 38.63 billion in 2024, which is estimated to be valued at USD 40.61 billion in 2025 and reach USD 59.97 billion by 2032, growing at a CAGR of 5.73% from 2025 to 2032.

Market growth is fueled by rising consumer awareness of environmental impact, which has created a strong demand for eco-friendly products. This shift prompts brands to adopt recycled PET packaging, particularly in retail and personal care sectors, boosting adoption of sustainable and recyclable materials.

Key Market Highlights:

- The polyethylene terephthalate industry size was recorded at USD 38.63 billion in 2024.

- The market is projected to grow at a CAGR of 5.73% from 2025 to 2032.

- Asia Pacific held a share of 36.33% in 2024, valued at USD 14.03 billion.

- The virgin PET segment garnered USD 22.15 billion in revenue in 2024.

- The rigid packaging segment is expected to reach USD 20.48 billion by 2032.

- The automotive segment is anticipated to witness the fastest CAGR of 6.73% over the forecast period

- North America is anticipated to grow at a CAGR of 5.58% through the projection period.

Major companies operating in the polyethylene terephthalate industry are Indorama Ventures Public Company Limited., Far Eastern New Century Corporation, Alpek Polyester, NAN YA Plastics Industrial Co., Ltd, SABIC, LOTTE Chemical CORPORATION, LAVERGNE, Inc, Amcor plc, Reliance Industries Limited., Eastman Chemical Company, BASF, Toray TCAC Holding B.V., Celanese Corporation, RTP Company, and TEIJIN LIMITED.

The market is expanding due to increased demand for sustainable and recyclable packaging solutions across industries such as food, beverages, textiles, and cosmetics. Advanced recycling technologies, including chemical and enzymatic methods, are gaining traction for converting complex PET waste into high-quality materials.

Regulatory pressures and corporate sustainability targets are further accelerating investments in circular economy strategies, positioning PET recycling as a key component in reducing plastic waste and fostering innovation in the global plastics and packaging sectors.

- In May 2024, Pact Collective and Eastman enhanced beauty packaging sustainability by qualifying multicolor PET waste for Eastman’s molecular recycling via methanolysis. This breakthrough enables hard-to-recycle PET to be converted into high-quality recycled materials, supporting circularity and reducing reliance on waste-to-energy and landfill disposal.

Market Driver

Rising Consumer Demand for Eco-Friendly Products

Surging consumer preference for environmentally responsible products is propelling the growth of the polyethylene terephthalate market. Increasing demand for sustainable packaging is prompting retailers and personal care brands to adopt recycled PET (rPET). This, in turn, is fostering innovation and investment in recycling technologies to ensure recycled PET matches the quality of virgin materials.

As consumers prioritize sustainability in purchasing decisions, companies are using recycled packaging as a competitive differentiator, thereby expanding market opportunities and supporting the shift toward a circular plastic economy.

- In September 2024, JEPLAN Group’s PET REFINE TECHNOLOGY introduced HELIX , a high-quality recycled PET resin produced via proprietary chemical recycling. Targeting global expansion, the brand supports a circular economy by enabling repeated PET recycling to meet rising demand for sustainable materials in packaging and consumer products.

Market Challenge

Quality Variability

The polyethylene terephthalate market faces the challenge of high costs associated with advanced sorting and purification technologies, which limits the efficient processing of recycled PET and slows its adoption. To address this, companies are investing in innovative, cost-effective sorting systems and developing proprietary purification methods that streamline operations while maintaining resin quality.

Optimizing these technologies and enforcing standardized recycling protocols help reduce expenses, improve consistency, and build trust among manufacturers and consumers, thereby supporting sustainable growth in the circular economy.

Market Trend

Rise in Joint Ventures for Recycling Infrastructure

The polyethylene terephthalate market is witnessing a notable rise in joint ventures aimed at expanding recycling infrastructure. Companies are collaborating to develop advanced PET recycling plants equipped with cutting-edge technologies to meet the growing demand for sustainable materials. This surge is boosted by regulatory mandates, increasing consumer preference for eco-friendly packaging, and corporate sustainability objectives.

These initiatives enhance recycling capacity, support the production of high-quality recycled PET, contributes to a circular economy by reducing reliance on virgin plastics, thus fostering environmental and market growth.

- In September 2024, Indorama Ventures, Dhunseri, and Varun Beverages formed a joint venture to build multiple advanced PET recycling facilities in India. Scheduled for completion in 2025, these plants aim to expand recycled PET capacity in response to rising demand driven by regulatory requirements and sustainability goals, thus supporting India’s circular economy efforts.

Polyethylene Terephthalate Market Report Snapshot

|

Segmentation

|

Details

|

|

By Type

|

Virgin PET, Recycled PET

|

|

By Application

|

Rigid Packaging, Films & Sheets, Fibers, Others

|

|

By End-Use Industry

|

Food & Beverages, Automotive, Textile Industry, Electrical & Electronics, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Type (Virgin PET and Recycled PET): The virgin PET segment earned USD 22.15 billion in 2024, mainly due to increased demand in beverage packaging, bolstered by consumer preference for lightweight, transparent, and recyclable materials.

- By Application (Rigid Packaging, Films & Sheets, Fibers, and Others): The rigid packaging segment held a share of 38.64% in 2024, boosted by its widespread use in beverage and food containers due to its durability, clarity, and recyclability.

- By End-Use Industry (Food & Beverages, Automotive, Textile Industry, Electrical & Electronics, and Others): The food & beverages segment is projected to reach USD 23.26 billion by 2032, owing to the growing demand for convenient, shelf-stable, and eco-friendly packaging solutions.

Polyethylene Terephthalate Market Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

Asia Pacific polyethylene terephthalate market share stood at 36.33% in 2024, valued at USD 14.03 billion. This dominance is reinforced by rapid industrialization, growing population, and increasing demand for packaged goods.

Rising awareness of sustainability and stringent government regulations on plastic recycling further boost the adoption of recycled PET in countries such as India, China, and Japan. Significant investments in recycling infrastructure and collaborations among key players propel regional market expansion. Additionally, expanding beverage and personal care industries contribute to the growing consumption of PET.

- In June 2023, the Asian Development Bank (ADB) extended a USD 44.2 million blue loan to ALBA to establish a PET recycling facility in Indonesia. This project highlights the potential of PET recycling and aims to attract further investment in waste management, supporting Indonesia’s efforts to reduce ocean plastic pollution and promote sustainability.

The North America polyethylene terephthalate industry is poised to grow at a CAGR of 5.58% over the forecast period. This growth is stimulated by increasing consumer demand for sustainable packaging and stringent government regulations promoting the use of recycled content.

Investments in advanced recycling technologies and infrastructure, along with strong support from key industry players, are accelerating PET recycling initiatives. The presence of major beverage and personal care companies adopting recycled PET further fuels market growth. Additionally, growing awareness of environmental impacts and circular economy practices in the U.S. and Canada is contributing to regional market expansion.

Regulatory Frameworks

- In the EU, Directive 2019/904 limits single-use plastics to reduce environmental and marine impact, promoting recycled PET usage and higher recycling targets. It supports a circular economy by promoting sustainable products, innovative business models, and efficient internal market operations.

- In India, the Plastic Waste Management (Second Amendment) Rules, 2022, define biodegradable plastics, enforce Extended Producer Responsibility, and regulate plastic waste processing. These measures support sustainable plastic use, recycling, and energy recovery to align with circular economy goals.

- In the U.S., the Consumer Product Safety Improvement Act (CPSIA) regulates chemicals and materials in consumer products, including plastic packaging. It mandates safety standards, testing, certification, and tracking to limit hazardous substances.

Competitive Landscape

Companies in the polyethylene terephthalate industry are increasingly investing in sustainable materials and innovative recycling technologies to reduce plastic waste and environmental impact. Key initiatives include chemical upcycling, development of flame-retardant and lightweight materials, and use of recycled content to produce low-carbon, high-performance products.

Firms are further expanding product portfolios with eco-friendly resins and enhancing supply chain transparency to align with regulatory requirements and rising consumer demand for sustainable solutions.

- In May 2023, SABIC launched the sustainable LNP ELCRIN WF0051iQ compound, which chemically upcycles post-consumer PET bottles into flame-retardant PBT resin. This thin-wall, non-brominated/non-chlorinated material is specifically designed for electrical applications, reducing carbon footprint by 11%, and contributes to SABIC’s diversion of 400 million PET bottles, supporting sustainability and circular economy initiatives.

Key Companies in Polyethylene Terephthalate Market:

- Indorama Ventures Public Company Limited.

- Far Eastern New Century Corporation

- Alpek Polyester

- NAN YA Plastics Industrial Co., Ltd

- SABIC

- LOTTE Chemical CORPORATION

- LAVERGNE, Inc

- Amcor plc

- Reliance Industries Limited.

- Eastman Chemical Company

- BASF

- Toray TCAC Holding B.V.

- Celanese Corporation

- RTP Company

- TEIJIN LIMITED

Recent Developments (Product Launch/Expansion)

- In April 2024, Amcor launched a one-liter polyethylene terephthalate (PET) bottle for carbonated soft drinks (CSD), made entirely from post-consumer recycled (PCR) content. This initiative aligns with sustainability and regulatory goals while accelerating time-to-market through Amcor’s expanding portfolio of eco-friendly packaging solutions.

- In August 2023, Indorama Ventures nearly tripled its PET recycling capacity in Brazil, increasing output from 9,000 to 25,000 tons annually. Supported by an International Finance Corporation (IFC) ‘Blue Loan,’ the expansion enhances its sustainability efforts by optimizing processes, reducing water use, and supporting its Vision 2030 target for increased global recycled PET production.